The Hirsch Airline Miles Settlement is open for registration. File by November 27th.

If you received an IRS Form 1099 from Citibank reporting to the IRS that you received income attributable to the receipt of promotional American Airlines miles between January 1, 2009 through July 13, 2017, you may be entitled to payment from a class action settlement.

The lawyers get up to $1.2 million. The two name plaintiffs get $25,000 and $12,500 respectively.

Those who register and affirm they reported and paid taxes as a result of a Citi 1099 are eligible for up to $245, those who do not affirm are eligible for up to $40, though how much is actually paid out to each person depends on how many people sign up. The total settlement pool is $1.75 million.

As usual the lawyers get almost as much as everyone who was supposedly harmed.

Ultimately whether or not Citi reported value received by a consumer to the IRS has nothing whatsoever to do with tax liability. If they didn’t report it and it was taxable you’re on the hook to report it yourself. And if they reported it and it shouldn’t be taxable, you should dispute the report.

The failure to disclose that they were going to report economic activity to the IRS always struck me as strange. But it makes sense that Citi might want to make this nuisance suit go away.

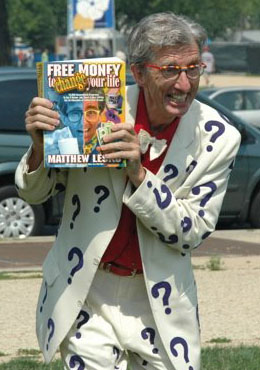

If you’re eligible, sign up, because like Matthew Lesko used to say, “the ones who know about the programs are the ones that get the money!”

(HT: SanDiego1K)

Class action lawsuits like this create massive positive externalities, and convey economic benefits to society well beyond the cash value paid by the defendant. I would much rather have private attorneys such as these keep companies in line, than to pay government lawyers (with salaries and fat pensions paid by taxpayers). We will never know how many banks will refrain from the same nonsense in the future, or how much money and aggravation it saved consumers, but society is no doubt better off because of this settlement. Thank you class action lawyers.

Respectfully disagree with first comment. Atty fees of this magnitude create incentives for many nuisance lawsuits and exaggerated claims. And businesses are reluctant to offer promotions without a lot of fine print that ends up deterring real customers. I believe atty fees, court costs, and the amount and length of time it takes to adjudicate these issues harm both honest reasonable consumers and businesses operating in good faith.

Think about it the next time you see the Morgan &Morgan commercial instead of a business advertising a good sale or product.

@ mark, are you really that simple. Nuisance lawsuit costs passed on to consumers. Society pays the cost. For example, nuisance insurance claims paid out all the time. This results in higher premiums for everyone. The other statements you make are also simple and wrong too. This suit will stop issuance of 1099s but issue remains of taxabiility. Benefiters are people lwho get bonuses or in insurance claim cases, people who file false claim to get nuisance payouts. It is not society in general. Socialy pays these costs in some manner.

On the lawsuit webpage, the text says the suit is open to those who received a 1099 for miles received as the result of “opening a Citibank *deposit* account and receiving American Airline miles”–which is a specific group, and does not appear to include those who received miles as part of a credit card promotion.

@Chad — those are the only ones who were 1099’d

When I opened a citigold account which had ty points as a signup I only redeemed the points up to a certain amount within one year, so as to avoid the 1099 issue all together.