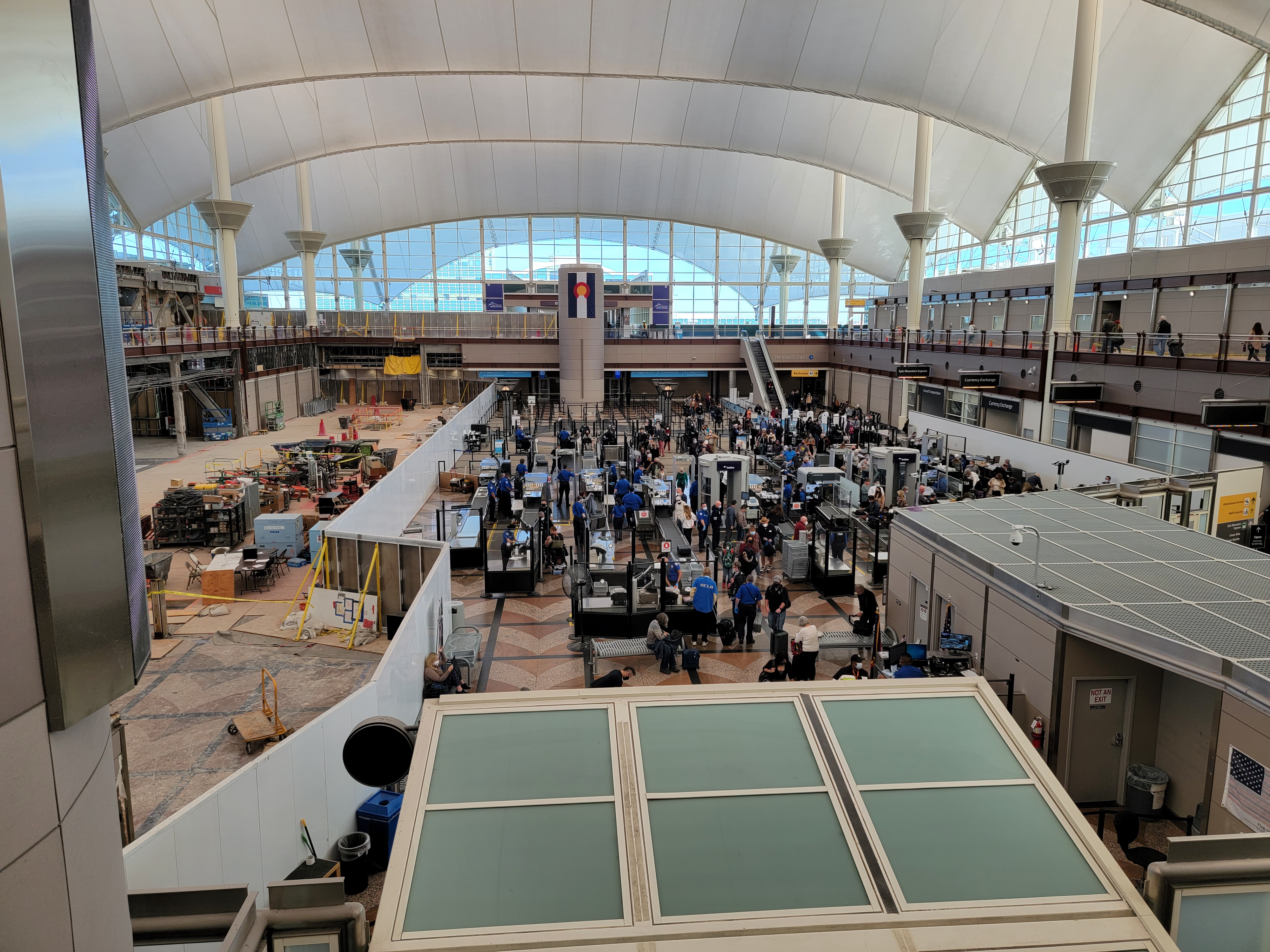

The U.S. is pretty unique is that almost all of air travel is managed by the government. Our airports are almost all owned by local governments. Unlike much of Europe, airport security isn’t just regulated by the government, screening is actually performed by the government at most airports.

The federal government directly provides air traffic control, unlike in places such as Canada and the U.K. And in the process the government provides pretty significant subsidies to U.S. airlines but often provides poor service.

It would actually be much better if the TSA wasn’t its own regulator, and if the FAA didn’t regulate its own air traffic control service. That’s the recipie that gives us poor accountability. If you don’t like privatization, at a minimum split up regulation and service provision into different agencies. That doesn’t get you all the way there, but it would be better than what we’ve got.

