Delta laid out a plan for SkyMiles several years ago. And all they’re doing now is executing on it.

When Delta rolled out the revenue-based earning part of their big overhaul of SkyMiles, I wrote that they had planned to go to revenue-based redemption too but backed off of that late in the game.

Let’s peak behind the curtain of what they were planning.

Delta’s focus groups towards the end of their process scared them out of revenue-based redemptions. Business travelers wanted to get value for their points instead of having a fixed amount of points buying a specific dollar value of ticket. Delta was worried an important customer segment would defect if they went all the way revenue on the mileage burning side of the equation.

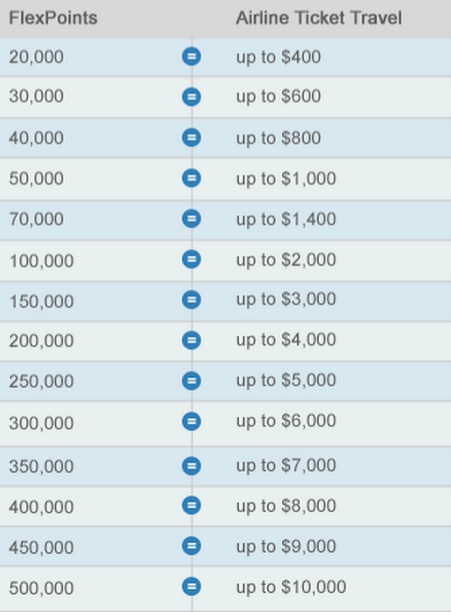

Delta wasn’t planning to do a transparent fixed-value per point. Instead they were going to offer a redemption chart sort of like US Bank’s FlexPerks program. There would be a table where a certain number of points would be required to claim tickets in a range of dollar values. 25,000 miles might buy any ticket up to $375, for instance.

Here’s the FlexPerks flight award chart:

Delta’s awards were going to look something like that (although, I believe, less valuable).

Along the way they had technology challenges with this, and it took longer than expected to put together, but at the end of the day it was customers saying they wanted the possibility of shooting he moon on an award – getting outsized value — that the fixed revenue-based redemption model eliminates but that’s a big motivator in consumer loyalty to a currency.

I’ve often derided the model as ‘being like a punch card’. For every X spent, you get Y. It upends the most successful marketing innovation in history which is, itself, wildly profitable on a standalone basis. This is a billion dollar business – which isn’t actually in ‘trouble’ in any conventional understanding of the term — that’s being turned on its head.

This isn’t S&H Green Stamps and it isn’t your neighborhood sandwich shop punch card. It’s a reward for your loyalty. The time spent with an airline becomes your reward, “you give us your business travel, you give us your paid leisure travel, and you become like a good friend that we will take care of down the road in the best way we can – with that free trip to Hawaii, with a business class trip to Europe for your anniversary.”

Frequent flyer programs changed what are essentially a commodity to be sold at the lowest price – an airline seat between any two cities – and turned them into a differentiated product with brand identity and customer loyalty.

The funny thing is I had heard Delta executives talk up the model in precisely the same way — that it had ‘the simplicity and fairness of a sandwich shop punch card.’

Delta didn’t make the full revenue-based redemption move right away.

- They rolled out revenue-based earning, and didn’t share what redemption would look like at all. They were shell shocked by the reaction to the notion that they were hiding the ball on those changes. So they relented and quickly finished up the chart for travel to/from the US (only).

- Then shortly after those new award charts went into effect, they were removed from the website.

And they started moving to the very model they had planned. They declared the end of the 25,000 mile award. In order to get there,

- A majority of routes started requiring 3 week advance purchase to get the lowest award prices.

- The cheapest routes got lower mileage prices.

- They ramped up their use of ‘journey control’ to make sure award availability would more closely match price.

The elimination of award charts let them get closer to their original plan of tying award prices to fares without actually saying so.

