News and notes from around the interweb:

- Horrid.

@itsakatylife Cutting your toenails in public? Are you kidding me? #ick #viral #fyp #trend #vibin #foryou #talks #storytime #toes #toenails #toenailclippings #gross #swimmingpool #publicpool #itendswithus #disgustang ♬ original sound – KATY - Delta lobbying keeps Allegiant from having its Viva Aerobus partnership for bizarre reasons

- Basic life advice:

Posts from the delta

community on Reddit - Starting November 8, you’ll need to pay with an Amex in order to use Amex Uber credits. No more just using the funds that come with a Platinum or Gold card but paying the rest of the charges with a better-earning card (like Sapphire Reserve).

- TIL: Malaysia has an elected Deputy King

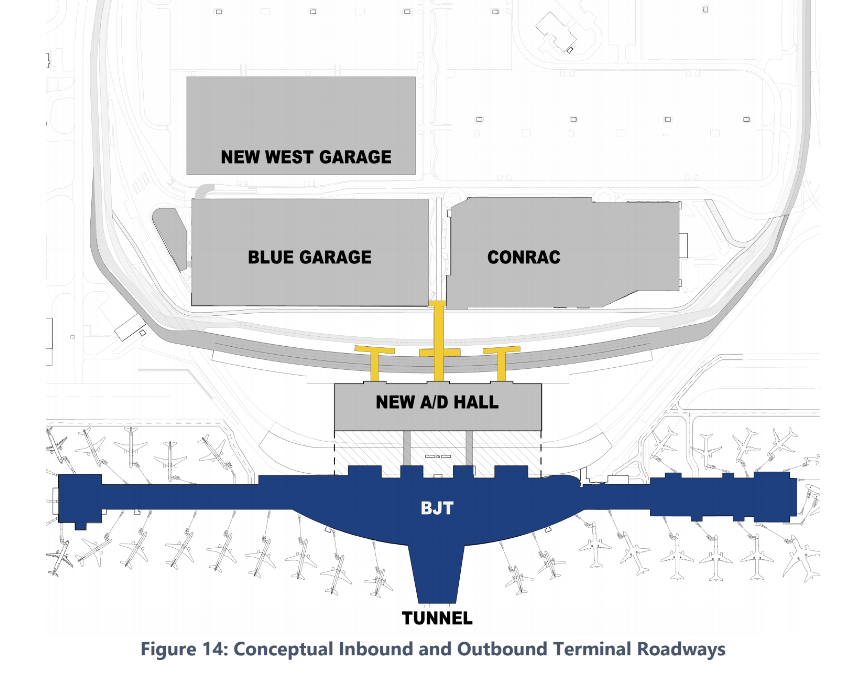

- Austin airport’s new headhouse project, currently slated to be completed in December 2029 is close to approval. It’ll involve demolishing the closest parking garage to the terminal and re-routing the entry road to the airport. The arrivals and departures hall project is budgeted at $865 million.

I need more clarity on the Amex Uber credits. I have the Platinum and Gold cards with both tied to my Uber account. No other credit cards are connected to Uber (so not using my CSR for example). However there are times I use less than the $25 monthly credit (along w any cash already in the account) so no charge against one of my Amex cards. Will I still be able to use the credit or have to manage the purchase so I exhaust all the credits plus any Uber cash I may have in the account so there is an actual charge against an Amex card every month or lose the credit?

@ Gary — Yet another reason to dump AMEX.

I’m guessing that very few people go to the trouble to split payments, so this is not a big deal.

@Gene

I have both the Platinum and Gold cards and they both pay for themselves. My JetBlue also does, but only through the free baggage and annual 5K points. My CSR does not pay for itself and I will cancel it next time around.

There are three major travel card brands (Amex, Chase, Capital One). Capital One is doing what they can to attract new customers, Chase appears content with the status quo, and Amex is trying to push customers away.

I’m not saying that pushing customers away is inherently a bad thing; part of Amex’s allure is its supposed exclusivity.

@ WileyDog — Drink the Kool aid. How many CapOne points are you giving up and how much time are you wasting keeping track of coupon clipping?

