I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Citibank and American Airlines have rebranded their small business card. It’s now the Citi® / AAdvantage BusinessTM World Elite Mastercard®. This reflects the new value proposition in conjunction with the airline’s small business program, AAdvantage Business that lets you double dip earning transferrable miles in a business account in addition to miles earned by the traveler for flying.

And with this refresh there’s a limited time offer to earn 75,000 American AAdvantage bonus miles after $5,000 in purchases within the first 5 months of account opening. The card’s $99 annual fee is waived for first 12 months. ![]() [See rates and fees]

[See rates and fees]

- This new offer is 10,000 miles higher than the previous one, and matches the best previous total miles offer for this card in the past. It comes with first checked bag on domestic American Airlines itineraries for the primary cardholder and preferred boarding on American Airlines flights as well.

- Earning is 2 AAdvantage miles per $1 spent on eligible American Airlines purchases, and on purchases at telecommunications merchants, cable and satellite providers, car rental merchants and at gas stations; 1 AAdvantage mile per $1 spent on other purchases; 1 Loyalty Point for every 1 eligible mile earned from purchases.

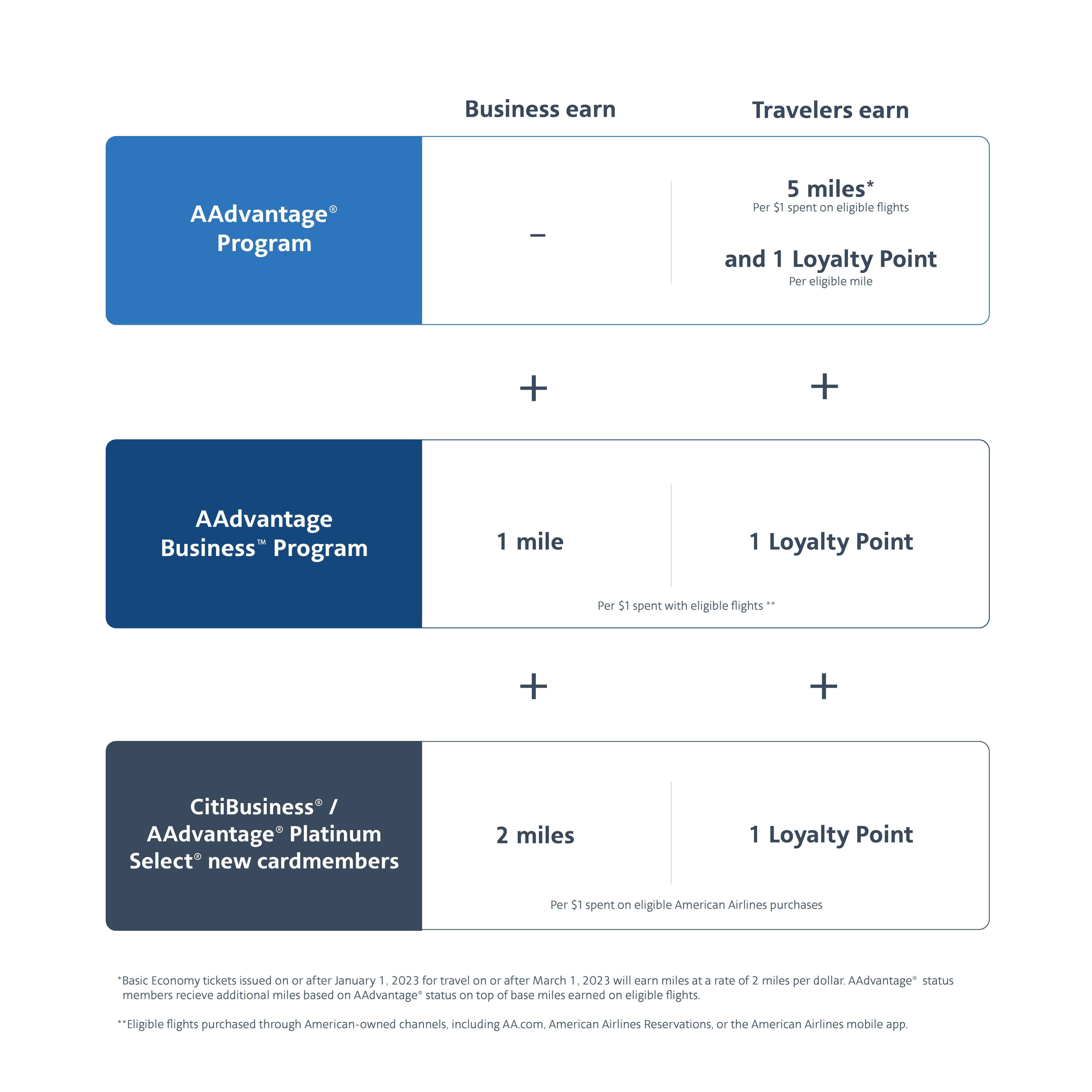

Here’s how the card works with AAdvantage business.

- Miles earned on the card (including the initial bonus) accrue into your AAdvantage Business account. If you don’t already have one, they open one for you, and you access it with your AAdvantage account number and password.

- Those miles can be transferred from your business account into your personal AAdvantage account, or into the AAdvantage accounts of any travelers you register/attach to your AAdvantage Business account.

- Normally companies need to meet $5,000 spend and 5 traveler minimums to transfer points out of an AAdvantage Business account, but cardholders have these minimums waived.

- While any authorized employee cards accrue miles into the AAdvantage Business account, Loyalty Points towards status from card spend accrue to each traveler’s own AAdvantage account.

- When travelers flag their solo trips for work when booking direct with American they also earn an extra Loyalty Point per dollar spent on tickets – as do you – so Citi® / AAdvantage BusinessTM World Elite Mastercard® cardmembers earn AAdvantage status faster.

- Earning in the AAdvantage Business program is three times as fast for those with this card provided that tickets are purchased with the card: base earn in AAdvantage Business is one mile per dollar spent on travel, while cardholders earn an additional two miles per dollar spent on travel credited to that account.