In the end they’re doing what they set out to do – moving not to a revenue-based fixed value per point, but instead to tiered award pricing based on the value of an equivalent paid ticket.

They just aren’t being honest in their communication and saying so, because they are afraid that transparency would cost them customers who became loyal out of the question for real value. What would happen if they told those customers there was no more real value to be had?

Good article. I hope someone at Delta reads it (and pays attention). I would also hope that when Airlines play games like this it would have a negative impact on their FF credit card partnerships. Why on earth would anyone want a card earning Skymiles when you could just get a Venture/Arrival/Flexperks and get fixed value redemptions on any airline you wanted?

And yet people continue to apply for their co-branded credit cards “because the current sign up bonus is really good” and continue to fly them. Consumers have what they deserve, every time.

Delta being dishonest and and treating its customers like idiots? No way.

Earth to delta: Good customer service is more than thanking us for the business (money) we give them.

the other thing is that amex is only giving one bonus per lifetime, so aside from churners, what regular person will reapply for a $195 card with no bonus????

I think most people like us, the type of people who read this blog, are hopelessly unaware of what a minority they are. We know all the ins and outs and want outsized value. We *like* arcane rules and loopholes because we can exploit them to the fullest.

But think of the average consumer, who doesn’t know how to “shoot the moon” and probably isn’t aware he should want to. There’s a reason Southwest’s loyalty program (not their airline, mind you, their loyalty program) is quite popular. People like simplicity. The average consumer doesn’t have the time or inclination to learn all the Byzantine rules and maximize their miles. They want their miles to work LGA-MCO, not to get seats in Singapore Suites.

God knows I’m not one of these people. I’m the type of guy who tacks on Mauritius to his trip to Paris upon noticing it’s only 20,000 extra skymiles (or was, at least). But Delta isn’t going to go broke making laws that focus more on Joe Disneyworld than me

James K is probably right, but my innermost soul hopes that Delta fails in what it is on the road to trying to do. My innermost self says that a certain portion of important customers really do want to dream and shoot the moon every once in a while. This is what made the frequent flier programs so successful in the first place. If Delta kills this concept, I think they are on the road to killing the success of the program. I certainly hope they keep a fair amount of “shoot the moon” dream awards. A punch card program or an expanded “Pay With Miles” doesn’t cut it with me. I do believe I will lose my brand loyalty.

Their new model cost them a first/business transcontinental flight for me and my spouse.

@James K: You have a point about the typical consumer’s behavior. People I know still use credit cards that earn zero rewards. Zero, nada, bupkiss, nothing. So, consumers do things that make no sense, often because its just too much trouble to figure out what card would be better.

On the redemption side, I think you’re right that most consumers aren’t going to end up redeeming for Int’l F because it’s just too much trouble what with all the complicated rules, award calendars, etc.. So they end up redeeming for gift cards, or LCD toasters, or flights to Des Moines. But! I think Gary’s right that airlines are giving up a valuable carrot if they eliminate the possibility of outsize awards. It’s kind of like the big stuffed animal in a claw machine. You’ll probably never get it, but you keep putting in quarters.

Southwest is an outlier and an inapt example. They are the sandwich shop of the airlines, and a perfect fit for a punchcard. No F, no international, no business, no room for aspirational rewards.

I feel sure that James K is right. I have a friend who flies all the time for work around the world. When he wanted to take his daughter on a trip through SE Asia, he used his Skymiles, because “he had enough.” He has no idea whether or not he got a good value for his Skymiles, and I don’t either, because he didn’t even remember how many he spent.

