Last month an American Airlines passenger got a huge surprise on their American Express statement. They refunded an American Airlines ticket, expecting $1,000 back. Instead, on February 21, American sent them $100,000.

The money wasn’t theirs! They quickly called American – but agent after agent insisted everything was processed correctly. They escalated to executive emails and social media. American kept insisting “the refund is correct.”

They might have stopped there, kept a record of everything, and sat tight. However they were worried – the ticket was purchased outside the U.S., so not in dollars. If American came back later, and exchange rates moved against them, they could be out real money.

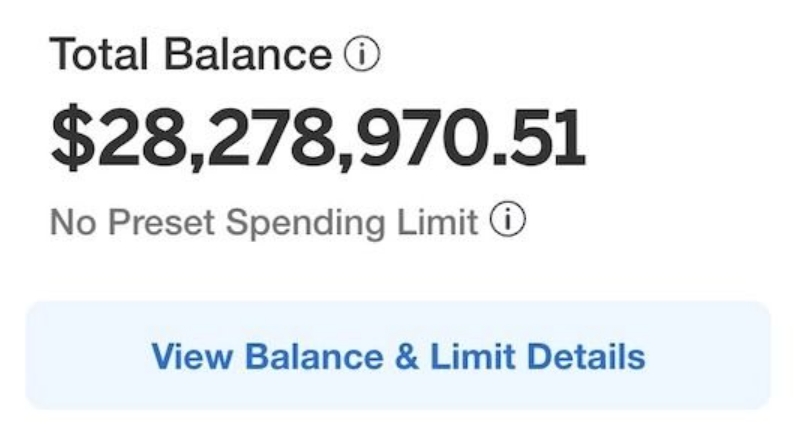

They escalated things with American Express and even tried to ‘dispute’ the refund. Eventually, everyone agreed that this was a mistake – but nobody could fix it. American processed an adjustment for the erroneous refund on February 27th – and charged them $28 million.

That was a lot of Membership Rewards points, billed to the passengers Platinum card. But they were afraid they’d be literally bankrupted by the mistake. They didn’t have $28 million!

Then on March 1, American Express suspended their account due to “high credit exposure.” It was a weekend full of stress, because no one working outside of normal business hours had the authority to correct a $30 million error. Come March 3, though, Amex acknowledged multiple errors. But they could delete the mistakes, they had to fix them.

By the next day, the $28 million charge was netted out. However there was still another incorrect $300,000 refund that got added during the attempts to ‘fix’ the problem – and currency conversion

costs and losses of $75,000.

Amex did get this cleaned by later in the month, both American Express and American have apologized – and offered compensation that the passenger refuses to discuss other than to say,

The value of the compensation is more than the interest I would have earned for $100K in 1 week in a [high yield savings account], and in the range of what [Southwest and Delta] offered to affected pax during their respective meltdowns.

Everything was wrapped up by March 24, ending four stressful weeks at the mercy of two mega-corporations and an inability to sort through errors.

Typical. Quick to take, slow to refund.

It might be several months before everything is settled. I have little faith that everything is good now.

I would have no doubt that this would eventually get straightened out. What I would be most worried about is other creditors seeing these huge “debts” on their credit report and freezing or canceling entirely unrelated credit cards and credit lines. Those kind of issues can linger for many months.

This comes down to software without human intervention and when the software can’t handle an anomaly the humans aren’t sure what to do. This could cause a credit review by other creditors and subsequent problems such as the closing of a line of credit. All done by automation without a huma in sight.

Learned recently Amex seems to have issues with credits and reversing charges myself as well, although in a way smaller amount. They didn’t seem to care about it when I contacted them.

In summary, bought plane ticket and addons to spend the annual $200 credit. Total cost was a little north of $200 and got the credits for the purchase. Airline cancels flight, I ask for refund and Airline refunds almost immediately. Contact Amex to reverse the credits as the flight was refunded but they just tell me to keep it and it’ll apply on my next flight purchases even though I insist on it to keep my books straight… so if I don’t end up flying to use the credits, I get -$200 to my balance and -1000 Amex points this year? Will they eventually catch it and I get billed for $200?

