News broke yesterday that Virgin America had received a takeover offer and was shopping itself to potential buyers.

We can eliminate United as the acquirer — the Justice Department would pretty quickly shut down such a degree of consolidation in San Francisco where United has a hub and Virgin America is based.

Virgin America in San Francisco

I suggested it was conceivable that JetBlue, a more boutique-style carrier focused on New York, could bulk up on the West Coast by aligning itself with Virgin America. I’m not predicting it but it would increase competition overall rather than reducing it. And it would presumably pass muster with anti-trust review.

Marisa Garcia makes the case that the most likely acquirer is Delta and offers four reasons, though I’m ultimately skeptical of the arguments which is decidedly not to say that Delta wouldn’t try something of this sort.

- Slots at Dallas Love Field. Delta wound up without any slots as a result of the federal government’s extracted settlement from American Airlines to sign off on the US Airways merger. Delta is squatting on slots at the airport, and to date they haven’t wanted to buy slots they’ve wanted those slots for free.

- Delta can afford them. They can afford a lot of things. Mostly they’ve been buying into non-US airlines like China Eastern, Gol, Aeromexico and Virgin Atlantic.

- Provide feed to Asia. It’s not clear that Virgin America’s strength in San Francisco could convince that local market to connect to Delta’s route network out of Seattle versus taking United’s non-stops. It makes little sense for Delta to try to build a parallel Asia network out of San Francisco to compete with their Seattle flights.

In Seattle they faced domestic competition from Alaska but not transpacific competition. In San Francisco they face United’s larger domestic connecting network and already-entrenched extensive Pacific flying, as well as incumbent corporate contracts. Any new San Francisco Asia flights would depress Delta’s yields on out of both San Francisco and Seattle.

- Delta could maintain separate brands. Virgin America has a strong brand identity. Outside of slots at constrained airports like Love Field and Washington National, it’s primary asset is its brand. Delta can buy 60 planes far cheaper than it can buy Virgin America.

If they leave the brand intact they lose the opportunity from merger synergies and really gain just the very limited income stream from the airline’s operations and the ability to redirect their schedule. And of course other suitors could maintain Virgin America as a separate brand, too, so this isn’t really a differentiator.