I agree strongly with AndyAndy and JamesK . If it’s just too complicated or they just don’t believe it they won’t do it . I frequently talk to people with family on the other side of the Pacific or Europe . I’ve tried to encourage people to apply for rewards cards , to join frequent flier programs or even to use a cheap phone calling plan . They won’t . I ‘ve emailed or talked to 30 or more people about tunalawsuit.com ( free $25 0r $50 voucher for tuna ) One friend ( only one ) called me , laughing , and said that was so easy I can’t believe it . No one else believed me . I’m only recently learning about some of these things myself and hoping to take better advantage of them . In nine years I flew across the ocean eleven times on paid tickets for 140,000 miles . In three months I’ve gained 240,000 miles from sign-ups . Really wish I had met Gary Leff a long time ago . Thanks , Gary !

Well, there you go again…

“This isn’t S&H Green Stamps and it isn’t your neighborhood sandwich shop punch card. It’s a reward for your loyalty. The time spent with an airline becomes your reward”

I think I said it before and will say it again (and again and again): Wrong! How 1990’s of you…

You seem to (willfully?) ignore the fact that the airline “loyalty” programs are not now, and have not been for years, actually loyalty programs directed to passengers. They are a scheme for the airlines to milk funds from banks. The time you (us, we) spend in a seat on any airline is irrelevant to the “loyalty” program — your credit score and the choice of the little shiny piece of plastic in your wallet is relevant!

The advent of “The Hobby” (geez that term appalls me) killed the “loyalty” programs. The “romantic” days of yesteryear are dead and gone.

It would be interesting whether a different short and long haul pricing algorithm would b used. There are definitely some short haul city pairs that price much higher than some transcon routes.

Also interesting would be how pricing is determined. It would be all inclusive fares + taxes + fees + fuel surcharges) vs fare component + fuel surcharges only.

@Gringo – If “The Hobby” is what we all are engaged in, it hasn’t killed anything. As James K stated, we are such a minority, we have almost no impact on this industry, which now includes the banks. I don’t believe for a moment that the banks are getting schemed by the airlines. While the banks probably are losing (or at least not making) money on us, their scheme is to use the spend dollars (which keep going up) which they hope will entice the masses into spending money they don’t have and then only pay the minimum balance and then pay 16% interest for the rest of their lives. The reward bonuses are just another spin on the $0 interest balance transfers.

What is clear, though, is that devaluation will continue (until the next great recession) so don’t hoard up those miles because they are just losing value every day….

Even Southwest offers two big carrots – their award tickets are fully refundable with no fee; and Companion Pass is attainable by most people who really want it. What carrots is Delta offering??? (I suspect they’re offering very dirty, dusty coal painted orange and shaped like carrots.)

Every time I have priced miles on Delta lately, they are about 1%, ie $800 is 80k miles. Unfortunately I live in a small town where Delta is the only real choice. So I’m putting all my credit card spend on 2% cash back cards. I can basically buy the Delta tickets at half price that way. I only use my Delta card for Delta purchases so I get the free bags. I wonder if they realize there is no motivation for anyone to use their credit cards given how they are fixing the mile value at 1%. (Unless other people can get 2% on different routes than I fly, ones with more competition?)

@Cindi

You are correct that typical economy domestic valuation is $0.01/point. For domestic business travel I seem to see around $0.018/point. The only time I’d see $0.02/point broken was when booking business on a partner airline, however with the new partner award devaluation that loop hole is closed. The Skymiles program is dead. There is no point to use a Skymiles card, or credit flights to Delta. In my case this also means booking as little with Delta as possible. IF we had true competition I’d book Delta flights through AirFrance, or Korean so they would get more of the revenue if I could.

I recently got a 1 way Delta from Kona, HI to Amsterdam for 70,000 miles in first/business. Normally that would cost me at least $2500, so that was a great value. That is on Delta metal, not a partner.

On the other hand, for another trip I bought a Delta RT ticket from the western US to London for only $2400 business and didn’t think it was worth spending miles in that case.

I also recently got a first class upgrade from LAX to Hawaii due to my Gold status, so that saved me some money.

I agree that often Delta valuations are terrible, at around 1c. But if you are flexible there are still deals to be had.