@Wileydog – like you I have the Amex Platinum, Amex Gold and CSR. Both Amex cards have credits that cover my AF (I have a spreadsheet that keeps up with all my various card credits).

The CSR doesn’t but my net cost is probably $150 (after $300 travel credit, Doordash (which my daughter uses heavily) and a few others. It is personal decision but every card I have doesn’t have to “pay for itself”. I value the CSR for 3X on all travel, their insurance (much better than Amex) and the ability to transfer points to Hyatt and United (which are not Amex transfer partners).

Also maybe a factor of my budget and lifestyle but $150-$200 is a decent meal and not an amount I would miss in r one to make a decision about regarding a credit card.

Need clarification for those of us who have both Amex Plat and Gold. How do we use Uber credit on both?

Uber website allows only one choice.

@Karl – I have both and get both credits every month. All you have to do is add each separate card as a form of payment.

I can’t help think it’s not a coincidence that Capital One deal with Uber (free Uber One and 10% 10x on Uber on some cards, though not Venture cards) also is scheduled to end in November (and there is no announcement on an extension yet).

Getting free credits from AMEX AND 10x on the rest from C1 AND Uber Cash rebates as part of Uber One is pretty sweet (I hold Platinums, a Gold and a SavorOne). I’ll miss it when it’s gone. 3x to 1x (CSR) isn’t a huge deal. 10x to 1x is much bigger.

@Gary completely irrelevant for this post but I have a bit of a quandary that I thought might pique your interest: I’m torn between getting the Hilton Aspire card and spending $30K this year and another $30K early next year or getting the Ink card that pays 2.5% cash on large purchases. I already have status with Hilton through next year so that’s not a factor. I’d be highly interested in hearing your thoughts.

Dubai is turning into Benidorm.

But I admit the gross act I was a little underwhelmed to read it was nail clipping. I thought at least something worthy of a John Waters production.

@ Retired Gambler — The mere fact that you have to keep a spreadsheet to make sure you cover your AF proves my point. An easier way to cover the AF is to close the card and use one with a WAY lower AF, like the CSP.

@Gene – I’m retired and a bit obsessive/compulsive so typical for me to have spreadsheets or detailed lists. Not a problem at all. BTW, I love my Amex Platinum and Gold cards plus my CSR (and a dozen or so others). Like I said I get more credits than the AF for both the Amex Platinum and Gold and cut the cost of the CSR down to $150 or so which is very reasonable. Then I get great lounge access (none of that w CSP), International Airline Program w Amex Platinum, etc, etc above and beyond the actual credits that offset the AFs. You, and others, would probably go crazy if you saw all the spreadsheets and similar such documents I maintain.

@Gene I learned a while ago that folks will ALWAYS find a way to justify some of these expensive cards. I’d be willing to bet a small amount that if some of these folks were honest, they keep these expensive cards because it makes them feel good about themselves.

Nothing like plopping down an Amex Platinum to try to impress the college kid waiting your table at the local Applebee’s.

If Synchrony were to make a JCPenney Mastercard weigh as much as the old Ritz Carlton and give you $5 back on $25 in spend once a month, you’d have folks who never shopped at JCPenney justify why that $5 bucks back makes perfect sense and will argue with you in the comment section like their life depends on it to tell how wrong you are if you call the card unnecessary.

@ Retired Ganbler — How’s that Expedia-like customer service from AMEX IAP? No way in hell will I ever buy another airplane ticket from AMEX travel, unless it saves ALOT. What are you actually getting for $150 from CSR? Severly devalued 3x Hyatt or 3x United points on hotel stays? The opportunity to stand in line to enter an overcrowded lounge and eat food from a disgusting buffet? I, too, have way too many high-priced credit cards, but I started asking myself these questions more lately, and I have been closing more cards than I renew. All that said, the one benefit that AMEX Platinum does offer that makes it worth having one per househld is the 5x on air travel. I used to justify two per household for the lounge access, but AMEX lounges suck, and we must have 12 Priority Pass memberhsips. Plus, we don’t ever fly in coach, so really don’t need international lounge access at all.

well said gene!