With planes full and stress high during the holidays, passengers can go to extreme lengths to be terrible. But we don’t usually hear of such bad behavior on the ground as a man who had several drinks before going to the Memphis airport, needing to ‘go’, and deciding to do so “beside a woman who was sleeping inside the terminal.”

Awesome Flight Attendant Video Explains Why Holidays Are the Worst Time for Experienced Travelers to Fly

The routine and efficiency of frequent travel were captured beautifully — albeit harkening back to before pre-check and mobile boarding passes, and you don’t have to swipe offer your elite card when returning a car at Hertz — by George Clooney in Up in the Air:

But now it’s the holidays. I’m grateful after a year of travel not to be going anywhere this season, to put some time in at home. When I do travel on peak holidays I do my best not to travel the Wednesday before Thanksgiving or the Sunday after, or the last business day before Christmas. These are amateur days.

Should All PreCheck Passengers Have to Go Through Nude-o-Scopes? And The Happiest Upgraders Ever

A roundup of the most important stories of the day. I keep you up to date on the most interesting writings I find on other sites – the latest news and tips.

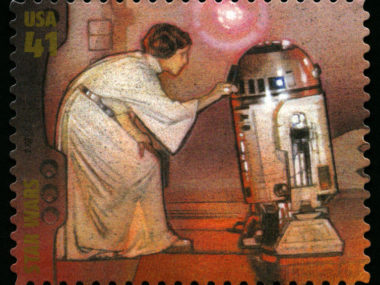

Carrie Fisher Went Into Cardiac Arrest As Her United Flight Landed at LAX, Unresponsive

Carrie Fisher had a cardiac episode onboard United flight 935 from London to Los Angeles today. She was reportedly “in a lot of distress on the flight.” Medical personnel met the flight and found her “unresponsive.”

This Southwest Airlines Ramp Agent Saved Christmas for a Little Girl in Detroit

An 8 year old girl named Eleanor lost her teddy bear — named Teddy — on Wednesday night after arriving in Detroit on a Southwest Airlines flight from Dallas.

At bedtime she realized her bear was gone. Her mother called Southwest and filed a lost and found report.

Man Voluntarily Gives Up Business Class Seat So He Can Assault Woman in Coach

The woman sought the assistance of the crew who ordered him to return to his business class seat. He kept asking to speak to the woman he had assaulted, but was told in no uncertain terms that he couldn’t. Instead he wrote two notes to her apologizing, saying in one that he “was stupid.”

He was stupid on so many level.

Man Denied Boarding On United Heads to Tarmac, Steals Luggage Tug, and Drives Off

This morning a United Airlines passenger scheduled to fly from Orlando to Chicago was denied boarding when airline personnel decided he was “behaving erratically.”

He proved them right, because his next move was to push his way onto the jetway, open an emergency door down to the tarmac — then hop into a luggage tug, and drive away.

AwardWallet Plus Price Tripling, Lock In Current Pricing Now

The free version of AwardWallet suffices for some. You enter your frequent flyer account numbers and passwords. Then you can update most of your account balances with a single click and see them on one page. You can log into your accounts with a single click.

When I first signed up I realized quickly I was happy to pay the minimum required for their premium membership that included expiration date tracking for many of my accounts.

Boston Flight Threatens to Divert Over Passenger’s Wifi Hotspot Name

There are some pretty clever wifi network names. I boarded a flight once and saw someone’s called “Pretty Fly for a WiFi.” They’re not all clever, at home I can see a neighbor in my building with a network named “condogirl.”

If you’re on a plane, though, you need to turn off your wireless transmitting devices (use airplane mode) once the door closes and you need to not name your network “bomb” or…

50% Off Europe Tickets Today Only and Drink More Alcohol at Disney

A roundup of the most important stories of the day. I keep you up to date on the most interesting writings I find on other sites – the latest news and tips.