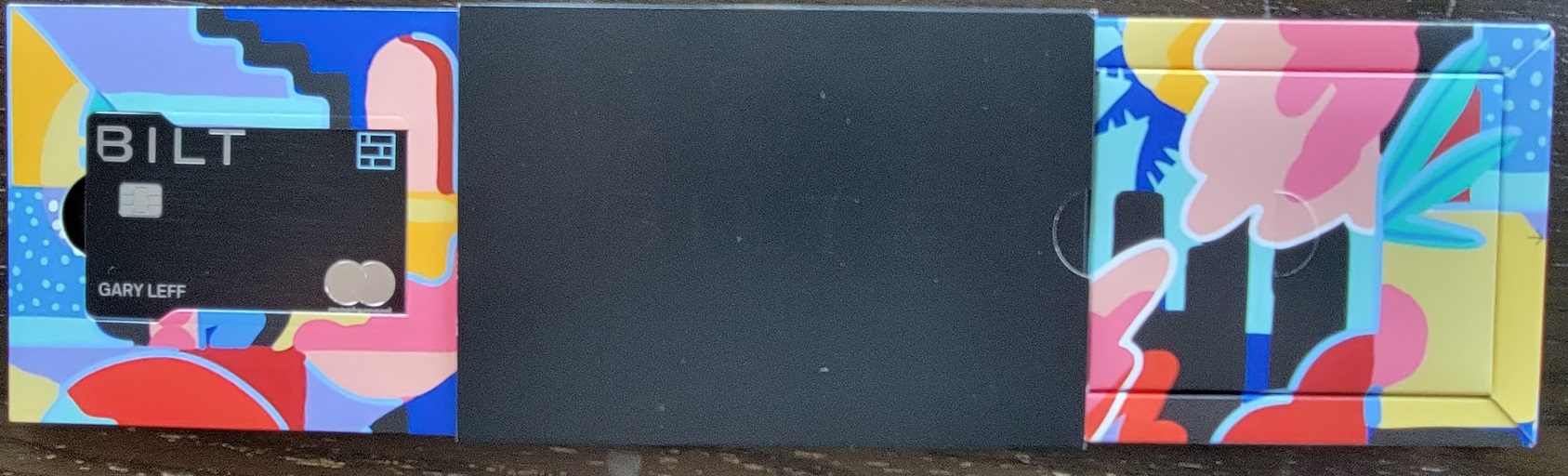

We’ve been waiting on Bilt Card 2.0 for nearly a year. We need to wait two more months for the details. But we’ve learned a bit more about the transition away from Wells Fargo to Cardless.

We’ve already known that Cardless would become the issuer of the Bilt card starting in February, with existing cardmembers transitioning, and that there would be (3) cards to choose from:

- No annual fee, as today

- $95

- $495

We’ll learn product details in “early January”. Existing cardmembers will be able to choose which of the three cards they want with no hard credit pull. New cards will be delivered for a February 7 cutover.

- Card number stays the same, so no need to change any autobilling.

- Therefore digital wallets auto-update and both Apple Pay and Google Pay will auto-refresh with the new card.

- All three cards will earn points for mortgage payments (“regardless of who your mortgage is from”)

Applications for the existing Wells Fargo card end Noon eastern today. Existing cards will work through February 6, 2026. Card balances transfer to the new card (although there’s also the option to just close the Wells card and not transition, and receive an Autograph Visa card with new card number instead).

That’s about as friendly and seamless of a transition that I’ve ever seen.

Ben beat you to it, Gary!

As to the specific stated changes, sure, same card is good, no hard inquiry for selecting one of their three new cards (by February 7), and I guess, for those with mortgages, it’s another option.

I just hope the ‘good times’ will continue because I like earning an extra $1,000 in points off paying rent (and transferring them mostly to Hyatt, Alaska).

I want BILT to continue… yet, I still think Cardless will screw us all (never forget what they did to those Boston Celtics card members).

So if you want the new card, apply before noon today? Or wait?

Do not hoard these points. Earn ’em, and burn ’em. As Immorten Joe would say: “Do not, my friends, become addicted to (BILT). It will take hold of you, and you will resent its absence!”

Ugh! This will be my 3rd Bilt card (not by my choice but by Bilt changing banks). Will this be another 5/24 hit???

If I’m understanding correctly, there will be no new cardmembers added for two months. Presumably so they can make this transition as smoothly as promised. Any thoughts on what two months without any growth means? They obviously aren’t a credit card company, Richard says again and again, of course. And…is the marketing buzz from the reset (with mortgages) thought to push demand to the launch of the new products?

@1990 “Ben beat you to it, Gary!” I was inflight with doors closed when the news became available, had to wait for taxi and takeoff, sorry!

@Gary Leff — Ahh, happens to the best of us! Glad you made it to where you were going safely (and/or are enjoying fast WiFi on-board!)

And my mortgage will be paid off Feb 1st. lol

Anyone else receive the mailer from Wells Fargo today about the conversion to Autograph?

“Whether or not you obtain a new Bilt 2.0 Card, your card will convert to a Wells Fargo Autograph Visa Card. Your new Wells Fargo card can be activated and used beginning on February 6, 2026, but will not be associated with Bilt or earn Bilt Rewards.”

“You should receive your new Autograph Card by early February.”

“There is no application or credit bureau inquiry.”

“Your Autograph Card will have a new account number.”

“This change will not impact your Bilt Points balance or how you access Bilt Rewards, subject to Bilt’s Terms and Conditions.”

Some real ‘mommie and daddie are getting a divorce’ vibes.

@1990 lol.

And has it been determined whether the ‘no hard pull’ conversion to cardless will create a Chase 5/24 hit as a new card tradeline?