Emphasizing earnings over excellence turned out to be bad business for Boeing.

Boeing is a troubled company. It appears they’ve been taking shortcuts for years, and that cost cuts have taken precedence over quality and reliability. They need more than a change at the very top, bringing up in-house senior executives to take the place of departing leaders. They’ve been in talks to re-acquire their biggest outsourcing vendor, which could be a start.

However there’s an odd framing in the narrative about Boeing. It’s clear that the company changed after merging with McDonnell Douglas. It went from a great engineering company to a financial engineering company, and this was intentional. As former CEO Harry Stonecipher (who had been CEO of McDonnell Douglas) put it,

When people say I changed the culture of Boeing, that was the intent, so that it’s run like a business rather than a great engineering firm.

But what’s strange is to say that this is an artifact of capitalism rather than the result of a series of bad business decisions.

Boeing Factory in Renton, Washington

Boeing Is A Great Example Of Corporatism, Not Capitalism

Boeing’s biggest customer is the federal government, not private industry. The federal government subsidizes Boeing’s foreign sales through the Export-Import Bank (in fact, Boeing has historically been the largest beneficiary of this government program).

The company is heavily regulated, and it continues chasing tax subsidies. It moved its headquarters away from its manufacturing to move to Chicago where it received significant government benefits. And as those expired it moved to the D.C. area, because their fates have been intertwined with regulators in Washington. This served to separate leadership from product.

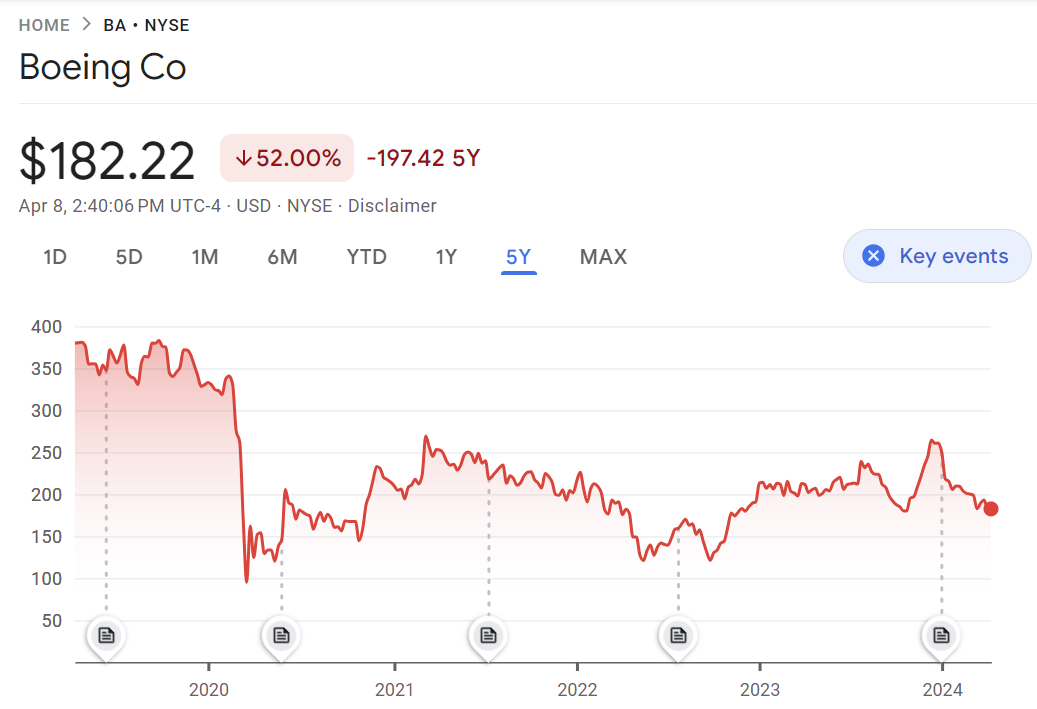

The Strategy Did Not Benefit Shareholders

Boeing is said to sacrifice quality and safety for financial gain, but that doesn’t make any sense. They haven’t actually gained! Here’s how shareholders have done:

The planemaker’s owners did alright for awhile, but as the results of short-sighted decision-making compounded, this financial engineering company turned out not to be nearly as valuable as people thought.

The Path To Long-Term Value Is Still Building A Product People Want To Buy (And Fly)

And the thing about share price is that in most cases it represents the discounted value of expected future cash flows, so long-term value is reflected in price. There’s not even really a short-term versus long-term thinking tradeoff.

Ultimately they would have been rewarded by delivering quality products that airlines want to buy more than competitor offerings, and that airlines are willing to pay a premium for. Instead they have products they need to discount heavily in order to gain orders. And they face limits on their production because of questions over their quality process – they can’t even build the planes they can sell.

Gary,

Boeing is just one more example of C Suite types more concerned with the quarterly stock price, their bonuses and what some junior analyst on Wall Street thinks rather than corporate longevity, quality and building a company in depth.

Boeing’s spin off of Spirit was just one example.

