American Airlines is running its annual fundraiser for Stand Up To Cancer, in place for five years. They’re awarding quite a few bonus miles for donations to cancer research.

Donations of $25 or more earn:

- 25 miles per dollar, but

- 50 miles per dollar if you pay with an American Airlines U.S.-issued cobrand Mastercard, on up to $10,000 in donations

The miles earned for donations to Stand Up To Cancer do not count as Loyalty Points. This is American Airlines and co-brand partners supporting a fundraising drive, not Stand Up To Cancer buying Loyalty Points (which American charges quite a lot for!). So this won’t help your quest for status. Too bad, a $4,000 donation to charity would earn Executive Platinum status if it did!

Is This The Best Organization To Donate To?

I don’t consider myself an expert on cancer charities, so please take this as flagging a mileage opportunity that you can feel good about rather than a recommendation of Stand Up To Cancer as such, though I don’t have concerns about them per se. They are primarily making grants to researchers.

I don’t have a sense of how good they are at picking the best projects, but most of you do need an intermediary for this – you probably aren’t in a position to identify and evaluate funding opportunities yourself (though you could probably Twitter direct message researchers you find online and offer to send them large checks through their university or research hospital).

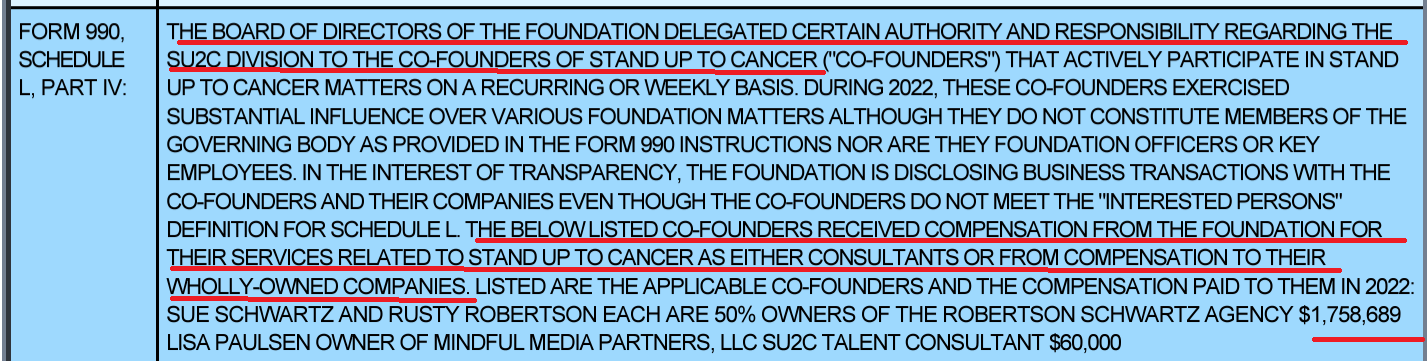

Stand Up To Cancer is not actually the organization you’re donating to directly. It’s a project of the Entertainment Industry Foundation, which is a 501(c)3 public charity, so normal donations are tax deductible. Here’s their 2022 federal 990 tax return filing. This stood out to me:

The largest activity of the Entertainment Industry Foundation is making cancer research grants, for instance $13.2 million to the American Association for Cancer Research in 2022, along with grants of $1 million or more to Mass General Hospital, Princeton University, Stanford and the Dana Farber Cancer Institute.

Their revenue seems to fluctuate widely between $50 and $100 million per year. They have net assets of nearly $90 million.

Are your donations tax deductible?

You likely shouldn’t attempt to deduct gifts through this offer on your tax return. The fine print on the offer suggests “For charitable deduction purposes, each mile is valued at 3 cents per mile. The receipt of miles may reduce the tax deductibility of your contribution.”

In other words, you are receiving something of value in exchange for your contribution. The value received reduces any deductibility. While I would take issue with the valuation here at 3 cents per mile, and it’s possible to argue for something lower than 2 cents (and thus there’s still deductible value), it hardly seems worth going toe-to-toe over that.

When Does The Promotion Actually End?

The promotion ends September 30th or when $3 million has been donated. These amount-capped promotions have become complicated in the past, such as when Mastercard reached its cap awarding bonus miles for Conservation International but didn’t tell anyone – the offer remained on the SimplyMiles website as AAdvantage miles-earning, and it took some time to award those miles because someone at Mastercard had to come up with additional budget first.

