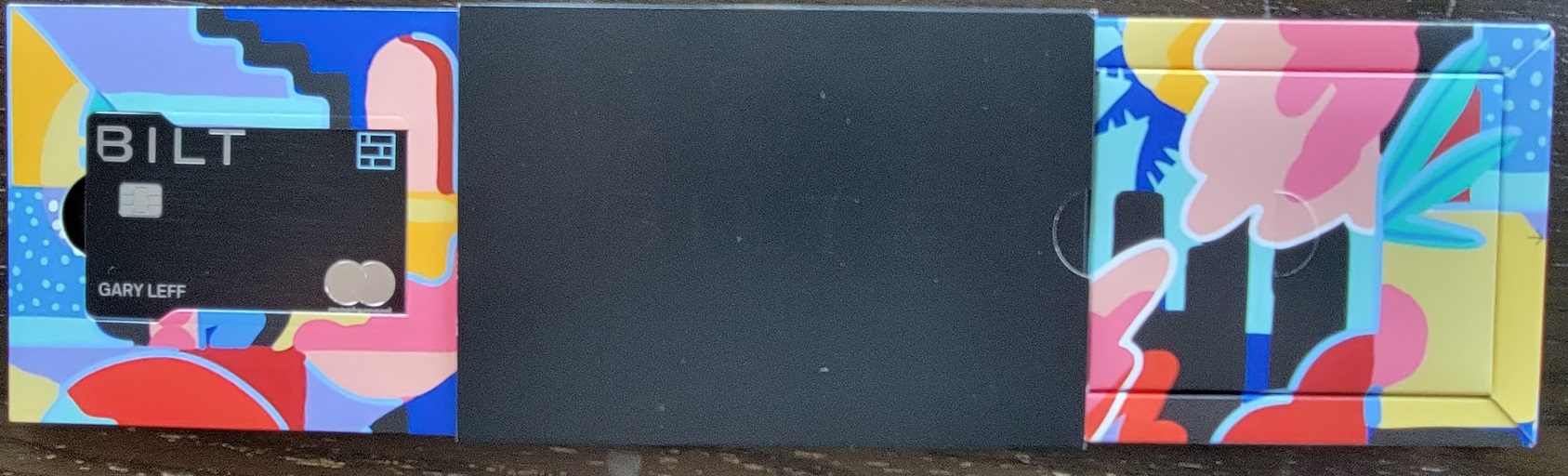

We’ve been waiting on Bilt Card 2.0 for a year. It’s coming February 7. Details will be shared January 14. There will be three cards, and that’s the date existing cardmembers can choose which card they want. Here’s how the transition will all work.

We have already known some of how the transition away from Wells Fargo to Cardless.

Cardless will offer the Bilt card starting in February, with existing cardmembers transitioning, and there will be (3) cards to choose from. Existing cardmembers will be able to choose which of the three cards they want with no hard credit pull. New cards will be delivered for a February 7 cutover.

- No annual fee, as today

- $95

- $495

We know that:

- Card number stays the same, so no need to change any auto-billing.

- Therefore digital wallets auto-update and both Apple Pay and Google Pay will auto-refresh with the new card.

- All three cards will earn points for mortgage payments (“regardless of who your mortgage is from”)

You can no longer apply for the existing Wells Fargo card. Existing Wells cards work through February 6, 2026. Existing cards have the following options:

- Close Wells Fargo card, or have them send you a Wells Fargo Autograph Card with new card number (Not Autograph Journey, and I do not believe they allow product changes to Autograph Journey)

- Any balances you’re carrying on the card can be kept with Wells, or transferred to the new card.

New details of the transition are now available.

- Details of the (3) new Bilt Rewards credit cards drop January 14, along with the ability of current cardmembers to select the one they’d like.

- You’ll have until January 30th to select the new card “to ensure a seamless upgrade” which means same card number; auto-updates to digital wallets; no hard credit inquiry to get the new card; card arrival by February 6th so you’re ready to use it when the old one stops working.

