I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

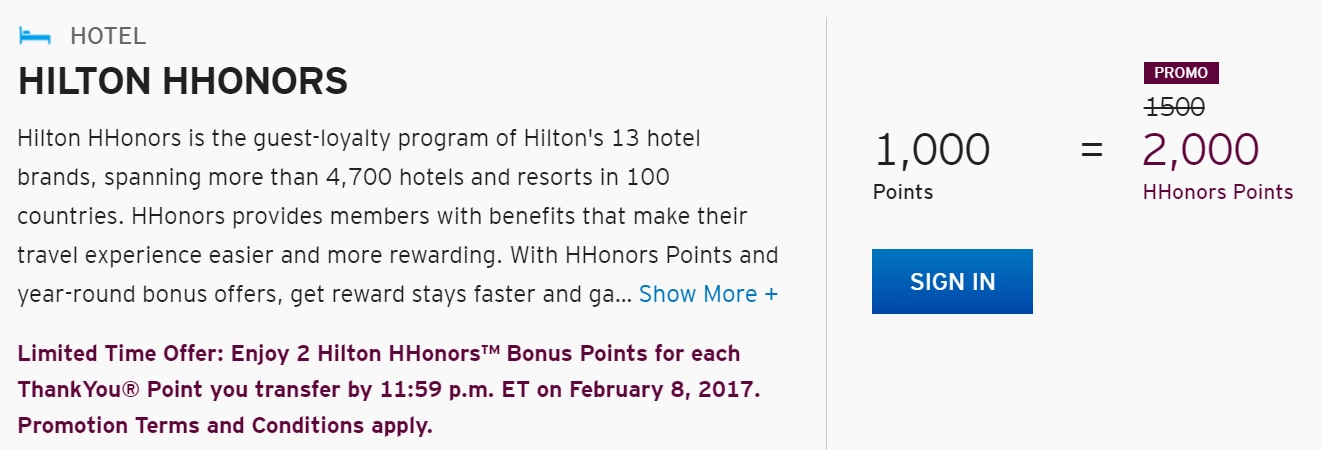

Citi ThankYou Rewards is offering a one-third bonus on transfers to Hilton HHonors through February 8.

Citibank introduced Hilton as its first transfer partner nearly 4 years ago. We’ve seen bonus offers for transfers to Hilton before including last year at this time.

View from the Hilton Colombo, Sri Lanka

Hilton points are generally worth half a cent apiece. I value Citi points at 1.6 cents each. Getting two Hilton points per ThankYou point means transferring points at a value of a penny. Not. A. Good. Deal. More often than not you’re better off just using Citi points to straight up buy travel. But even that’s not the best use of points in my opinion.

ThankYou points from a Citi Prestige or Citi ThankYou Premier account transfer to:

- Air France-KLM

- Asia Miles

- Etihad Airways Guest

- EVA Air Infinity MileageLands

- Garuda Indonesia GarudaMiles

- Hilton HHonorsTM

- Malaysia Airlines Enrich

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchid Plus

- Qantas Frequent Flyer

- Virgin America Elevate

- Virgin Atlantic Flying Club

I’ve been earning a lot of points on my Citi Prestige Card this year to diversity my points. I have large balances with both Chase and Amex (and several airlines). I prefer transferable currencies but I especially value diversification.

It’s good to see transfer bonuses coming from Citi, but in my view you can get much better value with other transfer partners. My favorite transfer partners are:

- Singapore Airlines which offers their own members much better premium cabin award space on Singapore flights than other Star Alliance frequent flyer program members get, and which has real value United Airlines domestic and Hawaii awards in addition to Star Alliance awards generally.

Singapore Airlines Boeing 777 First Class

Singapore Airlines Airbus A380 Suites Class - Etihad for their own first class awards.

- Cathay Pacific Asia Miles is a valuable oneworld partner with its distance-based award chart. Cathay has talked about making more award space available to members with their own points.

What’s the best way to use up 250 credit on citi prestige and get something as close to cash as possible and close up the card immediately? Assuming you have no plans to purchase an airline ticket.

Totally unrelated, but not sure where else to post it. Is anyone going to talk about the disaster that Hyatt’s Reddit AmA was??? It was pretty much exactly what I expected. A cooperate condescending exercise attempting to tell us how awesome WoH is and how it imparts further value to Hyatt customers when in fact it is quite the opposite on both fronts. Jeff got eviscerated. I mean seriously Hyatt if WoH really is an upgrade/enhancement why is it being met with so much negativity (and no it’s not just the 25 night Diamonds complaining) and don’t give me that bs that change is hard.

I would buy a $250 ticket on SW next year then cancel. You will have full credit without penalty on SW account for future flight. Or you might be able to buy airline gift cards in small increments.

So I should cancel my Hyatt credit card?

So is there a good flexible currency for those interested in hotel stays rather than flights? Chase has several hotel partners, but at mostly terrible transfer rates except to Hyatt. Amex rations seem similarly poor. SPG has added Marriott as a redemption option, but I’m not sure if that counts as flexible…

I’ll transfer to Hilton to top off my account for an AXON award at the Conrad Maldives. I’m points rich and cash poor, so to me this is a GREAT deal.

Gary — If you are to keep using the label of “Thought Leader in Travel” , then you need to think like one. You cannot compare Citi TY points in cents per point (cpp) to HH in cpp because while a CENT is a CENT, a POINT is not a POINT if Citi awards a different number of points than HH for the same or similar size transaction. The division of cents by points or cpp therefore does not yield a quantity that you can compare across programs. The concept is so trivial a “Thought Leader in Travel” should have understood it a long time ago.

Apparently some readers are incapable of reading the headline and understanding the implied meaning

Bad math is bad math is bad is bad math is bad….

It’s amusing how clearly you don’t get it. How one earns HH points or TY points is irrelevant in Gary’s scenario.

The SOLE point that matters is that it’s not worth transferring a currency worth 1.6 cents per point into a 2x multiplier of one worth 0.5 cents per point. Now IF HH points were worth 0.8 cents or more, then it might be worth it…but of course they aren’t.

It’s really not that complicated.

DCS,

Are you arguing that transferring Citi TYP with this bonus is a good deal?

(BTW, it’s a yes or no answer, no need for an essay.)

At some point, with transferable currencies, you have to have some way of normalizing them — we tend to use dollars to do that. FWIW, I transferred a little more than 60,000 TYP to SQ for a J ticket from HND-SIN-JNB. For the same amount of TYP, I could have transferred them to HH and got a decent hotel in the upper mid-range scale for ONE night. I can’t even get a $500/night hotel room for 60,000 TYP, but I can get a plane ticket valued at $4,000?

Do you mean to tell me that you can do some fancy math to “prove” that HH is a better place to put 60,000 TYP than SQ KF? (And for those who say I’d never spend $4,000 on a J ticket, well, you’re right. I’d also never spend $500/night on a hotel room, either.)