American Airlines is replacing its small business loyalty program Business ExtrAA with the new AAdvantage Business which is now available. Instead of having a completely separate program, small businesses will earn AAdvantage miles in their own account on top of the miles earned by travelers, and they’ll redeem miles just like consumers will.

That’s a simpler system, and there’s one clear benefit for travelers: they will earn one additional loyalty point towards their status per dollar spent when adding an AAdvantage for Business account number to their reservation. Today, travelers don’t receive any direct benefit from the business program, only the company does. However the new program is less rewarding for companies – and by a lot. So better for travelers, less rewarding for businesses.

This change makes sense on another level. Business ExtrAA was a sales program and now there’s not much of a sales organization at American. They’ve folded what’s left of sales into other parts of the organization, and they’re no longer going to run a separate business program. That’s fine! This new program offers a benefit to travelers, and may also help them acquire new small business credit card customers. But it could also have been more rewarding for companies.

Earning In The New American Airlines Small Business Program

Members of the new business program earn one additional loyalty point per dollar spent, so a general member earns 6 points per dollar towards status, while an Executive Platinum earns 12 points per dollar.

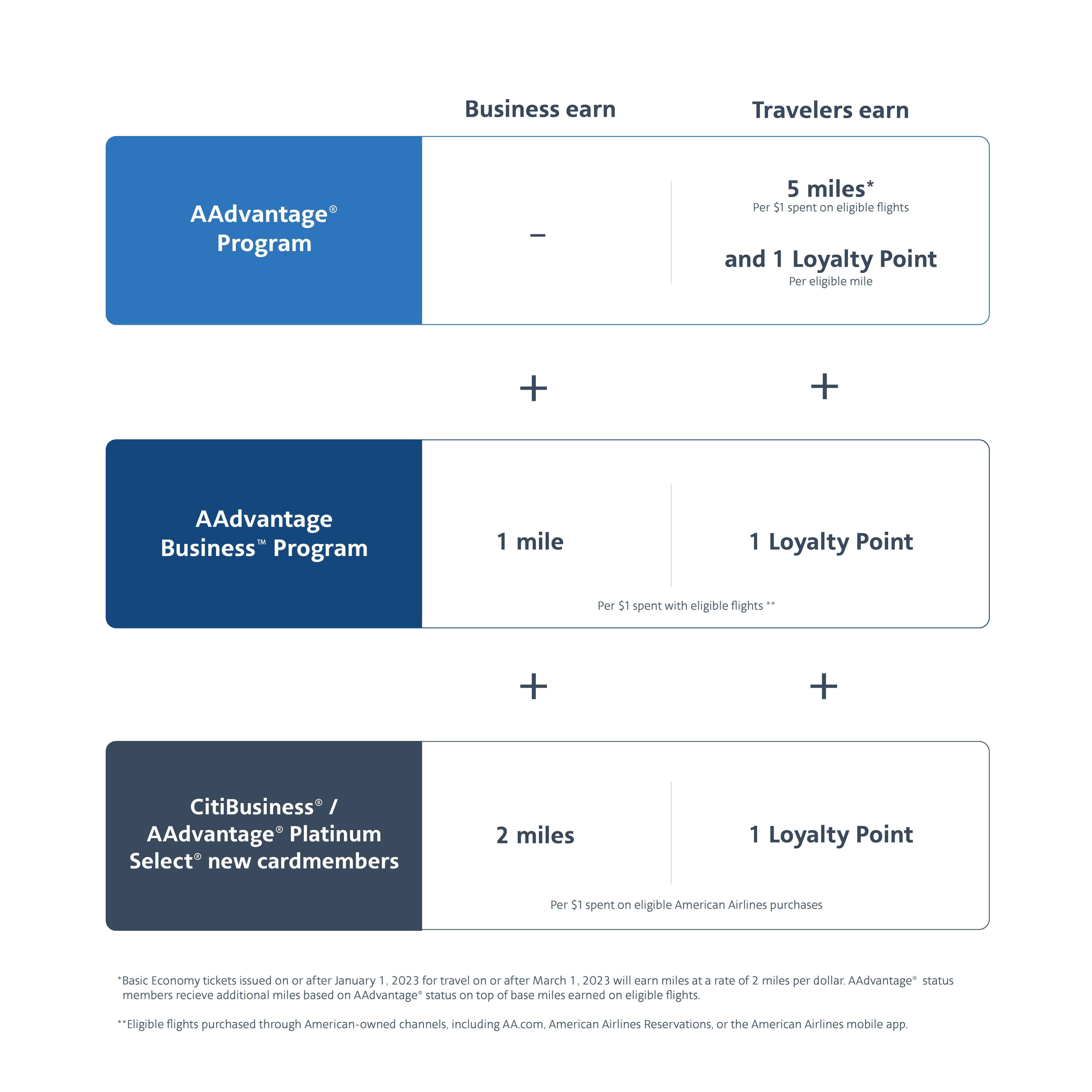

Businesses earn 1 AAdvantage mile per dollar spent in addition to the miles earned by travelers at the company, when the business’s account number is applied. This triples to 3 AAdvantage miles per dollar for those with the Citi-cobrand AAdvantage small business card (and only that card). This contrasts with earning 1 Business ExtrAA point per $5 spent in the current program.

When making a booking and an AAdvantage number is entered, American prompts the customer to answer whether the trip is for business or leisure for whether to credit this or not. I guess everything is really for business, if you work while you’re traveling.

Put another way, a traveler needs to answer whether they’re booked for business or leisure, when what they’re really being asked is “would you like this booking to earn points for your company and extra credit towards status for you?” I guess you might say “I hate my company enough to forego the status credit” but if that’s true I really hope you reconsider what you’re doing with at least 24% of your year.