Getting the card historically hasn’t added to 5/24 (for getting approved for Chase cards), according to most reports I’ve seen. You can have this card even if you have a Citi or Barclays consumer card, and even if you already have a Barclays AAdvantage small business card. And anecdotally I’ve found the card easy to get, with readers reporting great success.

You can generally only receive an initial bonus on a Citi card every 48 months. I recently got this card again because I wanted to use an AAdvantage Business account, and because I realized it had been a little over four years since I’d had it previously. Note of course that this limitation applies to the same specific card, not to card families. I also hold a Citi Executive card, and that didn’t get in the way of being approved or earning a bonus. I also have a Barclays Aviator Silver card – you can have a Barclays AAdvantage card and Citi AAdvantage card at the same time.

Any issues with being a sole proprietor with the revamp?

Gary – Wouldn’t it be still more Loyalty Points lucrative to put AA spend on the Citi AAdvantage Executive card?

Do we have a hard data point on whether the bonus 2 miles is an actual bonus or is just the 2 miles for AA purchases on the card?

If I read that correctly I would get 3 Loyalty Points on spend as a Sole Propriator if I get the card (and the AA business account) making the spend required for Platinum only 25k (*3 = 75K Loyaly Points).

Is that correct?

How do I know if I had this card or received the bonus in last 48 months? I didn’t want to waste inquiry. just called citi credit card number and asked if I received a bonus on this one? I called citi card number and asked this and they told me without providing card numbers they can’t say anything.

Also, what happens if I attach my business account number to my reservation but pay with my executive card that earns 4x AA points. Do I still get the extra loyalty points ?

As a current AA business program participant I have a hard time with this recommendation. The program rollout has been truly awful. There is no support from AA – or even anyone willing to talk about the program. Phone calls are bounced, emails unanswered.

Not a single bonus loyalty point has posted so far from our account. And no one knows why

I would really like AA to provide a good, or even half decent, business program. I would consider signing up for an AA business credit card if they did.

But they haven’t. So I won’t

Do they charge 0.5 cent per point to transfer miles to a personal account? If so, that’s $375 to transfer the SUP miles! Not sure I think it’s worth it ..

@Marti – no fee involved