American. The Hertz of the Skies.

American Express is widely known and referred to as the “Evil Empire”.

About two decades ago, as an early-20s “kid” not making a lot of money, I woke one morning to a deposit from Oracle Corporation of $13,000 to my checking account. It was marked payroll.

I certainly didn’t work for Oracle. I tried to contact my bank to get it reversed. They kept telling me it was valid and it’s mine and are you sure you don’t expect this deposit?

I spent hours and days trying to contact Oracle to get it reverse.

Two weeks later…. another deposit.

I spent more time with my bank and trying to contact Oracle.

I was 22 and broke.

Anyone wanna guess how this story ended? LOL 🙂

LAMBOS, HOOKERS, AND BLOW.

Until Oracle realized their mistake.

Luckily I documented my attempts with both the bank and Oracle and when they wanted to press charges, I was like I will litigate this let’s just settle and make a deal, eh? You’re a mess and I am a mess, so let’s not make me call the local news station and make this a thing, eh?

It was a fun six months.

I’ve been following this one as well, thanks in-part to Gary’s reporting on it. Yeah, it is almost as if we should not blindly trust these mega-corporations, who are indeed fallible, and maybe should also have robust regulations and regulators to serve, protect, and defend consumers, who are relatively powerless. Oops, sorry, I guess I’m ‘woke,’ and now must be ‘renditioned’ to El Salvador to pay for my crimes of advocating for better circumstances for the common person. Oh well. It’s been nice.

@Miguel95 — Have you ever watched Mr. Robot. I, too, at times, have had E-Corp ‘vibes’ with Amex and other ‘mega-corps.’ You know, Evil Corp. If you know, you know.

@Mike — That’s quite a tale. Glad you got to enjoy yourself for a bit. Probably should have invested it instead, then kept the profits, knowing that you might have to return the principal at some point. Or, do what you did… Ah, the memories–they can’t take those away, can they? Bah!

@Craig Jones — You know, sir. It’s called a power disparity. And the powerful almost always abuse it.

Criminal level incompetence

“Interest” on the $100k is only relevant if it’s cash. Nobody pays you interest against a credit card balance. This guy was never out any actual cash. He was out the ability to use his Amex for a while and however much time it took him to fix the mess.

Still dealing with an Iberia issue with my Apple Card. Booked tickets to Spain, since we are moving there. Told the res agent we needed to book our dogs in cargo. First ticket issued was for Level. Then we were told Level does not transport pets in cargo. So, we changed the ticket to Iberia, from JFK-MAD-BCN. This was booked for a Friday night flight, arriving Saturday. Same story – we told the res agent we would be traveling with our dogs in cargo. Iberia later informed us that they had no cargo service on Saturday (has to be a lie). So, we changed our departure date to Tuesday. Provided the pet transportation form along with the crate size, only to be later informed that the crates were too big! In total, there were at least 12 calls to Iberia and four Live Pet Transport forms sent to IAG Cargo. I also need to mention that the original flight on Level was never cancelled by the res agent; so we were appearing on two flights to Spain, both leaving the same day, one on Level, one on Iberia. Finally sent a complaint letter to IAG. IAG apologized for the mistakes and stated that the tickets could be canceled and refunded. So, we called Iberia again and were promised the tickets were canceled. They were not. Another call finally got the tickets canceled, but no refund as of yet. Goldman Sachs, the servicer of Apple Cards, is giving Iberia until MAY 2nd to respond to my dispute! So, I will have to wait another month plus to perhaps get this resolved.

Well, he was *potentially* out cash due to the exchange rates — if they kept switching things back between dollars and his local currency, I mean for $28,000,000 a 1% fluctuation could have made him out $280,000. I mean, it really sounds like they were depositing and withdrawing amounts rather than actually cancelling any transactions….

