I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

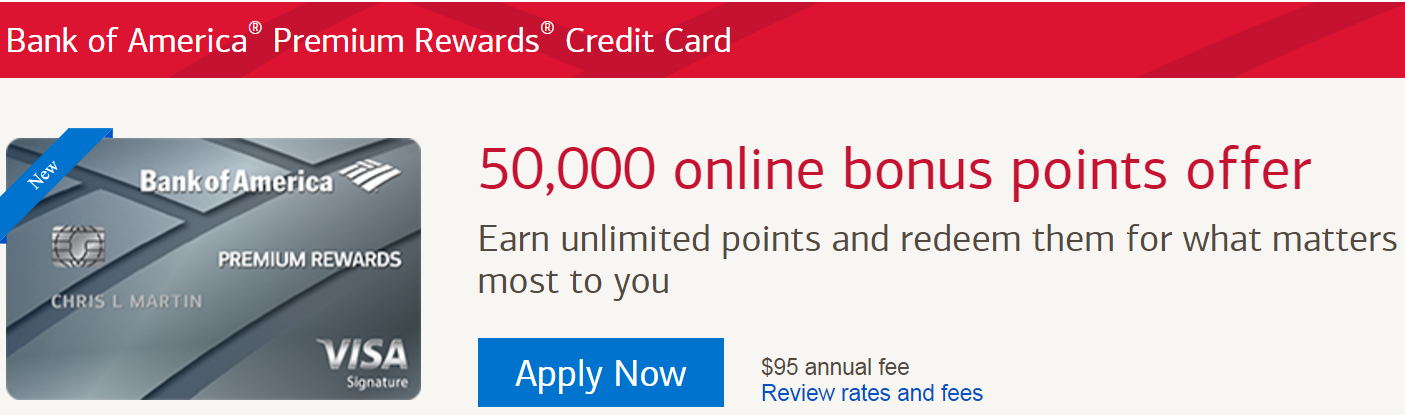

Bank of America has entered the premium rewards credit card market (or that’s what they want you to think) and they’ve come up with a name for the product to emphasize this: Bank of America Premium Rewards Credit Card.

We learned about the product last month and it’s just now live for applications.

This does not appear to be a competitor to the Platinum Card by American Express. It’s not in the super premium card space.

Instead it’s a competitor to the Chase Sapphire Preferred Card and the Citi ThankYou Premier Card. And it isn’t as good unless you have $100,000 or more in assets on deposit with Bank of America.

Here’s what the Bank of America Premium Rewards credit card offers:

- Signup bonus: 50,000 points after $3000 spend within 3 months

- Earning: 2 points per dollar on travel and dining, 1.5x on everything else

- Annual fee: $95

- Benefits: $100 travel credit, $100 Global Entry or TSA Precheck credit, no foreign transaction fees

- Standard Visa Signature travel protections: trip delay, trip cancellation, baggage delay, lost luggage, emergency evacuation

Put another way, it’s a better signup bonus for the no annual fee Bank of America Travel Rewards card which earns 1.5x on everything.

That hardly compares to the Chase Sapphire Preferred which has a better bonus, a $0 annual fee the first year before becoming $95, and whose points transfer to a variety of airline and hotel loyalty programs.

You Won’t Likely Be Spending BofA Points for Asiana Business Class…

There’s solid value here for BofA investment clients though. Through Bank of America’s Preferred Rewards program earning on the card ramps up based on assets on deposit:

- $20,000-$49,999: 2.5x on travel and dining, 1.875x on other spend

- $50,000-$99,999: 3x on travel and dining, 2.25x on other spend

- $100,000+: 3.5x on travel and dining, 2.625x on other spend

That’s really just a no annual fee Bank of America Travel Rewards card with additional travel and dining earn and a travel credit to offset the annual fee.

Copyright: wolterk / 123RF Stock Photo

I still think that Chase Sapphire Preferred is a much better card than this new BofA effort, and it doesn’t even attempt to compete in the super premium space — without lounge access, hotel or airline elite status. Instead it’s a niche product for Bank of America investment customers. A decent enough card but in no way a game changer.

(HT: Chong786)

@Gary, I’m confused, first you say “$100 Global Entry credit”, then “without […] even it seems a Global Entry or TSA fee credit”

which is it?

It has the credit, initially it seemed as though it would not

Is that 100k in BofA accounts only or does Merrill Lynch (the ML balance did for a discount on a mortgage I took out recently) count as well?

You can redeem for either Global Entry or Pre-check credit. Global Entry includes pre-check, which is the better choice.

The $100k includes both BofA accounts and Merrill Lynch investment accounts. It does not include retirement accounts. Also, note that if you sign up for Preferred Rewards now, I believe it takes the daily average balance of the last 3 months and uses that to determine which “level” you fall into.

While I understand the versatility of Chase’s UR points, you still wind up having to pay $95 for that card anually. From your post, though, it seems like Bank of America will pay you $5 to have this card? And that’s before the Global Entry “allowance” which isn’t avaialble with the Sapphire Preferred. Seems at least worthy of consideration in that regard, no? 🙂

Not seeing why this “hardly compares” to the CSP. They both have AF of $95 that Chase waives the first year, but this card has the airline credit every year, and the GE credit every 4 years. Is it worth $100 (or close to that) to have transferable currency? Perhaps. But if you already have another premium Chase UR card, then this one is superior, especially if you have assets at BofA.

Teaser or True? BofA online marketing says the “Airline Incidental Statement Credit” ($100 annually) can be used for “seat upgrades.” That would be nice, if it truly includes Business Class. AMEX Platinum fine print explicitly states their $200 “incidental airline fees” credit excludes upgrades. Granted, BofA to AMEX is an apples to oranges comparison, because the cards are in radically different leagues. But one $100 upgrade credit per year would more than pay for the $95 BofA card. It would take a lot of food, baggage, and change fees on a single airline to come total $200 a year for most travelers. I currently hold the $0 fee regular BofA Travel Rewards card and now intend to explore this further with BofA. If true, I’ll switch. It’s a good card for me, because BofA also increases the stated cash reward by 10% when I redeem it to my BofA checking account, and another 25% on top of that because I reached one of their Preferred Rewards tiers (preferred simply means “high aggregate balance across several BofA accounts”).

Okay I don’t understand at all why the CSP is considered a better card. The power of the BOA card is in the “….and everything else” category which starts at 1.5 points and can be maxed out at 2.5 with a high enough BOA bank balance. There are many of us who have substantial vendor payments on credit cards every month and this seems like a very good solution with the airline credit making this card essentially free to hold.

While it’s true there is a Citibank solution at 2x, it does not come with travel/dining bonuses which to me means this card is approximately a wash with $20k in BOA and a clear leader with $50k or more in BOA. I don’t see anyone who keeps more than $50k in assets with Bank of America seeing this as a difficult decision.

1.5x, 2.5x it matters x OF WHAT and a Chase point transfers to a variety of different airline miles.

With 100k in a BofA account though the value proposition starts to look attractive.