Airports, though, should be privatized. Municipalities own assets that in some cases are worth several billion dollars on net. But the money is locked up tight and can’t go to provide services, reduce debt, and shore up finances (including retirement obligation timebombs).

- Since airports get federal grants, the federal governments require that all airport money stay in the airport. It can’t help support the local communities that own the airports.

- But airports can be privatized, with the sale (or long-term lease, versus short-term concession) revenue going to the municipality. And the private company that takes it over is allowed to earn a specified rate of return.

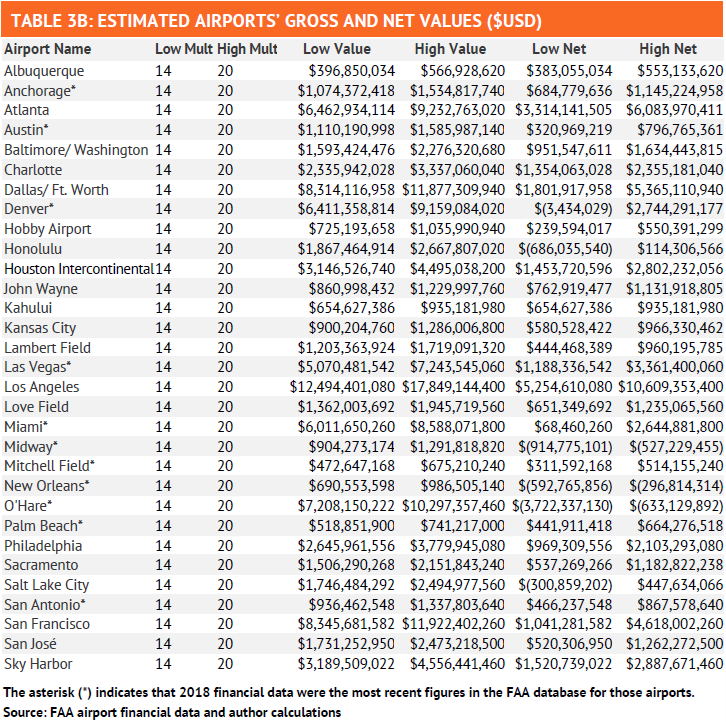

A 2021 study found that over $130 billion was locked up in just 31 airports. Taxpayers have these huge assets they don’t benefit from owning, but it doesn’t have to be that way.

- Chicago O’Hare is worth $7 – 10 billion

- Phoenix Airport is worth $3 – $4.5 billion

- LAX is worth $12 – 18 billion

- Dallas – Fort Worth is worth $8 – 12 billion

A National Bureau of Economic Research paper offers lessons from airport privatizations from around the world, some of which are surprising:

- Privatization improves airport performance only when private equity firms are the buyers, driving higher passenger volumes, more international routes, fewer cancellations, and stronger financials through investment and capacity expansion (not cost-cutting).

- By contrast, non-private equity owners, often targeting airports in more corrupt countries, show little improvement beyond pre-existing trends.

The study looked at 2,444 airports in 217 countries from 1996 through 2019. There were 437 privatizations, inclduing 102 involveing private equity. For private equity privatizations:

- Passenger volume increased 87% after privatization, and there were 21% more passengers per flight.

- Airports gained more international routes, more low-cost carriers, and had fewer cancellations.

- Operating income increased 108%, driven by revenue growth (retail + fees), not cost-cutting or layoffs.

- The gains were largest when there was competition from nearby airports and when deals were structured as long-term leases.

In contrast, non-private equity owners didn’t show improvement. Margin tended to come from cost-cutting. This difference seems to be because private equity owners incentivize larger aircraft through fee structures, expand terminal capacity, and lobby for deregulation. They break cozy ties between airports and state-owned carriers, opening access to new airlines. They bring in professional management and global best practices.

This suggests that privatization per se doesn’t guarantee improvement – but that private equity seems uniquely effective. Since airports tend to have strong regulators, wealthy consumers, and powerful airline counterparties, we don’t need worry about downsides that raise concern in other sectors.

To be sure, we expect to see higher airport fees than when profits are entirely locked into the airport and prevented from supportin gthe local community. That indirectly raises travel costs (offset by greater competition and seat capacity increases incentivized by the airport). But it’s also balanced by better service and more flights. Airlines may lose, while passengers gain through choice and quality.

