I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

American Airlines and Citibank have revamped the Citi® / AAdvantage® Executive World Elite Mastercard®. And you no longer have to spend money on the card to earn Loyalty Point bonuses.

AAdvantage status is earned based on most activity in your account, from flying to credit card spend to online shopping and more. You earn ‘Loyalty Points’ for this activity. Previously, when you spent $40,000 in a year on the card you’d earn not just 40,000 Loyalty Points towards status but you’d also receive 10,000 bonus Loyalty Points. That’s changed. Now,

- Cardholders receive 10,000 bonus Loyalty Points when they earn 50,000 Loyalty Points from any source in a year

- Cardholders also receive 10,000 bonus Loyalty Points when they earn 90,000 Loyalty Points from any source in a year

- No spending on the card is required to earn these Loyalty Points – it’s enough just to be a cardmember.

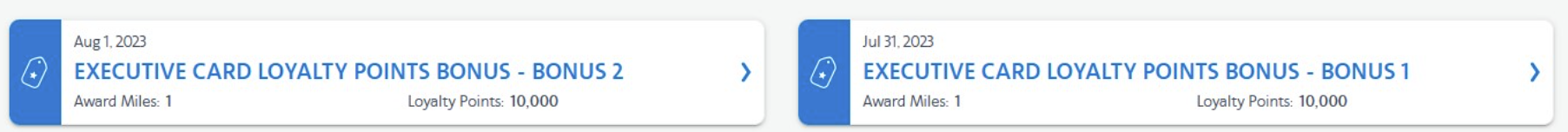

A reader who has just gotten the card, and had already earned over 90,000 Loyalty Points this membership year, shared his surprise:

I applied for and was approved for the CITI AAdvantage Exec card for the 100K bonus. I was approved, and as soon as I received my card I was given TWO Executive 10,000 AA LP bonuses. … I get that extra bump without doing ANY spend?

You no longer need to spend any money on this card to earn its Loyalty Point bonuses, and the potential to earn these bonuses has doubled. What’s more, it appears that new cardmembers receive the bonuses right away if they’ve already hit the 50,000 and 90,000 Loyalty Point thresholds this year.

What’s interesting is that it’s better to earn Loyalty Points by spending on the Barclays Aviator Silver card, earn the Loyalty Points bonuses for spending on that card, and collect the Loyalty Points bonuses you get for earning Loyalty Points anywhere.

In other words, have this card but don’t spend any money on it once you’ve earned the upfront initial bonus. Perhaps book any room nights at AAHotels.com using this card.

Now, I liked the way this card was set up previously from a price-value standpoint but that was never going to last. The Citi® / AAdvantage® Executive World Elite Mastercard® was too good, a $450 annual fee card that included American Airlines Admirals Club membership and offered no annual fee authorized user cards that included Admirals Club lounge access, including for two guests.

Citi has raised the annual fee to $595, and they now charge $175 for the first three authorized users and $175 for each authorized user thereafter. They’ve also added several benefits and statement credits to help make the card more worthwhile.

To promote changes to the card they have a 100,000 mile initial bonus for a limited time (after spending $10,000 within the first 3 months of account opening). That makes getting the card in the first year an absolute no brainer, since at a value of 1.3 cents per mile that’s worth $1,300. And it comes with American Airlines Admirals Club membership.

Admirals Club Washington National Airport E Concourse

Along with the new limited-time offer and new annual fee, the card now adds:

- Up to $120 statement credit on eligible Avis/Budget car rentals each calendar year

- $10 per month in Grubhub statement credits

- $10 in Lyft statement credits each month after taking 3 eligible rides that month charged to the card

- Earn 4x miles per dollar on American Airlines flight purchases, 5x after spending $150,000 on the card in a calendar year for the remainder of that calendar year

- Earn 10x miles per dollar on eligible rental cars booked through aa.com/cars, and on eligible hotels booked through aa.com/hotels – that is on top of the lucrative earn for booking through those sites

- Bonus loyalty points for having the card and achieving certain thresholds (whether you spend on the card or not): 10,000 bonus loyalty points after reaching 50,000 loyalty points in a status year, and 10,000 more loyalty points after hitting 90,000 loyalty points in a status year. (This is instead of the old 10,000 bonus loyalty points after $40,000 spend on the card.)

Admirals Club Washington National Airport E Concourse

Plus trip cancellation and interruption, trip delay, and lost baggage coverage are back with the card.

I am a cardmember, it’s how I get my Admirals Club membership, and I have an authorized user card on the account for my wife. So the card now has a $320 increase in cost. But it was cheaper than it should have been before, and the $120 Avis credit and the additional 10,000 loyalty points that I’ll earn as a cardmember mean I’m going to hang onto it especially since my home club in Austin has the best staff in the system.

For those that do not currently have the card though, the 100,000 mile offer means there’s not really a hard choice here. As an existing cardmember I see a higher fee with no up front bonus offer. Applying for the card for year one is an easy decision, then decide eleven months from now whether you value it for the long term as I do.

Admirals Club Washington National Airport E Concourse VIP Room

Information about the Citi AAdvantage Executive Card is neither provided nor reviewed by its issuer.

Does being an Ambassador Club member get me into any partner lounges? Or is this strictly for AA run Ambassador Clubs?

how long is this limited offer going to be available? thanks

Remember this post next time Gary complains about airlines devaluing their FFP redemption rates.

Get yer cheap points here!

I signed up for the Instant Status Pass promotion earlier this year which requires me to earn a certain number of Loyalty Points every 4 months to get/maintain status. Would the bonus points from this card count toward that requirement? I need another ~10k LPs and I have about 60k so far for the year so that would make this card even more attractive.

Interesting. I’ve had the new executive card for a month now but the LP’s still haven’t shown. Once they do I’ll have EXP for a year.

My card renewal just processed yesterday and it was only $450 after calling for a retention offer last week ahead of the card anniversary (but not getting one). I sent Gary a screenshot of the Citi mobile app showing the renewal amount. It also shows up on the statement that closed on the same day as:

To confirm, the LP bonus from this card stacks with the LP bonus milestones from the Aviator Silver? I thought I recalled some language saying you can’t get both?

Yes, you can get both, for a total of 35,000 status points via credit cards. I myself have 30,000 of them accrued for the status year so far, sitting at about $45,000 spend on my Aviator since March 1.

@Luke, how long before the Executive bonus hit? I have a little over 100K LP on the year, and have had the Exec card for about two weeks now (already reached minimum spend) but have not gotten any LP bonuses. I got the Aviator Silver bonuses earlier in the year.

I was above 90,000 when all the changes went live on July 20-whatever, and both bonuses hit my account within just a couple days. If you qualified more than a week or two ago, then I’d consider calling AAdvantage when you have time. Anecdotally, the bonuses seem to be posting quite fast for most members in general.

@Luke I called AAdvantage customer service, spent an hour on the phone while they kept trying to make up reasons why I didn’t get the bonus (you need to contact Citi, you need to spend $40K first, etc). Eventually they said they couldn’t figure it out and asked me to email. I emailed them Monday, and the first of the two 10K bonuses hit today.