Chase is updating benefits with Lyft. That’s no surprise because merchant-funded offers are always going to change. We don’t know the exact arrangement between Chase and Lyft.

- Lyft gets access to Chase’s customers, which is valuable. So presumably they’re funding the benefits.

- On the other hand, Amex has Uber and Chase is going to want something similar so perhaps there’s more favorable terms than if Lyft came in off the street wanting to buy access to high income, credit-worthy riders.

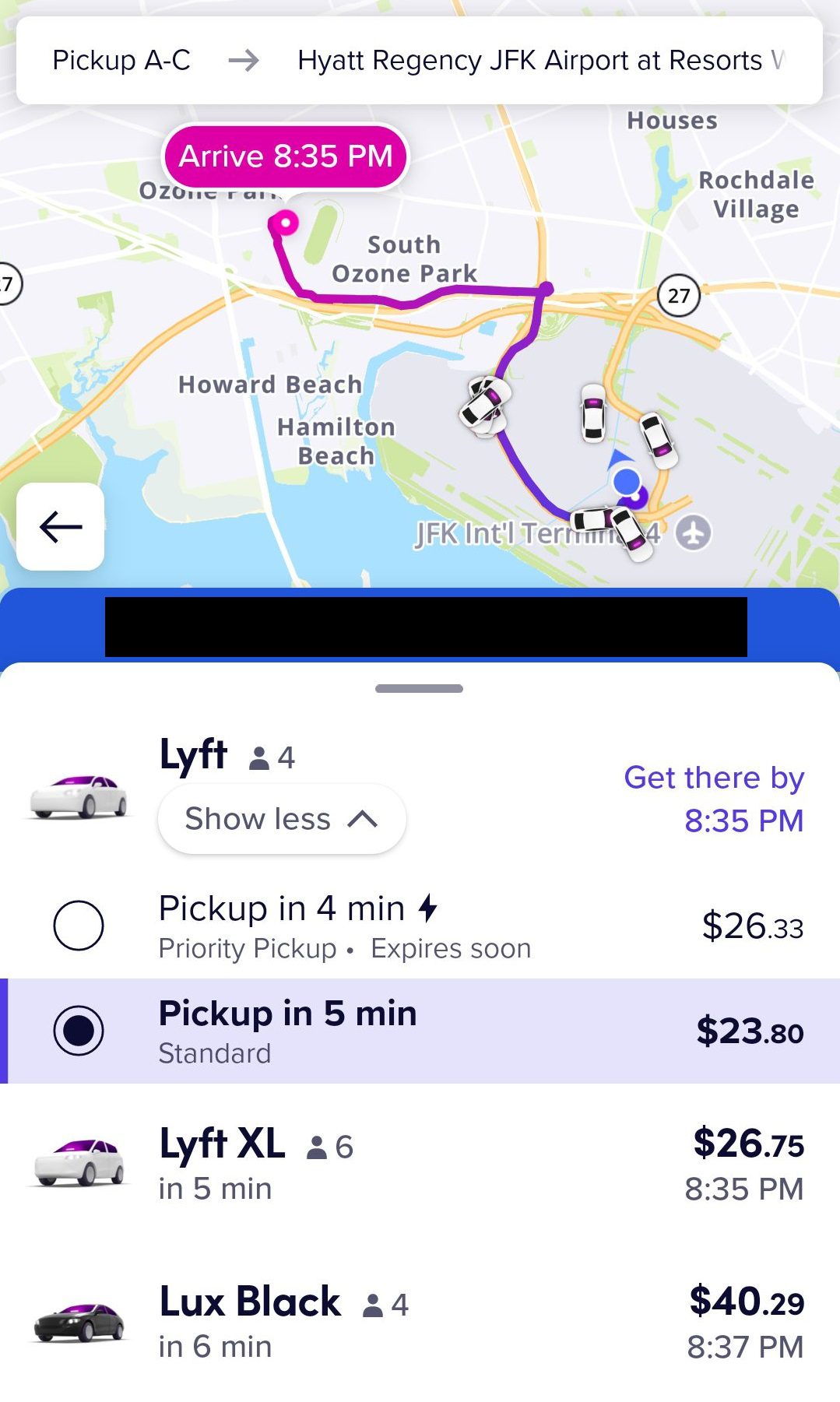

The biggest change is that Sapphire Reserve won’t earn 10 points per dollar anymore with Lyft. That’ll drop to 5x like Sapphire Preferred. However, Reserve cardmembers will receive a $10 per month Lyft credit. Additionally, Freedom cards drop from 5x to 2x. This goes into effect April 1 and the benefits are slated to last through September 30, 2027.

Sapphire Reserve & J.P. Morgan Reserve

- Cardmembers will receive 5x total points when riding with Lyft, plus a new $10 monthly in-app credit.*

- Cardmembers who have already signed up for the 2-year Lyft Pink benefit will continue to have access through the duration of their benefit term; however, cardmembers will not have access to sign up moving forward.

Sapphire Preferred

- Cardmembers will continue to receive 5x total points on Lyft rides.

