I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

American Express needs to do something to keep the $5000 annual fee Centurion (“Black Card”) feel worthwhile.

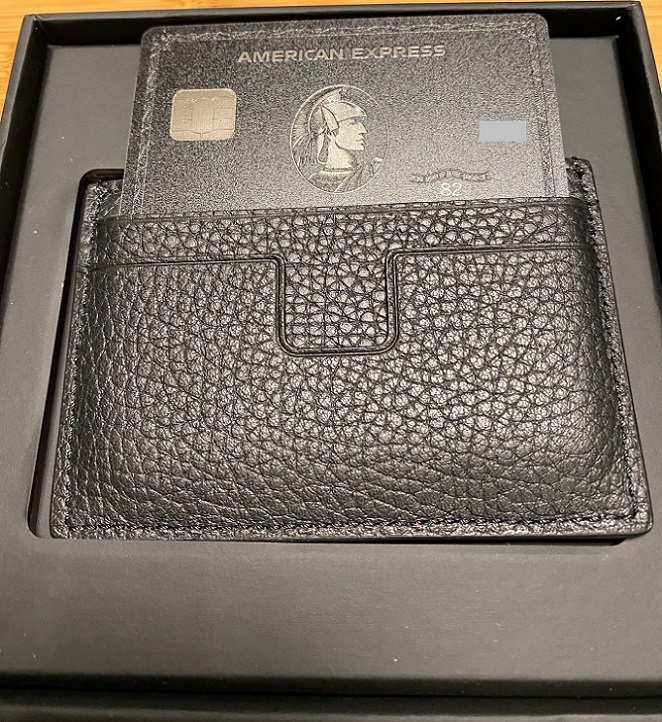

Unboxing The American Express Black Card

The benefits of this card, on top of what Platinum customers receive, are mostly Hertz Platinum, Delta Platinum, and Hilton Diamond, in addition to a $250 quarterly Saks credit. It no longer receives an annual $200 airline fee credit. Here’s a deeper dive into the card’s benefits.

American Express has been opening a network of airport lounges over the past decade, because that’s where their cardmembers are. After initially trialing the first Centurion lounge with Centurion cardmembers only in Las Vegas, the program expanded significantly. New York is their biggest market, and it looks like they have a new space coming, at least initially for Centurion cardmembers only.

Centurion New York is expected to open in March on the 55th floor of One Vanderbilt, about a block from the Hyatt Grand Central (former Grand Hyatt), featuring food by Daniel Boulud.

Here are additional details.

“*Guest access policies and hours of operation for Centurion New York are subject to change. All access to Centurion New York is subject to space availability. To access Centurion New York, patrons must present a government-issued I.D. and must be at least 18 years of age to enter without a parent or legal guardian. Centurion Members must also present their valid American Express Card. Purchases may be made using an American Express Card or cash. Reservation cancellation fees will apply if cancellation occurs within 24 hours of reservation time. Details and prices are subject to change. Patrons must be at least 21 years of age to purchase or consume alcohol at Centurion New York. Please drink responsibly. American Express reserves the right to remove any person from Centurion New York for inappropriate behavior including, but not limited to, conduct that is disruptive, abusive or violent and/or failure to adhere to any house rules or terms or conditions. American Express will not be liable for any articles lost or stolen or damages suffered by any patrons of Centurion New York. Access to Centurion New York is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.”

I’ve been on the 91st through 93rd floors of this building where the views are incredible (the Wells Fargo-Bilt launch party was held there).

Conceptually this isn’t really different than the holiday lounge popup for Chase United credit card customers at the Mall at Short Hills, New Jersey. Just more expensive. New York is both a hub and destination for cardmembers, and providing them a space that others cannot access drives value to the card – which otherwise is very weak for points-earning, and about the same weight as the Platinum card and the no annual fee Bilt Mastercard…

Information about the American Express Centurion Card is neither provided nor reviewed by its issuer.

Time to open a lounge in Palm Springs.

What makes it a lounge? It reads like it is a for purchase restaurant that is for members only. What am I missing?

The annual fee is $5,000, but you’ll be charged a fee if you cancel within 24 hours of the reservation time.

Just Amex being Amex.

So is this NY lounge (and other non-airport lounges) only open to Black Card holders?

Food is complimentary at this lounge, and no limits on visits and time spent? If true a 5k annual fee doesn’t sound too bad if used as a daily “office” space in midtown with michelin star quality meals, for sure can’t be sustainable

It’s unclear if any f/b is free or if it is paid restaurant open to black card holders.

This is being billed as a private city club – aside from certain bar snacks, private city clubs charge for meals and drinks (which are billed to the member’s account and paid monthly). I would expect a similar setup here – a bar with maybe some snacks (peanuts and such), but meals and drinks for a charge.