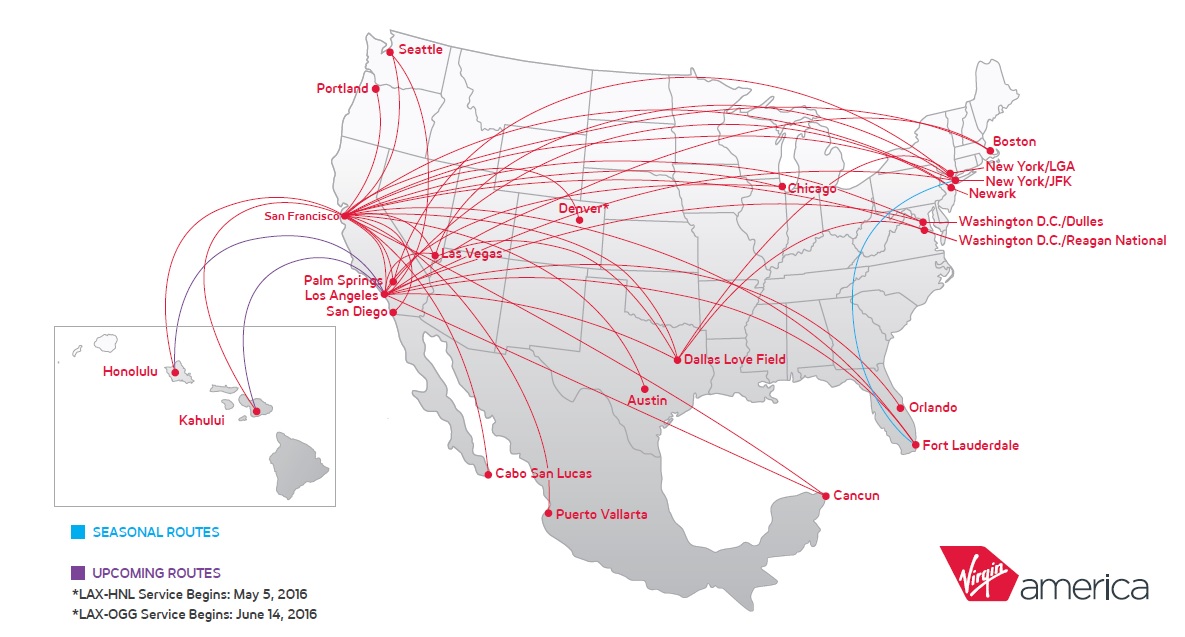

At just $1.5 billion in revenue and 7 million passengers, Virgin America would be a local market strategic acquisition and not a broad-based game changer for the four largest US airlines. Any of them other than United could make a case that Virgin American’s two dozen destinations don’t create too much concentration from a legal standpoint.

American and Delta might get some scrutiny over Los Angeles, and Delta over New York, but those concerns could be easy to dispense with in furtherance of the overall deal.

For Virgin America they’d get aircraft that wouldn’t have to go out weight-restricted for their Hawaii routes.

As with the US Airways acquisition of American, I hope this doesn’t happen of course.

But then they could finally kill off SkyMiles and make us all Elevate, ready-made revenue-based program!

It’s hard to imagine the regulator would approve any further acquisitions by AA DL UA WN outside of BK court proceedings. Based on their market position, they’re most suited to pair with AS B6 HA, with jetBlue having the advantage here.

DL having hubs at SEA SFO LAX SLC makes little sense since they’ll all be just cannibalizing each other.

Could be Delta but wouldn’t it be more interesting if it was Etihad or IAG ? Personally I’d vote for Jet blue or Alaska but I don’t think it’s a good fit for Alaska.

JetBlue makes perfect sense. Plus regulators might like to get two small carriers to rival the big three.

I just can’t see any of the big three getting VX. Pick you poising, DCA slots, LAX. There’s a reason to nix any of those deals.

All four of those reasons are less than compelling. But then again, Delta does some stuff out of left field every now and then.

Noooo!

I think JetBlue would be the best candidate. Are they looking to buy?

I think Delta is very plausible, esp since SFO is such a growth market.

But Jamie Baker the airline analyst thinks it won’t be a US carrier, but someone like Etihad who takes a stake.

It would be interesting for sure to see a Gulf carrier take the legal maximum stake in a US airline…. generate feed for their own flights… Perhaps an even more interesting scenario would be an airline spinning off its frequent flyer program and a Gulf carrier buying that in addition to the maximum allowed stake in an airline. Would be interesting to see US government position on that. But could be a way to gain extra control of the carrier in practice.

If it was Delta, which I very highly doubt, there is about 0% chance of that passing through the DOJ and DOT for antitrust reasons……

VX’s brand is deeply ingrained in their fleet and the on board experience. From the mood lighting to the seats. You can’t have a legacy airline like DL and their planes being swapped in for a VX route and expect customers not to notice or be content.

I also am not quite sure what an international purchase would even mean due to the rules governing foreign interests in domestic airlines. VX had that problem when they were getting started as Branson wanted to own the whole thing but could not.

Jetblue sort of makes sense. VX’s strong presence on the west coast would play well with Jetblue’s northeast stronghold, but again you get into problems about what the airline’s identity would be.

My initial thought was Alaska, to give them a broader west coast network and even more feed to Hawaii, plus some slots for transcon and midcon routes. Although if Alaska was the purchaser, they might sell off the DAL position to one of the ULCCs.

JetBlue makes the most sense as fleet commonality would be perfect and antitrust issues would be minimal to non existant. Delta would face antitrust scrutiny especially with their code share with Virgin Atlantic. Foreign ownership is off the table by U.S. Law otherwise Sir Richard would have had majority interest in Virgin America.

If JetBlue absorbed Virgin America they could broaden their route network to include airports like BWI, DCA, BDL, PVD, DTW on east coast to open up other west coast cities.

WN would be interesting.

The bottom of your article is incorrect pertaining to us Airways “acquisition ” of AA. Not hardly. It was a merger. Both carriers would have survived but AA stockholders received 75% of the new AA. US Airways got 25%

@Eric US Airways was the effective acquirer.