I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

In 2014 American Express started limiting customers to one bonus per card per lifetime. In 2016 they extended that rule to small business cards.

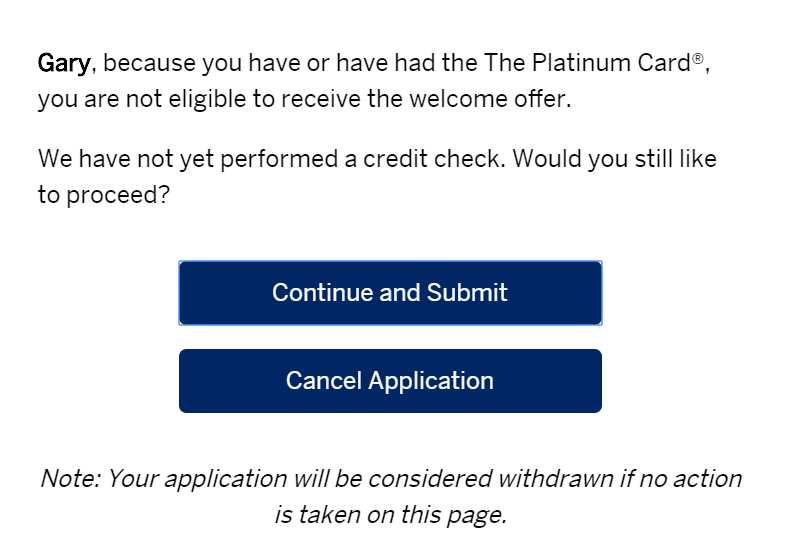

Lifetime means as long as American Express sees you as having had a card in the past. Often that seems to be around seven years. You can ask American Express what cards you’ve had in the past and they’ll tell. But there’s no more guessing, because American Express has a new popup when you submit an application — before they pull your credit — noting you’ve had the card in the past (or currently have it) and therefore aren’t eligible for a bonus. You can proceed with the application if you wish, or stop the process. (HT: The Points Guy)

Frankly this addition is a convenience, and reduces uncertainty in the process. It avoids angering customers who don’t realize they aren’t eligible for a bonus for a card they had years earlier and feel unappreciated.

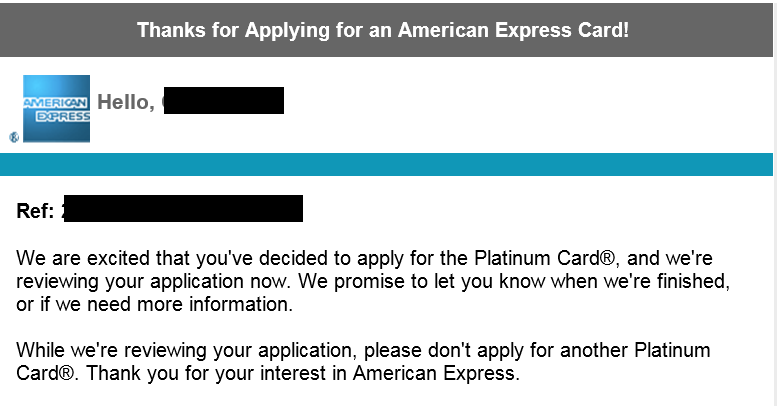

In spite of cancelling the application though I did receive an email from American Express telling me my application is in process, so the kinks haven’t all been worked out just yet.

American Express has also just added new restriction language for bonus eligibility,

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

We don’t yet know exactly what this means. It seemed to me to be too ambiguous on its own to be meaningful. However a similar popup will come up if this criteria is going to exclude you from a bonus. (HT: Award Travel)

[Applicant name] based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive this welcome offer. We have not yet performed a credit check. Would you still like to proceed?

As we accumulate data points on this new rule we’ll learn just when it excludes someone from an American Express initial bonus offer.

Given the message you got, I’m curious whether they proceeded with the credit check or not?

Any info on whether this works in your browser settings block pop-ups?

Any idea if they’re checking if you’ve gotten a bonus in the past on a card or is this only if you’ve held that card that you’re not eligible? I’ve held the Plat Skymiles card for a very long time now, since before signup bonuses were offered.

@ Gary — Overall, I guess this is bad news, as I suspect many more people are going to be turned by the new rule that was initially anticipated. However, it is nice to know up front, rather than get banned or FR’d or something similar.

I think this is great news. There is no sense in taking a FICO ding when they know your application will be turned down. I wish the Citi and Chase had the same system in place.

Joel

Wouldn’t a Chase or Citi phone rep be able to tell you whether or not you’re eligible for a bonus?

It’s one more nail in the coffin of the hobby formerly known as “travel hacking.” Amex is finally clamping down on practices like card churning and “manufactured spend.” Once upon a time, there were a few hundred hobbyists who found and shared some very smart ways to work “the system” and live large. Amex and the other card issuers didn’t pay much attention to this clever community. It probably wasn’t worth their time or effort. But then “travel hacking” became a business. The community of hundreds metastasized into thousands. Blogging businesses thrived, and now anybody who hasn’t declared bankruptcy can get premiere cards with Priority Pass memberships. Amex has always wanted affluent profitable customers who’ll keep their cards and use them for actual spending. They may have been willing to tolerate a relatively small number of outliers who churn and burn. But it looks like the outliers have become a critical mass. The party is winding down. It was fun while it lasted.