Delta once promoted themselves as the best airline for upgrades. Not only did they offer ‘unlimited domestic upgrades’ for elites before United or American but they even hyped upgrades to private jets but that program turned out not to be real.

In 2019 Delta largely eliminated mileage upgrades. Instead of costing, say, 25,000 miles each way (or 25,000 miles plus $500) they now cost the difference between coach and business class, paid in miles with miles worth just one cent apiece.

Delta’s top tier elites are no longer even able to upgrade from coach to business class on international flights, something that American and United elites can still do.

At Delta, business class is something you have to pay full price for (unless you’re on a corporate discount!) and miles are just a currency ‘same as cash’. And if you prefer to spend cash they offer financing.

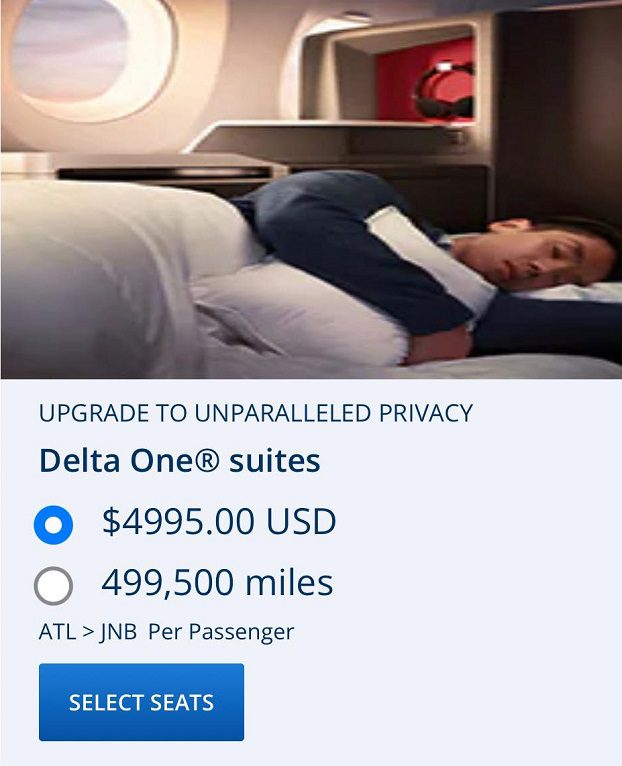

Mileage upgrades at Delta are now available almost any time there’s a paid seat available in business class, but that’s almost useless. An upgrade on Delta can cost up to one million miles roundtrip. Here’s one way on an Atlanta – Johannesburg itinerary:

None of this should be surprising. Delta will charge 180,000 miles for a one-way business class saver award to Europe when partner Virgin Atlantic will charge 50,000 miles for that same exact seat.

The Vice President of the SkyMiles program explains how they’re able to get away with this: people still join the program, use their co-brand credit cards, and redeem their miles.

He acknowledges lower value that he calls ‘sustainable’ and ‘holistic’ and suggests they’re “not necessarily trying to play the game with customers” of delivering more value than competitors.

If you’re a top tier elite you now have to buy premium economy if you want to roll the dice on an upgrade to business class (they can still be tough to come by) and you will spend hundreds of thousands of miles for that upgrade as well. How that encourages customers to spend money on a Delta credit card, when they’d be better off at 2% cash back since they’d get twice the return on their spending even for Delta upgrades, I find it difficult to understand.

@ Gary — This soon-to-be-former Charter Delta Diamond member has a solution — don’t fly Delta internationally. I have rarely done so. In my world, they are effectively a domestic airline.

That’s a steal only a million miles for an upgrade? They need to double or triple it

Delta customers aren’t happy enough unless fully bent over with delta emptying the last of their pockets.After all they are the only airline who can get you there on time,not cancel a flight and put you on a meter to monitor your time in their world crass clubs

Go go go delta

A good reason not to fly Delta.

Why fly Delta as long as Aeromexico, ITA Airways, La Compagnie and Icelandair are all cheap?

DL gets more and more customer unfriendly every day.

I believe it’s still possible to upgrade with miles on intl flights only under the old chart (good luck finding it) and OY space needs to be available. Also good luck finding an agent who remembers how to do it correctly.

