I’ve gotten tremendous value from Bilt Rewards since the program launched three years ago. They’ve ‘built’ a big customer base by offering rich rewards, while solving a big distribution problem for merchants, landlords, and banks.

As the first rewards program that offered points for paying rent, they were able to reach affluent young urban professionals – a demographic that’s highly prized by brands. That landed them a rich credit card deal with Wells Fargo (maybe too rich, but Wells was also an early investor and has seen that value skyrocket). And it’s positioned them to work with some of the best travel brands and retail companies.

This morning Bilt is out with a new message to program members that reveals a real pivot in strategy. The message is ‘we’re not just a credit card’. They partner with restaurants, Walgreens, Lyft and are even more than renting since they offer rebates on working with a realtor.

In this message they lay out some of their vision for 2025, walk through their economics, and drop what I view as something of a bombshell about plans for the Bilt Card.

Laying Bare The Bilt Rewards Economics

Bilt recently laid out the economics of their points redemptions on Reddit, in an unusually transparent move. The upshot is that they care about their average redemption cost – the more people who redeem for rent at low value, or redeem their points at Amazon (7/10ths of a cent), the more they can afford expensive points transfers to programs like Hyatt.

Bilt says they’ve “issued tens of billions of points to members for rent payments” and millions of members have taken advantage of Rent Day benefits “like complimentary elite status on airlines and hotels, complimentary rideshare credits, and more.” I’ve loved their status offers with United, Hyatt, Air France and Alaska and record-setting transfer bonuses to Virgin Atlantic, Air France KLM, Hawaiian, Emirates and more.

They’re sharing a deck with members that explains,

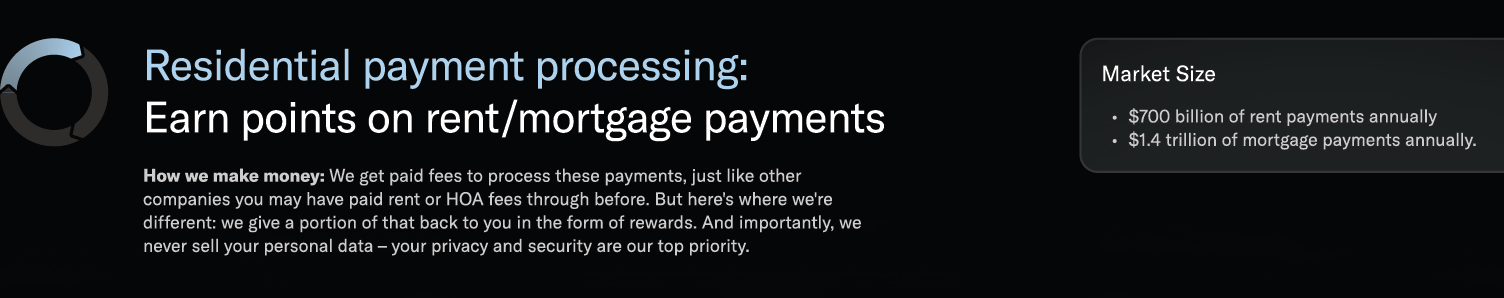

- They get paid for processing rent payments, and in addition to what they’re paid for rent charges on their Wells Fargo co-brand this helps fund the points earned for rent. They get paid to process rent payments,Bilt reports processing over $36 billion in rent payments annually, more than tripling year-over-year, and they expect to double in the coming months. If they even capture a day’s float on those payments at current interest rates that’s lucrative too.

- Businesses that want to market to their lucrative demographic pay them commissions, which they rebate a portion of to you in points. Bilt shares that their Neighborhood Benefits merchant partnerships are up to $3 billion in spend annually, up 50% year-over-year with $1 billion in dining spend (2.5x year-over-year growth); $300 million with Lyft (up 50%); and $350 million through their travel portal (up 75%). [That only accounts for half the reported $3 billion though of course there’s fitness and pharmacy as well.]

- They’re a loyalty program for landlords – and they earn commissions on leases funding the points they offer, just like they rebate a portion of the commission a realtor earns when representing you on a home purchase. In both cases, payments to Bilt are a marketing expense and you go through Bilt because you pocket a piece of that.

A couple of interesting factoids are that about 15% of Bilt members have a Bilt credit card, and they have about 24,000 local businesses in their partnership network.

15% of Bilt members with their cobrand strikes me as huge, since most people are signing up for the program as a required means of paying rent (Bilt works with 70% of the top 100 landlords processing rent payments). However we know from Wall Street Journal reporting that in the first 18 months, over 1 million card accounts were opened.

