Air France KLM’s Flying Blue is the best frequent flyer program in the SkyTeam alliance. It’s legions better than Delta SkyMiles. At the airline’s investor day, they explained how they’ll be doubling down on the loyalty program to drive profits, as relayed by Brian Sumers in his invaluable Substack.

U.S. airlines see loyalty programs as cash cows. That’s not as true elsewhere. In Europe and Australia, credit card interchange is regulated, so rewards card deals aren’t as lucrative.

- In Australia, we’ve seen Qantas make each point worth less in order to keep awarding around one point per dollar for credit card spend. (Card fees have gone up, and in some cases points-earning has been capped.)

- In Europe the cards themselves aren’t as profitable, and the deals look different. For instance a past Air France-American Express deal involved sharing the interest paid by cardmembers rather than buying miles from the airline.

- So it’s a profitable strategy to look to the U.S. market. Air France KLM has become a transfer partner of all of the major currencies, in order to get a piece of lucrative U.S. credit card rewards.

In fact, Air France KLM has pursued an explicit strategy of improving their program so that it’s attractive to U.S. customers with points to transfer. They re-introduced an award chart, added free stopovers, and reduced the cost of business class awards.

While the largest U.S. airlines were able to raise $6.5 billion to $10 billion backed by their loyalty program, Air France was able to raise over $1.5 billion. They can’t reproduce what U.S. airlines can, but they have strong revenue and prospects.

At Investor Day, the airline shared that:

- Flying Blue accounted for 15% of profit in 2022

- That’s about $200 million

Here’s key data about the program:

It has about 22 million members, and 13 million active members, defined as “having earned or redeemed miles over past 36 months.”33 percent of total members are based in France.

12 percent of total members are based in Belgium, the Netherlands, and Luxembourg.

72 percent of total members come from Europe.

Another 12 percent come from North America.

This year, Flying Blue members have accounted for 41 percent of all flight coupons sold by Air France and KLM, but 47 percent of revenues. According to the company, this 6 points of difference is worth €1 billion in revenue.

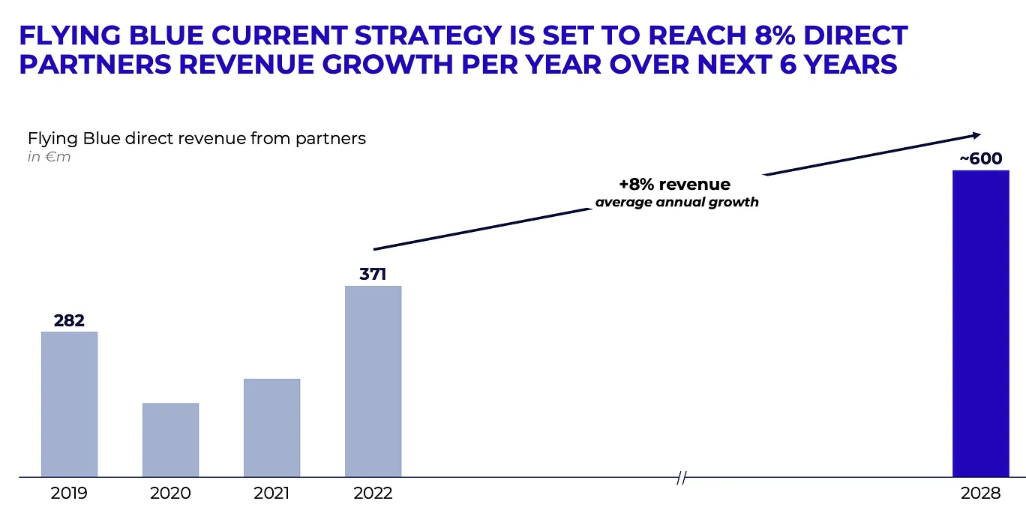

They have plans to grow revenue from selling miles to partners by 8% annually, increasing the percentage of miles sold to non-airline partners to 60% by 2028.

- Build out their new Canadian co-brand card

- Focus on German and UK card market

- Sell more miles to U.S. bank transfer programs

- Increase revenue “from ongoing partnerships with companies like Bilt, Amazon and Hertz”

One thing that has had several of Sumers’ readers worried, and contacting me, was the line that they are “even talking to counterparts at Delta — a joint venture partner and minority owner of Air France-KLM — about best practices.”

I take that as a throwaway, a reason to have confidence that Air France can pull this off, not that they’ll copy Delta. They would undermine their own strategy if they did this, and they know it, because they are in a very different market position than Delta. They know they need an attractive program to drive revenue growth.

And they see it as a competitive advantage against airline competitors as well. Group CEO Ben Smith was President of Air Canada when they decided to bring loyalty back in-house and was part of discussions around building the new Aeroplan. He says they “are just now starting to dial up our Flying Blue,” and that it is “the key unique tool that we have that the others do not have.”

Many airlines around the world participate in loyalty rewards transfer programs such as Membership Rewards precisely so they can participate in the rich US credit card market. Air France/KLM is not near as profitable as DL which is apparent in the same investor deck but Flying Blue does contribute heavily to their program.

It is precisely because Delta owns equity in so many airlines that it can have board room discussions about best practices including aircraft sourcing, network strategies which go beyond the joint ventures, and competitive strategies.

AF/KL is copying DL’s strategy of aggressively negotiating with Airbus which gave Delta a piece of its distribution network as part of the big A350 order earlier this year.

So, yes, AF/KL and DL will cooperate and DL will share what has made its program a success but the lessons will be applied very differently for very different reasons.