A Lot Less Value For Business Spending

Right now in Business ExtrAA $3,250 in spending earns 650 points which can be redeemed for a confirmed domestic upgrade when purchasing minimum fare class (not valid on basic economy or N, O, Q or S fares). In the new program it’ll take $15,000 ($5,000 with CitiBusiness card) plus a $75 co-pay for a confirmed domestic upgrade.

AAnytime awards in the Business ExtrAA program are also a lot cheaper than the equivalent through AAdvantage.

- An AAnytime business class roundtrip award to Europe, Asia or Australia with Business ExtrAA requires $90,000 in spend currently. For Europe that includes any seat on British Airways.

- It takes $115,000 spend in the new program to get a saver British Airways business class roundtrip award.

- And it will often take $175,000 – $350,000 spend to get an American Airlines business class award in the new program…each way

Required spend amounts for an award through AAdvantage Business are cut by two-thirds (since earning from ticket spend is at three times the rate) for those businesses that have a CitiBusiness AAdvantage card.

It’s still the individual with that card that earns miles in their own account from card spend (and loyalty points from that spend), but the business earns two miles per dollar spent on tickets that have an AAdvantage Business account attached instead of one mile per dollar. Anyone engaging in the program is going to want the CitiBusiness card – and the cardholder earns an additional Loyalty Point per dollar spent on American as a traveler, too.

Nonetheless, eligible companies should certainly sign up even without the co-brand because American Airlines spend does provide rewards (even if less than before) and because employees benefit from attaching the account to their bookings via faster status-earning.

Qualifying To Participate In The Program

In order to participate in the program, a company needs at least 5 active, registered business travelers. Business ExtrAA had imposed a requirement of 3 unique travelers and $5,000 minimum spend in the preceding 12 months two years ago (with existing accounts grandfathered until January 1, 2023).

The $5,000 minimum spend requirement now applies in order for a company to redeem miles, though they can start earning right away. And that requirement is waived entirely for those with the CitiBusiness AAdvantage card.