Of course, 20,000 of their neighborhood merchant partners are Rewards Network restaurants where Bilt is a bolt-on, an option to earn Bilt points instead of airline miles (Bilt points are generally more valuable, of course). The restaurants Bilt went after directly are generally great – places I eat at regularly. Most Rewards Network restaurants are not.

Beyond restaurants, earning points with Lyft and on Walgreens purchases are great.

They appear to want to scale in this area, perhaps because of challenges with the economics of their credit card deal and what that could look like in the future, but also because they want to grow faster than just the current credit card offer scales.

It’s gotten them to a $3.2 billion valuation already, of course. They’ve reportedly been profitable. Their deals are good for Bilt and good for members, but they want to grow, and the current arrangement where Wells Fargo funds rent payments may be too generous by the issuer to be sustained as-is in the long-run (although earning 3x on rent payments with an Alaska Visa is probably more economically sound).

Where Bilt Is Going

Bilt says that the year ahead is going to include:

- Earning points on your mortgage both for making monthly payments and for refinancing. That’s awesome because right now options for earning points on mortgage payments without a 2.9% fee to do so are very limited. Even following the Alaska Airlines model, 3% fee for 3x earn would be fantastic, especially since Alaska card spend counts towards status. I predicted we’d see points for mortgage origination and refinancing as well – we’ve seen it before (I’ve earned points for this myself over the years) and it dovetails nicely with points for real estate transactions.

- New credit card partnerships for paying rent presumably like with the Alaska Visa and this will be with a variety of credit and debit cards (“expanding partnerships to help you earn more rewards on rent, whether you use the Bilt card or other credit and debit cards you may already have”).

- Adding points-earning at grocery stores, gas stations, and parking. I’m not sure how much I care about parking, and gas station mileage programs are sometimes less-rewarding than the gas station’s own program assuming you have to choose. However grocery store earning is something I’ve missed since the end of United’s GroceryMiles program with Safeway in 2010.

- Expanding and improving on one-tap restaurant payments and automatic FSA processing at Walgreens. These are nice innovations for ease of life.

- More rewards for lease renewals.

In our pilot programs, Avenue5, one of the largest property management services, saw 95% of residents renew their leases earlier when offered rewards incentives – showing just how valuable these rewards are to our members.

New Credit Card Value Proposition Coming

There are hints about a big change in direction for their co-brand credit card partnership.

Their deal with Wells Fargo runs through 2029, but apparently hasn’t worked out nearly the way Wells had hoped. Wells spent money aggressively to get into the co-brand business, very generously on initial deals as an investment in building a portfolio and experience that would become a platform for seeking out other, bigger deals.

To support that, there were aggressive assumptions about how people would spend on the cards and how much consumers would revolve. And this was done during the ZIRP era. They’ve since appeared to head in a different strategic direction, leaning into their own card portfolio more (for instance launching their own lucrative Autograph Journey product).

Bilt’s letter to members downplays the importance and role of the card as transitional,

In our first two years, the Bilt Mastercard gave us a bridge to rewarding customers on rent payments while we built something much bigger: a payments platform that rewards members regardless of how they pay rent.

And it refers to new products coming in a 2.0 that they expect to grow beyond the current offering – moving from 15% of members up to potentially 25% (“We expect the Bilt card to remain the preferred payment option for 15-25% of our members”).

It’s unclear whether the “tiered offerings” they’re talking about mean the introduction of premium cards at different price points in addition to the current card, or different value propositions. However the letter saying “We know you want more premium offerings“ sounds like a second, annual fee card.

What’s really surprising in the letter – more candid language! – is their saying that “These are all things that require support from our issuing bank partner, and we’re actively working on solutions.” This sounds like throwing serious shade at Wells and doing so very publicly. My eyes nearly popped out of their sockets though when I read that sentence as such candor over large partnerships rarely makes it into carefully crafted public statements.

With guidance from industry legends Ken Chenault (former American Express CEO and Bilt Chairman) and Phillip Riese (former President of American Express Consumer Card), we are building towards Bilt Card 2.0. This next evolution of our card program would focus on tiered offerings that better serve different member needs while delivering enhanced value through new benefits on housing spend and our neighborhood network. We expect the Bilt card to remain the preferred payment option for 15-25% of our members, as we continue to innovate and enhance the card experience.

