I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Need to meet the $4000 minimum spending requirement within 3 months of account opening to earn the 50,000 point signup bonus for a Chase Sapphire Preferred Card?

Or need to hit the $5000 spend on purchases within 3 months of account opening for the Ritz-Carlton Rewards® Credit Card — newly issued as a Visa Infinite card — to earn 3 complimentary nights at any participating Tier 1-4 Ritz-Carlton?

Ritz-Carlton Kapalua, Credit: Ritz-Carlton

It can make sense to pay a fee to use a credit card to pay bills like rent when earning a big bonus like that, but it usually doesn’t make sense to pay a 2.5% fee (Plastiq, which works with almost any bill) or 3.5% fee (Radpad) for everyday spending.

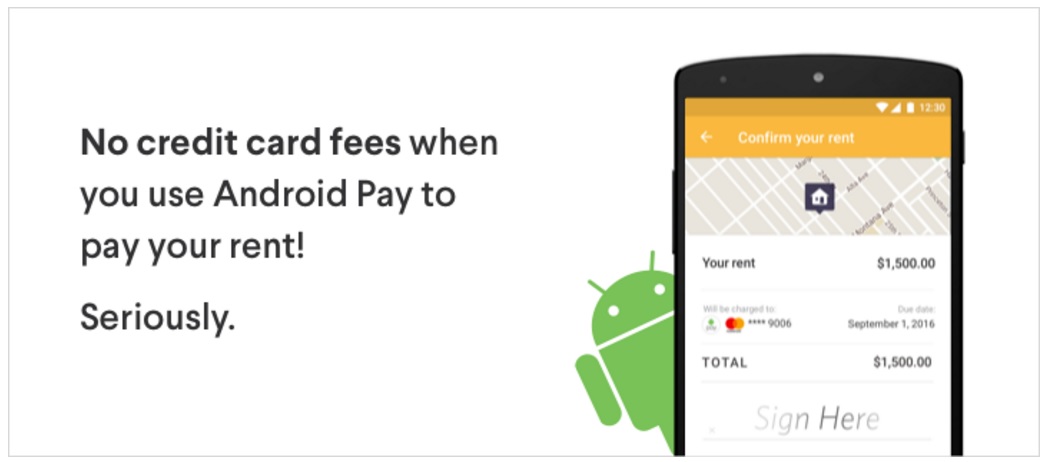

However through the end of the year Radpad will let you pay your rent with no fee using AndroidPay and the credit card of your choice. (HT: Doctor of Credit).

That’s right, you can now pay your rent online with a credit card and Android Pay on the RadPad app without your landlord even needing to know. They can get a check on your behalf from RadPad just like they always have. From now through the end of the year you can simply log into Pay with RadPad from an android device, sign up for Android Pay using the credit card of your choice, and schedule your rent payments.

Your landlord gets a check in the mail (so don’t leave paying until the last minute), you get the miles, and you’re on the way to your next big bonus. That’s a really great deal, enough that you might even want to prepay a bit of 2017 rent when December rolls around. One of the best deals of the year.

Update: Chase cards don’t currently work with AndroidPay. Citi cards do, though American AAdvantage co-brand cards are excluded from that. American Express, Bank of America, and US Bank consumer cards do.

Considering chase doesn’t work with Android pay.. There is a slight issue with using this for any chase card

I guess Radpad doesn’t like iphone customers. F U too, Radpad!

Sorry for the obvious question, but I’m assuming this only works for paying rent, and not for paying mortgages?

For those (like me) with iOS, if you know someone you trust who has an Android Device, I would bet you could talk them into letting you use their phone to download the app and make payments. Just a suggestion…

does this work for mortgages as well?

rent only

@Jordan is correct i have updated the post

How do they know it’s for rent? Could you theoretically send any payment to any individual as “rent payment”?

I set up one of my Visa cards but it says there is a big fee over 3% for credit card. I don’t see anything about a special no fee deal. Scam?

This is the 2nd time in as many weeks that Gary has incorrect or expired information. I also see the 3% fee for credit card. He obviously gets a kickback from Radpad for promoting them or wouldn’t do a rush job like this w/o checking to make sure it’s legit. What a waste of time.

3.5% not 3%

Don’t jump to conclusions, AB. As of last night, the app update is pending approval in the Google Play store. Do some research on your own before insulting those who are apparently doing it for you.

https://twitter.com/radpad/status/763207662477508609

@JP: They ask for a copy of your lease agreement. Not always, but they’ve been known to request it, especially if they think you’re trying to game the system.

As a note, the checks they send do include some weird legalese T&Cs that I have yet to see anywhere. Radpad claims it’s just boilerplate stuff, but my landlord nevertheless refused to get involved and accept them.

3 days after original post. Radpad does not permit my Android phone to pay rent with Android Pay.

Have no idea how this works. I have used Plastiq which charges 2.5% to pay my rent and satisfy my spending with Chase Sapphire.