I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I gave a talk recently where I promised that 90% of the people in the audience would walk away with a minimum of $500 in value right away, that some people would get as much as $20,000 in value, and that they’d be able to use the information over and over too.

That’s actually pretty easy to do. One audience member is a JP Morgan Private Bank investment client, and has a credit card that offers him free United Club membership. He didn’t know that, and he’s been paying for United Club for years. Most people didn’t know about trip delay or lost baggage benefits either.

We talked about tracking miles (such as using AwardWallet), and earning the most valuable points — transferable points like American Express Membership Rewards and Chase Ultimate Rewards — and always earning more than just one mile per dollar for their spending.

I helped folks decide to close some of their high annual fee cards, too. For most people it’s important to have one premium Chase card whose points transfer to airline miles.

- Chase Sapphire Preferred Card earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. The card earns two points on travel and dining at restaurants and 1 point per dollar spent on all other purchases worldwide.

- Ink Business Preferred℠ Credit Card has an 80,000 point signup bonus after $5000 spend within 3 months. That can even be enough for a roundtrip business class award ticket between the US and Europe.

It earns 3 points per dollar on travel — that’s airlines, hotels, rental cars, tolls, even Uber — and 3 points per dollar on shipping and advertising on social media and search engines, so great for anyone who advertises on Facebook or Twitter, or who spends money advertising with Google. It also comes with $600 protection against theft or damage when you use it to pay your cell phone.

We talked about the approval rules for various credit card issuers, including Chase’s “5/24” that they won’t approve most people for new card accounts that have had 5 or more cards opened in the last 24 months.

And getting started in the hobby with the Chase Sapphire Preferred Card is the no brainer to begin with. You see the value of the points once you’ve successfully redeemed them, and then take the next step with a higher annual fee card or a small business card.

The points from all three of these cards transfer to:

- Airlines: United, Southwest, British Airways, Singapore Airlines, JetBlue, Virgin Atlantic, Air France KLM, Aer Lingus, Iberia

- Hotels: Hyatt, IHG, Marriott

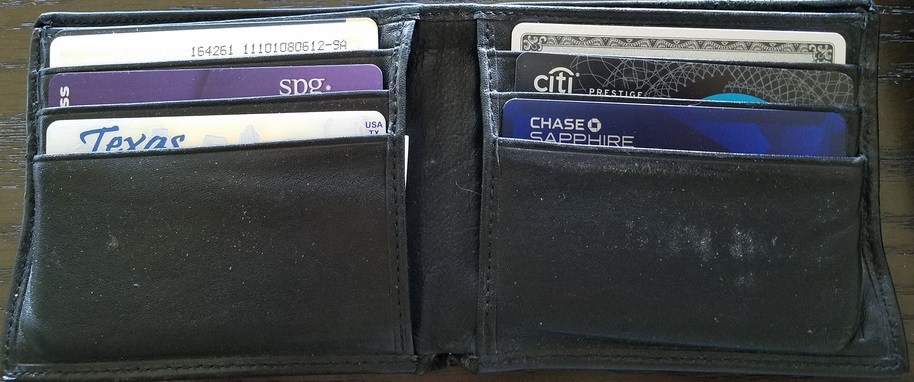

I did show everyone my wallet by the way (but only because they asked).

This is all basic and obvious stuff to regular readers of frequent flyer blogs. But for the executives in this audience it was new.

Getting up to $20,000? Well a few couples decided to get both the

Just be careful recommending the “credit card game” to people who aren’t EXTREMELY good with their finances. It’s not obvious to most of us, but the vast majority of people are TERRIBLE with money. They will sign up for these credit cards and not pay off their bills — and then be worse off with all the interest. It sounds nuts, but how do you think the banks can be so generous with the sign-up bonuses? If you want to talk ethics about this hobby, you have to serious consider this. Many of the people you recommend these cards to will get in trouble with them. It’s just reality.

“Get $500 – $20,000 in Value…”

Was that couple about to pay $20,000 out of pocket for that vacation if you didn’t show them an alternative way?

I track my savings every year and it is normally around $8,000/year, all airfare is coach vs. actual price, hotels vs. actual price, and net of all annual fees. No value placed on benefits other than travel credits. So not bad and it’s not free, normally it’s around $2,000-$3,000 for $10,000-$12,000 of travel.

