While the U.S. has a reputation in the world for smaller government and greater free enterprise, nearly everything about aviation is an exception. U.S. airlines were already heavily subsidized before the pandemic, but an explicit $79 billion in appropriations (not counting tax relief and subsidies for contractors) underscored that.

However it goes far beyond that. In the U.S.,

- airports are owned by governments

- airport security is done directly by government at most airports

- air traffic control is managed by the government

From the moment a passenger steps inside the government airport, goes through a government checkpoint, and has their aircraft’s movements dictated from gate-to-gate by federal authorities, they’re in the hands of government far more than private enterprise. And nearly everything that is nominally private is regulated at a highly granular level.

Best practices for safety in both security screening and air traffic control would separate out the role of regulatory supervision from actually performing duties. The TSA, effectively, supervises itself which is bad for accountability. So too for managing the movement of aircraft, which leads to more costly service, more congested airspace, and more limited investment in technology.

In much of the world screening is done privately and regulated by the government, air traffic control is much more efficient in other areas of the world (NavCanada is a great model, and handles not just Canadian traffic but also across the North Atlantic), and airports are privately owned representing a great revenue opportunity for local jurisdictions.

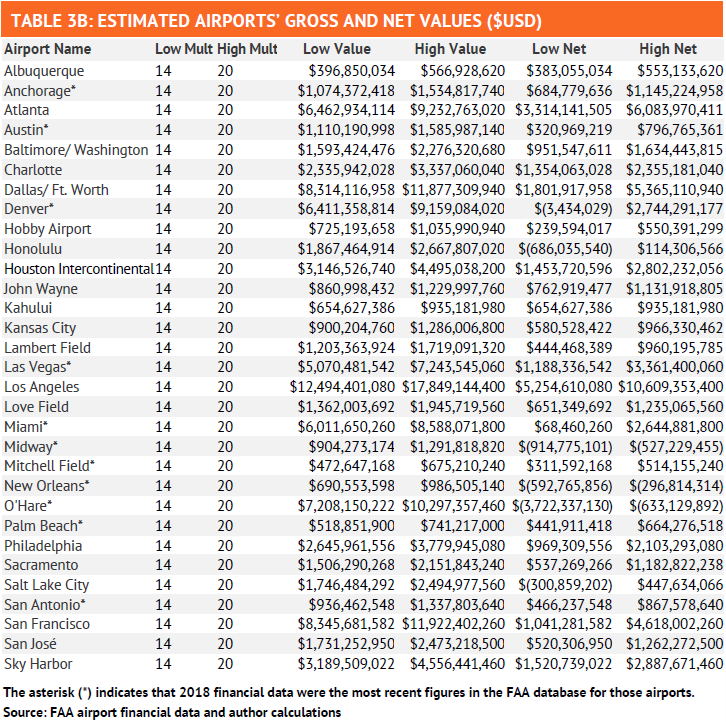

The Reason Foundation took a look at just how much major U.S. airports are worth. 31 airports may be worth $131 billion. For instance,

- Chicago O’Hare is worth $7 – 10 billion

- Phoenix Airport is worth $3 – $4.5 billion

- LAX is worth $12 – 18 billion

- Dallas – Fort Worth is worth $8 – 12 billion

Airports are worth billions of dollars, but they generally don’t contribute to paying for local services even though they’re almost invariably owned by local governments. That’s because federal regulations don’t allow local governments to receive airport net revenue (profit). This is also unique in the world – governments elsewhere generate substantial revenue from their airports.

So the way to unlock this value is not to actually own the airports. Taxpayers have these huge assets they don’t benefit from owning, but it doesn’t have to be that way. Because federal rules allow airports to be leased out long-term, with lease revenue supporting local government budgets. You can decide whether that money should pay down debt (or cover long-term pension liabilities), lower taxes, or go towards social services. But it’s money that’s mostly just locked up now (a handful of airports are grandfathered out of this, including the Port Authority of New York and New Jersey).

The Reason study has some important caveats – you’ll see both a gross and net valuation for each airport because U.S. law requires airport bonds to be paid off in the event of a lease.

There are some elements of privately-run airports consumers like – they tend to do a better job providing services passengers will pay for – there are downsides as well. Anyone that’s ever gone through the Sydney airport knows they’re routed through duty free for a reason but remember that even the Chicago O’Hare and Dallas – Fort Worth airports have removed people movers to ensure passengers walk more and are encouraged to drop into shops.

