I don’t believe that Chase will ever make money on its Sapphire Reserve product. They’re effectively spending all of the interchange on rewards and benefits, and any margin must be coming from customers paying an APR — but with the high income, high credit, and high assets Chase reports about Sapphire Reserve cardmembers you’d expect even that to be a smaller group of customers than usual.

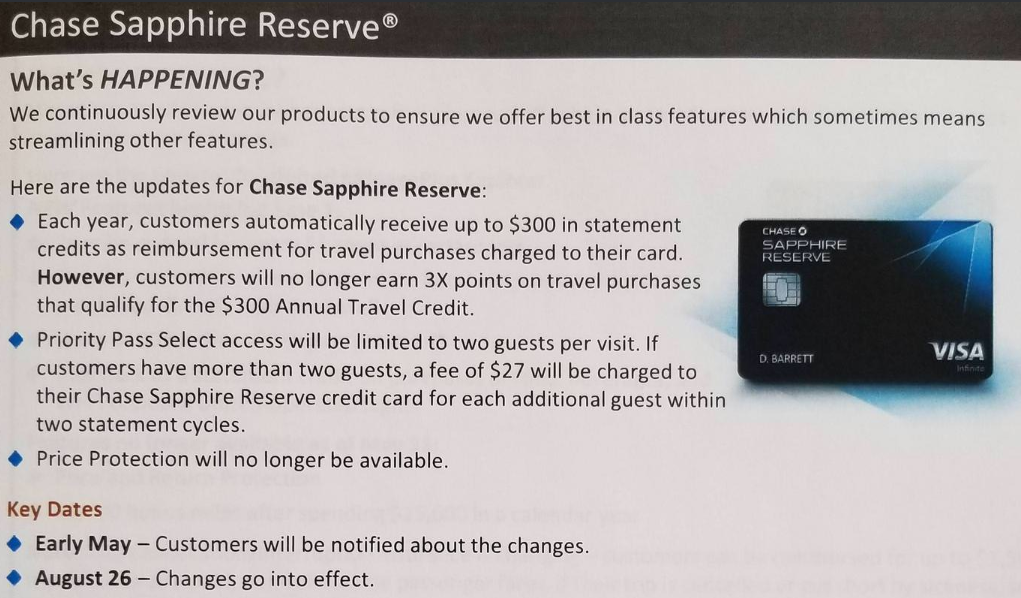

So it’s not surprising that we see the bank looking for cost savings. And a logical place to look is limiting lounge access. They’re still offering Priority Pass Select. They’re still offering unlimited lounge visits. But as reported by Bhatdj on reddit they’re going to limit cardmembers to two guests on each visit. (HT: @IadisGr8)

That means no more 35 guests entering a lounge on a single Priority Pass card and no more bringing in 19 school kids.

At the same time the specific limit of two guests surprises me.

- It’s going to be tough inconvenient for families, who can still get an authorized user card with Priority Pass for a fee. Still I’d have expected a 3 or 4 guest limit.

- Because Chase has seen unlimited guests as a differentiator from American Express Platinum which expanded to offer 2 free guests last year in response to Chase’s own generous benefit.

Last week the Wall Street Journal ran an error-ridden story about airport lounge overcrowding. And there’s no question that use of Priority Pass-eligible lounges shot up as a result of Sapphire Reserve popularity. Here are the guest numbers – mostly via Priority Pass – by month for The Club at PHX:

This isn’t going to make much difference, most people don’t bring in many guests, but it will save Chase some money at the margin.

Similarly, there are two other changes being made both marginal — the money they give back via $300 travel credit each year has been earning 3 points per dollar on travel. It won’t going forward. Those 900 points aren’t huge, but multiplied across all cardmembers is a savings along the lines of the old story about American Airlines removing an olive from salads in first class.

Finally as with other cards they’re eliminating Price Protection from Sapphire Reserve.

These changes go into effect August 26.

Guess Udo will have to bring his crew to Starbucks. Perhaps we can call negative cc changes getting Udoed. As in Chase just Udoed Priority Pass.

@Gary – That’s why we can’t have nice things. As my accountant used to say: “Pigs get fed, hogs get slaughtered.” This was a great benefit for families with more than +2 guests. My five kids are grown up but we fly together a few times every year. I used to leverage the Delta Reserve and Diamond Skyclub Executive (before it was called Executive…) when they were little to bring them in (immediate family under 18). Now that they are adults, they all have a CCs that gets them in. I guess I won’t be trying any PP lounges with the fam with this card.

We’re being nibbled to death by ducks. I rarely travel with others, and if I do never with more than one or two. So the lounge issue really isn’t one for me.

I notice that they’re stripping away “price protection” too – I’ve never actually used it, but that benefit certainly gave me comfort when using the card to buy “things”.

It’s just petty pulling back the 600 points from the annual $300 rebated travel.

Can’t blame chase. Travel hacking so widespread, gotta look at the way it can be totally abused by hogs. The abuse is pretty shocking. I actually am surprised Chase has not gone to AMEX model and simply say once in lifetime bonus. You can have card again but no bonus second time around.

Chase dropping price protection may not improve CSR economics. It will discourage usage on high-ticket, non-bonused retail items (electronics, appliances) that are the sweet spot for this service. Going forward I will just max out freedom 5x, put 3x spend on my CSR with all other spend going to freedom unlimited. Their PP process is cumbersome versus other issuers e.g. Citi. They added a “wet signature” requirement to add more friction, ultimately lowering claims. I had call multiple times to get PP claims paid. Citi’s process is much more efficient and customer-friendly.

@gary

Remember that chase signed a deal with visa to get flat rate on interchange fees.

@Mwwalk yes I am accounting for that, they don’t have to pay visa on each incremental transaction

We still have 1 CC with unlimited Priority Pass guests – Ritz Carlton!

Makes me wonder if I would be punishing Chase if I cancel my CSR card now or actually helping them achieve a goal of reducing exposure. As people sit on the fence about switching to the AMEX card, news like this only adds incentive. As it is, Chase is just trying to make the CSR just another card rather than trying to find ways to retain some charm while reducing their exposure. If nothing else, I thank them for the 100,000 points.

I’m more miffed about losing the points on the $300. Since authorized users get their own PP membership, I think this really about getting families to pay up for an authorized user or pay for the kids to have lounge access. If this is what they have to do to keep the core benefits of the card intact, that’s fine by me.

I’m getting tired of cards eliminating immediate family lounge access…

Whether guests are immediate family members or not is irrelevant in terms of overcrowding at airport lounges (and at PP restaurants). What DOES matter is the number of guests allowed per PP member.