Let’s face it; the SkyMiles program is dead-dead-dead.

This would be a good time for a reminder that Delta, just like every other large jet US airline, is a for-profit company whose first priority is to maximize the value to its stockholders.

Delta devotes more than 25% of its floor space on its widebody aircraft to business class, is the only US airline that was profitable in all 3 global regions (transatlantic, transpacific and Latin America) pre-covid (and did it for multiple years in a row) and was also profitable on its international route system last year.

In contrast, United – which touts itself as the largest US international carrier – lost money flying the Pacific even before covid and consistently underperforms Delta’s profits even over the Atlantic – United’s strongest region.

American has lost billions of dollars flying the Pacific and to continental Europe and has now retrenched to its strongest partner hubs plus S. America.

We all would like to get a service that someone else pays for but upgrades that don’t pay what Delta can get by selling its seats is essentially looking for a subsidy. It’s great if you can get it but you shouldn’t be surprised when the fountain runs dry.

and Delta does allow upgrades to Premium Select; while hardly the same thing as Delta One, it is a significant step up from Economy or Economy Comfort.

Well-run companies price their product to get the maximum returns for their investment. If Delta miscalculates, the free upgrades will be back. If they don’t come back, then Delta One is clearly worth a lot more than people have been “paying”

@ Tim Dunn – agree completely. People on this blog and others may whine but these airlines are businesses and run as such. They aren’t here to give away tickets. If you don’t like it fly someone else (although good luck finding great deals on any of them using points). Frequent Flyer programs are now largely irrelevant. Sorry but true. I’m lifetime Gold on DL and lifetime Platinum on AA w over 3 million miles each but now retired and fly whomever I want. I look for good domestic awards and can usually find something I like but have to be airline agnostic do it. I still have around 800,000 AA and 100,000 DL miles but increasingly transfer my Membership Rewards or Chase Ultimate points for airline awards or just pay cash.

All the bitching and whining won change things. Accept reality and make the most of it. The coming recession may change things but right now there is usually little value in frequent Flyer programs

@Gary – DL also eliminated another popular way of accessing business class – they eliminated SkyBonus international award redemptions ……with no notice.

Bottom line? Delta SUCKS.

@ Tim Dunn @ AC — You are absolutely correct about Delta’s pricing. @ AC — There is still plenty of value in mileage programs, albeit a lot less the last couple months. Award availability will improve when the recession comes.

Diamond for 8 years…I am done. Loyalty goes both ways. I flew enough even during the pandemic to maintain my status but the new SkyMiles devaluations and diamond benefit cuts have me taking my business to United and AA

I am a Delta elite-status traveler and a Delta shareholder and I am very happy with the carrier. I don’t have problems with business class upgrades. That said, I don’t expect availability on every flight or at high demand periods.

Gene,

maybe award availability will decline if a more and more likely recession occurs and maybe Delta will simply adjust capacity to match demand.

United still acts very much like the way Pan Am did – fly wherever it seemed sexy to do so and allow its domestic network to subsidize its international network. That is not possible during a recession.

Delta has long been as good at matching supply to demand as any airline except perhaps Southwest – and both do it because they dominate their markets.

Let’s also keep in mind that Delta has a much more fuel efficient international fleet and also is paying less than American or United for fuel -so Delta is very well positioned in a downturn.

Can’t wait for the flights to the Moon upgrade … you’ll have to turn your phone to horizontal …

Happy to fly DL when it makes sense domestically, and happy to buy domestic F, but I credit the miles to Flying Blue, which is a much better program. And the only time I have flown DL internationally is when AF was having a strike and they re-routed me.

We had it good in the US when we had Delta at least as a respectable carrier that operated on time, fed you well, and at least had the business traveler in mind. Loyalty was never particularly rewarded with Delta, but at least when you flew them they’d generally get you where you needed to go without needing an exam table and gloves.

Now, post-Covid, we’re stuck with a bunch of airlines that can’t seem to actually fly airplanes while their management teams color around the edges of the operation looking for additional ways to screw everyone. Demand is at record levels and they can’t figure out how to serve anyone. What utter buffoonery, but it’s all of us who pay the price.