There have been way too many outstanding US companies destroyed by this mentality. Outsourcing, divesting of ownership of assets and spinning off pieces until nothing is left.

Until the Board of Directors realize that stock price is not a true indicator of quality of a corporation things won’t get better.

Look around. Boeing is just the tip of the iceberg.

Corporations have also cut R&D for a quick profit and paid later on by not having the most up to date equipment to sell.

Gary is spot on partly, not partly.

Boeing acquired McDonnell Douglas but it was MDD, like the Star Trek Borg, who assimilated Boeing and ruined it.

The stock chart is misleading. Boeing stock has slowly increased in value over time. It did have a huge leap 2012-2016 but the recent trend is just the continuation of that steady increase.

It’s tough to make large commercial jets. Many have tried. Only Airbus and Boeing have proven it. Embraer is trying but is not there. China is not there but has tried the Y-10 (707), ARJ21 (MD-87) and C919 (A320).

You’ve been the CEO of how many aerospace companies?

And they MURDER whistle blowers…..

@DesertGhost I’m guessing as many as you. If you want to play that game.

Not an excuse, but part of the problem is corporate raiders agitating for seats on the BOD. Therefore, the focus of leadership is dividends & stock buyback & bonuses & stock options.

If in doubt:

– GE which was manipulating its EPS just to satisfy Wall Street. Now spun out into three parts

– Bed, Bath & Beyond was buying back stock while failing to pay its venders

– Mighty Sears lost touch with the customer and stripped bare for its real estate holdings for cash

– McDonald Douglas got caught in a squeeze by wringing out existing airframes beyond their useful life (MD11 & MD90). It did it again via the MAX and B777X.

– The last new product from Boeing was the B787 and the attempt to outsource like crazy nearly killed the project. Now, Boeing is attempting to buy back Spirit Aerospace.

– Dave Calhoun (CEO of Boeing) will get a block of stock and cash at the end of the year for his failure to lead. Unfortunately, no claw back feature in his contract.

In an extreme “What If” scenario, the government requests either Lockheed-Martin or Northrop Grumman straighten out the mess.

I pray Airbus is taking notes on how not to run an aerospace firm.

@DesertGhost, what a ludicrous, shortsighted, ignorant comment. It does not take a rocket scientist to see how many missteps Boeing had, some of which were absolutely negligent and even criminal in nature.

If one so chooses, they can select a premium Delta flight to travel from LAX to elevated destinations around the world.

The question isn’t “what was the impact of corporate decisions on share holders?” The correct question is “what was the impact of corporate decisions on the CEO and senior management?”

One thing we learned since the dot-com bubble (and subsequent bubbles) is that many, many CEOs DON’T ACTUALLY CARE ABOUT THEIR COMPANY’S LONG-TERM VIABILITY. I remember one show on CNBC a decade ago where a former CEO openly talked about how if bad business decisions could nevertheless get him a high 8-figure salary (at the time) for three or four years, he didn’t care if the company went bankrupt as a result of it — he would be set for the rest of his life.

When company management knows the fastest way for them to get rich is to drive up the stock price/company’s financial value in the nearer-term, the tendency in the companies is to pursue approaches that mask how they are undermining the long-term value of the company but boost the value or payouts in the nearer terms of greater relevance to corporate management, those riding along on managment’s coattails and others just wanting the “get rich quick(er)” scheme to play out for them personally.

Boeing has perform equally poorly with both its military and space groups. With NASA, it is no longer even in the same ballpark as SpaceX. If NASA was a private company it would have dumped Boeing.

I’d be interested to know your day job, Gary. Riding in back of airplanes seems to have provided a lot of insider knowledge – you speak with such conviction.

My fear (and opinion) is that the US airlines have also caught the Boeing disease, and are well down the same road. US commercial aviation is truly eff’ed for the time being. This disease is curable, but our current society may not allow the curative steps to be taken.

Oh, c’mon; it wasn’t ‘run a business completely backwards.’* Executives were/are MURDERERS. Complete and utter murderers. Knowingly killing the 738-max murder victims = MURDERERS (for those without a clue: one does not have to pull the trigger to be a murderer; any doubts, do your own homework and pull your heads out .) Two of the greatest mass murders in the history of this great country. Knowingly killing innocent people = MURDERERS.

Of course, some of the MURDERERS are being paid TENS OF MILLIONS OF DOLLARS to not be employed by Boeing to not MURDER YET AGAIN. Of course, others are currently employed to MURDER AGAIN. Of course, there are a number of MURDERERS previously and currently in the FAA, actively complicit in the killings. Are the next BOEING/FAA MURDERS going to be next exposed by the (already on the record) most recent witnesses to the next MURDERS via the 787++?

CORRUPTION after CORRUPTION after CORRPTION obviously includes cheap corrupt whores in the senate/house/judiciary/’supremes -including utterly corrupt thomas’.

Gary, you are obviously failing to call a spade…err, a murderer; which certainly doesn’t have anything to do with you not calling a murderer a murderer, thereby making a lot of money from the MURDERERS, directly and indirectly, right*? You have access, don’t try to bullshit us readers that you’d have the same cushy access and the same profits if you called a spade a MURDERER.

