Alaska Airlines won the frenzied bidding war to acquire Virgin America. And now they’ve reached an agreement with the Department of Justice to allow the merger to go forward.

Alaska likely overpaid, but saw Virgin America — barely profitable even with low fuel prices — as the only opportunity to pick up gates at congested airports.

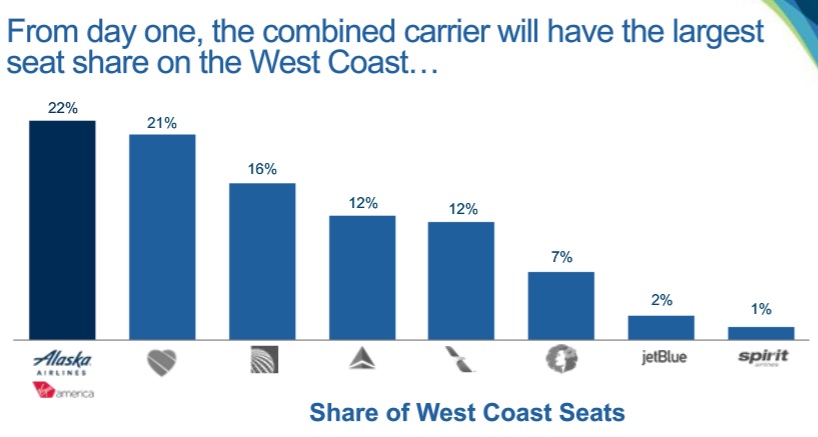

The combination makes for the biggest West Coast airline, and buys them a San Francisco hub to diversify away from the intense competition they face from Delta in Seattle.

Key to making the deal profitable, according to Alaska, is selling their Bank of America co-brand credit card to Virgin America’s Bay Area customers.

From the outset it appeared that this deal should have sailed through anti-trust review. It’s really pro-competitive. It’s a much smaller deal than Delta-Northwest, United-Continental, and American-US Airways. In fact it creates an airline that, while still smaller than its domestic rivals (including the combination of Southwest-AirTran) that will be better positioned to compete against its larger rivals. There’s only non-stop overlap on about a dozen city pairs.

Yet the Department of Justice opposed the deal, and entered into protracted negotiations before sign-off.

While much of the speculation surrounded Alaska’s codeshares with Delta, indeed earlier today there was speculation that the price of approval would be an end to Delta codeshares with Alaska, I’ve argued that the price of DOJ approvals would be scaling back American Airlines codeshares.

American and Alaska don’t have an immunized joint venture, so they simply represent more than one airline selling a single flight. In that sense codeshares increase competition.

And in the end it’s American Airlines codeshares that DOJ is extracting concessions out of to allow the Alaska – Virgin America deal to move forward.

Alaska Air agreed to “substantially reduce” the scope of a codeshare agreement with American Airlines to preserve competition, according to a filing Tuesday in federal court in Washington.

Alaska characterizes it differently in its press release,

Alaska did agree to implement limited changes to its codeshare agreement with American Airlines. The majority of Alaska and American codeshare flights will remain intact.

Here’s what the ‘limited’ or ‘substantial reduction’ in American Airlines codesharing involves: Alaska can no longer codeshare on routes where Virgin America and American offer current competing service. In addition, they won’t codeshare with American on routes where it would otherwise make sense for Alaska to launch new competitive service of their own.

This affect 45 of 250 markets. The biggest being:

- Los Angeles – New York JFK, Boston, Seattle, and Chicago

- San Francisco – Chicago, Dallas

This is a hit to Alaska revenue in the tens of millions of dollars per year. That’s not enough to stop a multi-billion merger.

Alaska does not give up gates or slots at congested airports. So they won’t be divesting any of the things they’re actually buying in the Virgin America acquisition. However they do have to obtain government approval to sell or lease any Virgin America gates or slots that had been obtained from American in its own DOJ settlement as part of the US Airways merger at Dallas Love Field, Washington National, and LaGuardia.

For customers Alaska and American continue their full frequent flyer earn and burn relationship.

If you read DOJ’s release, they say they did this to basically encourage the combined carrier to compete with AA. They seem to be agreeing with your premise Gary that a larger “fourth” airline is better for consumers and that competition will be greater without the codeshare. I tend to agree with that sentiment.

It would seem pretty clear that the “big three” wouldn’t be allowed to codeshare; and if Alaska/Virgin America is going to join them as a major player, they should largely have that same restriction.

@Daniel

I agree for the most part. Though just a reminder, that this keeps Alaska very firmly in 5th place behind Southwest and United.

Will the changes in Alaska’s codeshare agreement with AA affect the AAdvantage partner earnings between AS and AA?

I am taking a couple of Alaska flights in 2017 but crediting the flight to AAdvantage to earn EQD’s according to the AAdvantage/AS Partner earning chart. Does anyone know if earning EQM’s/EQD’s by flying on AS will be negatively affected?

Thanks

@Gary, you wrote: “Key to making the deal profitable, according to Alaska, is selling their Bank of America co-brand credit card to Virgin America’s Bay Area customers.” With this is mind, I have a question:

I had a Virgin America (VX) co-branded credit card with Barclays, and when VX severed that relationship, I received a new VX VISA from Commenity bank, and then Barclay’s sent me an arrival+ World Elite MasterCard . . . w/o receiving any kind of sign-up bonus from either one.

So . . . should I sign-up for an Alaska Airlines card NOW to get the bonus before they merely shove one down my throat?

Here comes the JetBlue and Alaska merger—-to be the 4th legacy carrier—soon to be named JetBlue. I mean who wants a main hub in Fairbanks, Alaska…..I mean Bill Fairbanks, 002. Poor Bill….I mean Richard Branson, even he couldn’t get that frigid looking, pot-smoking Eskimo off the Alaska logo.

Who cares they can’t codeshare on competing long haul markets with AA. Who would fly AA metal on those when they get full mileage with Alaska! Remember, they’re the last ones who offer this, and if they’re smart they’ll advertise it as the true competitive advantage it is.

I wonder if AA was proud when they told Alaska they couldn’t give their customers full mileage on AA flights when they wanted to? Later days, American. We’re flying Alaska transcon and everywhere else they go – for the miles!

Considering it turns out AS codeshare operated by AA still earns based on aa chart (25% for cheapest flights) and towards the AS metal 20/40/75K requirement, it’s not as big of a loss on the BOS-LAX codeshare. My original understanding was AS coded AA operated gets AS 100% earnings chart.Was so sad when it was clarified.I still have about 400,000 AS miles left but i just need to get used to long haul coach once those are used up.