I suspect something like that will be at play here – they aren’t going to take your money and not award the miles. Rather, some time after hitting the $3 million cap they will pull the offer.

How Much Are American And Its Partners Contributing Through Stand Up To Cancer Member Donations?

The $3 million member donation cap is a window into how how money is being contributed by American and its partners. If $3 million is donated by AAdvantage members, then 75 to 150 million miles will be awarded for those donations. There’s 150 million miles of exposure.

- They book travel liability for miles earned through flying at around a penny apiece, which is $1.5 million.

- They book travel liability for miles sold to third parties at around 1/8th that.

- The internal cost of a mile is around 75 basis points.

The co-brand marketing budget is potentially on the hook for up to 75 million miles (the extra miles earned for paying via co-brand card), likely at a cost of around $750,000.

Should You Take Advantage Of This Offer?

There are tremendous things happening in cancer research. For instance, we could see a personalized vaccine for melanoma as soon as 2025. I feel like we’re forgetting the positive lessons on speeding research that we learned during the pandemic. Operation Warp Speed was a success, but we aren’t clearing the bureaucratic hurdles to important treatments enough.

If you’re interested in earning 50 miles per dollar on donations to cancer programs, likely without a tax deduction (but many of you don’t itemize anyway!), then it’s a worthwhile offer – you can buy miles and feel good doing it.

It’s cheaper than most buy miles offers, cancer charity component aside, and maximizing the value of buy miles promotions when they come around requires spending far more money.

I still like wrapping a plane with the names of supporters though like they did in 2019 though.

Limited-Edition Amenity Kits Available Onboard, Too

American is launching a limited-edition amenity kit design with Raven + Lily.

Flagship first and business class kits are Stand Up To Cancer yellow, orange and red plus Raven + Lily’s zig-zag trim. The premium economy kit features Stand Up To Cancer yellow. There’s a QR code inside the kits to donate to the campaign.

They haven’t announced yet when these will become available, for how long, and whether they’ll be available globally on eligible flights, or limited to certain flights or regions.

Thanks for posting, Gary ! Aside from the $ 0.03/mile reduction from your donation for tax purposes, the $ 1,758,689 paid annually to the two founders is disgusting. What’s surprising is that Charity Navigator gives them a nice 100 % score, but goes on to point that their “Program Expenses” top 20 %. This isn’t a real charity, it’s a scam.

Further to what TexasTJ says, this “cancer research charity” spends nine times its research budget on “awareness”. If you want to give to research efforts, this Entertainment vanity project is not the place

@TexasTJ – it’s not clear what the entities controlled here and receiving those payments are doing in exchange for the funds. It may be genuine services at market value, or even below! I don’t know the particulars but thought it was still important to flag the question raised by the tax return disclosure (tax returns of public charities are public).

Do we get 50 miles per $ credit with AA Citi Business Mastercard?? Thanks in advance.

Can I use AA Citi business mastercard to get 50 points per dollar? Please let me know. Thanks in advance.

@ Raj

I have confirmed with American Airlines Executive Headquarters that the AA Business master card is indeed eligible for this donation promotion

They sent me an email stating it in writing

In addition to charity, how good is this promotion to ear AA Mike at 2 cent? Any input. Thanks.

I have a college student that periodically needs to fly to/from school on short notice, numerous times he’s been able to use 7.5K AA miles o/w rewards where he’s received from 3 to 4 cents/mile value for the redemptions (for tickets that would have been purchase with money otherwise). I value AA miles at far greater than 2 cents ea, IF I had an AA Mastercard I’d be all in on this promo.

Is anyone getting a receipt that would meet the IRS’ requirement for “contemporaneous written acknowledgment ” for donations so that some part of the donation can be tax-deducted on an itemized tax return?

@Stan – that’s not required for gifts under $250, and as I suggest above I really don’t think this is deductible because of the value of the quid pro quo for the donation [you could deduct the difference, i suppose, between your contested actual value and the 2 cents per point you’re paying]

So 50 miles per dollar with AA credit card. Any extra/bonus miles if also enrolled in Citi Miles Ahead Savings bonus where one gets 25% more miles? How many extra miles would one get per dollar (with AA credit card), if any, with this offer?