Don’t have the money for your dream trip? About 15% of people finance United Airlines Vacations packages. Vacation package financing is common, even though the Puritan in me thinks that borrowing money to go on vacation is probably not a good idea most of the time.

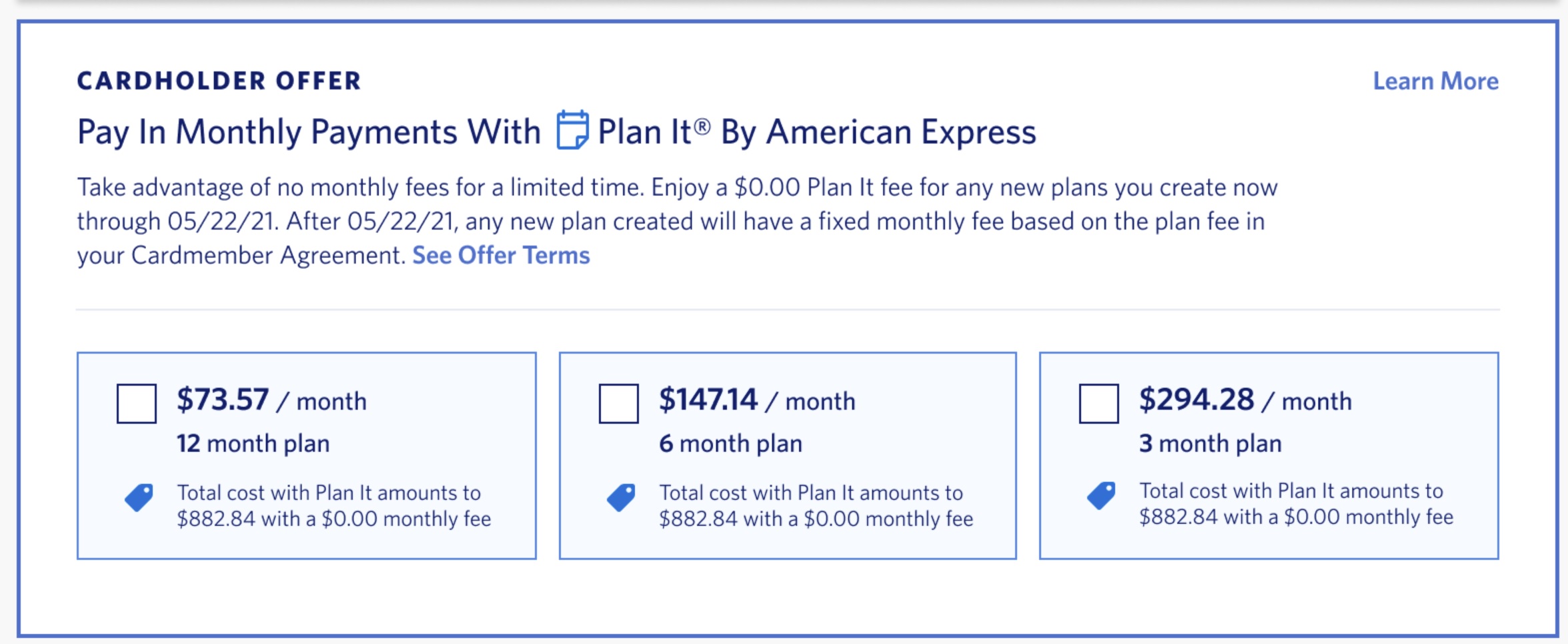

Delta Air Lines and American Express are testing out a new airline ticket financing option for Amex cardmembers. And in the mockup being focus grouped there’s a limited-time no fee offer to spread ticket purchase costs out over 12 months (“12 Months Same As Cash”).

I’m told they’re also testing financing for upgrades. That seems like a questionable idea, at least for the consumer. I understand needing credit for a ticket purchase in an emergency (more than, say, a vacation). The use case for buying a ticket and then deciding to finance an upgrade seems more… limited.

Soon your job will be your credit.

Delta already offers financing for air and hotel package travel. While “immediate payment” is currently required at Delta.com for ticket purchases, there is already an option for Paypal credit financing.

Many years ago I wrote that credit card rewards aren’t for you unless you’re able to pay your cards off each month – and the cards themselves don’t encourage spending more than you otherwise would. I like to think that’s how we all behave, but the numbers suggest otherwise.

A no cost financing option aside, since it’s just limited time, if you’re financing ticket purchases you probably shouldn’t be doing it on an airline credit card – even with a discount offer on the interest rate.

And monthly payments for a flight upgrade is almost enough to make one sympathize with bad advice from Dave Ramsey.

For what its worth, these offers looks like true 0% financing (the waived “fee” they discuss is the waived interest charge). It makes sense to take advantage of these when offered (Apple Card has been very successful offering these)

If you have to finance an airline ticket or, God forbid, an upgrade maybe you can’t afford to travel!!

The credit card rewards that many of us enjoy are only possible because people finance things. Whether or not financing is a good idea really depends on several factors.

@P Ness – not really true, American Express offered rewards with charge cards that don’t include financing for years. That said, higher payments to cobrand partners are in many cases bets on APR (Cf. Costco Visa)

Maybe there are a very few limited situations where financing a ticket this way is necessary but financing upgrades like this is a shameless move. It’s the equivalent of a payday loan in that Delta will make sure they get their money no matter what. My expectations from Delta are exceedingly low these days but I’m simply aghast at this one.

When Amex first introduced Plan It with some no interest promos I went for them even though I had the cash to pay the statements in full. Can’t beat the time value of money!