A roundup of the most important stories of the day. I keep you up to date on the most interesting writings I find on other sites – the latest news and tips.

Qatar Airways Threatening to Leave oneworld

Qatar Airways CEO Akbar al-Baker is not happy with oneworld members American Airlines and Qantas, and suggests it may not make sense for Qatar to continue in the airline alliance as a result.

He has already spoken with the head of oneworld about this and “will wait for him to come back before deciding what to do.”

Confirmed: Hyatt Buying Two Roads Hospitality, Picks up ~ 85 Hotels

On Friday I wrote that Hyatt would be acquiring Two Roads Hospitality.

The deal has now been publicly confirmed. The deal announcement cites 85 properties, 10% fewer than are listed on the Two Roads website. Acquiring the group will grow Hyatt’s footprint by about 13%.

Should Airline Compensation Go To Your Employer — Instead of You?

When an airline pays out compensation for a delay, and you’re traveling for work, are you really entitled to keep the money? Shouldn’t you turn it over to your employer?

Let’s assume your employer bought the ticket and both travel and the delay were during business hours. You’re getting paid, and your employer is the one suffering the loss (of your productivity).

New Expanded Dallas Fort-Worth Centurion Lounge Already Limiting Admittance Due to Crowding

A week and a half ago the Dallas Fort-Worth Centurion lounge re-opened in its new larger location.

At the time I wrote that “I still expect that the lounge will get crowded at peak times.”

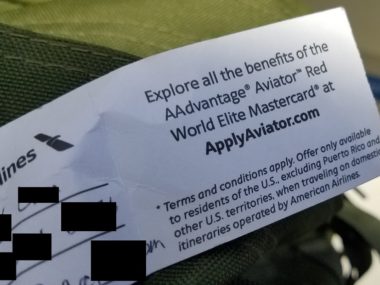

A Grand Bargain With American Airlines For Bigger Lavatories: Credit Card Ads While You Go!

Currently American Airlines is installing smaller lavatories across its domestic fleet, taking a few inches away from customers who have to go in order to squeeze in an extra row of seats.

The problem is that today American Airlines isn’t generating any revenue from its lavatories so it’s no surprise they’re trying to limit lavatory footprint.

How to Spot if a Flight Attendant is Attracted to You and End of an Era for Tokyo Sushi

A roundup of the most important stories of the day. I keep you up to date on the most interesting writings I find on other sites – the latest news and tips.

Spray Painting 10 Cadillacs Half-Buried Nose First Into the Ground

In 1974 ten Cadillacs (models from 1949 through 1963) were buried nose first half way into the ground. The cars were placed in a wheat field Marsh owned, and then in 1997 moved two miles west to a pasture belonging to Marsh along side Interstate 40.

Unquestionably Cadillac Ranch is one of the better stops along one of the world’s great drives (“Or perhaps you don’t want to see the second largest ball of twine on the face of the earth who’s only four short hours away?”).

United Says ‘Lavatory Leak’ Soiled All of Veteran’s Belongings, Will Take 8-10 Weeks to Compensate Him

Dave Harris flew home to Colorado Springs on Friday after a six month deployment in the Mideast. He says his “whole life for six months” was in his checked bag. It contained his uniforms, “workout clothes, gifts for..family, jewelry” for his wife.

Friends picked him up. On the way out from baggage claim tot he parking lot they all noticed a disgusting smell coming from his bag.

Hyatt’s 2 Big Chances to Grow and the Cost to Airlines of Keeping Planes Hot

A roundup of the most important stories of the day. I keep you up to date on the most interesting writings I find on other sites – the latest news and tips.