Air Canada along with Aeroplan’s financial partners has made an offer to buy Aeroplan, the spun-off frequent flyer program with which Air Canada has an exclusive agreement through June 2020.

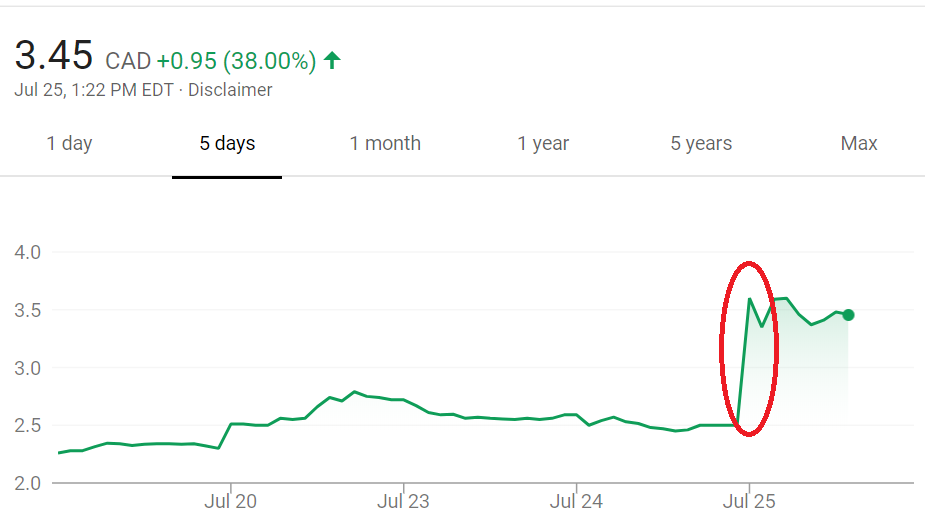

The market seems to like this deal, or at least believes that the move signifies some deal will occur at a price premium over prior-day trading.

Aimia, the parent company of Aeroplan, has now issued a statement. They basically have said we know about the offer, we’ve actually been talking to Air Canada and partners about it for some time. And they’ll respond in due course.

Aimia Inc. (TSX: AIM), a data-driven marketing and loyalty analytics company, today confirms that it has received a conditional proposal from a consortium (the “Consortium”) consisting of Air Canada, The Toronto-Dominion Bank, Canadian Imperial Bank of Commerce and VISA Canada Corporation to acquire the Aeroplan loyalty program business (the “Proposal”), and acknowledges the press release issued by the Consortium earlier today with respect to the Proposal.

This public Proposal follows prior private engagement and discussions between Aimia and the Consortium. The Board of Directors of Aimia had formed a special committee of independent directors (the “Special Committee”) some time ago in connection with such engagement and discussions and had engaged legal and financial advisors. Further to its ongoing mandate, the Special Committee will consider this Proposal in consultation with its legal and financial advisors to assess whether the Proposal is in the best interests of shareholders and the Company as a whole and will make appropriate recommendations to the Board of Directors.

Given the nature of the Proposal, shareholders of Aimia do not need to and are advised not to take any action with respect to the Proposal at this time. Aimia intends to provide updates if and when necessary in accordance with applicable securities laws.

Notwithstanding the Proposal, consistent with the Company’s announcement on July 19, 2018, Aeroplan remains committed to maintaining differentiation on exceptional value and delivering a more flexible and enhanced experience for the engaged base of five million members.

In the meantime Aimia will continue planning what the future of Aeroplan looks like as an independent program.

So they claim to be a data-driven marketing and loyalty analytics company. Could they, in essence, sell back Aeroplan and focus on their other business ventures? Or is Aeroplan their only real business venture?

The funny thing is that Aimia has over 300 million in cash reserves. So, Air Canada could essentially devalue the outstanding points liability from 2 billion to almost nothing and still put 50 million in their bank :/

@sullyofdoha – Air Canada is not trying to buy Aimia, just the Aeroplan program