When writing about the upcoming changes to Starood’s cash and points awards, I said that it’s good that cash and points will become available for premium rooms and suites, and also good to the extent cash and points awards will be more available than before.

It’s bad to the extent that you could have gotten a standard room cash and points before at a lower price, and the rooms that had been available before will now cost 21% – 25% more.

But I also said that cash and points remains a good deal relative to standard award nights. I didn’t go indepth into the analysis of why that’s true.

Reader RQ commented,

I think it’s awful Gary.

In most cases it now costs more than 2 cents per point to “buy” the difference in starpoints between a C&P award and a standard award (figuring an approx. 15% tax). Which means there are very few cases where it would be better to use C&P over a standard award.

I don’t think that’s quite right. Although I understand the frustration.

Now, RQ is correct in how to think about whether cash and points are ‘worth it’. In paying cash, you are basically buying the difference in points between the cash and points number of points required and the number of points required on a standard night.

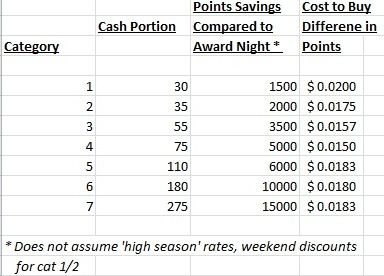

In my world I believe every question can be settled with a spreadsheet. So I plugged in the number of points that cash and points award saves compared to a standard award night in the same category.

For this purpose I am assuming it’s not high season (where the savings would be much bigger in cash and points’ favor). And I assume we’re not talking about a weekend night where category 1 and 2 hotels are 1000 points a night cheaper for a standard room award.

Here’s the price you’re “buying back” your Starpoints when redeeming cash and points.

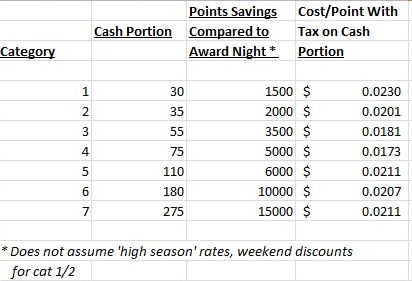

Now RQ makes one additional point that shouldn’t be overlooked. You will generally pay hotel taxes on the cash portion of a cash and points award. That means a cash and points stay is a little bit more expensive than a regular award stay. So let’s do the analysis assuming taxes on the cash portion of cash and points. What does this do to the price you’re effectively buying back Starpoints at?

Category 3 and 4 hotels are where cash and points awards are ‘most worth it’. That was true before and remains true.

If you aren’t willing to buy Starpoints at 2 cents apiece then you aren’t getting the value you’re looking for out of other categories. But remember that these are effectively purchases at the margin because they’re necessarily coming at the point of redemption. You might not want to be buying all of your points at 2 cents or more apiece, but would you buy half your points at that price?

That’s the question to answer. I value Starpoints at over 2 cents each, so I still consider this a value. And when redeeming for a category 4 hotel, I only need Starpoints to be worth more than 1.7 cents.

But the spread between what you’re buying points for using a cash and points award, and what those points are worth, has narrowed.

Where These Changes Inevitable?

I noted in my original post on the subject that Starwood had not ever raised the price of cash and points awards before.

But I then also made clear that this is not an excuse to do so now. (“But that’s not just an argument that it’s reasonable to see award chart inflation. I don’t think it really is.”) I’m not sure I gave enough of an explanation of why, though.

Room rates may go up, but that’s what Starwood’s hotel categories are for. When a hotel’s room rates rise, then each year Starwood moves hotels around the different categories. It may go from category 3 to category 4, in which case the cash and points price for that hotel goes up. Eventually there wind up fewer and fewer category 1 and 2 hotels perhaps. But there’s no reason that the price of a category 3 redemption needs to rise. And there’s no reason a category 3 cash and points award needs to rise, either.

Lucky covered the changes and disagrees with that analysis,

I really don’t think we can blame Starwood, given for how long they kept rates the same.