Thing 1, yes. Anthony, yes.

At first, I questioned why Amex didn’t pick a location in the 50s, a little closer to the money. But, upon reflection, the location makes a lot of sense. For those who live in the City, they are already taking a cab, so what’s a few extra blocks? For those who live in Connecticut, where a lot of the money lives, it’s 1) an easy meal after work before catching the train home or 2) an easy Saturday night out – step off the train, walk across the street, grab an early dinner, and walk a few blocks to the theater district.

I gave up my Centurion Card after they doubled the annual fee from $2500 to $5000 while also removing the $200 annual fee credit, and refusing to offer 5x points on airline purchases like the Platinum does. Equinox and Saks are not present in the city where I live. And making the Saks credit quarterly just seems designed to either create breakage or force unnecessary spending.

Hertz took away the Platinum service benefits due to Covid and hasn’t restored them. Delta Platinum is only marginally useful. You can get Hilton Diamond via other credit cards.

As you said, the Centurion Card isn’t competitive for spending and not really competitive for benefits, either, unless you believe the snob appeal of having a Black Card is valuable. It doesn’t get you an upgrade if you present it at hotel reception.

No, I’m not spending $5000 on a mediocre card just to show off.

Good points to Lee on the Connecticut angle. If you live in Manhattan, as I do, it will be very useful for meetings and lunches. When they doubled the annual fee, we dropped our Equinox membership and were immediately made whole. But it’s the soft benefits that keep us coming back…

– Upgrade at the time of booking at several major hotel chains. If you don’t always book the lowest class room, this pays for itself with a handful of stays.

– Airport VIP service. Two days ago, arriving in ZRH, the plane parked at a remote stand. The BMW 7 series was waiting for us and whisked us to the VIP lounge, where we enjoyed refreshments and used the facilities. They went and got our bags, and coordinated with the ground transport, and when everything was loaded they came and got us. And if you are going out of Schengen, you get private VIP passport control.

– We currently have three different events coming to NYC that we have tix to. Last year we had an intimate “intro to classical music” with Yo-Yo Ma. Fun stuff.

– And, yes, Hertz Platinum rocks. We don’t do much Hilton, but when we do we’re treated like royalty.

All in it more than pays for itself.

Upgrade at the time of booking if you pay rack rate: you can get that via luxury travel agents without being a Centurion member.

Airport VIP service: Is that something you paid extra for? I certainly never experienced that. I’m pretty sure that is not standard unless you pay for a VIP package per trip.

How does Hertz Platinum rock? You take the same airport bus to the consolidated facility as everyone else. It used to rock. But now it’s not any better than Avis Presidents Club.

It’s more hype than reality.

@ Carl most of American Express card products are mediocre

I rarely spend anything with them.They lost me years ago and their customer service stinks in whatever pathetic country they farm it out to

Greed did them in

@carl hertz plat services have been restored at most stations. The VIP services referenced are included when you buy a business or first class ticket through amex cent travel.

The best value proposition for the $5k fee is the Equinox membership which is worth well over $3k annually if you use it. Interesting that you do not mention it here and it’s buried in your original write up. The value of equinox, Saks, clear and Uber on their own add up to $5k. Which means delta, hertz and Hilton and the other perks (just saw John Legend from the 3rd row at an intimate concert) come at no cost

@BeantownFlyer. Now, if they could get me 3rd row seats for a John Lennon concert, I would pay the $5K.

I’ve had the card since almost the beginning and seriously consider giving it up each year, as I live in a secondary market. The Equinox membership would be great but we don’t have one where we are. Better that they offer a country club membership or membership to our local fitness center.

Have tried to get access to the concert series but am not fast enough. If there’s say 20,000 US based Centurions and 70 people attend an exclusive concert. It’s more marketing doublespeak than actual usefulness.

I do enjoy the lounge access and VIP escort when flying Business or First internationally, but with COVID, we haven’t been able to take advantage of that perk the past couple of years. They did offset the annual feel with a $2k travel credit which did make it hurt less.

The concierge service is almost useless as everything I ask them to do pretty much they can’t. Like research which flights would have the most upgrade potential, setting alerts so that when upgrades open up, they get me the seats I prefer, getting booking for hard to get into events or restaurant reservations.

All in all though, we don’t put spend on the card as the rewards are not competitive to even the Platinum Card.

We put all of our spend on American Airlines branded cards so that the wife and I make Executive Platinum each year, now that they have switched to loyalty points. You really don’t get as many miles flying anymore.

Bizarre that the entire value proposition for this card is: If you pay a fitness membership and live in these select areas it’s worth it!”