Of course, airports aren’t the only assets that could be unlocked we rarely hear about. Did you know that the federal government owns over 600 million acres of land or more than a quarter of the land in the United States?

Just another way to spread the wealth and dilute other services in the process…

I seem to recall a similar argument was made for privatizing parking in Chicago to “unlock value”. That didn’t exactly work out as advertised.

Better use in the airport system than some corrupt democrat run city that doles out welfare to societies most worthless.

@ Gary — Um, not a good idea. Privatizing airports would lead to runaway lease costs, and it would give crooked politicians access to more public money. No thanks

Of course there are many upsides to privatization of airports.

A word of warning though.

Huge increases of “airport taxes and services” as we see in Canada and soon, many parts of Europe. Add another $70-90 bucks to your airplane ticket for these “enhanced” services.

Just saying.

I am surprised that airlines haven’t sold naming rights.

Salesforce San Francisco International Airport

Microsoft Seattle Tacoma International Airport

Hyundai Philadelphia International Airport

But some names are already long…

Nvidia Thurgood Marshall Baltimore Washington international Airport

Ben and Jerry’s Ice Cream Bill and Hillary Clinton Little Rock National Airport

Delta Airlines Founding Member of Skyteam Hartsfield Jackson International Airport

Nice article, Gary. You’ve raised two subjects, with the first being Federal Agencies that provide both Services and Oversight. I’d argue that in all cases, Services should be privatized, and Oversight should remain a Federal Agency. As for the value of all of the Airports, you can file this under “Why we cannot have nice things”. Politicians on both sides of the aisle will tend to spend any excess value in the near term (under their watch), leaving what used to be terrific assets as empty, valueless and depreciating non-assets. If the value is under-utilized today, so be it, I prefer that to robber-baron politicians destroying their value on useless causes.

Case Study #1 – LHR

I guess they consider PANYNJ as a private company, what a crappy study report.

Do you really want private equity running airports? If you think things at airports are expensive now, wait until private equity turns their talent for “make line go up” on airports.

Gary, you regularly rail at force maze walking through gift shops to get from security to your gate. You rail at international airports not posting gate info (to get you to linger more and maybe spend more). You rightfully point out the stupidity of removing moving sidewalks at JFK (more walking, more opportunity to impulse buy stuff)

If you like what Elliott Capital did to Southwest, you’ll LOVE what Bain will do DFW.

[Gary, I know this is just “engagement farming”. Really, a low-effort post. Perhaps you’re traveling and had this queued up to auto post]

The issue is that most major airports don’t have any competition. If private equity were to get involved, they would squeeze it for everything it is worth, just like they did with Chicago parking meters. Look up that corrupt boondoggle.

Several people have already brought up serious concerns with your suggestion. I will just add that a figure like “Passenger volume increased 87% after privatization, and there were 21% more passengers per flight.” is too vague to be useful. What was this based on in terms of what was studied, and for what period? What was the numeric baseline? And if it is across the board accurate (and not including a post-COVID rebound) could the system really handle that much of an increase?

But that last line about selling off public lands–well, the GOP is already sniffing around at that. I can just see their logical endpoint, which would be something like “Have a Geyser Burger at McDonalds-Yellowstone Park”, or “Stay at Yosemite Sam Resort at Warners-Yosemite”. Cute.

I oppose the privatization of our high-value airports used for my common carrier flights. Privatizing these airports will be but a means to rob the country and consumers Russian mafia business style.

I’ve already had enough of Project 2025 types destroying that which made America great, and they are only just getting started.

Just say no to the further Russianization of America.

I’m so tired of taking public assets and giving them to the private sector. I’m a firm believer in capitalism but privatizing public assets, from prisons to stadiums is simply citizen taxpayers underwriting profits for the private sector. All kinds of “number crunching” makes it appear a good idea. But all kinds of longitudinal case studies prove otherwise.

Do other countries with government-owned airports have artificial revenue restrictions like this?

Why not just get rid of the artificial revenue restrictions (and raise the PFC cap)?

And PS: Private equity ruins absolutely everything it touches. And aren’t there national security concerns with allowing such an important piece of infrastructure to fall into private hands?

It’s entertaining to read some of these comments. For those who oppose the free market due to man’s human nature and moral weakness, then you must, for the same reason, reject every type of government action.

Amen. The United States has Third World quality infrastructure because it is owned and managed by incompetent and self-serving politicians and run for the benefit of rent seeking labor unions and politically connected corporations. There is absolutely no reason for these services to be provided by the government and the rest of the world is proof that privatization works for people while public ownership works for the politically powerful.