As the Biden Regime Recession sets in, the Delta clowns will soon be charging 5 million sky-pesos for a business class ticket.

Leaving Wedneday IAH-SIN booked in Delta One for 230,000 miles. Never try to upgrade internationally using miles, but I can almost always get what I want when I book to begin with.

Miles and points are practically worthless these days, all award charts (airline and hotels) went through the roof !!!

@Robert Kaping – you paid 230,000 miles one way for a business class award?

So much for being a Diamond on Delta… It is not worth spending $15, 000 per year… And not even getting a biz class upgrade once in awhile.

230,000 miles for a business award is nothing.

A couple OPM business class tickets earns that many SkyPesos since Delta has no cap.

@Gary,

feel free to let us know what you spent on in-transit hotels on your latest trip report.

Many of us wonder why you don’t seem to mind spending so much money (or miles) on hotels but expect air travel to be given to you for pennies on the dollar.

Since Delta doesn’t fly to Singapore right now, it was at least partially a partner award.

Since it went over your head the first time, let me repeat that ALL THREE of the US global carriers are publicly traded, for-profit companies which have as their first responsibility to maximize shareholder value.

Delta just happens to do it far better than American or United – which explains why Delta as a company is worth 2.4X what American is worth and Delta is worth 60% more than United.

Who do you expect to subsidize your business so you can enjoy the benefits of your job on someone else’s tab?

Premium Select is a trash product. AA and UA have far better PE products. I’m a DM/MM and done flying DL over the Atlantic. Looks like they will be domestic only for me.

@Tim Dunn – you fail to understand that the frequency programs are the biggest driver of airline profits, so giving consumers very little value usually risks the profits those programs deliver. Delta has been an anomaly in this regard and it’s interesting to see. There are some unique reasons why – brand, geographic strength, and historical accident (being Amex’s second largest cobrand partner when Amex bolted)

Tim, just give it up already. The same argument you spout over and over that all 3 carriers are for-profit companies, all terrible, but only DL is the least of the terribles is a sad argument to make. Let’s remind you AGAIN that Delta took public money during COVID for the sole and explicit purpose of RETAINING STAFF to be ready for the claimed rebound. Instead they slashed 30%+ of staff through buyouts and forcibly reduced hours to create loopholes around the subsidy rules given to them by the government. Now look where we are! They claim boo hoo, staff shortages, didn’t see it coming… Oh, and to cap it all off, CEO Eddy doesn’t want to call it a ‘bail out.’

At least call out the subsidies and bail-outs for your precious Delta when you try to rail on Gary…

This is great news- for Delta non-revs, at least

😉

Chase,

ALL US airlines received federal grants proportionate to their labor costs pre-covid. In fact, Delta received less grant money than American even though Delta generated more revenue pre-covid than American because Delta did so with lower labor costs. But all airlines received the funding so I’m not sure what your point is.

Gary,

I fully understand exactly the issues; you don’t seem to understand that a free market is composed of willing buyers and sellers that make economic exchanges at the points that maximize each of their economic benefits.

As much as you think Delta doesn’t offer value through its Skymiles program, they clearly have managed to have the most valuable loyalty program in the world and get the most revenue from their credit card partner than any other airline. Whether you accept those numbers or not doesn’t matter. Using the loyalty programs as collateral allowed investors to see what FFP programs are really worth. I lost you on who think bolted from AXP; it certainly wasn’t Delta.

And it is precisely because US airlines have relied on their FFPs for revenue to the exclusion of their own operation that the legacy carrier segment of the industry has perpetually underperformed airlines like Southwest which has been the gold standard for financial success of an airline worldwide. While Delta does not have the balance sheet that LUV has, DAL generated margins pre-covid as good as LUV and will do it again this summer. DAL has repeatedly said that it isn’t interested in being just like the rest of the airline industry in terms of financial performance and they are pricing their products to make money with the best of the industry and not use American or United or Air Canada – which margins lower than United – as a barometer.

Again, I get that you and everyone else wants to get more than what you pay for but given that AA and UA are far less profitable than DL, esp. on their international operations, someone is picking up the tab for others to enjoy far more than they pay for.