How The Cutover From Business ExtrAA To AAdvantage Business Will Work

The new AAdvantage Business program is available today. You will no longer be able to accrue Business ExtrAA points after December 15, 2023 That’s also the last day to submit credit requests for past travel.

An AAdvantage Business account number can only be added at the time of booking when making a reservation through American Airlines. You cannot add it later. While it is possible for a travel agency to add the number to a booking they’ve made, agency bookings are not eligible to earn in the program.

Today Business ExtrAA numbers can be added at any time, even after travel. Of course there’s no built-in incentive for the traveler to add it. There’s also a cottage industry of scammers who collect ticket numbers of random passengers and submit them for credit to their Business ExtrAA account.

If you have an existing reservation with a Business ExtrAA number in it and want to switch over to AAdvantage Business, you’d need to cancel and rebook. Similarly, if you have any reservations past December 15 and you want to earn in a business program, you’ll have to cancel and rebook.

There Are No Longer Any Business.. Extras

AAdvantage miles accrued in an AAdvantage for Business account are the same as AAdvantage miles in a personal account. Redemption options are the same as for a regular member. However there is no status component to the program and no ‘loyalty choice awards’ or other threshold bonuses built into the program. So there are fewer features to AAdvantage for Business than for AAdvantage, and no features in AAdvantage for Business that are not part of AAdvantage.

That’s too bad because I’ve used Business ExtrAA points in the past to gift Admirals Club members and elite status, and those options are far more dear in the new program.

It’s also possible to confirm upgrades through Business ExtrAA online – something it’s not possible to do with mileage upgrades or other upgrade instruments. So for now at least we lose some functionality, too.

How The Program Will Work For My Odd Scenario

I am a Business ExtrAA member for a mid-sized company with 300 total employees, where I’m Chief Financial Officer. The account is tied to my AAdvantage number. At our budget level we’re using corporate cards rather than small business cards. I guess I could get a CitiBusiness AAdvantage card for the business and not use it.However if I were to get a CitiBusiness AAdvantage card tied to my AAdvantage number for my travel-related LLC that would trigger the double earn rate as well.

On the one hand it’s odd to require larger companies to get products that aren’t really appropriate for them in order to gain value out of their business travel incentive program, but American has largely moved away from managed travel and Business ExtrAA was the self-serve version of that for smaller companies, larger ones used to do direct deals that mostly don’t exist anymore. Since they’re not incentivizing large business accounts in the same way, there’s a certain consistency with their internal logic to turn the program into an incentive for companies to take the small business credit card.

This article is not helpful. There’s no link to the new program’s website or details on how to sign up.

Ah, this is why the Aviator Business card is no longer available. I wonder if it will be back?

Will the changeover happen automatically, or will businesses need to create a new account in the new program? Will existing business extra points be converted and if so at what rate?

@Doug Existing BusinessExtra points will not be converted. You can redeem for the current awards until Dec 15. Dec 16 – Jan 31, you can redeem for miles or donate them. After that they are forfeited.

@Gary according to the FAQ they increased the minimum for non-cardholders from 3 to 5 travelers

This is great, but it still kinda sidesteps the fact that they terminated Airpass, which a ton of small businesses used and which presented tremendous value…

Where do you see the program allowing just 3 members for Citi cardholders? thanks.

Apologies if it seemed hidden https://www.aa.com/i18n/aadvantage-program/aadvantage-business/overview.jsp?anchorEvent=false&from=comp_nav

I mainly use business extra points for BXP1 certs. Seems like they can only be used through December 15.

@Brian Same with me. Where do you see that they can only be used through December 15? The BXP1 Terms and Conditions still state:

“Upgrade awards expire one year from award redemption date.”