- If you do not select a card by January 30th, you’ll just transition to Wells Fargo Autograph.

- Selecting a new card gives you the option to move account balances “shortly after February 6” and to close your old Wells Fargo account if you wish (if you don’t want them to send you an Autograph card).

These choices will all be available in the Bilt app. This is as easy a transition as I’ve seen with any change in issuer. I don’t think I’ve ever seen a product choice at the same time as the transfer. I’d have probably fought to make the change automatic rather than opt-in (so if you don’t select a card you get the no annual fee option by default). Relying on customers to make the choice will surely shed a lot of cardmembers. But that may have been too expensive.

On the Wells side I sure wish I had the option to opt into Autograph Journey, though I could always apply for one. Now that Sapphire Reserve no longer earns 3x on all travel, Autograph Journey has a real use case: 5x on hotels; 4x on airlines; 3x on restaurants and other travel and points transfer partners. They haven’t allowed Autograph -> Autograph Journey product changes. And I don’t really value any of their other currently-available cards. I might product change to Active Cash, but I value that less than spend on my Venture X (2x on everything) and less than a Citi Double Cash (because 2x from Citi means better transfer partners than Wells offers).

The other thing I wish for, but that’s not realistic, is that the new Bilt card wouldn’t take up a Chase 5/24 slot. But even with the same card number, it’ll be a new card from a new issuer with a new account opening date. I assume I’ll really value the new products enough for this – after all, they’re introducing points-earning for mortgages (something sadly no longer available with the Mesa card).

I have a feeling I’m going to like some of the features of their $495 fee card – though, and I have no inside knowledge here – I worry that you’ll be paying for a Priority Pass membership and I already have four of those. So not valuing Priority Pass, there’ll likely be a pretty high hurdle to sell me the premium card. Let’s see what kind of value they deliver!

As a mortgage holder, genuinely curious about this. If I can pair mortgage earning plus Rakuten transfers at 1:1 past 5/15 with one of the ‘fee’ cards, could be a real winner.

Step 1 — Close whatever card Wells Fargo sent me in the mail. Step 2 — Continue ignoring Bilt and wait for their bankruptcy to occur.

Basically it comes down to sign up bonus. If Cardless offers bonus, take the autograph and apply for new Bilt card.

Winter is coming, @1990?

Isn’t Gary the Cardless propaganda machine?

When Gary claims it’s not going to hit 5/24, it hits.

So if Gary says he doesn’t know, he probably knows.

Lotta hope-ium going around with this. I remain skeptical, not pleased about 5/24, and ‘cool’ with no hard pull. Calendar reminder set for January 14. Can’t wait to read-up on all the ‘fine print’ on how screwed we all are… yippie! Mesa! Celtics! Lehman! Lol.

@L737 — Oof. It seems winter is here, according to @Gene, at least.

Does anyone think it’s a bit odd for them to not give the details of the 3 cards. That to me seems to signal most people are going to be very disappointed. Just saying….

@ 1990 — Ha! 😉

@Mike they’re giving details of the card weeks before the card is available, which is unusual. You want to release details in conjunction – or at least as close as possible – to when customers can actually apply. That’s how you generate excitement and applications. Releasing the details of the product *now* and not taking applications until February would be a poor move for building the card portfolio.

As I am not a renter, I do not currently have a Bilt card. I do have a mortgage and have been waiting for Bilt to offer points for mortgages. You address transition for existing card holders. Could you please supply info for potential new card members?

Thanks!

I wonder if they will allow multiple mortgages and the limit to mortgage amounts.

multiple rents/mortgages….

only one non-BILT (you know if you live in a BILT apartment/home) address per account. but you can pay HOA or other fees but it is not anything goes.

we already had one non-B so spouse opened account to pay our second home HOA fee.

New York City rents are potentially $10ks so limit would be high. And have never seen a “rent” limited to home so commercial rentals possible.