When pressed, he expands in the comments:

While points might not be easier to earn, there’s no doubt that there are more and more points in circulation each year, which could reasonably cause a devaluation.

But I think this gets the economics of the program wrong.

‘More points in circulation’ means devaluation for an airline program where those increased points are chasing a limited set of (capacity controlled) seats the airline expects not to sell. Then either the price of those seats has to go up, or you have unsatisfied members who just can’t find seats.

But the economic model of most hotel programs including Starwood’s is different. They don’t have “more points chasing fewer rooms.”

Instead they sell points (to their hotels, to American Express, to their other partners) and manage redemption categories so that their redemption costs are lower than associated revenue.

Where they run into trouble is when more and more rooms are being redeemed at sold out hotels, and they have to reimburse an increasing percentage of redemption nights at each hotel’s average daily room rate instead of at their discounted reimbursement rate.

That has never been a component of cash and points awards in the past at all.

So the only ‘justification’ (other than “because we can”) for increasing cash and points award prices is to change the economics of the award and get more availability. Whether that’s good or bad for members is open for debate.

But it isn’t required by the economics of the program, as a result of time, as a result of rising room rates, or because there are ‘more points in circulation’.

At first I was very annoyed by the increase, and I will admit that it sucks whenever a “devaluation” occurs.

However, the devaluation is not as bad as first predicted. Two essential facts lessen the devlaution:

1. We earn 3-6x (depending on status) per $ spent at Starwood.

2. Inflation increases prices of hotel stays and other items (if using SPG AMEX).

As a result, we should expect “devaluation” over the years on any program that is dollar based. If they don’t “devalue” the redemptions, they will lose even more money.

I still hate it, but it is likely a necessary evil in any program that is dollar based.

I think they’re doing this ‘because they can’. Any rise in availability of C&P will be minimal and I would be surprised to see too many properties who never have C&P availability to begin offering some. I might help slow the erosion of even more properties never offering C&P availablity.

your analysis does not include 5th night free on full points redemption- admittedly cannot be used all the time, but changes the value considerably in cases where it can–

@m – 5th night free on awards doesn’t affect this analysis. it does, however, affect the analysis of whether a free night award vs cash and points makes sense if the stay if 5 nights.

Let’s not candy coat this folks… it doesn’t matter if SPG increases the availability of C&P options… they are increasing the C&P it takes to get those rooms… by an average of 21-25% – That is a ridiculously high inflation rate… Hello Marriott…

@Gary;

You’re point about the margin is right on. No where more so when you have constraints on the number of points you can use (not enough points to do all the stays you want).

But whereas I would always try for C&P on stays of three nights or less, now it’s only when I have to because my points are constrained.

Do you still earn Starpoint by using C&P, if not, then there is an opportunity lost as well other then taxes

And, although you may already know this, points vanish with the new year. My 12K just evaporated. Damn! Yea, hello Marriott, especially if I can get 25% off by finding a better rate. (And SPG web site is crap too.)

@Gary K – I don’t think you will be pleased with Marriott

Is Dave Plude and Gary K are the same person with “Hello Marriott”..@Dave Plude, I don’t think SPG points will “vanish” at the beginning of new year (it’s not EQM) but it does have expiration date of 12 months if you are not an “active member”. You may still call SPG and get your points restored..

Of course they’re still worth it, but they’ve transformed from a capacity-controlled exceptional value worth seeking out to something marginally better than regular awards, depending on priorities and balances.

So the number of required points is going up by 25% and the cash requirement is going up between 17% and 25%. Then of course you have some hotel category creep over the years that makes some of the properties more expensive points wise. I just applied for a Club Carlson card. Different kinds of properties for the most part but for my purposes I think overall I will likely get more bang for my buck with them especially if they run some good promotions again. Starwood program was decent in the past but now these changes makie it less attractive to me.

@Gary — I don’t think that’s a correct way to value the points, since the object here is not to buy them, but to use them to save money.

..

The value should be (Price – Copay + Tax) / Points. This will vary depending on how expensive the rooms are and how much you truly value staying at a certain hotel…kind of like how much you’d realistically pay for first class vs. using points.