Just to comment, I don’t think his point is to suggest he’d get interest off the card balance — it’s more to say he’s not disclosing exactly what he got give a rough idea of the amount.

Agree with Justin. This is over dramatizing goofy mistakes. The passenger was never out any cash. They credited him way too much. Then they billed way too much. Then they credited him way too much. Then they gave him some money and/or points for the harrowing experience and his time on the phone correcting things. This should be a funny story at the expense of how technology screws up. Serious doubts that anyone who was told the 100,000 vs 1,000 story told him to keep the $100,000, but stranger things have happened.

The solution to trying to deal with AmEx is simple: Chase Sapphire Reserve. When you have a problem, a human answers the phone at Chase. They listen, they understand and they fix it. I jumped ship back in 2016 when the Sapphire cards were invented because I could no longer deal with AmEx after more than 35 years. And I have very few issues. Three cheers for Artificial Intelligence, it will ruin us all. You can’t run a high-level CC operation without smart humans doing your customer service.

I just got charged erroneously nearly $10k+ for a 75 person reception- for one hour- at the Hilton Anatole hotel in Dallas, TX.

They gave me an itemized bill that our group of 75 people had 526 drinks in a one hour time span. Each drink was $18, and then including the tax and ‘automatic’ gratuity, increased the total charge to $11k.

So somehow, 75 people had 7 drinks, PER PERSON, in one hour. And that’s assuming everyone drinks. Oh yeah, because they are short-staffed, they pulled our bartender for 20 minutes.

And just like in this case, the first response was, “It’s correct, that’s what was billed.” It then took hours of emails and calls (I dare anyone to try and get a hold of a human being when you call them… It’s all AI chatbot/voicemail hell).

So the extra $9,800 charge put me over the limit, which affected the next work/conference I was holding.

And- while they can Ready, Shoot, Aim and charge my credit card in one day, it took their systems 8 days to refund me the issue once they admitted it’s unlikely that each one of us had 7 alcoholic drinks.

Ugh- just horrible customer service on an easily contested issue. And the AI voicemail chatbots are the worst.

I had an experience with AMEX trying to fix over of their errors for over 8 weeks. They suspended our cards over their error.

The people in revenue management at AA need to have their heads examined. The mistakes were truly extraordinary and could have cost AA a lot of money if they had failed to catch it in an audit. However, that chance is pretty slim, and someone would have eventually caught the mistake, which would have resulted in a huge charge back to the credit card that could have put the customer out a serious amount of money due to foreign exchange fluctuations. I have no idea how or why they charged his card $28M. That is truly beyond me. I’m going to blame that one on AI.

In today’s world, I can’t fathom why someone would pay to carry a credit card. All of my cards pay me, not the other way around. Also, outside of the USA, Amex is frequently not accepted, and if it is, there is a surcharge.

Because the benefits of card is worth 4x to 5x the yearly fee? And thats not including the points. Every one is different of course, so what works for me may not work for you.

At first you say “an individual,” then you say “they.” Why?

@Ronald Johnson – LEVEL is horrendous – I once booked a ticket on Iberia, with no mention of LEVEL at all in the booking process, only to arrive at the airport to discover it was a LEVEL flight. Other folks had paid for premium economy on Iberia to discover they were actually in super crappy LEVEL basic economy. Will avoid Iberia from now on if humanly possible.

I read this article and with all the ad breaks, super short paragraphs and disjointed writing, I really have no idea what happened or how it was resolved.

What’s with this “they” business? Does the author know the protagonist’s gender status?

It makes for such cumbersome, tedious reading.

I just booked flights through Delta and was offered a $500 statement credit if I applied for an AMEX card during the checkout process. No thanks!

It sounds like the AA and Amex ‘compensation’ was about $100.

