I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

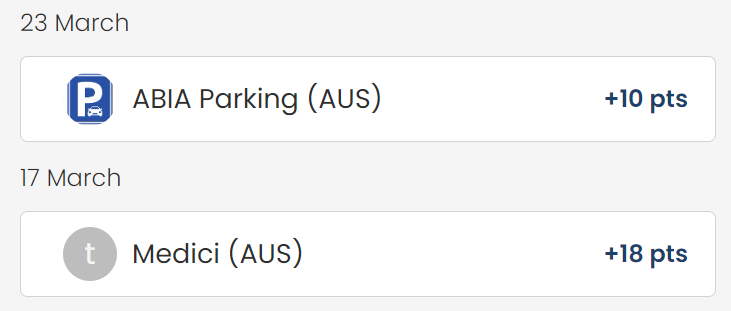

ThanksAgain is a rewards program where you register your credit card, and it scans your transactions for eligible activity and offers you points – that can be converted into frequent flyer miles or gift cards.

It began years ago as a general retail rewards program. Many dry cleaners were included. Then nearly a decade ago they pivoted to being largely rewards for airport spend. They’re in over 130 U.S. airports.

- Airports don’t know who their customers are

- But if airport retailers reward spending through ThanksAgain, an airport can track who is spending on premises

- That gives them the opportunity to incentivize people who park to spend money on restaurants, those who dine to spend money on retail, and target offers by which terminal you use, etc.

I rarely (never) see targeted offers to encourage cross-spending, the way this service is sold. Airports aren’t great at marketing or using data, they’re usually ossified creatures of local governments. But the concept is sound. I once told the CMO of a large mall company, looking at starting their own loyalty program or signing on with now-defunct American Express Plenti (the latter I advised against) that they should buy ThanksAgain. Airports are basically shopping malls, with similar incentives aside from the political meddling.

It’s easy to forget that ThanksAgain exists. You don’t see a lot of signage for them, but sign up and you may earn a point per dollar on your in-airport spend. Redemption options and redemption rates have generally been devalued, too – the only airline transfer partner left is Alaska Airlines, and it’s a 2:1 conversion rate not 1:1. Still, Alaska miles still expire and transfers are a good way at least to keep an account active.

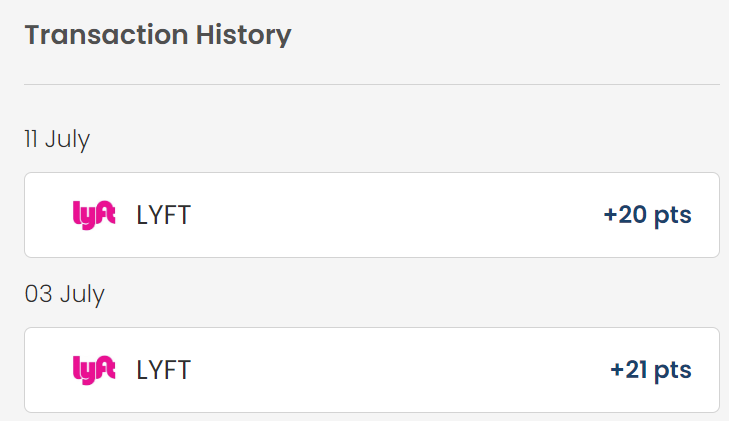

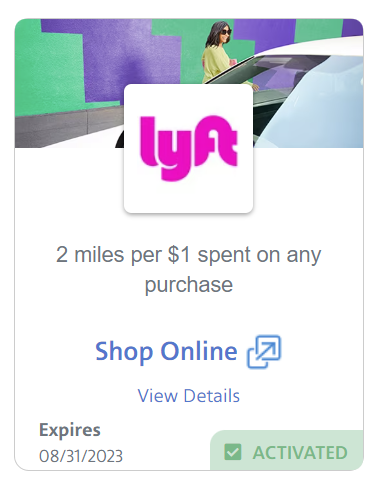

Plus, ThanksAgain isn’t just airports. They also partner with Lyft. And while it is no longer possible to ‘link’ more than only loyalty program account to Lyft, you cannot for instance earn with Alaska, Delta, and Hilton at the same time anymore on your Lyft rides, you can earn with a linked loyalty program and ThanksAgain.

I link my Bilt Rewards account to Lyft. Bilt has the most lucrative Lyft partnership followed by Alaska. As a Bilt Rewards member, you earn 2 points per dollar spent with Lyft when you link your account (all Bilt Rewards members are eligible, regardless of whether they have a Bilt credit card).

I also link the credit card I use to pay for Lyft charges with my ThanksAgain account, and earn ThanksAgain points for my Lyft rides.

The most lucrative credit card for Lyft charges is Chase Sapphire Reserve® which offers 10 points per dollar on Lyft (Chase’s JP Morgan Reserve does as well).