That’s a bad take, Gary. @Chuck (and many others above) thankfully get it.

Public goods and services do not need to make a profit; they operate to serve the us (think roads, the military, the postal service, etc.) We all benefit.

However, as usual, @Mike P does not get anything; while he celebrates ‘free markets,’ our economy in the USA is currently captured by the ultra rich and large corporations. #47 literally is bullying and nationalizing companies, like Intel, which was recently forced to sell 10% to the government.

(Mike, please do the ‘SOURCE!?’ meme, again. Then, give us one of your ‘what did I say that was incorrect?’ And I’ll say… ‘all of it, Mike, all of it.’)

@1990 – airports *DO* make a profit. right now that profit isn’t allowed to be spent for public services. it gets frittered away. (in the alternative, it sometimes gets given back to the airlines, e.g. DFW airport basically gave American Airlines its CARES Act subsidy in rebated landing fees)

” And I’ll say… ‘all of it, Mike, all of it.’)”

That’s because you can’t beat me. I argue with facts, logic and principles. You, on the other hand, resort to slogans, worn-out tropes, and constantly avoid addressing the point made by others.

Thanks Gary, this is an interesting subject for debate. Sadly, many here will just dismiss the idea immediately, having never studied it further.

This was clearly written as propaganda and given to the “author” to spread. When will the ultra wealthy quit taking everything from the people? I guess never with lackeys like this guy working for them.

@Gary — Never said airports don’t currently make a profit; I’m saying, they shouldn’t *have to* in order to exist.

Thankfully, we don’t deal with major airport bankruptcies or closures due to financial performance, because in most places, we recognize the societal good of continuing to operate these (for-all-intents-and-purposes) ‘utilities’ for the public good.

@This comes to mind — It’s not really a debate; yet, depending on who gets in the ear of our ‘king,’ I imagine, anything and everything could be simultaneously privatized or nationalized depending on whether he likes or dislikes them. If it were the other ‘team’ doing this, you’d revolt. That’s the real problem here. And, day by day, we’re looking more like post-Soviet Russia (mid-1990s), where mafia tactics, not rules or laws, win the day. Not good for most of us, fellas.

@Mike P — Mediocre.

“I accept your surrender!”

Horrible idea.

“Unlocking value” by selling off assets is always a bad deal in the long run. And it often becomes a barrier to progress because companies have contracts that ensure they make money, thus precluding doing things a different way.

@1990…With every post, you continue to validate my position. You’re incapable of refuting my argument.

I like @derek’s idea. Nothing wrong wth collect adevrtising $$. We could even have Orange Facist Palm Beach International Aiport.

I can see nothing good coming from “unlocking” that money. The politicians will simply spend anything they can get their hands on. That goes for Ds and Rs. Then the costs will have to go up.

‘Not validated by Mike P’ is a badge of honor. “Your boos mean nothing… I’ve seen what makes you cheer.”

Sell public airports to for-profit entities that will then do their utmost to gouge passengers until the end of time – what could possibly go wrong? Oh yeah, see Heathrow.

“Privatization improves airport performance only when private equity firms are the buyers” and then nobody gets a pension and all the hard-working people who put in decades of service are squeezed from all ends by the evil vultures from Blackrock etc.

Got it.

My first thought is that privatizing airports in the US would just result in them all being owned by Blackrock, who would extract all the value from them, spin out the land holdings, and lease them back.

My second thought is that it’s a tough plan to get behind when Changi and Hamad are owned by their respective governments and are 1000x better in every way than any US airport.

This was an opinion piece, I guess the whole site is

Look at HNL, run by the state. You arrive at an airport suitable for a banana republic.

Filth, flies, bed bugs, mold …

Bathroom fixtures out of order or at least out of supplies.

If you privatize it and the operator doesn’t improve things, you can just _fly_ to another, better run, airport . You’ll miss Oahu, because the bridge is out (Hawaii is an archipelago.) (OGG is also state run.)

Another reason this Gary guy is Conservative garbage. Every single case study shows how bad privatisation is for tax payers. Just look at what private equity has done to healthcare. Every single industry that is privatized (that was once publicly owned by tax payers) gets gutted.

> The U.S. is pretty unique is that almost all of air travel is managed by the government.

You lose all credibility when you don’t even proofread your opening sentence.

Would you tell us if a private equity firm paid you to write this article?

@Prince Philip – Would I tell you? Sure. Did they? No.