If you think DL is an anomaly, it is probably because you have grown accustomed to below-cost pricing by legacy airlines for so long that you don’t bother to ask yourself if the fares you pay – including mileage programs – are financially successful on the same scale that you expect for your own business.

This is the obvious result of massive consolidation. I expected the most successful airline to basically have a FF program in name only. Does DL even need an alliance?

Just seems like supply and demand here. Most flights on Delta to Europe are already booked in J for next month (and going forward), everywhere we looked to BUY tickets in J were high price due to limited seat availability. Flights are full. So, there is no wonder you can’t find a cheap upgrade with points. That’s how supply and demand works. If it’s wide open, of course you can find good award availability. If it’s full, you won’t.

@ Tim Dunn @ AC — You are right Delta is a private business and has the legal right to price its tickets at whatever the market will bear. It doesn’t need to have SkyMiles at all — it can eliminate the program completely! But you know what else is private? @Gary’s blog. He equally has every right to inform his readers which airlines reward loyalty and which don’t so we can make informed decisions about where to spend our own money. We’re under no obligation to give any of it to Delta.

@Gary’s piece was informative for me in particular. I live on the west side of Manhattan (EWR and JFK are about equally convenient for me) and have been a longtime United 1K. Delta sent me a targeted promotion for Diamond status two years ago, which I accepted. I re-qualified for top tier status at both airlines last year but this year am aiming to pick one to focus on. Gary’s post helped me make up my mind to quit Delta and stick with United.

Delta targeted me for their promotion so presumably they thought it was worth investing in an effort to cultivate my business. But even with Diamond status I’ve literally faced hours-long waits every single time I’ve had to call Delta. If I call United from my cell phone, their system recognizes me and I’m speaking with a live rep within seconds every single time. Two years ago, when I accepted the status match and was seriously thinking about switching to Delta, United seemed to lag Delta in a lot of ways — Delta had better operational performance, better lounges on domestic flights (Polaris lounges are better than SkyClubs but only available on long-haul international), happier employees/better service. But with a new United Club at EWR, operational performance that’s now more in line with Delta, a seemingly happier employee base at United after they got rid of less happy employees during the pandemic, AND a vastly more rewarding loyalty program, United is now equal to Delta on most dimensions and vastly better on some. I travel internationally a lot, and having a consistent experience on United is also a plus.

Ultimately, I dont’ see the point of being loyal to Delta in the way that I am to United. If Delta offered a much cheaper option or a better flight then yeah I’d probably book that as just a one off and pay for a premium cabin since I wouldn’t have any status on Delta (I often pay for premium cabins on United as well). But out of NY, both airlines have very comparable service — and I’m getting a better value with United’s loyalty program, since I’m happy to book a few fun weekend trips to places I might not have visited otherwise when upgrades are easy to come by (this is a win-win since United cultivates a loyalty by giving a nice seat that otherwise would have gone empty, and I get value from snagging a nice upgrade). Keep in mind that United Polaris uses a high-density configuration in business class, which they set up precisely so they would have more business class inventory and be able to give away more upgrades while still having plenty of seats for paying customers. Delta’s configuration is much less efficient so they simply don’t have the inventory to give away upgrades as freely — but the less efficient configuration honestly doesn’t “feel” any nicer. United did a good job designing their biz class seats.

Which strategy will work better in the long run? Hard to say, but I work in a recession-proof industry and if we have a recession, I’ll certainly keep spending money on United. With Delta, I’ll try to figure out a way to burn my remaining certs this year and then call it a day.

Delta has accomplished one thing to embolden other airlines/programs to also aggressively

Over price on revenue and award

I’m shocked when I see 50 k and up for a one way coach ticket

Come Sept I think they will see a rude awakening.

John,

I appreciate your narrative and personal response but I’m not trying to argue that there will be people that will choose United based on what it provides consumers.

My point is that United runs its entire operation at a lower profit margin and will continue to do so Despite their execs’ talk of rosy demand, United will still operate its airline at about 2/3 of the profit margins as Delta.

It is noteworthy that you accurately note that Delta and United are tossups for you in NYC; for the vast majority of people where specific geography in NYC is not a consideration, that is true.