@JDN only redeemable through then. After that, if they don’t clear they are forfeited

Would appreciate some further clarification if Gary, Jon, or others have insight. So let’s say before 15DEC2023, I redeem for a Business Extra “Anytime” flight award certificate. Then I should be able be able to exchange that cert for a ticket through the validity of the cert (one year from date of issuance), correct? OR, must I *ticket* (not just have the award cert issued) before 15DEC2023? And regardless, once that BE Anytime-level cert is ticketed, would I be able to change dates, cities (within the same award region; not changing the name of the pax), as I currently can, or will changes no longer be permitted post-15DEC2023? Thanks.

@Gary this article says: “The $5,000 minimum spend requirement now applies in order for a company to redeem miles, though they can start earning right away. And that requirement is waived entirely for those with the CitiBusiness AAdvantage card.”

But the TOS seem to imply that having a CitiBusiness AAdvantage card waives BOTH the spend requirement AND the number of employee requirement:

“In order for the Business to be eligible to transfer AAdvantage® Miles earned under the Program to Business Travelers or Travel Managers, as applicable, the Business must either: (i) have $5,000 USD in Flown Revenue during the Measurement Period (as defined below) and five (5) unique Business Travelers who have taken at least one (1) flight during the Measurement Period; or (ii) be a Cardholder (items in (i) and (ii) are referred to herein as the “Qualifications”).”

What’s your perspective?

As a 20-year EXP and BusinessExtra small-business owner, I will not use this program, as explained below, and this gives me a further push away from AA.

I joined the new program today and held a new flight for myself under the program while waiting for my other travelers to register. Then called the EXP desk to get them to bump the fare class from Q to G before ticketing so I could use one of my many, now useless, BusinessExtra uprgade awards. I was informed that the EXP folks can no longer touch these reservations except for seat assignments, schedule changes and the like, and changes can be made only through a “virtual assistant”/chat. I went online to the chat, and wouldn’t you know it, there is no option for “AAdvantage Business” questions. You gotta be kidding me, I’m not even going to waste my time trying to go through chat hell.

I hate to diss AAdvantage Business as it’s just getting started, but it surely seems designed to DISadvantage business, at least small ones.

Oh, and for another tentative trip I tried to book, it won’t even let me put two registered business travelers on the same reservation! Duh.

@ ex_AA_EXP according to the terms, any unredeemed flight certs will be refunded into Business Extra points on Dec 16

@Jon – Thanks much for the response. Yes, I did find the detail in the FAQ, too. So basically, ticket by 15DEC2023, and once ticketed, then post-15DEC2023, one can’t make any changes that require the award to be canceled, because then the ticket cannot be reissued..

I wonder what qualifies as a new CitiBusiness cardmember to get the +2 miles for the business.

Will our current Business Extra # be used for the new program? In other words, do all employees still accrue miles, or do they now have to sign up again with a new number that may or may not be issued after signing up for the new program? I went through all the FAQs after today’s email and this is not addressed anywhere. Am I missing something? Some of my employees have moved on but their BE is still linked to my BE acount even though they don’t work here anymore. It’s amazing how quickly changes can be made by AA, and how little useful info is out there.

There is one new number for the organization, whose travel manager then sends email invites to members of the org as desired. When they receive that invite, they reply and accept Ts&Cs. After that, when the new member goes to aa.com to make a reservation, the first step of each booking is to say whether it’s “personal” or “business” travel. The booking is then automatically associated with the org without having to enter the org #.

This threw me for the first day, since the booking page DOES have a box to enter BizExtra or OnBusiness #. Leave that blank! On my first 10 tries, I put in my new org # and it kept replying “Please enter a valid number”. Very frustrating!

How does this affect larger companies such as mine, where all booking is done through Concur? Will we no longer see American flights, as happens with Southwest currently? AA could be saving Delta’s bacon if true, and also helping United and JetBlue as the AA flights won’t show up.

Chase AA Biz card currently has a 75k signup promotion, but my business only has 4 (at most) travelers. Does that mean I won’t be able to qualify under the new structure?