Airports aren’t the only assets that could be unlocked that we rarely hear about. Did you know that the federal government owns over 600 million acres of land or more than a quarter of the land in the entire country?

Why not sell you house too? The Reason foundation has an agenda that in the long run will mean we all pay more to use airports.

There are definitely instances in which the private sector could do a better job than current public sector ownership and operation — there’s no reason for the federal government to be selling flood insurance. It should be providing a catastrophe back-up like the terrorism reinsurance program. Having said that, the private sector operation/ownership with public oversight model assumes effective public oversight. But there are numerous examples of regulatory capture by the regulated. There are also examples of superior service from publicly-owned enterprises. Recall how Massport / Logan handled the massive snow storm several years ago (publicly-owned and operated) while KIennedy (PANJNY public oversight of privately-operated terminals) was a catastrophe. Consider also the fails of private electric utilities versus public utilities (the Northwest has a long history of successful public utility operation) or the private ownership of water systems (Flint). I imagine also that the public-private partnership models works better with smaller airports where a local government can’t achieve the economies of scale of a major hub.

this is a terrible idea. We’ve heard this libertarian stuff before. Privatization has already gone too far, as we can see in the healthcare, prison and military industrial complexes. In the long run, grand scheme of things, privatization does not save money, because the airports (or whatever is being privatized) will have to generate profits once they are privatized– profits that do not go to the taxpayer.

Ever wonder why “airport taxes” are so sky-high when you depart in Europe? $135 or whatever in Frankfurt, vs. $5.60 or whatever it is in the US?

My own horrific experiences with privatized airport security in frankfurt and other european airports make me think that whatever shortcomings the TSA has wouldn’t really be helped either.

Leasing airports out would just mean another party is trying to make a buck — off of us, the travelers, of course.

The argument that a few things are not efficient in government institution means that we need better more efficient government — not undermining what we have more trying to get rid of it. Anything a private company can do, the government can theoretically do too, and cheaper, because there is no need to make a profit. Many countries in the world have government that works — if we don’t, that’s our fault.

Without commenting on the specific issue, it is worth noting that academic research is compromised . . . let alone research by some think tank.

It is all too common for us to believe that research performed by academics is unbiased. If economic interests are involved in the subject matter, the research will absolutely be biased.

Someone or some organization with an economic interest “sponsors” the department or the professor’s seat in the department — so, the school can say that the specific research project itself was not sponsored by the person / organization with an economic interest. The academic results desired are essentially purchased and then used to support the sponsor’s position.

==========

Turning to the subject at hand, it would be worth privatizing one major airport to see how it goes — wading into the pool so to speak. The benchmark of success should not be cost alone. If services meaningfully improve, that’s worth something.

Such a venture would not be dissimilar to utility “franchises” granted by government bodies and a public utilities commission (for better or worse) would be the likely regulator. The question is whether the regulator would impose a scheme that is terminal (no pun intended), such as the electricity scheme adopted in California roughly fifteen years ago.

@Reno Joe we do have one example in the US. San Juan, PR’s airport is privatized and they have done a reasonably good job with it.

There are several very good reasons for airports to be locally and publicly owned

1. Airports are enormous parts of the economic development strategies of cities and regions. Even if the profits do not pass to the city, Atlanta has recognized the enormous benefit that ATL brings to the city and the region with an outsized positive impact. Atlanta, like Detroit, has managed to run their airports much more efficiently than the region and given the primary carrier the ability to have a strong say in keeping costs down. Cities like Pittsburgh built a massive but expensive terminal complex and lost the hub in part because it was so much more costly. As the most cost efficient large airport in the world, ATL is assured of abundant air service for decades to come; with costs per enplaned passenger that are almost 1/10th of airports like ORD, it will make sense for airlines in ATL to support routes that will not work in other cities.

2. The free enterprise system works where there is competition but utilities and transportation infrastructure have monopolies in their region. Privatizing simply adds a profit margin markup that has to be passed ultimately to consumers.

