Participate in the AAdvantage Business program when it’s easy and you’re traveling solo, but the new offering for small and mid-sized businesses is mostly too low value and too much of a hassle for most to find worthwhile. They’ve designed something to offer less value, fewer benefits, and that customers have to jump through too many hoops for – simply too clever by half.

American’s small business Business ExtrAA program ends December 15th. You’ll no longer be able to credit trips to the program after that date. And any redemptions other than converting Business ExtrAA points to miles must be completed by the 15th as well.

Under the new program you can only add an AAdvantage Business number at the time of booking, and only when booking direct with American Airlines. Booking through a travel agency at work? You can’t earn through the program. My take on AAdvantage Business in a nutshell?

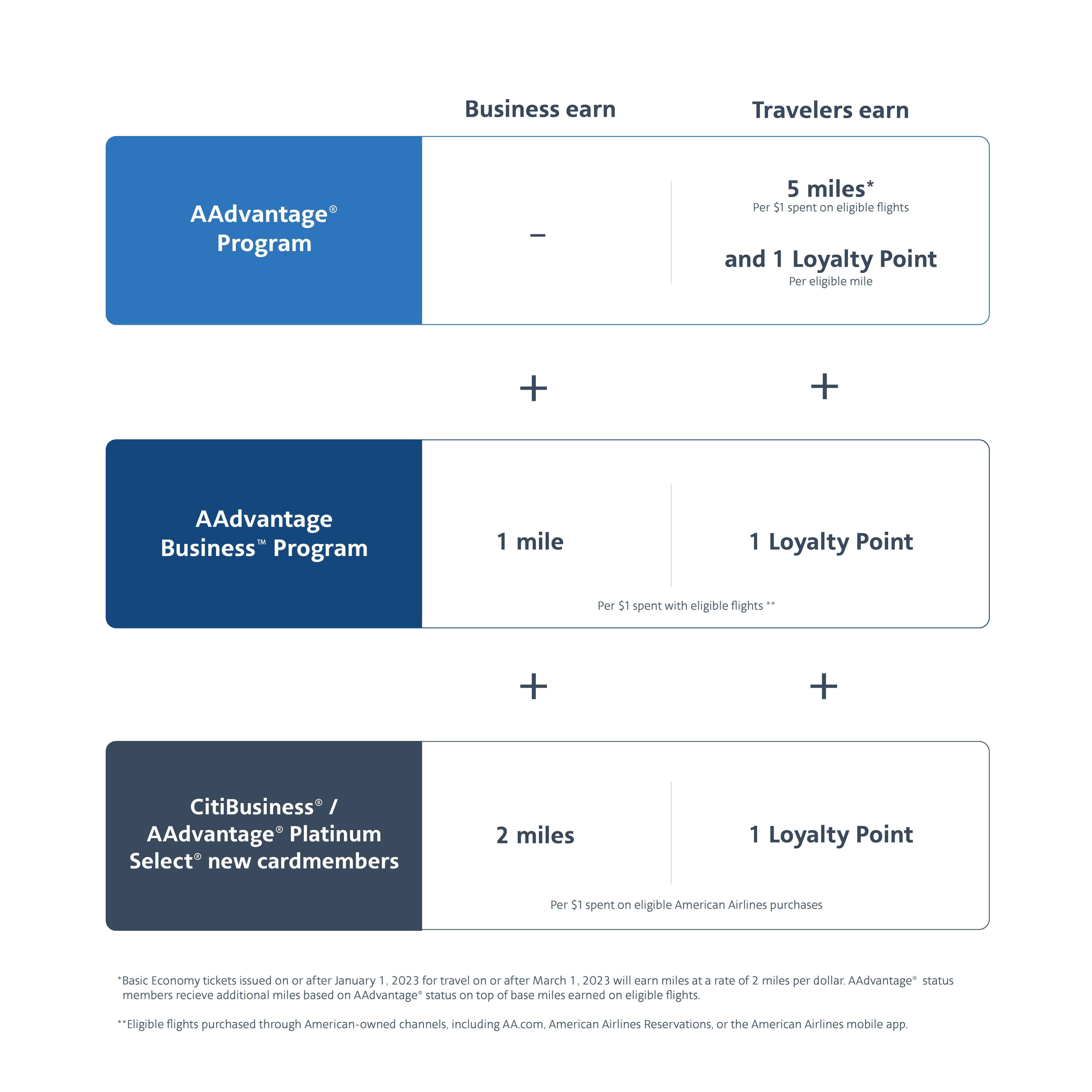

- Travelers earn 1 extra Loyalty Point per dollar spent on airfare. That’s a benefit to them.

- Earning 1 AAdvantage mile per dollar spent for the business is better than a hole in the head – not nearly worth what the old program delivered, and too much hassle to earn more.

- And it’s only worthwhile for solo travelers, who have to give up some elite benefits for their companion if traveling with someone else in order to earn points in the program.

The program is a big devaluation compared to what you earned through Business ExtrAA. In fact, base earn in the new program is about a 75% devaluation. Comparable awards require around four times the ticket spend compared to Business ExtrAA. And special awards like AAdvantage status no longer even exist.

