I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

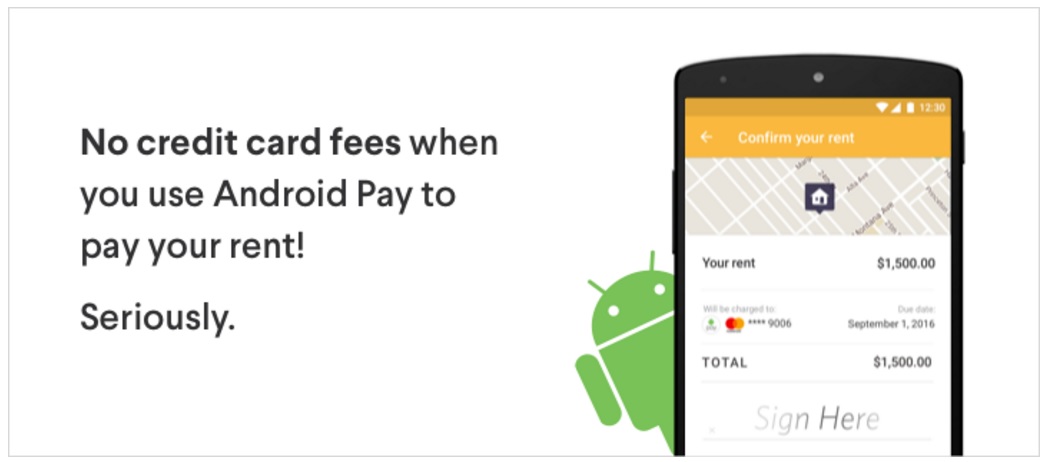

A couple of weeks ago rent paying service Radpad announced they would facilitate paying your rent for free with a credit card through end of year using AndroidPay.

That’s right, you can now pay your rent online with a credit card and Android Pay on the RadPad app without your landlord even needing to know. They can get a check on your behalf from RadPad just like they always have. From now through the end of the year you can simply log into Pay with RadPad from an android device, sign up for Android Pay using the credit card of your choice, and schedule your rent payments.

Unfortunately Chase cards don’t support AndroidPay. And RadPad, AndroidPay, and Amex weren’t working together. So I was thrilled with the news from Doctor of Credit that Chase products are expected to work with AndroidPay beginning September 7.

Beginning September 7, Chase customers who use Android Pay will be able to enroll their eligible Chase Visa-branded consumer credit cards, consumer and business debit cards, and Chase Liquid cards to make in store or in-app payments using their Android device.

It seemed like paying rent would be a great way to meet the $4000 minimum spending requirement within 3 months of account opening to earn the 50,000 point signup bonus for a Chase Sapphire Preferred Card or new Sapphire Reserve.

Or to hit the $5000 spend on purchases within 3 months of account opening for the Ritz-Carlton Rewards® Credit Card — newly issued as a Visa Infinite card — to earn 3 complimentary nights at any participating Tier 1-4 Ritz-Carlton.

Ritz-Carlton Kapalua, Credit: Ritz-Carlton

Unfortunately just as this was all going to work out, RadPad pulled the plug on the no fee AndroidPay promotion.

Prior to the promotion, Android Pay users represented less than 5% of all rent payments on RadPad. Six days after the promotion, Android Pay users represented 70% and the number continues to climb. Thousands of renters have signed up in the last two weeks to pay their rent using Android Pay, equating to more than $5M in rents.

…within only a few weeks we’ve surpassed the budget for the entire year that was allocated to subsidize the credit card fee.

You can still use a credit card to pay whatever bills you wish (not just rent) with Plastiq — but that comes at a 2.5% fee.

And the good news is that if you already “signed up and qualified for the promotion prior to August 24th” you can process fee-free credit card payments for rent through the end of the month.

If one has signed up for the promo with Amex card for example, can we switch cards to Chase for next months rent since Chase adds support only after 7th Sep?

Amateur hour at Radpad

I had always thought radpad was a bit amateurish, but this proves it. I’ve used them for a while but I’m now thinking I shouldn’t trust them with my financial data. I won’t be back.

Always amazes me the risks people will take to manufacture spend with subtier merchants. I would not want any of my money to be passing through these people. Even paypal is a PITA now.

RadPad will still waive fees for those who have had fewer than 5 in the last 24 months

I had no problem paying my rent with the spg amex card through android pay.

Will get a check in 2 days. Then its goodbye radpad.

Thanks for the easy rent and meeting the spending quo.

Radpad. It’s clear they can’t be trusted with our rent money. Epic. Fail.

It’s funny that Amex was the only one declining… The spend looks like the definition of fraud.

For example, new Android pay user who just added a card then goes and spends $2500? Fraud.

Obviously in this case most of it wasn’t, but it’s easy to see why Amex declined most of it.

Mine cleared AMEX, but Ive had this card for 9 years with an average of $40K a year on it… how do you close your RadPad account? No options on weak ass website