3. US tax law favors government bond and that tax advantage might not be available for privately owned public assets.

And then you have abundant examples of toll roads that are under concession even in the US and they aren’t in any better condition – and often worse – than publicly managed assets. Local control provides the greatest accountability at the lowest cost for most public transportation assets.

Interesting that the two Nation’s airports are not included. Oh wait, is it because they are owned by the federal government?

So Austin can’t keep it’s airport profit.

Who gets it? Feds? Is is plowed back into operations? Or is the airport run “at cost?”

I am so happy with the fact that the cable company in my town owns its own cables said no one.

Who’s on the title makes no difference as to quality of services: to the contrary, cable companies suck probably because they own their cables so they are monopolies that governments can’t kick out.

I’ve seen a few privatization activities during my time in Chicago, and they haven’t gone well. The Chicago Skyway was privatized, but in an attempt to make it profitable, the prices were raised so high, that people took longer and slower routes to avoid the high tolls. Chicago privatized their parking meters, but so many handicapped people could skip paying that the city had to reimburse the party who were running the concession. I can’t imagine what Covid did to that arrangement. Finally, there’s the Indiana Toll Road, where the original lessor of the road has to declare bankruptcy, which is not uncommon in these highway deals. If O’Hare had high fees, the northern suburbs would be more likely to fly out of Milwaukee. Probably not the business travelers, but the leisure travelers would, some already do it.

On top of this, much of the airport infrastructure was funded with Federal tax money, so why should a municipality be able to extract that value that we already paid for? The biggest downside of public airports are the connected insiders who get the contracts for concessions and construction, who build campaign contributions into their bids. But anyone trying to put a lease deal together would run into the same thing. Every form of transportation has some form of government subsidies, all the way to bicycling. While it would be great for everyone to pay their way, it’s not always easy to determine how to do this fairly.

@Omar

SJU is not privatized, it is still owned by PR. What PR did was issue a concession to an operator to manage it – kind of like what JFK does with each terminal. PR had to do this because they were broke and could not issue the bonds to support updating the airport.

I disagree. Private enterprise is great in a lot of situations but airports are not one of them. While the TSA has many issues, overall there’s no way that a monopolistic private company is more trustworthy than the federal government in this circumstance. Remember that charming move some months ago where Heathrow decided to jack up fees on customers because the privately owned airport wasn’t making as much money as the shareholders liked? That’s exactly why a transparent and publicly owned airport system is vital. Many people don’t have multiple viable airport options so if their airport went private and started screwing them over rather badly there wouldn’t be much – if anything – they could do.

I’m suspicious of anything coming out of the Reason Foundation, Cato, or any other libertarian think tank. It sounds too much like “I’ve got mine, so f you.”

The price passengers pay would go up if the airports were privatized, because now there are shareholders who want their dividends, and the CEO who wants his bonus based on an inflated stock price. Not to mention Wall Street hedge funds trying to game the stock valuation.

@Sal it’s not quite like JFK. PR basically leased the airport to the company which has full control to run it as it sees fit. That’s the kind of privatization I believe is being discussed in this article not an outright sale of the asset.

Further privatization of public transport infrastructure in the US is a recipe for disaster and the public being fleeced. The cronyism in favor of the rich and well-connected would only get even more extreme and do so for the detriment of the general public in the country, all while providing concentrated benefits to a small minority at the expense of the vast majority.

That Reason Foundation should call itself the Koch Stooge Asylum.

The problem with privatization is that for the most part, local government owners view the “sale” as a source of a cash windfall to bail out their overleveraged pension obligations or blow it on some stadium boondoggle. Then the debt gets taken out by a private party to pay for the “sale” (at inflated rates due to higher risk and lack of muni bond tax exemption) and in order to pay back the debt and a nice return to the private investors, there has to be a combinations of cutbacks and cost increases to users to make the numbers cash-flow out.

Let’s improve how our weaker public authorities like PANYNJ run our airports instead of selling off the family silver. A lot of public authorities— e.g. MWAA, Massport, the City of Charlotte—all do a fine job managing their airports at reasonable prices for fliers without the involvement of private equity geniuses that fund Reason Foundation studies.

Maybe Biden could just take out a Reverse Mortgage on all the airports? 🙂

Since most airports in the US aren’t federal government property and your suggestion can’t be done even otherwise under current circumstances, you’ll have to go pay for a fraudulent “Trump University” real estate class.