At first blush this looked like a way to get small businesses to take the Citi Business AAdvantage card – since the new program is promoted as earning 1 point per dollar spent on travel by employees in the program, but 3 points for businesses with that card.

However payment with the CitiBusiness card is required for a ticket to earn two more points in the AAdvantage Business account that flight is credited to.

It’s not just whether the business has the card. The card must be used as payment for tickets. And in practice that means all of the business’s travelers need to have the card to book trips themselves, so it’s probably their primary business card. I’m not sure that’s worth it, compared to other cards a business could use.

Moreover, crediting a trip to AAdvantage Business requires telling American that the trip is ‘for business’. You have to select that you are on a business trip to earn in the program. But selecting that only allows you to travel with one passenger on the reservation.

American tells me “this has been implemented as an additional guardrail for the company to ensure the travelers are only booking business trips under their account.”

- Being on the same reservation is the best and easiest way to share your elite benefits with a travel companion, and to increase the likelihood that you’re rebooked together during irregular operations.

- And people don’t just travel on the same reservation for leisure. I’ve done plenty of work trips with a colleague where I make the travel booking and we travel together.

Sure, a majority of business trips are booked solo, but that doesn’t mean business trips cannot be booked together. However you give up the ability to have multiple people on a reservation if you want to credit the booking to AAdvantage Business.

I guess I’ll transition to the program, use it myself when traveling solo (for the extra loyalty point) and make it available for others to choose to do the same. There will be some AAdvantage-earning for the company that happens as a result. But we’re not going to put CitiBusiness cards in everyone’s hands – we use corporate cards at work, not small business cards, and this program isn’t going to change that.

American doesn’t believe they need to incentivize business transactions anymore. They’ve fired most of their sales staff and sales support, ended their sales incentive program Business ExtrAA, and believe that people will fly them based on schedule and price so why offer more discounts and rebates? That’s a fair bet. But this new program clearly flows from that model – rather than one of rewarding customers.

Cant even sign up. As Business Extra travel manager tried signing up 3 times in last two weeks and the new Business website keeps erroring!

Another negative is that my SWU’s only show as an option if I search the app for business travel. Among other inconveniences that means that I’m only searching for one confirmed upgrade seat. Since I tend to use the confirmed upgrades for important trips with my wife the single upgrade availability doesn’t help much.

Great post, Gary! I’ve been thinking along these lines and I’m saddened to learn most of my fears are well-founded. So here’s my question (which I can only imagine is shared by many others): “What is the best play with Business ExtrAA points before December 15?”

Gary – have you been even able to sign up?

Their signup website kept failing after completing all field. We have Citi Business cards, so not sure if its related as Citi email said we would be provided additional info at a later date, yet AA emails keep coming encouraging us to signup and transition from Business Extra to the new program.

These airlines (corporations en mass) are trying to squeeze human beings of every last profitable penny.

They first created the goalpost of a loyalty program to reward their loyal patrons, now they’ve not just moved the goal posts but they split the original goal posts 3 different ways and continue to move them at whims in order not to reward but as another form of money extraction.

Most of the people they extract from are not rich, but the executives who get bonuses for coming up with these extraction schemes are: it’s literally the rich taking from the poor.

Literally every corporation operates like this; the money doesn’t go to the regular employees of the corporation it goes to the people concocting the schemes at the top.

Sick

I had the same issue as James above. Tried signing up, filled out the entire form, and routinely got an error page stating that they couldn’t verify my business (I ensured that name, EIN, all info was correct). Frustrating to say the least, especially after having received an email blast from AA promoting the new program and asking me to sign up….

Dont think American really wants anyone to sign up as we cant either get past their website error. To top it off, there is no one to call to inquire with that knows as the sales organization has been gutted!

I am not sure why they even bother spending money on this program at all.

They’re clearly not a business airline anymore, and the number of business people who will only endure the worst of the US3 airlines if they get a few extra loyalty points is … zero? Sore, they’ll fly AA if there’s no other choice, but then AA is just giving away points and getting nothing in return, which is totally stupid.

I wrote the following in a comment to Gary’s article explaining the program, on the first day of the program. Still relevant:

As a 20-year EXP and BusinessExtra small-business owner, I will not use this program, as explained below, and this gives me a further push away from AA.

I joined the new program today and held a new flight for myself under the program while waiting for my other travelers to register. Then called the EXP desk to get them to bump the fare class from Q to G before ticketing so I could use one of my many, now useless, BusinessExtra uprgade awards. I was informed that the EXP folks can no longer touch these reservations except for seat assignments, schedule changes and the like, and changes can be made only through a “virtual assistant”/chat. I went online to the chat, and wouldn’t you know it, there is no option for “AAdvantage Business” questions. You gotta be kidding me, I’m not even going to waste my time trying to go through chat hell.

I hate to diss AAdvantage Business as it’s just getting started, but it surely seems designed to DISadvantage business, at least small ones.

Oh, and for another tentative trip I tried, it won’t even let me book two business travelers on the same reservation! Duh.