Clearly, though, Delta is running a more profitable business. Some would argue its Delta’s captive hubs that subsidize NYC, Seattle and LAX. That might be true but the question is why no other airline has managed to duplicate what Delta has done in its core hubs. Delta doesn’t have less restrictive FFP guidelines for NYC – so they clearly are getting revenue from other hubs to subsidize their coastal hubs or they really are finding higher quality revenue than United.

Let me reiterate one more thing since you identify as a NYC passenger. DL’s refinery strategy is paying off in spades and reducing its cost of fuel in NYC by perhaps a $1/gallon. When you fuel a widebody across the Atlantic, the difference amounts to $10k or more. Add on that Delta got rid of its 777s during the pandemic while UA still has dozens of them and the fuel cost difference between the two on comparable international routes amounts to $25k on a transatlantic flight and up to double that much where UA uses 777s (including the -300ER) across the Pacific.

I mention fuel costs jus as I do for pricing; companies cannot sustain costs that are competitively uneconomical. UA and DL have been locked in a battle for dominance in NYC for years; it is very possible that the future will not be determined by award charts or onboard amenities but by fuel cost and fleet fuel efficiency – which means that UA will either have to pull back its NYC aspirations or subsidize its higher NYC costs from somewhere else on its network – if jet fuel costs esp in NYC remain as elevated as they are now.

best of luck to you however you decide. I appreciate you taking the time to recount your personal experiences and preferences.

Gary – as has been explained many times, the benefits of spending on Delta cards include:

1) Spending to qualify for status

2) Earning SkyMiles that can be combined with those earned via flying

3) Redeeming SkyMiles for domestic flights

4) Redeeming SkyMiles for international coach

5) Redeeming SkyMiles for international business class during flash sales

I’ve stated to spend more on my Delta Reserve recently (past two or three years). This has helped me earn Platinum, and soon Diamond status. Upgrades have been easier, and RUCs have gotten me upgraded on transcon flights into DeltaOne. I expect GUC will help me get upgraded into Delta One when I get them. RUC/GUC alone are worth thousands of dollars.

SkyMiles themselves aren’t worth all that much (1.1-1.2 cents). But that can buy a lot of domestic travel, which can then be upgraded via status. And I think you are also overstating the value of other currencies.

Yes, it is a free market economy. And, certainly, each airline can do what it wants. But, might we categorize Gary’s efforts as advocacy as opposed to whining? Alternatively, might we categorize Gary’s efforts as giving readers a reality check? Assume benevolent intentions.

Reno,

the free market for thoughts allows everyone to share their perspective.

While I rag on Gary, I do appreciate that he takes on topics that matter to alot of people.

I don’t doubt Gary’s intentions… I am simply saying that his world and those of a whole lot of others isn’t reflective of ALL of reality if they don’t consider the economic costs and benefits on BOTH sides – the consumer and supplier.

Gary doesn’t have Wall St. analysts as readers – he appeals to readers that want more than they pay for. There just has to be people like me that insert reality into euphoric discussions that appeal to desires that are as illusive as a mirage.

It is still true that there is no such thing as a free lunch.

@Tim — Thank you for the thoughtful explanation. I would just note that the audience of this blog is consumers, not investors, so I think the relevant question — and the point Gary is focused on — is whether Delta is delivering a good value to consumers or not. It is difficult for consumers to get good information about what awards *actually* will cost at time of redemption and how available they are, so publicizing those differences with vivid examples helps to educate consumers on which airline will offer a better value. I think that’s valuable for a consumer-oriented blog, as that’s a key piece of information consumers will factor into their decisions. This isn’t a situation where @Gary is complaining about something that all the airlines are doing — American and United do not charge 1 million miles for a business class upgrade (even “non-saver” rates are generally much lower at UA at least), so that’s a point of differentiation that consumers ought to know about.