..

This formula will use actual redemption opportunities, and if we do see more high-end cash+points redemptoions show up, well then maybe the value of the points will go up.

..

On the other hand, what good is a theoretical value of an SPG point when to redeem it you have to travel during inconvenient times and stay at less than ideally located hotels.

..correction, that formulate should really be [(Full cash cost) – (Cash copay + taxes)] / Points since the taxes and fees might be different in each case. That’s not even accounting for the point earning on the $ spent, so should be factored in as well.

@Frequent Churner — my formula is how to decide whether to use cash and points or a standard award night. You are asking whether to do either vs pay cash. Two different things.

My formula calculates the value of each point in any scenario, which is the whole discussion…whether SPG points have devalued or not.

..

Your formulate calculates how much you have to pay to save X number of points, which isn’t the end result of any redemption. The goal is to figure out how much money each point saves you.

As hotel room prices inflate, along with incomes and budgets, it becomes easier to earn more points. As Starwood Guide points out, people earn 3-6x points per $, so if cash rates increase then point accumulations increase as well. This gives some justification for a point rate increase rather than category shift. On the other hand, I suppose they could have just shifted all hotels up by one category, and perhaps this would have garnered more or less the same reaction from travelers.

@Antonio – but as cash rates increase, hotel categories increase, which means the points required to redeem increases. That’s built into the system already.

@Frequent Chruner “Your formulate calculates how much you have to pay to save X number of points, which isn’t the end result of any redemption.” But I’m not evaluating the ‘end result of redemption’ I’m comparing the RELATIVE VALUE of cash and points, given redemption. Which is what I was setting out to do given the change in relative value of cash and points.

Gary

In simple terms, let us clarify this.

They lose money on standard awards redeemed at sold out hotels. The C&P are never a loss for them as they are capacity controlled.

Now they are raising rates on capacity controlled rooms (without telling us that capacity controls go away completely for these rooms in exchange for these changes)

AND for suites and Cat7, they already raised rates on those before.

So let us simplify this – They are raising rates because they can and want to and care nothing for loyalty.

So it is SPG for the airline miles I may need and hello Hilton and Hyatt for the high end and Marriott and Carlson and Priority club for the lower end. Even in miles, Wyndham seems OK, as the MC is accepted everywhere.

My observation for the budget conscious traveler (which I consider myself to be) is that one wants use points to reduce cost while traveling. To do this you need to maximize your points value. Only use your points when the rate you would have to pay otherwise is high, don’t use the “rack rate” for comparison, because hardly anyone actually pays that, use what you would pay. One needs to be frugal in other words, and I suspect many of the people who read these blogs are. Elite benefits comes into the equation as well of course. So they have changed the equation significantly for this kind of traveler, in some cases cash and points will still make sense. But I think they have tilted the value in their program to redeeming large number points during peak periods and rates are high, i.e when the hotel may be sold out.

I would be curious to see what your new valuation of Starpoints would be

I was generally in agreement with you of your 2.2 cpp valuation, but my valuation was largely based on the 3-4 times a year I would get outsized value C&P. Even a minor devaluation of Starpoints knocks out all but C3 and C4 redemptions

And even if C3 and C4 becomes more available, it gets tempered by the fact that

A) C5 now becomes “unavailable” (in the sense that I and I’m sure many others wouldn’t redeem for it anyways)

B) Instead of getting “great” values on C3 and C4, I’m getting “ok” values

C) Now many times where using C&P was the best option for C3 and C4, now cash becomes the best option (More often than not you can get C4 hotels for less than $200, and at that point, I’d probably go with cash if there’s at least a 2x points promo or better)

So even if C&P becomes more available, I think it will become much less “available” if you get what I’m saying

And to answer the obvious question “what about transferring to miles”, I am pretty miles rich, so while I certainly get some value out of the fact that you can transfer SPG points to so many airlines, I don’t need miles in the “mainstream” programs, so all SPG does for me on the miles front is the one-off “niche” trip (i.e. EK) that isn’t so simple to book with US or AA