Earlier in the month I wrote about how much money US frequent flyer programs have earned so far this year. While offering some caveats, one analyst’s figures are as follows:

| Airline | Marketing Revenue Jan-June 2018 | Year-Over-Year Increase | ||

| American Airlines | $1.15 billion | 10% | ||

| United Airlines | $962 million | 12% | ||

| Delta Air Lines | $805 million | 12% | ||

| Southwest Airlines | $563 million | 14% | ||

| Alaska Airlines | $215 million | 3% | ||

| JetBlue Airways | $80 million | 23% | ||

| Hawaiian Airlines | $34 million | 53% |

There’s no need to do back of the envelope with Qantas, in fact Qantas shares real numbers about its frequent flyer program. During fiscal year 2018:

- $272 million profit (up 1%)

- 24.1% margin (down from 24.5%)

- Qantas points-earning cards issued grew by 7%

- 12.3 million program members (up 4.2%, their Woolworths partnership is a driver)

The biggest thing that holds down profit at Qantas is interchange regulation. Rewards credit cards aren’t as lucrative.

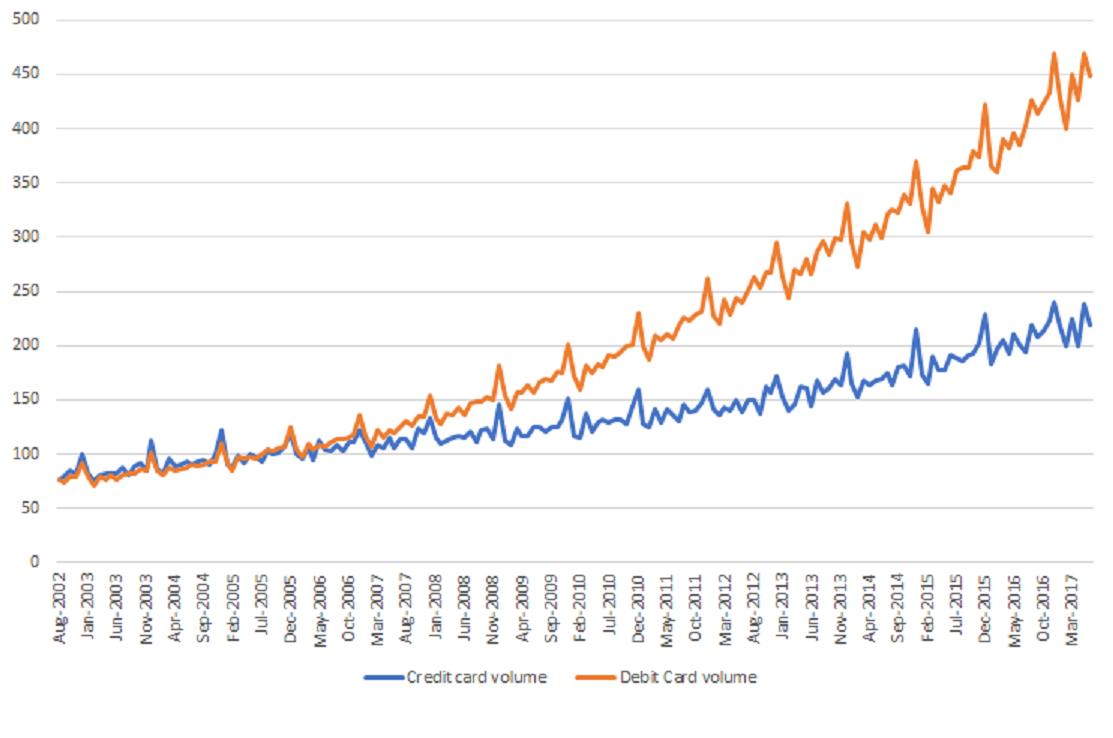

In 2002 the Reserve Bank of Australia introduced new credit card processing rules – starting in 2003 (1) interchange fees on four party card networks (i.e. Visa and MasterCard) were capped and (2) merchants were allowed to pass these fees on to consumers. The goal was to get consumers to use cards less by reducing rewards incentives.

Interchange – merchant swipe fees – fell by 50%. Annual fees grew, issuers capped the rewards you could earn on many cards (thus encouraging consumers to switch cards when they hit the cap). Consumers moved to debit cards and American Express cards which initially weren’t covered by the cap.

Source: Reserve Bank of Australia

It doesn’t take much to extrapolate out to programs 8 times the size in the U.S. and with greater margins on credit card business, suggesting that the estimates for US programs seem order of magnitude reasonable. It’s also no coincidence that Qantas devalued in a huge way a year after interchange regulation went into place. Instead of offering, say, half as many miles per dollar on credit card spend they started just charging twice as many miles for many awards (though in some cases more).

Credit card interchange regulation in the U.S. would probably mean just less lucrative earn for future spend, but devaluation of existing points balances. Perhaps just as much of a risk is that the same effect could be driven by new payment technologies which compete down interchange rates.

Is that in Australian dollars? $272m profit in USD with a 24% margin would mean revenue over $1.1 billion and make them tied for largest in the world by revenue which doesn’t sound right.

@ Rob it is right. The figure is in USD. QFF is insanely profitable, and has been for a number of years. In comparison Qantas international had 399m AUD EBIT, which is around 290m USD. On a margin basis QFF is the most profitable segement in Qantas group, exceeding all of their flying business.

Can someone elaborate on why the Australian central bank would want to push people away from credit cards?

@David Pretty crazy considering AA has 100 million members and qantas has 13 million.

@121pilot. The reason Australia’s central bank did this was a sort of fairness crusade. Their logic was that merchant fees were high which was passed on to all customers by the merchant in the form of higher prices for things so the merchant could cover the fees charged by the card companies. But the bank would then take those fees and invest them in offering rich credit card rewards. So it was seen as everyone is paying more, but only credit card users are being rewarded. As an economist, I can respect that the central bank is concerned with inflation management and eliminating this overcharge then reward scheme reduces inflationary pressure on prices by a small amount, but it feels very paternalistic to me to assume consumers are too dumb to know what is best for them.

I have a hard time imagining interchange regulation in the US beyond what was enacted on debit cards. While merchants love to b!tch and moan about the max 3% they pay for credit card payments, it isn’t as though cash management, insurance, and losses are costless to businesses.

With apologies for the cynicism, the RBA did it because the retail lobby was stronger than the banking lobby. Tellingly, the ACCC have since had to come out with regulations that restrict retail surcharges to the actual cost of processing the transaction.

Andy 11235 – i’m in retail. 3% sucks.

The main reason QFF is so profitable is that they have the local card market in their grip. There are four main banks in Australia and each of them issue Qf cobrands and also offer points transfers on their proprietary rewards cards. The end result is that 33% of all card spend in Australia goes through a QFF earning card.