DesertGhost: you obviously also cover for MURDERERS, you anti-American, anti-Constitutional, corporate-whore MURDERER. Aerospace CEOs MURDERERS: see osprey, desert storm cancers/terminal diseases, etc, etc.

There is no “Boeing disease”, pull your heads out, ffs. It is pure CORRUPTION and MURDER.

longer stock vesting periods for executive comp as well as pay tied to actual performance not stock price or total sales. With demerits for delivering flawed products and or drawing unwanted regulatory attention.

Jack Welch’s legacy. His disciples are great at sowing seeds for destroying companies.

The investment bankers, private equity folks and fancy management consultants are much worse than the Jack Welch brigade. Mergers and acquisitions peddlers and turnaround specialists are their own monsters.

The C-suite board responsible for two planes falling out of the sky and killing 346 souls should all be executed. We now know they knew exactly that the MCAS system was at fault. The DOJ let them get away with murder for pennies on the dollar (look into where the bulk of the settlement money went to… hint: it’s not to the families).

If you want to call the above “corporatism” or “capitalism” ok… whatever. The terms people just throw around are never defined so it’s just obscuring any productive fixing of our broken institutions and poor quality of our leaders.

What I’d like to know as a novice Avgeek, what happened with Boeing under Calhoun?

I understand the discussions about the merger and emphasis on stock price/profit, at the cost of safety, and the FAA dropping the ball. What I haven’t read about or seen is what was Boeing like with Calhoun after the Max8 crashes. He testified and promised safety improvements and transparency, etc. But was it all just talk or was there really some improvements?

I will respectfully disagree a bit, but in a constructive way:

Boeing’s travails are not a matter of “is it capitalism or corporatism at fault.” It’s *both* capitalism and corporatism. Corporatism has seen Boeing move its HQ to be closer to Washington DC and attach itself more firmly to the Dept. of Defense. Capitalism has seen Boeing emphasize payout to shareholders over R&D, because R&D and cultivating an engineering culture of excellence is an expense that is hard to quantify in terms of ROI and justify to a financial mind.

It’s incredibly easy and seductive to chip away at a good engineering company with a thousand little cuts. Each little cut seems like it should not really matter. And each cut adds some pennies to earnings per share, and *that* is directly tied to rewards for the executives. It’s a no-brainer. The new baseline becomes the post-cut environment. The short term results are good. So, gentlemen, how do we repeat last year’s banner earnings year, this year? A few more cuts here and there?

Capitalism is a double-edged sword with good and bad powers: it can reduce waste in a powerful way, with constant pressure to reduce costs. Historically it has done that very well. However, there is no built-in signal in capitalism that says “this particular cut is not reducing waste, it is diminishing your core strength and capital.”

It was bound to happen that corporate America would push the capitalist process beyond its sweet spot. It’s exactly like an athlete trying stimulants and steroids. Wow, that stuff really helped in my last match! Maybe a little more…and a little more … and then one day you have a heart attack, or your liver starts to fail.

The culture of corporate America makes it hard to fight this. Starting with the Supreme Court decision in Dodge v. Ford Motor Company (1919), everything pushes for short term gain as measured by money. This has hollowed out General Motors, Hewlett-Packard, IBM, and now Boeing.

Southwest just said that they now expect to receive just 20 new MAX aircraft from Boeing this year, down from over 100 at one point. Even though WN has been repeatedly reducing the number of expected deliveries, 20 has got to be a low going back decades.

United is bound to see an even lower number than they already expected.

Boeing is destroying airlines that depended on them.

@Cole Thompson, I think Calhoun should be pushed out even quicker than his stated timeline but it is likely that his successor is not going to change policies much. Why? because the big investors, including institutional investors and pension funds, put in people like him to do exactly what he has done, extract incrementally more money from the company to enhance shareholder value. If the whole thing collapses, the big investors will pull out and go on to another company. Smaller investors will probably take a proportionally greater part of the loss. This is where Airbus has an advantage. It is tied directly to several governments and they don’t want to see their investment diminished as well as not seeing problems with employment and tax revenues.

Gary you miss the point. All the C suite execs have made out to tens of millions of $$ regardless of lives lost and stock market performance. As Airbus has gone from zero percent market share to over 55% no one has made more money than the outgoing CEO and their C suite execs. The Board is incompetent. The only engineer is Mollenkopf who is more familiar with low power radios than aerospace manufacturing. The long term goal is to spin out the commercial unit into oblivion whilst milking it ferociously and leaving it reliant on federal

Largesse and become a defense unit reliant on lobbying and where quality is simply not a concern

I think its not ‘corporatism’, but basic rental capitalism.

Merge with another company, gain from their profitable position — be it market share, brand iconics, expertise — what have you.

Then you strip the target of its ‘excess’ costs to gain margin; once the value of this process goes, you merge with something else.

Unfortunately I think that the rental capitalist method of outsourcing their expertise and production process control to others is being attempted by government agencies to a disastrous end, i.e. NASA.