I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

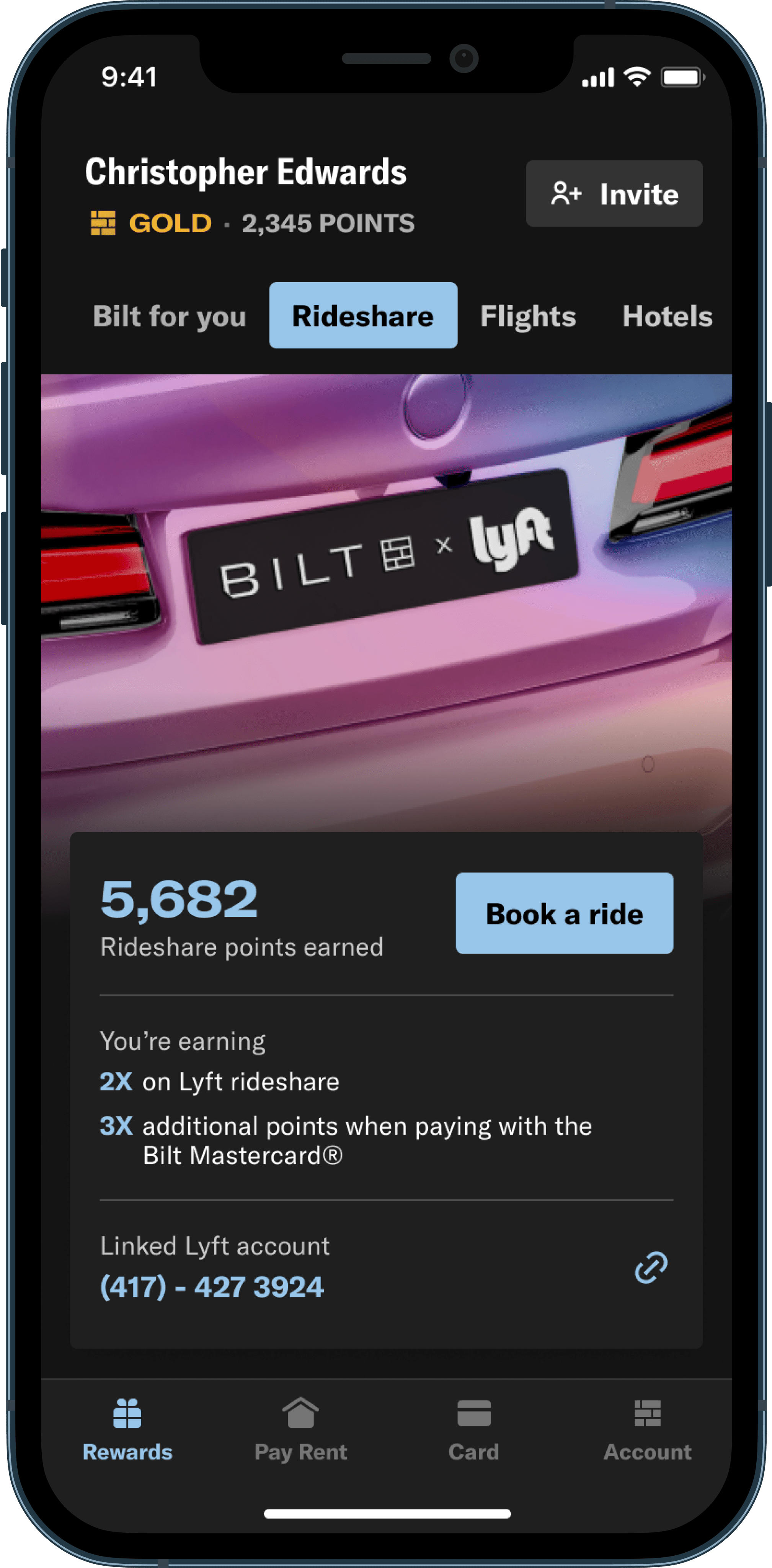

Bilt Rewards has introduced a new partnership with Lyft. There’s a new tab in the Bilt Rewards app that allows you to link your Bilt and Lyft accounts. You can earn 5 Bilt points per dollar spent with Lyft:

- As a Bilt Rewards member, you earn 2 points per dollar spent with Lyft when you link your account (all Bilt Rewards members are eligible, regardless of whether they have a Bilt credit card)

- Spending with Lyft on the Bilt Rewards Mastercard earns 5 points per dollar total (2+3)

This is really interesting because Bilt members earn points when linking their airline and hotel accounts, but it’s not enough on its own (without occasional promotions for linking) to transfer those points out to airline and hotel partners. Add in the Lyft partnership and a lot more members will reach the threshold to transfer their free points.

And I consider Bilt to be the best/most valuable earning partner for Lyft rides. You now have a choice of points-earning when you take Lyft, you can link your account to your choice for:

- 2 Bilt points per dollar

- 2 Alaska miles per dollar

- 1 Delta mile per dollar

- 3 Hilton points per dollar

Earning 2 Bilt points has the highest value followed by Alaska then Hilton with Delta last, although Delta earning increases and becomes more valuable than Hilton on airport rides. You used to be able to double dip but that’s no longer the case. You have to choose one partner to earn with.

Meanwhile, for Lyft, this provides market access (Bilt members, who are disproportionately young urban professionals) and effectively gives them access to people who want to earn American miles, Hyatt points, and many more – not just Delta or Hilton points (two relatively low value currencies) and Alaska miles (valuable, but more niche). Indeed you can even earn Amazon credit for your Lyft rides now since that’s a Bilt option (though not one I’d take up).

Each Bilt point can be spent at 1.25 cents apiece towards travel through their portal or transferred 1:1 into:

- Star Alliance: Air Canada Aeroplan, Turkish Miles & Smiles, United Airlines MileagePlus

- oneworld: American AAdvantage, Cathay Pacific Asia Miles, British Airways Executive Club, Iberia Plus

- SkyTeam: Air France KLM Flying Blue

- Non-alliance: Emirates Skywards, Virgin Atlantic Flying Club, Hawaiian Airlines HawaiianMiles, Aer Lingus Aer Club

- Hotels: Hyatt, IHG One Rewards

The Bilt Mastercard is the no annual fee card that lets you earn points paying rent at no cost (up to $50,000 per year, Update: now up to $100,000 per year) and (outside of Rent Day on the first of the month!) earns double points on travel and triple points on dining. Rideshare didn’t earn 2x, but now Lyft earns 5x.

Of course you choose a credit card for points-earning when you pay for your Lyft ride, and Bilt is now one to consider. However Chase heavily bonuses Lyft spend also:

- 10x: Sapphire Reserve and JP Morgan Reserve

- 5x: Sapphire, Freedom, Ink cards

I think the 10x earn remains a no brainer with Chase. For 5x, Chase works too. Otherwise consider Bilt.

Bilt continues to innovate and impress. It is the outlier fi-tech card . . . it has survived.

Gary, if you could add two features/benefits/whatever to Bilt, what would they be?

Lyft Prink comes free with the Chase Sapphire Reserve.

Am I the only one who can’t get my Lyft and Bilt accounts to link? I’m going through the process, it opens the Bilt app, I confirm that I want to link the two, and then it says it will open the Lyft app to complete the process – but when the Lyft app opens, nothing happens :S

Lyft only offered 2 Alaska miles per dollar through 12/31/2022. Lyft now only pays 1 mile per dollar.