I’m not qualified to comment on the investment thesis for either airline as I personally invest mostly in index funds and don’t spend time trying to pick stocks. But unless there’s some reason to think that UA and AA’s offerings are unsustainable and will necessarily be rolled back soon, I don’t see why consumers should care that Delta is more profitable. To give just one simple explanation, suppose that Delta gets a huge yield premium relative to UA because it has a ton of fortress hubs whereas United’s hubs are mostly in competitive markets. It might be that UA can’t just easily copy Delta’s strategy because opening a new hub at this stage of the airline’s development may not be worth the investment required — maybe all the good “fortress hub” candidates are taken by now, and trying to open a hub where DL already has one would just result in ruinous competition where neither airline profits at that hub so that wouldn’t improve things either. In that world, it may be the case that UA will always be less profitable than DL by virtue of having fewer fortress hubs. But that shouldn’t matter to consumers. In this hypothetical, it may be that Delta management rationally decides the best thing it can do for its investors is *NOT* invest in customer loyalty, because its most profitable customers have no realistic alternative and any such investment will just add cost without improving revenue. United, by contrast, may be “stuck” in more competitive markets — due to decisions made decades ago that can’t now be easily reversed — but as a result its best strategy today might be to actually compete to drive loyalty in those competitive markets, taking advantage of the fact that Delta is not willing to do this because the benefits to its business in competitive markets would be offset by added costs with no benefit at its many fortress hubs.

That doesn’t mean United’s strategy is wrong or flawed. It’s just that the airlines face a different choice set because of long-term investment decisions. Consumers who *DO* have a choice should be aware of those differences so they can choose the airline that’s offering the better overall deal to consumers today.

To the extent that @Gary is suggesting that Delta management is dumb or irrational, I would agree with you that’s silly. Airline managers are paid a lot of money and spend a lot of time figuring out what’s most profitable for their airline given their starting point. But I read his criticism as primarily a warning to consumers, and it is entirely appropriate to highlight for savvy consumers that SkyMiles is not remotely as rewarding as MileagePlus or AAdvantage so consumers can take that into consideration in their own decision of where to spend their money.

@ Tim Dunn

I welcome your input – you take a position and seek to back that up with local argument and fact.

That said, surely we need to be careful not to conflate the performance of the airline’s operations with that of its associated frequent flyer program (FFP)?

Delta has the FFP generally recognised with the greatest value, although not by that much.

Delta USD 25.931 billion

American USD 23.440 billion

United USD20.172 billion

Source: On Point Loyalty 2020 Report

Note that even as the most valuable FFP that does not conclude that it’s the most profitable, best run, offers the most value to its members, drives high value repeat business to the airline, etc., etc. In other words it does not necessarily follow that an airline that you personally perceive to be well run has mastered its FFP to its potential.

There were recently business award seats SYD-LAX in whatever DL calls business class available through Velocity points (no longer of course now VA and DL have parted ways) – 94,000 Velocity points versus 360,000 DL miles. WTF!!!

DL is relying upon ignorance amongst its members that they are trending to just a one or two percentage or less net return through the earn and redeem cycle (% when you earn one mile per dollar and redeem for one cent per mile) as @ Gary recognises in his credit card example.

Now look at the revenues into modern FFPs – the cash is coming from sale of points from third parties. The major driver for that income is no longer selling airfares on your parent airline, but taking a cut of a broad rage of credit card and retail and other financial transactions through the medium of miles and points.

To such extent it doesn’t matter which airline gets your business, rather which FFP you process your spend through.

So..performance of FFP and performance of airline operation not necessarily reflective of each other.

FFPs will generally trend to seek greater net profit though various strategies (revenue models, dynamic redemption models, etc).

BUT at some point there may or may not be push back from consumers.

ALSO FFPs are accountable to the third parties to whom they sell their miles / points, and that’s not just the parent airline, but the credit card companies (including the billions bucks annually from Amex alone): at what point does the third party jack up and say, stop screwing the membership I’m trying to market to I paid for those bl—dy miles to die the consumers’ credit card engagement?!

When I’m an investor looking at my investments, I’m focused on the long-term profitability of the companies I choose to invest in.

When I’m a consumer—which is always the case when I’m traveling—I’m focused on the reliability, service, and value delivered by the airline or hotel.

Likewise, I don’t consider my other consumer choices from the standpoint of what would be best for the seller. So I don’t focus on eating at the most profitable restaurant, or buying a car from the dealer with the highest markup, or getting an eye exam from the optometrist with the biggest yacht.