This year alone my husband and I have gone to Mammoth CA,flown to the Philippines (and also Sabang Palawan) on points. Headed to Sorrento, Croatia, Greece (Mykonos, Crete) for the summer again hotel and airfare on points, then back to Mnl and then New Year in Japan, In between are trips to Tucson and SFO again all on points plus SW companion pass. Ditto on the AF expenses, but so worth it. Talked to people have posted about it, but few would take the plunge because it does take work. For me it’s fun. Would I have paid for the trips out of pocket? Most of the aforementioned ones yes. Would I have stayed in the same hotels for the Europe trip (which would have cost 20K+++ Euros alone)? We won’t know and the beauty of traveling with points, we won’t have to know. Because of points, the world has become a much smaller, more beautiful place. Points have allowed us to explore and extend our circle of friends tremendously.

It’s amazing to me how many people, including most of my family, believe that playing the miles and points game is unethical and shady. At first, they don’t believe me when I say I’m flying first or business and then, when they see for themselves – the pajamas, etc., they become jealous and suspicious. Now, I no longer try and persuade them of entertaining the hobby, even if they are financially responsible. I wish someone had told me about it long before I discovered it for myself! Thank you, Gary, for all your insightful articles – they have made a real difference in my travel life!

I like how you have your affiliate marketing-affiliate commission disclosure clear and concisely available to be seen in the header of this blog post, Gary. I see you’re serious about your “side hustle millionaire $ gUaP $” from making money in affiliate marketing. I applaud you for that b/c I’m in affiliate marketing also.

I’m sure you address this ad nauseum in other posts, but I still fail to see how one can claim a first class ticket and five-star resort stay is “valued” at $20,000 when clearly most/all people are not paying that much. It is “priced” at $20,000, which is very different.

$5-10K list price for longhaul business/first is worth maybe 25% of that in cash. (For me, YMMV, but it is demonstrably NOT 100% of that, what with revealed preference and all…)

$20,000 in value is quite a stretch. Worse case scenario and you can pretty regularly just buy the points needed in your example (2*150,000) for around $6,000 through most programs. And that’s with about 10 minutes of effort.

Why so negative. I had a trip with two Cathay Pacific FC tickets to Thailand that sold for $26,000 each and that I got with AA miles. Would I have paid it? No friggen way! But did I absolutely love it and feel richly rewarded? You bet. Find other things to complain about. in my experience, those who complain about this never did it. If you had, you would feel the same way I do.

Years ago I had the AMEX Black Card. Occasionally I got $500 gift cards and used one to buy a $500 sweater from Barneys in NYC. Would I have paid that? No way. Did I LOVE the sweater? I sure did until my wife put it in the dryer!!!

Gary, thanks for putting the card value in perspective, even if they are a bit exaggerated. Most people i

I know are dismissive about my advice on earning award points, but as soon as I post photos of me and my family members flying First all I hear is how lucky I am or how I must be rich. Seriously, it seems people are unable to put 2 + 2 together to get 4.

@Gail Very interesting comments. I have seen people say how do you do it. Then they say that is too much work. These people have good credit so getting a card here and there is not an issue. However some may view credit cards like a loaded gun. And they think its a scam like you mention. I think its a small overall percentage of flyers for any given airline that redeem the majority of all awards.

@Gary: Why do you carry the Citi Prestige and the AMEX Platinum? They duplicate lounge coverage.

@L3 – I no longer carry Citi Prestige although with the changes in earn, and a desire to diversity currencies (have tons of Chase, Amex) I am considering focusing on either Citi or Cap One.

I’m with those who question the “valuation” of these aspirational awards. One way to look at it – if some days those tickets are priced at $20,000, while other days they are priced at $15,000, would you actually care enough to redeem your points preferentially for the $20,000 days? Would you decline to redeem for a day the flights list for $15,000 and hold your points for a day they’re “worth” $20,000? If not you are passing up a supposed $5,000 in “value,” which actually you know doesn’t exist and you don’t care about.

I think Gary himself has made the point that the true value of points is that level at which you are indifferent to holding the points or cash. So if someone offered you 150,000 Chase points or $20,000 cash, which would you take? Or would you be indifferent?

Note I am not saying don’t redeem 150,000 Chase points for a premium experience. That’s fine. I am saying it’s pointless to brag you got a $20,000 “value” out of it.

This article was posted on April 1st – just saying – made we wonder

I could use a good $20,000 right about now for PPC advertising. 🙂

@Cohagan

You can buy the points for $6000 but you are not guaranteed to be able to use them. Yes saver awards or anytime awards can be 110k miles-180k miles for first class but if only 1 seat is opened up once in a while, if you want to guarantee a seat you do have to pay the $20,000 list price.