But more importantly, I’ve been reading and passing along your feedback and requests for the current Wells Fargo issued-and-operated Bilt card program. We know you want more premium offerings – and also ways to earn points on your mortgage payments. We also hear the challenges many of you have had with approval rates, credit line sizes, and the need for basic tech features like authorized users, pay over time, and auto-pay integrations. Some of you have mentioned that your credit limits are too low to cover more than a month or two of rent, leaving little room to take full advantage of the card’s benefits – especially considering the average FICO for these members is above 750. We hear you loud and clear. These are all things that require support from our issuing bank partner, and we’re actively working on solutions.

Something big is happening with Bilt’s credit card partnership. We don’t know what yet. But it’s not surprising that they’ve been building quickly using the funding investors and that partnership have provided to expand into restaurants, pharmacies, residential real estate and beyond to diversify beyond just being a card program.

I’ve ignored Bilt, but a buddy of mine swears by it and I am doing a bit more work on it. It seems like a worthy addition for most people – especially if earning points on mortgage payments becomes a reality.

One thing I never figured out – can people earn points on HOA payments today?

@Gary: Most offerings are not class-leading:

1) Real estate commissions is only 0.625%. Most participants can do better. E.g. Redfin offers 1%;

2) Uber: Better deal buying Uber gift cards at a discount. E.g. Costco offers 20% off;

3) Rewards network offers 7+ miles after minimal usage. Seven airline points are worth > 10% on most airlines (using Points Guy estimates);

4) Supermarkets 3x points on Citi Spectra (worth over 5% using the same metric);

5) Walgreens — nobody waits in line at Walgreens the time they expect you to;

Bilt is good on special airline transfers and on the 1st of the month, but even this unique feature is significantly denuded now that it is limited to a $500 cap on the 1x -> 3x spend;

Bilt is obviously a program that seems to be focused on large metropolitan areas both in its benefits and earning structure. Hopefully they will not disintegrate as their structure becomes unsustainable. Fortunately for us, there are plenty of fish in the sea.

Bilt tilted away from me, since they decided they didn’t want customers like me. Large payments on Rent Day–with a significant component of taxes–are gone. Trivia is gone. Very lucrative one-off bonuses are gone (the last one limited to $500–seriously?). Transparency is questionable in view of how the change on taxes was communicated (it wasn’t publicly). So, I bailed out with 2x Avios last month, and am now basically done. The shame is that I was one of Bilt’s earliest fans.

I’ve had the BILT MasterCard for a year now; my only regret is that I did not use them sooner. This year, I earned their Gold status and redeemed nearly 130,000 points, mostly transfers to Hyatt. I enjoyed Richard’s Reddit post, and agree with him that Amex is cheap by passing on the excise tax to consumers. With BILT, I’ve come to expect is that this program will change, often every several months, but the fundamentals remain good, namely, earning points on rent. I miss the Rent Day bonuses, but I can live without them. I hope this program lasts, because it has been good to me.

I’d love to use Bilt, but my property owner doesn’t want a check. He wants an ACH into his routing/account number, and that’s the one thing that Bilt can’t seem to do (yet?).

Kerr : we are profitable if we make more money generating the points than it costs us for users to redeem.

Reddit: what a genius! Such insight! Most enjoyable post ever.

@ Anthony. I’ve ignored BILT also. My HOA charges and additional 3% to process ANY credit card payment. The local country club (Invited Clubs owned by Apollo Global Management) also charges 3% to process dues payments made with a credit card. Seem these for profit companies think they are quasi government organizations and charge credit card processing fees just as City of Austin and Travis County do. So far the credit card fee for IRS is a breakeven miles purchase.

Gary, please put a “SELL-OUT, PAID SHILL WARNING: THIS IS A TIMED ADVERTISEMENT” Warning on posts like this. You are doing nothing but waiting out the embargo Bilt imposed on paid travel bloggers for posting this PR crap. Good job. Please warn those newbies that can’t see through this.

Oh, and tell your sponsor/boss Kerr hello

@Leo – I don’t know what compensation you think I’m getting and there’s some pretty big calling out going on here if you actually bother to read the post.

R.R.: I only pay Bilt rent via ACH. Not sure how you’ve missed that prominent option in the app.

Carl –

I need to push an ACH payment to the property owner’s routing/account number. He will not pull it using Bilt’s routing/account number. I can’t find a push option – can anyone advise?

I would be happy with an annual fee option for BILT Mastercard if that lifts the Rent Day bonus cap and gives industry leading bonus categories, or at least uncapped 2X on all spend.

Carl, institutional owners typically do have an ACH pull capability. But, individual owners typically do not have an ACH pull capability. In the case of individual owners, a renter would need to initiate an ACH push or cut a check.