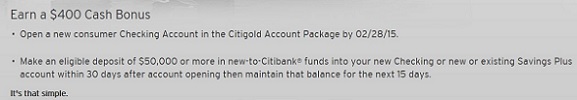

Citibank is offering $400 for opening a new Citigold checking account by February 28.

You have to deposit $50,000 within 30 days to earn the bonus but you only need to keep the funds there for 15 days.

The bonus funds don’t credit for 90 days so you have to keep your account open that long — pull the funds after 15 days, you’re looking at $90 in fees but net of $310.

$310 in 15 days on a $50,000 deposit should work out to something like a 15% annualized return on those funds.

Obviously this offer isn’t for everyone or even for most, it’s a good return for those with $50,000 liquid. It highlights how valuable a new high net worth account is to the bank — though it’s striking that they only require the funds in the account for 15 days, they’re certainly open to hot money and being gamed. That tells me the key metric for marketing is accounts in this category opened, not profitability of those accounts.

(HT: Joe Brancatelli)

Taxable and time-consuming…

This looks interesting. What is the $90 in fees you reference?

If you have $50,000 cash sitting around, you’ve missed out on potential gains of over $100,000 in the past 6 years just by investing in a basic index fund.

I see now. I was a able to pull up the info. Saw it was $30 per month fee if under $50K.

One way to work this out is to withdraw from an IRA and redeposit the money back into your IRA within 60 days (per IRS rules to avoid being taxed/penalized on the early withdrawal). Not worth the complexity and risk for me personally, but this strategy could work for others.

I just applied. Will this result in a soft or hard pull?

The fees killed me on this one, though Jon’s IRA method would be worth trying if you planned to keep the account for the long term. I’d modify it, though, and just to a bank-to-bank IRA transfer. You never have to touch the money yourself.

@Preacher, I’m guessing you’ll be the first to know!

You will also pay taxes on the $400 so it’ll be more like $280 or less

Citi is such a pain in the 8ss when it comes to these bonuses.

I had to waste so much time to get them to honor the $500 sign up bonus. One of my readers did the same and he wasn’t able to get the bonus (though I’m sure he wasn’t as persistent).

http://therewardboss.com/2014/02/10/open-a-citi-gold-checking-account-get-500-expires-22814/

After the hassle, taxes and fees you’ll pay, this is prob not worth it.

better than leaving it in a money market at your existing bank for the next 90 days, and better than a CD in terms of cost to get it out over the next 90 days of you need it. That’s what this offer competes with.

If anyone parks $50,000 into a bank account for $400.00 after 90 days is:

1) Thinking poor

2) Have to report each deposit and withdrawal over $10,000 to the IRS.

3) Pay the highest tax rate on that cheap return + ObamaCare penalties on the gross (or you’re paying more for ObamaCare)

4) Giving $ to Citi to fund their peanut $4 Billion USD given to the DOJ.

In the past Citi gave $100.00 for a $1.00 deposit, thus they are kidding no one.

It’s a great deal. Comparing the ROI to the stock market is foolish, as the Citi offer is a risk-free rate of return. Comparing it to treasuries would be more appropriate.

@Cogswell,

Nobody cares about the past. Do tell me about the performance of the stock market over then next 3-6 months.

I can give you several examples of bear markets lasting for more than a decade.

@ABC

Yes of course we can’t guarantee stock market returns in the future.

But after taxes and the fees mentioned you are getting less than $190. Is that even worth a couple of hours of your time and the inevitable follow up when the bonus doesn’t post?

$50k invested in a tax advantaged account will obliterate this deal in the long term

According to a February 17th entry on this blog (credited to Doctor of Credit), you can use a non-AmEx credit card to fund new Citi checking accounts ( http://viewfromthewing.com/2015/02/17/open-citibank-checking-account-fund-credit-card-earn-points/ ), even in an amount that would completely meet the requirement for this offer.

So, if everything works out right, you fund this account with $50k from a credit card that does not code this as a cash advance (Barclays cards reportedly work), leave the money in place for two weeks, pay off most of the credit card from this new account and earn the credit card rewards from $50k spend plus plus the $400 account opening bonus (90 days later, less tax). If you used a 2% cash back card, that’s $1400 (before taxes), which might be worth the effort and risk (mostly the risk that the funding credit card transaction would be treated as a cash advance).

Poor Mr. Ed. He so needs a life.

Personally, if I had the time, I’d open the acct. Unfortunately, I am too busy trying to earn money the old fashioned way. But, if I were retired I would do it.