I think people continue to join and spend on their cards because there is a long lag between the enthusiasm of enrollment and the inevitable disillusion of attempting to redeem miles or collect on status benefits. So when you are chasing status, it is because of a value you perceive in your mind, not the actual lackluster benefits you will later realize was all you ended up with.

Same logic as to why so many people favor nationalized government health care. They imagine current health care level service is what they will get for the price of zero, instead of the bureaucratic inefficiency machine they will actually get. They just won’t realize it until many years later when they actually need a procedure and have to wait.

I am glad I was able to tee up a discussion that has resulted in some VERY good responses.

I have repeatedly said that I know I am looking at what airlines offer from an investment standpoint but I too, like others, shop as a consumer, not an investor. However, I don’t fall for alot of “it’s too good to be true deals” like the massive AA loyalty giveaway that resulted in multiple bloggers including Gary wondering if they would get all of the miles they thought they would. I want companies that reward real loyalty but I also don’t to play games to get that something that likely is too good to be true.

Delta clearly has set out to redefine how it runs its business as a global airline – and from a business standpoint, they have already achieved their goal; they were the most profitable global airline pre-covid and are set to take that position again this summer. They clearly have a different customer base – possibly driven by their captive hubs but NYC BOS LAX and SEA are highly competitive markets so the value they offer consumers is not limited to just what they can get by with in captive markets.

I completely understand that some people will view Delta and every other airline’s service and pricing differently and, because I believe in free markets, I expect others to make their own decisions. It is up to Delta to figure out how to maximize its profits and to understand its customers well enough to adjust its strategies if they no longer produce the best results for the company – which clearly means that they aren’t providing sufficient value to enough customers.

But after following the airline industry for over 45 years, I also think we are close to yet another division among the legacy/global airlines and it will be defined by financial indicators – driven by profitability, balance sheet strength, and fuel cost. Delta has done some very unconventional things that led the industry – including cutting travel agent commissions, pricing, and more recently buying a refinery. Many people forget that one of the biggest factors that drove Southwest’s growth post 9/11 was its fuel hedges that gave it a huge cost advantage to other airlines. Delta now has that via the refinery – along with Alaska and Southwest via hedging but Delta also has supply advantages.

FInancially weaker airlines have always priced below cost – but they don’t do that for long. Pan Am, TWA and others litter the pages of airline history and offered great deals despite at times being “service leaders.”

My only point about discussing the financial aspects of award pricing is to note that a deal today is rarely one that is sustainable if the company providing it is not profitable or offers it on an unprofitable segment of its network; we have access to enormous data about US airlines because of outdated requirements to file reports which no other industry requires.

Delta’s award pricing might be high at times but they offer award sales but there is a distinction between consistently low award pricing at other carriers that consistently are not generating profits at levels to generate returns sufficient for their investors.

My only caveat about pricing – award or other – is that if someone is either considerably higher or lower than the competition, the latter being more likely to be the case, the chances are it is not sustainable long term.

Every time I hear/see Delta’s Premium Select, I always think of cat vfood. What next, Fancy Feast?

All you people do is bitch. An airline is a business. Giving free shit away to over privileged pieces of shit elites like you will make businesses go broke. Fuck you and your self entitlement. Delta is the best and people know it. Delta isn’t know to be the 9/11 airlines. Delta does what Delta does because there are way too many diamond medallions. Too many Diamond and Platinum medallions means Delta is the best and has to start charging for things in this messed up economy. It’s pieces of shit like you that drives everything up in prices and stupid. Fuck you Fat ass cry baby.

Paying flight attendants for boarding time takes away from profit. Don’t those flight attendants know that the airline is a for-profit company working for its shareholders? How dare they!

Look, the $5 Amex Offer at Starbucks takes away from profit. The $150 checking account bonus at PenFed takes away from profit. The T-Mobile Tuesday 25 cents per gallon off of Shell gas takes away from profit. The 250k point Amex sign-up bonus takes away from profit. It’s a game.