Sadly DL only has Amex cards to get the 15% award discount. Need to pay up for Platinum to make it worthwhileto hold otherwuse. Cringing at the thought, though never had issues with the old Costco Amex.

Mike provides a good cautionary tale to always dispute ACH anomalies as well. There were debit-card system meltdowns in the early 90’s and the early 00’s that left me stranded with a multiple faux withdrawals that drained and froze my account. After that, I went to credit cards almost exclusively. I could never get over how snide the bank was on these – as if they were inconvenienced. Moral of the story is to always have an emergency cash stash as well.

@Alex — it’s easy to understand why they charged his card $28 million by mistake: they didn’t mean to make the charge in USD, they meant to make the charge in the currency of the country in which the passenger lives. For example, as a hypothetical, if the passenger lives in Vietnam, a 100 U.S. Dollar charge would be 2.56 million Vietnamese Dong. The American Airlines employee who is likely an American and therefore likely not all that familiar with foreign exchange (Americans’ worlds center around the USD) key-punched in the 28 million whatever-currency into the system when the system was expecting U.S. Dollars. Bing bang boom — a $28 million USD credit card charge to the passengers Amex Platinum card.

“more than the interest I would have earned for $100K in 1 week in a [high yield savings account]”

Soooooo… Like $100? HYSAs are mostly 4-something-percent APY, but let’s be generous and call it 5%.

So that’s $100,000 x 5% / 52 = $96 and change. That probably doesn’t even cover minimum wage for the hours it took to force AA to fix it.

So typical, the bean counters have made so many cuts… the remaining workers are overloaded. Also many of the competent employees left the workforce after the Scamdemic.

Folks, it’s not going to get any better. As more old folks head off to retirement I’m not optimistic on where the knowledge will come from to deal with these types of problems.

Reading all of these comments confirms my belief that AI is still at the stage that it’s more artificial than intelligent.

That is the point at which you call the U.S. Attorney’s office and let the millstones of justice do their work. Once that is resolved then you call an attorney to file Unfair and Deceptive Practices Act claim with additional counts for fraud, unjust enrichment, defamation, and anything else I or one of my brethren can come up with.

Hopefully the feds will open an investigation. Clearly both Amex and AA lack appropriate risk control mechanisms that could end up costing them millions. These transactions should never have occurred if the companies had reasonable processes in place.

Why would Amex approved a charge or chargeback in this amount? Even if it did not exceed the credit line (unlikely) why not generate a “did you approve this charge” text before permitting it to hit the account?

A lot of questions here that need to be answered.

I had been a loyal Verizon wireless customer for 25 years. Unlimited everything family plan.

Three years ago I switched to AT&T. Why? Because for my last 5 years Verizon kept sending me email bills for another customer who lives in my hometown of Greenville, South Carolina. (I got to know the accoint holder…♂️)

I kept calling and going in person to Verizon locations to get them to stop sending me someone else’s bills including information about when that family of five cell phones went over their limits etc. I showed Verizon that every email had a statement at the bottin of the page that assured me that Verizon valued privacy…

Twice Verizon told me there was nothing they could do about it. Twice I was asked, in a menacing way, « Why are YOU getting their bills?! » Twice I was told that I should change my email address.

The rest of the time Verizon assured me it would not happen again. Once they gave me, and the other account holder a $75 Credit for the « inconvenience. »

At the end of the five years I called Verizon’s legal department in New Jersey but no one would talk to me or put me through to a lawyer.

I finally gave up and switched to AT&T.

That’s nothing. Google “Citibank credit error” to learn how Citi credited a guy 81 trillion dollars when they meant to credit them $280. Yep. 82 trillion!

It’s because they outsource to Indians to book these people’s tickets and they act surprised because of the scam

For those who don’t speak in code, $100K at today’s 4.5% APY earns about $86 in a week, and Southwest’s 2022 holiday computer fiasco resulted in the DOT requiring that they issue vouchers for $75.