US Airways used to be the ‘official consolidator of Star Alliance premium class inventory’, a role since taken up by Avianca LifeMiles selling points cheap so members could book awards on partner airlines. They make money selling other airlines’ seats at a discount, but for more than they pay for inventory that would otherwise go unsold.

When US Airways management took over American they brought the mileage sale philosophy to AAdvantage. Most months you can buy miles at a discount.

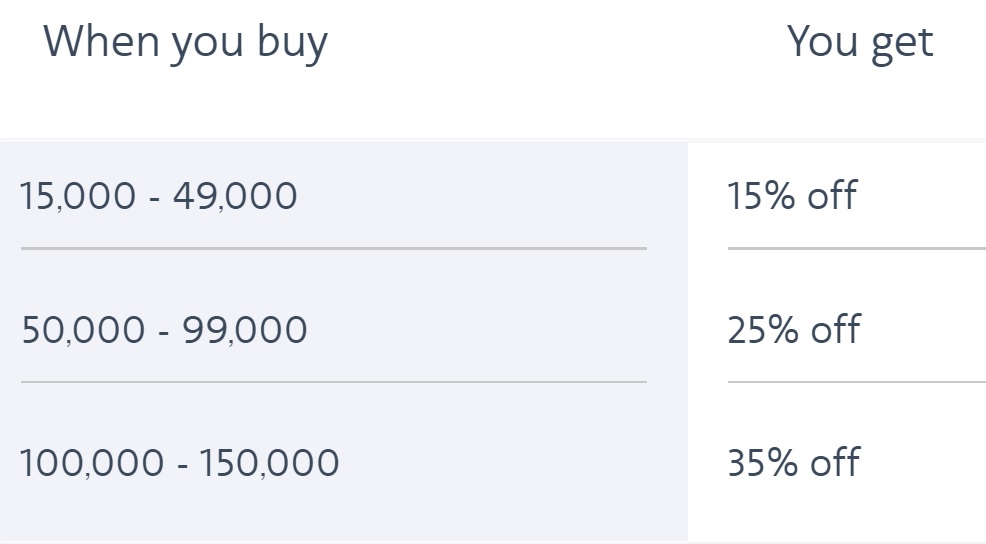

For October the offer is a tiered discount based on the number of miles purchased.

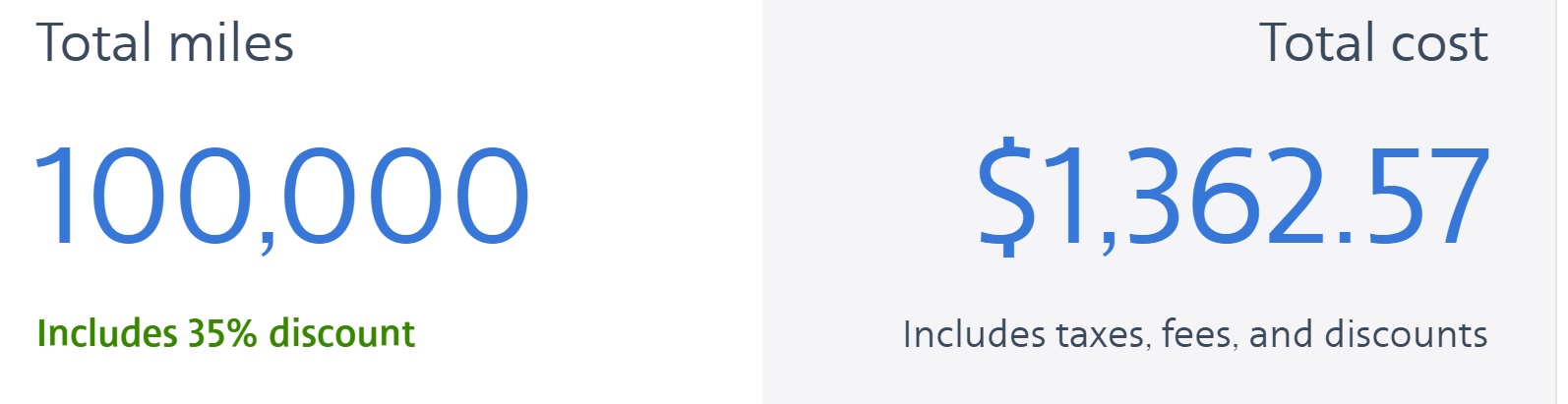

It sure seems like the discount being applied, though, is greater than it should be because at the top discount tier you’re buying miles at just 1.36 cents apiece rather than close to 2 cents.

The price is almost low enough where I’d buy miles, save for Vasu Raja’s recent comments about the direction he wants to take the AAdvantage program. As Chief Revenue Officer he’s been given oversight of AAdvantage as part of his portfolio.

(HT: One Mile at a Time)

@ Gary — Is there any risk AA can change the price after purchase?

No @Gene but they could cancel the transaction

Looks like they pulled the deal. Pricing at $3000 for 100k miles now.

Whichever way you cut the deal the price/mile is not exceptional (although good) and is in line with what AA has offered in recent times.

So no, not a pricing error.

Must have been an error. They raised the price. 100,000 is now $2096.25 with the 35% discount.

Dead

Dead, but knowing something dumb is coming around the corner it still makes no sense to exchange real money for fake points. Earning them is one thing, but parting with cash is quite another.

Total miles

100,000

Includes 35% discount

Total cost

$2,096.25

@ glenn t — AA has never offered a mile purchase price this low. USAir may have, but that was not recent.

That is not AA’s price today, that’s for sure! Gary, where did you see this?

FYI you can NOT get a refund of the Federal tax if you Fly Internationally if you

1. Do not have a copy of the Receipt showing the tax paid and proof of payment

2. Clam for refund must be done with in 3 THREE years of the date of the the purchase transaction

3. Must file a claim with the IRS who will most likely send it back to you as they are about as bright as a 1st Grader in Advance Math.

4. Claim MUST be filed by certified mail

@ tomri — In other words, don’t waste your time.