As airlines try to pacify Wall Street by squeezing customers, they may actually be leaving revenue on the table.

That’s because caring about customers matters for an airline’s bottom line. It’s no accident that Alaska Airlines has one of the best operating margins of any airline in the world.

Delta differentiates its product somewhat from United and American with better on-time performance, their recent IT meltdown notwithstanding. But they’re the ones that started the industry trend towards giving customers less for the same money.

Instead of trying to continually drive down price while giving customers more, the three major airlines try to give customers less by taking away the ability to change tickets for a fee, to have advance seats assignments, and for elites to be able to upgrade — unless they spend more on a ticket.

US airlines used to differentiate themselves through their frequent flyer programs, trying to be more rewarding, but with planes generally full they’ve invested less in marketing and give customers less for flying. It still makes sense to concentrate flying on a single airline when possible because flying as an elite member is better than being a non-elite.

While airlines act as though price is the only thing that matters, and incremental revenue is all that matters, customers do choose or rule out airlines based on value propositions and experience. Speaking only for myself I used to go out of my way to fly American even when they were a bit more money or when I had to connect versus taking another carrier’s non-stop. I don’t do this as much anymore, which means less revenue for American. I’ve flown only two American segments since requalifying for Executive Platinum two months ago.

This is just anecdotal, but one firm tried to quantify the financial effects of customer perception. And they found that it makes a huge difference.

C Space took a look at what would happen to Delta’s financial performance, if it could adopt a more customer-pleasing approach and somehow close the 4 point gap in the survey between its own Customer Quotient score and that of Alaska’s.

“It generated a return on asset improvement from 8.5 percent to 10.4 percent, per our calculation, Trevail says. “That translates to a $991 million increase in operating income and a revenue increase of $8.8 billion annually. So you see, improving a company’s CQ score a mere 4 points can have massive impact on a company’s bottom line.”

That’s orders of magnitude more than Delta claims to be making upselling customers to get back things like advance seat assignments they used to get as part of their ticket.

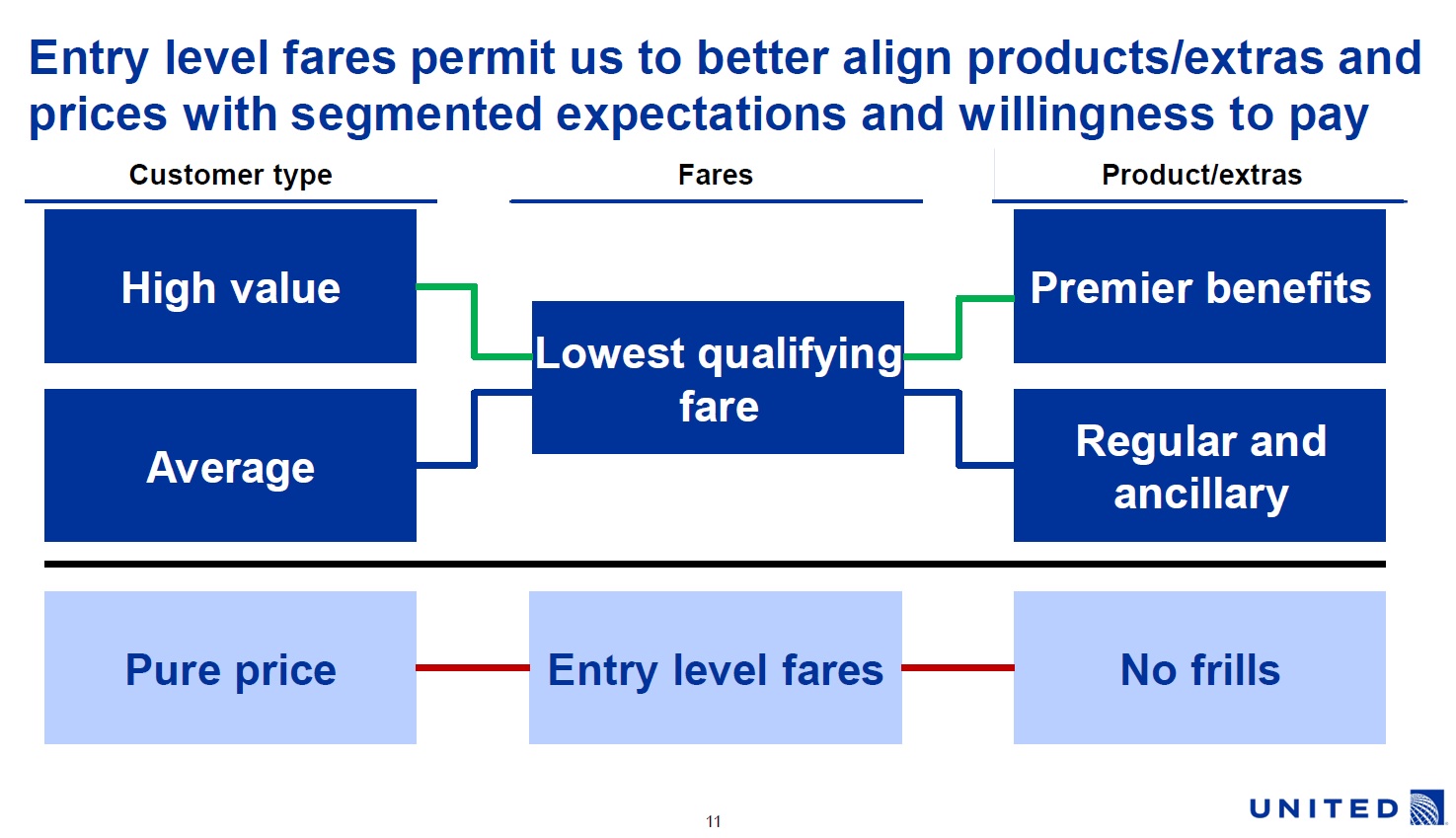

American plans to follow Delta. And that’s United’s plans as well:

Indeed, there’s nothing even inherently wrong with a la carte pricing. But it’s clear when American will stop allowing customers to check bags to their final destination when traveling on separate tickets — even when both are American Airlines tickets, and even if it means having to clear immigration and customs to collect bags just in order to re-check them — that customers aren’t at the center of major US airline decision-making.

It’s hardly a novel idea that you’ll maximize shareholder return over the long term by focusing on your customers and figuring out how you can deliver increasingly greater value to them at the same or lower prices. Airline brand and reputation matters, and airlines even sometimes believe it which is why they do spend on advertising. But the best advertising of a mediocre product only calls attention to the gaps in product.

So before you advertise, think about what you’re delivering for your customers and think about whether you’re making your product easier or harder for your customers to use when adopting changes.

“Delta differentiates its product somewhat from United and American with better on-time performance, their recent IT meltdown notwithstanding. But they’re the ones that started the industry trend towards giving customers less for the same money.”

Au contraire Delta has led on free booze and free entertainment in the back of the bus. Not only that, but based on my experience, you’re much more likely to find a fresh cabin with wifi, entertainment and power on Delta than either of the other legacy carriers. So while you may be stuck in the back, you’re at least getting more for the baseline product.

When I saw the headline , I immediately thought of British Airways.

And this should

Is why it’s our DUTY to post any miles flown with these three carriers (if we have to) to Etihad, Singapore and Alaska for Delta. Enough is enough. The US Airlines are worst thanightmare Discount European Airlines. #enoughisenough

@Justin – I’m not sure it’s fair to say “you’re much more likely to find a fresh cabin with wifi, entertainment and power on Delta than either of the other legacy carriers.”

You’re going to find wifi on both American and United. United FINALLY caught up. (Bloody #@!$ it took awhile.) Delta is investing in faster wifi, and in a more coherent way, than the other two legacies. That may create a gap in the future. I’ll give Delta the edge on seat power. Not sure that fresh cabins on their old planes are actually a differentiator between AA and United.

@Justin I could care less about free booze (I often have a 1 hour drive home from airport) or IFE (generally mediocre anyway). For me – and I suspect most elites – the key perks (aside from good operational performance) are free E+ seating, early boarding (so I don’t have to check a bag), and miles I can use at saver levels. UA is 3/3, DL only 1/3. I’ve had working power plugs on every recent UA flight as well as DirecTV and wifi on most. So I don’t think DL has an edge here. If I’m “stuck in the back” (which for me means E-) or even worse a non-aisle seat then the game is already lost.

Abusing customers seems to work well for the cable company. Airlines have a similar lock on many markets, at least in the short run.

Great post! Airlines are no different from any other business with multiple suppliers: customer satisfaction drives profitability.

(nsx — in the U.S. cable companies are monopolies; the number of Americans that can choose their supplier is … zero? — while when flying from A to B almost always you have a choice of multiple airlines).

Regarding the revenue-based mileage accrual system, I can’t figure out why if it’s actually revenue-based, the person purchasing the tickets can’t keep all the “miles” earned based on price paid. The language in the AAdvantage program terms and conditions is: “Mileage can only be accumulated one time per flight, regardless of the number of seats purchased.” My husband has been Exec Plat for years while I’ve merely been what I call “coattail status” when flying with him or on his miles by myself. And every year, it seems, I get really close to Gold without trying or thinking about it, just because I obviously have to take the miles for the flights I’ve flown. If I could just let my husband keep the miles from my AA flights, they’d do a lot more in his account for both of us. <–I think I just answered my own question.

This is what I expected from Doug Parker.

Obviously when the next economic crisis hits the carriers are going to improve things for the customers trying to win them back

@Leonardo- posting miles to SIngapore to “stick it to carriers who are less rewarding to their frequent fliers”- did you really say that? All the 3 legacy carriers still have *much* better rewards to their frequent fliers than SQ, including both discretionary and guaranteed upgrades to premium cabins, low/no fuel surcharges on redemptions, etc. The American flyer is totally spoiled.

I also have seen many posts on this blog over the last month advertising superpower fares to Europe and Asia, many on those same 3 legacy carriers. So it doesn’t really seem like the airlines are finding it easy to fill their planes anymore, at least in the off season. So where do they go to make money instead?

“American plans to follow Delta. And that’s United’s plans as well”

Well, true. Really……Delta and United execs are inside American’s boardroom, and that’s American’s plan to keep them there (as much as they sit inside Delta and United’s boardroom).

Not so much at Viacom, however. American needs that style of shakeup—-kick ’em out!

Airlines in the US are directly the result of Obamanomics. Your money doesn’t matter fools.. Now Cowtow and get in line or Perish.

“In the place of a Dark Lord you shall have a Queen! Not dark but beautiful and terrible as the Dawn! Treacherous as the Seas! Stronger than the foundations of the Earth! All shall love me and despair”

Welcome to Your NIghtmare.