But I also stack Lyft-earning with ThanksAgain. It’s minor ducats in the scheme of things, but I don’t want to leave points on the table and it’s passive earn if you’re signed up with ThanksAgain and have the relevant card registered in your profile.

They even have a referral program.

- 500 bonus points for everyone who joins using your link, attaches a credit card to their profile, and completes a qualifying transaction. And receive 5 bonus points for each qualifying transaction of $2 or more made by the people you refer.

- The person who is referred receives 100 bonus points at signup (no activity required). So signing up via a referral link is better than signing up directly.

- Referral bonuses are capped at 50,000 points (worth up to $500 or 25,000 miles).

This is my referral link and you’re welcome to leave yours in the comments.

Meanwhile, did you know that right now there’s also a quadruple dip? The American Airlines-Mastercard site SimplyMiles.com will give you 2 American AAdvantage miles per dollar spent with Lyft if you register for this offer and pay with a linked MasterCard:

SimplyMiles has, at various times, Lyft offers and Uber (and UberEats) offers as well. Always worth scanning those as well.

Do you have time to look into ‘Miles’ cards vs ‘Cash Back’ cards?

With airlines devaluing points regularly and seat availability becoming less prevalent, I think it would be interesting.

Too low a price to sell my transaction data, unless I have a card fillet for Lyft.

Gary- tried using your referral link to sign up- but continuously get error message when entering any password- with no explanation of what they require.

Thanks Gary for posting this ThanksAgain nuggest and letting us post referral links. Here is mine, https://thanksagain.com/?referral_source=RRGG

@ Gary — Thanks Again requires you to link to you bank login rather than simply providing your credit card number. That is wholly unnecessary and very off-putting.

How is it any different from the 5X you earn on Lyft with the Chase Sapphire Preferred?

@Chris – it is stackable.

– You earn from your credit card spending (eg 5x CSP)

– You earn from a program like Bilt, Alaska Airlines, Delta or Hilton by linking your accounts

– You earn via ThanksAgain by registering your credit card, such as CSP, with ThanksAgain who scans the transactions and awards points

And as I note, you can also earn with a program like SimplyMiles, Chase Offers, Amex Offers or Citi Offers if they have something at the moment with Lyft.

Went ahead and signed up. With all the services I have reading my transaction data at this point, I figure, meh, what’s one more?

Here’s my referral link for when the others max out:

https://thanksagain.com/?referral_source=PMK2

I agree with Gene. No way I’m giving them my bank login info just to get a few points here and there.

Hi Gary – I’m not seeing the Lyft promo on the SimplyMiles site, even when logged in under my AA account.

I see 66 available offers on SimplyMiles but none for Lyft. Wonder if this is targeted to just certain users? (I’m AA EXP so figured it would show up it…)

I am aware that all SimplyMiles offers need to be activated individually so hopefully the current Lyft offer you screenshot in this article is extended to more/all users in the coming days.

Thank you!

Cool! never heard about this, thank you Gary!

Already signed with your link. And thanks you letting us post ours.

Here’s mine:

https://thanksagain.com/?referral_source=BBK

It is a fair point that it is going to be rather hard to earn with this program just due to the limited footprint. They are getting all my transaction data for what will be a rather limited number of earnings opportunities.

THANKS FOR THE INFO AND HERE IS MINE.

https://thanksagain.com/?referral_source=WDBONUS

I use Juno to charge my Lyft spending because I get 5% cash back.

This is a great find! Thanks. They certainly do not market it properly.

Here is my referral link:

https://thanksagain.com/?referral_source=BMILLER

Happy travels!

Very cool, Emirates has an Everyday Rewards program too that works similarly,

And my ThanksAgain ref for anyone: https://thanksagain.com/?referral_source=CLARENCE

Might as well share mine!

https://thanksagain.com/?referral_source=PROFOP

On top of that, Dosh also sometimes has Lyft offers and can stack with all of the above, I believe.

Thanks for the tip.

Here’s my referral

https://thanksagain.com/?referral_source=AFCSLINGER

Stacking on more bonus points is a plus.

https://thanksagain.com/?referral_source=TARF

@Peter

Have you checked any airports? The ones that I frequent, DFW, ORD, ATL, LAS, all have pages of merchants. It appears that just about every restaurant in those airports, participates. Considering how high airport prices are, this gives a little bit back.

Simply Miles also requires you to enter a credit card. The fact is we give out tons of information in everyday transactions. The banks know everything about you. And so does Apple…This is just the way it is.

@Gary: Lyft link on Simplymiles does not exist for my account.

Does associating a card with ThanksAgain (e.g. giving them your transaction data) then clobber any other similar associations for that card (e.g. FuelRewards, Alaska Mileage Plan Dining, etc.)? That is to say, you’d only want to employ ThanksAgain for a card which is only used within an airport?