Tim – on which boards of other airlines does Delta have seats? Legitimately asking – because I think you overestimate the depth of these boardroom discussions.

All FFPs devalue their program. Some are just more aggressive than others.

It’s a matter of time that FB will devalue it’s program more. Just look at the past few years what the redemption levels were needed compared to currently.

However, it’ll still be a ways to go compared to how quickly DL and systematically DL has gone to devalue their SM program.

Oct

I believe Delta asks for a board presence in every airline in which it has an equity stake which I believe is Virgin Atlantic, AF/KL, Aeromexico, Latam, Korean and China Eastern. All of its stakes are over 5% so it is customary in western businesses to be given a board presence for that amount of stake – the SEC sets 5% as the threshold when other investors have to be notified.

DL has a non-voting board presence – just observer – in China Eastern but I am pretty sure it is voting in other equity airlines.

DL doesn’t invest in other airlines just to make sure they don’t “get away” and go to other airlines. DL’s equities are part of a strategy to be a part of running the whole business including redeploying aircraft when it doesn’t make sense to operate them under the JV.

ie. the UK to S. Korea is not part of the DL-VS/AF/KL JV but DL is in a position to suggest to VS that one option to redeploy aircraft is on the LHR-ICN route which meets multiple objectives for KE which is also a JV partner.

other airlines cannot talk about what DL can with its equity partners.

good question and discussion… thank you.

and DL and AF/KL undoubtedly know that the role of global loyalty programs is similar in that it provides an advantage when competing w/ low cost “domestic” airlines whether in the US or in the EU. AF/KL is simply a more compelling alternative to EasyJet for anyone that is globally minded.

@ Gary — Free Spirit outshines SkyMiles, so that is a pretty low bar.

Tim, this is what I am talking about – “ 5% so it is customary in western businesses to be given a board presence for that amount of stake”

That is soooo not true. It is not necessarily customary. You get upset when I challenge.you – but you are wrong. And as someone who has sat in on numerous board meetings, I say again that you are overestimating the depth of board meetings on the issues you claim.

Delta’s seat on China Eastern’s board is observational only.

“ other airlines cannot talk about what DL can with its equity partners.” That is not necessarily true, from a legal perspective. Delta having board seats does not allow for conversations not covered by antitrust immunity – it has nothing to do with equity. AA and BA can talk about the same things Delta / VS can. Board members are often told this, and are usually excluded from votes on issues dealing with the other airline.

“AF/KL is simply a more compelling alternative to EasyJet for anyone that is globally minded.”

Tim – Gary’s point was that the FB program is more compelling than SkyMiles. Nothing you wrote refutes that.

And I’m not saying that as an AA fan boy that you accuse people of being. I too can read 10-Ks and 10-Qs, as does Gary, and the “facts” you cite are often spun in the best possible light. Equity stakes are not necessarily what you make them out to be either. Aeromexico and Virgin Atlantic being obvious exceptions. Don’t forget, AA has (had? – don’t know what it has been written down to) in China Southern. AA did next to nothing. Perhaps (probably) a function of AA’s management – or lack thereof. But Delta with its 5% stake probably has only the same input into China Eastern that AA has in China Southern – which is to say very little.

Oct

first, show us the percentage of ownership DL has in its equity companies

5% is SEC required for disclosure.

5% doesn’t mean you get boardroom presence – and I never said that.

And, since you discount the value of DL’s equity stakes, tell us why they do them. THAT is the issue.

There are a couple of airlines in the world that have tried to develop multiple equity stakes. Delta is the only one that has managed to turn it into greater access and profits.

And, I know that there are things that AA and UA can talk about but they have no financial reason to try to connect the global systems of their equity partners as DL did w/ the VS decision to add LHR-ICN. And DL didn’t invest billions of dollars for that reason.

let’s be clear, though, that DL bought back less of its own stock pre-covid but invested in other airline stock.

As for FB or even SAVE’s loyalty program being better, you and others still fail to see the total picture.

You do realize that the purpose of loyalty programs is to REWARD and CREATE loyalty?

Skymiles might be the stingiest in terms of rewards but they have an enormously loyal following which is increasing its revenue premium.

SAVE is losing money. Their loyalty program is not generating revenue sufficient to offset their problems as DAL’s program does.

AF/KL has a different paradigm than DL as Gary notes; he still can’t admit that DL gets more revenue on the bottom line from its loyalty and CC programs because DL’s program generates more revenue at every step of the process than AA and UA>

I am happy to be challenged by anyone w/ facts and not name-calling. Congrats on the about-face

@Gary Is FB sometimes still locking up miles you transfer, or is that a thing of the past? Have not use them much due to that issue some time ago.

@David – I haven’t had the experience recently, but I would still make sure you have an open (not brand new) account, and I would book over the phone if it is your first points transfer and redemption

FB does not seem to have as many saver business class rewards as it used to, but you still see some, and I like their hard and soft products and lounges. I have long credited all my DL flights to FB. The current AF card gives you no reason to use it, but if AF started giving loyalty for spend like AA and UA have started doing, that would change.

Flying Bliue is a pathetic, mismanaged program. I’ve been communicating with them for 2 months, trying to get credit for the second leg of a flight taken on Dec. 18, 2023. FlyBlue representatives repeatedly ask for the same information and documents (boarding passes), in spite of the fact that I have already submitted all of that. They provide contradictory information; they tell me that I have to raise the issue with Delta (even though my tickets had my Flying Blue number). In other words, lots of time and effort has been wasted trying to resolve a simple issue. I don’t need that in my life, and at that point, I am ready to give up on their program. Back to applying my miles towards Delta Skymiles.