I totally agree that the awards have been significantly devalued under the new program.

As for the best use of expiring BusinessExtra points, I found that the 3200-point BX1B award for domestic first-class round-trip travel (PlanAhead) was the best value. I found three economy flights in my upcoming schedule that I could cancel for trip credits and replace with first-class award trips. Note that although you need to use the points before they expire, the flights themselves can occur after the program ends.

I think that Gary’s lament that you have to use the AA Business Platinum card to get two extra Loyalty Points is incorrect. A traveler will always get a first LP per $ spent on “Flown Revenue”, which as usual excludes a ticket’s taxes and fees, and which won’t be posted until the flight is flown. Under the new program, a business traveler will get a second LP per $ spent on “Flown Revenue”. And travelers will almost immediately get whatever benefit they get from the method of payment used.

To get a third LP per $ spent (*including* taxes and fees), the traveler should be able to use *any* AA card. In the credit-card month just ended, I spent about $1240 on future AAdvantage Business flights using my Citi Executive card, and on the Citi statement just issued, I see 4960 miles awarded (4 miles/$ on that card). I expect to see those miles and 1240 LPs posted to my AAdvantage account in a day or two, as soon as AA gets that spend report from Citi. And I should see another 2*(~1100) LPs posted after the flights are flown, the “~1100” being the approximate total “Flown Revenue” of those flights.

No argument from me if you think it’s complicated and confusing 🙁 .

Whoops, didn’t I say it was confusing? The “a first LP” in my comment should be “a first 5 to 11 LPs, depending on status”, 11 in my case as an EXP. And ” 2*(~1100) LPs” should be “(11+1)*(~1100) LPs”. So, as you can see, compared to the status bonus, the extra LP per “Flown Revenue’ $ is not much incentive for all the hassle.

To match your account to the new program, add 1 or 2 leading zeros to your BusinessExtra account when registering. I figured this out on my own after many failed attempts

Gary, I STILL don’t understand if we would get additional LP’s with the Citi Business card. Asked this on Your last post about the launch of the program and You ended up deleting/taking down the whole post.

So is is +1LP for being in the program PLUS +3LP for using the CITI Biz card? So it would be 5LP per $ Spent if you buy direct from AA, are enrolled in the new Biz program, and use a newly opened Citi AA Biz card?

Lastly, does a Sole Proprietor qualify for the program? Or only larger businesses with multiple employees?

Sorry to ask so many questions, but I’m an EXP and have read everything 5 times and am STILL confused on all of this. AA is making it very difficult to stay on the hamster wheel…

Gary, I STILL don’t understand if we would get additional LP’s with the Citi Business card. Asked this on Your last post about the launch of the program and You ended up deleting/taking down the whole post.

So is is +1LP for being in the program PLUS +1LP for using the CITI Biz card? So it would be 3LP’s per $ Spent if you buy direct from AA, are enrolled in the new Biz program, and use a newly opened Citi AA Biz card?

Lastly, does a Sole Proprietor qualify for the program? Or only larger businesses with multiple employees?

Sorry to ask so many questions, but I’m an EXP and have read everything 5 times and am STILL confused on all of this. AA is making it very difficult to stay on the hamster wheel…

@Benjamin G – I did not take down / delete the post. Weird. https://viewfromthewing.com/new-american-airlines-small-business-program-earns-aadvantage-miles-faster-elite-status/

+1 LP is for travelers who credit to an AAdvantage Business account, and has nothing to do with use of CitiBusiness card for payment. A sole proprietor can participate, but in order to redeem miles a company needs at least 5 active, registered business travelers and $5,000 minimum spend in the preceding 12 months or to be a CitiBusiness accountholder.

Gary’s clarification above is correct.

As expected, the 4 miles per $ for AA spend on my very recent Citi Executive card statement and the corresponding 1 LP per $ were posted to my AA account this morning, along with 1 LP and 1 mile per $ of non-AA spend. I won’t see the “Flown Revenue” LPs and miles until I take the flights early next year.

Bigger corporations are more likely to require one traveler per ticket, so that each employee fills out their out expense account. This allow for better control over booking class after-the-fact, so that a high level employee allowed to fly business can’t bring someone along who isn’t eligible for business class. But, these same employees are more likely to use something like Concur, and won’t be able to book direct anyway.

How does the article relate to the headline?

Gary – American has been degrading its services in many other ways too. They terminated the Airpass program, they no longer provide special rates to travel agents (such as American Express Travel), and they do not allow those travel agents to use the lowest price on AA.com. Previously, I favored American for all my travel, even when it involved an extra leg. Now, I favor anybody but American,. They have forgotten their customers

The new American Business program is a crap. One needs to first register all employees as travelers and each one ticket to be booked separately . You cannot book two employees together in singe reservation

Also if you did a mistake in selecting business , then all way need to cancel and rebook

In addition registration as traveler is not good to book as business but to add as business travel every time booking . Also the points are lower compared to Business Extra .

with this new crap program AA going to lose all business travelers .Better change this with new release in May2024