Whether we call this that we do a “hobby” or a “game,” our beloved blogs keep us up to date on opportunities that open and close. While it IS a sin to feel entitled to more, it is NOT a sin to simply want more. And, it’s not a sin to “arrange one’s affairs” so as to achieve more.

I don’t criticize any of the airlines for what they do on their side of the game.

To be certain, I have long argued that tier status is worthless if one simply buys premium cabin seats. That ticket buys a person virtually every benefit that tier status provides. So, I’m not arguing from a position of entitlement.

Delta is just bottom of the manure piles. Cruddy airplanes, cruddy service and don’t care about people. Quit them and wouldn’t get on one of their airplanes. I am and A&P and a Pilot. I wont fly domestic any more and Co biz class on foreign airlines.

Having been sitting on a pile of SkyPesos from an AMEX CC offer for years, I have never found any use for them – until today. Every time I’ve searched for awards on Delta, the price has been ridiculous, even considering I got the points for “free”. (Got close once using them on Virgin, but the dates didn’t work.) But with transatlantic flights being priced what they are and Child2 needing to return to Dublin for school, I thought I’d search for awards. (Children fly economy. Sorry, kids.) Could spend 30K on AA, but I value those miles. United is more than it should be on the date that need, so no go there. But Delta has exactly one date where they’re priced at 35K, and that’s the date I need. Not the greatest routing, Flyover-LGA-YYZ-DUB, with two three-hour layovers and a transatlantic flight on a WestJet 737, but it’ll get him there and he’s got an AMEX Platinum Authorized User Card and a Priority Pass to kill the time in a relaxed atmosphere.

Now to install the Delta shopping button to get the extra 1025 miles I need to round out my miles and find an award that burns the rest of these damn things.

We all saw this with AA Several years ago and now look at them. I have been for- hard Delta Diamond for years but come on … tickets are double triple or more vs United and they are shipping away at the reason to stay loyal. Now AA is doing a full 360 going back to all miles count towards status etc etc …

The pendulum swings …. It’s almost as sad as it was watching my beloved SPG Get systematically demolished by Marriott. It’s like when I had to watch Notre Dam burn down a month after visiting it.

Sad

“He acknowledges lower value that he calls ‘sustainable’ and ‘holistic’ and suggests they’re “not necessarily trying to play the game with customers” of delivering more value than competitors.”

They can do this because they’re that far ahead of United and American. It sucks, but without significant improvements with other airlines, I’ll keep using Delta because it’s a better end to end experience.

Delta One is not really business class, that’s first class, the headline is totally misleading too, what you’re saying is it can on select round trip iteneraries cost 500,000 each way

@John Ghang “Delta One is not really business class, that’s first class”

Delta disagrees https://news.delta.com/worlds-first-all-suite-business-class-introduced-delta-one

Northwest Airlines knew how to treat their upper tier customers in their world perks program much better than Delta. Delta has a way of ruiniing a good thing just like what they did with their scheduling, the route structure, and pulling out of lucrative cities in Asia.

Since DL mortgaged its skymile program during the pandemic is it actually DL making these moves regarding the use of the miles ?

They think they can pull this off because they have run the financial and demand models and they know that the majority of their profitable customer base won’t leave them. The day frequent flyers switch their spending from Delta to AA or United, this will change. Until then, expect to see the lack of upgrades continue or even more things like this. One other thing to keep in mind. Delta’s market cap is far higher than AA or United, so their business strategy appears to be working (or at least the market seems to be supportive).

Delta is just using the rule of business/capitalism in which the customer votes with their money. Delta is simply a better airline to fly. Period.

Delta is my preferred airline. It is now my preferred airline for domestic trips. Although I understand them doing this, not for Diamond elites although. They should rethink this tier and gain loyalty from top tier customers. I upgraded my wife on a trip form Europe it cost 353,000 miles to do that one way upgrade in July of this year. The ticket costs skyrocketed and is shameful to be honest. Its all about demand although. I used to upgrade both the EU and Asia trips when space was available for 15,000 to 35,000 miles, that was a good deal and value. I just can’t spend company funds of 12,000 to 18,000 for delta one anymore. I started using AA, and United now for long haul trips and now I’m top tier with United as well. I can upgrade for value on those flights now… In the end Delta looses!!!