Chase Freedom (Freedom, Unlimited, Flex, Student, Rise)

- Cardmembers will earn 2% total cash back on Lyft rides.

Chase Ink (Biz Cash, Cash, Biz Plus, Biz Preferred, Biz Premier, Biz Unlimited)

- Cardmembers will earn 5x total points or 5% total cash back on Lyft rides (depending on specific card).

*Excludes Wait & Save, bike, and scooter rides. Maximum statement credit is up to $120 annually.

The Lyft Pink benefit isn’t renewing, which isn’t much of a loss – this merchant-funded offer mostly consisted of other merchant-funded offers (like Grubhub, SIXT). It was a bit odd in that the rideshare subscription program wasn’t predominantly about rideshare. But there were some discounts attached, which was great when free but not worth paying for (don’t forget to cancel).

Merchants offer discounts and rebates to gain business. Eventually they determine that they’ve gotten as much as they can through those discounts. The business they’ve generated is all there is. Or they’re spending too much for the continued business – perhaps they either keep it without the discounts (likely the original plan or hope) or they’re willing to give it up. I imagine Lyft is cutting back on what they’re willing to fund, so customers in turn receive less.

Sapphire and Ink products remain the most lucrative paying for Lyft, but Sapphire Reserve less than before. Freedom is no longer a card of choice for this purpose. I’ll miss the extra 5 points per dollar I’ve been receiving on Lyft rides. I use Lyft enough that those points were far more valuable than the $10 per month credit that’s being added.

Lyft remains far more rewarding than Uber when pricing is similar. You earn paying by credit card, and can link Bilt, Alaska or Hilton accounts to earn with your spend (that’s the order in which I value the partnerships, and you have to choose one). You can also earn linking your spend card with ThanksAgain. And there are also offers that can be added to your spend card via sites like SimplyMiles (if paying with Mastercard) or the likes of Amex, Chase and Citi Offers.

Meanwhile, Chase’s Sapphire Peloton partnership runs through December 31, 2027.

Sapphire Reserve

Cardmembers will continue to earn 10x total points on eligible Peloton Bike, Tread and Row purchases over $150 with a max earn of 50,000 total points.

Sapphire Preferred

Cardmembers will continue to earn 5x total points on eligible Peloton Bike, Tread and Row purchases over $150 with a max earn of 25,000 total points.

This is a little disappointing. The 10x on the CSR was nice. These $10 in-app credits are fine, but often come with caveats, like on Citi AA Exec (3 rides per month, then get the credit, so need to take 4 rides per month, technically). For those of us who live in cities with decent mass transit, where we do not want or need to have our own personal vehicles, these rideshare companies have been a real service for us, when we need them. For instance, if you have multiple people and baggage going to an airport, that’s $70-120/ride, depending on the city/distance. Getting 1000 back in Chase UR points is a bit more valuable than a $10 in-app credit. Regardless, it was nice while it lasted.

I assume the monthly in app credit expires of not used

Lyft Pink essentially comes with a bike share subscription, which in NYC (Citibike) can be worth around $190 per year, so this is a huge loss.

At the same sticker price, Uber is cheaper if you buy discounted Uber gift cards from Costco.

OMG Chase is adding another coupon book! Gotta copy amex. Wonder how high the breakage is gonna be on this “enhancement”

Too bad Chase is following Amex into the gutter by adopting the coupon book credits. And Chase is far worse as the Amex Uber credits are relatively easy to use on Uber Eats pickup orders.

Looking at my ride history I use Lyft an average of 5x a year but rides tend to bunch up on trips. So these credits are worth a fraction of $120

@gary How is the $10 in app credit earned per month? Must I have a Lyft ride first & pay with CSR in order to earn $10 off on my *next* ride? Or, is $10 automatically applied on my current ride if I pay with my CSR (as it is with Amex DL Plat)?

@Alex — That’s a great use of Lyft Pink. Saves me $5 each time. Free for 45 minutes using the non-EV bikes. The trick is to redock the bike by 40-minutes, then, simply pull out a new bike, technically, can bike for free indefinitely that way. Works really well along the Hudson River bike paths. If you know, you know. Wear a helmet!

Does the credit apply if you use Lyft bike share in any way?

@Martin — That’s a good question. I cannot find any fine-print via Chase at the moment, so maybe we’ll get an email from them soon. This all does go live tomorrow, so maybe someone just need to hope on a Citibike and tell us what happens afterwards.

@Gary Leff — Chuck and William over at Doctor of Credit cited VFTW in its post about this topic. That’s high praise! Those guys are awesome, too. VFTW and DoC are definitely two of the best sites out there currently for these industries/hobbies.

I doubt anyone cares much, but, uh, activist hedge fund Engine Capital Management did recently take a 1% stake in Lyft, and acquired some board seats, so expect a Southwest-style hostility soon. Whenever ‘those types’ get involved, it’s usually bad news for consumers and workers, alike. Great for the executives, though. I mean, for those folks, it’s likely to be a huge payday. We’ll see!

Nice April 1st joke