The Associated Press ran a piece yesterday, “Major changes coming to how your credit score is calculated”

I didn’t cover it right away because it’s about VantageScore and not FICO and because I wasn’t at all worried about the changes. But since several readers have asked me about it, and One Mile at a Time wrote about it suggesting that it “will impact many of [your applications]” it’s worth mentioning.

- Changes going into effect later this year

- Will use trended data, which looks at

the trajectory of a borrower’s debts on a month-to-month basis. So a person who is paying down debt is now likely to be scored better than a person who is making minimum monthly payments but has been slowly accumulating credit card debt.

- Will knock down scores if you have too much credit, though it’s not clear how much that means. No doubt it will vary by overall individual profile. The idea is a lot of outstanding credit means you could get into financial trouble quickly. This is the opposite idea from keeping as much unused credit as possible (low utilization ratio), showing how responsible you are with credit.

- Judgments, tax liens, and medical debts wont be considered. These were often wrong, and medical bills would go to collection before insurance processed payments. The 3 major credit bureaus entered a settlement in 2015 to exclude these from score calculations.

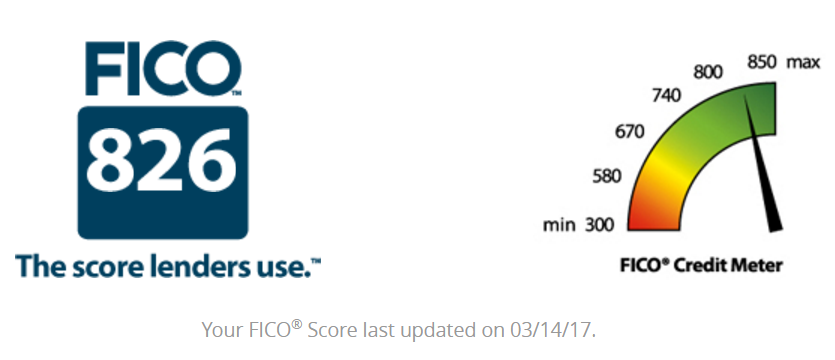

Doctor of Credit notes that FICO is used in 90% of credit decisions. FICO is also used in mortgages, which is precisely what I care about my credit score for. I’m not marginal for an auto loan. My score is likely too high in some sense as it is already.

At some point (1) some lenders may move to VantageScore for more applications than today, and (2) those lenders could start using VantageScore’s 4.0 model which is what’s changing.

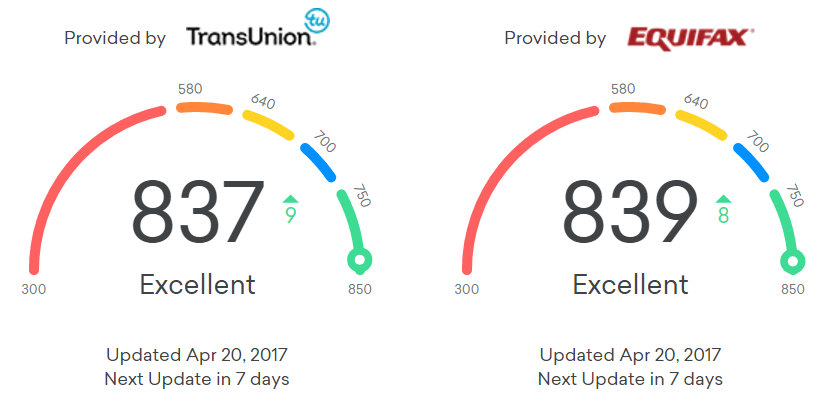

If you want to see your VantageScore, you can check it free at CreditKarma.com which currently displays their 3.0 scores. There’s no where yet to model what changes will come from 4.0 scoring.

This is worth knowing about but in my view not worth worrying about.

Can you elaborate on the part about medical bills?

I have some family whose Credit Scores are getting killed – almost entirely because of medical debt.

Did I read correctly that those are not supposed to be considered in determining Credit Scores? Can they petition to have those removed in some way?

I agree with your overall assessment and the fact that the most cards won’t be affected but I am curious to know what banks now use Vantage.

As if credit scores weren’t confusing enough, more changes are coming. At least these changes seem to be consumer-friendly.

Thank you for putting it in the proper perspective. Yeah this story has been circulating on many different news services for weeks, all with the same headline “Major Changes…” I applaud you for titling your article “Changes,” and resisting the click urge others have caved to. Thumbs up.

It’s refreshing that more people are caring about their credit scores/credit health. It’s a very important piece of our currencies today and how we interact with businesses. I never thought much about my credit score until about 10 years ago; I went to my credit union to bring an auto loan from an out of state and difficult to deal with bank. The loan officer took my info then came back with an approval on the loan and said that she’d never seen a credit score as high as mine. After that I was sure to pay attention to it, to review my credit history annually, and to even buy the score back when it wasn’t so easily found for free.

I’ve always seen my scores on Credit Karma to be about 10-15 points higher than my FICO score, which can give a false sense of security.

If these impacts bring down the CK score to match the FICO score (assuming it would go down because I have so much outstanding credit, like all of us here…), I would welcome that.

My scores on CK are always lower than screws I get elsewhere.