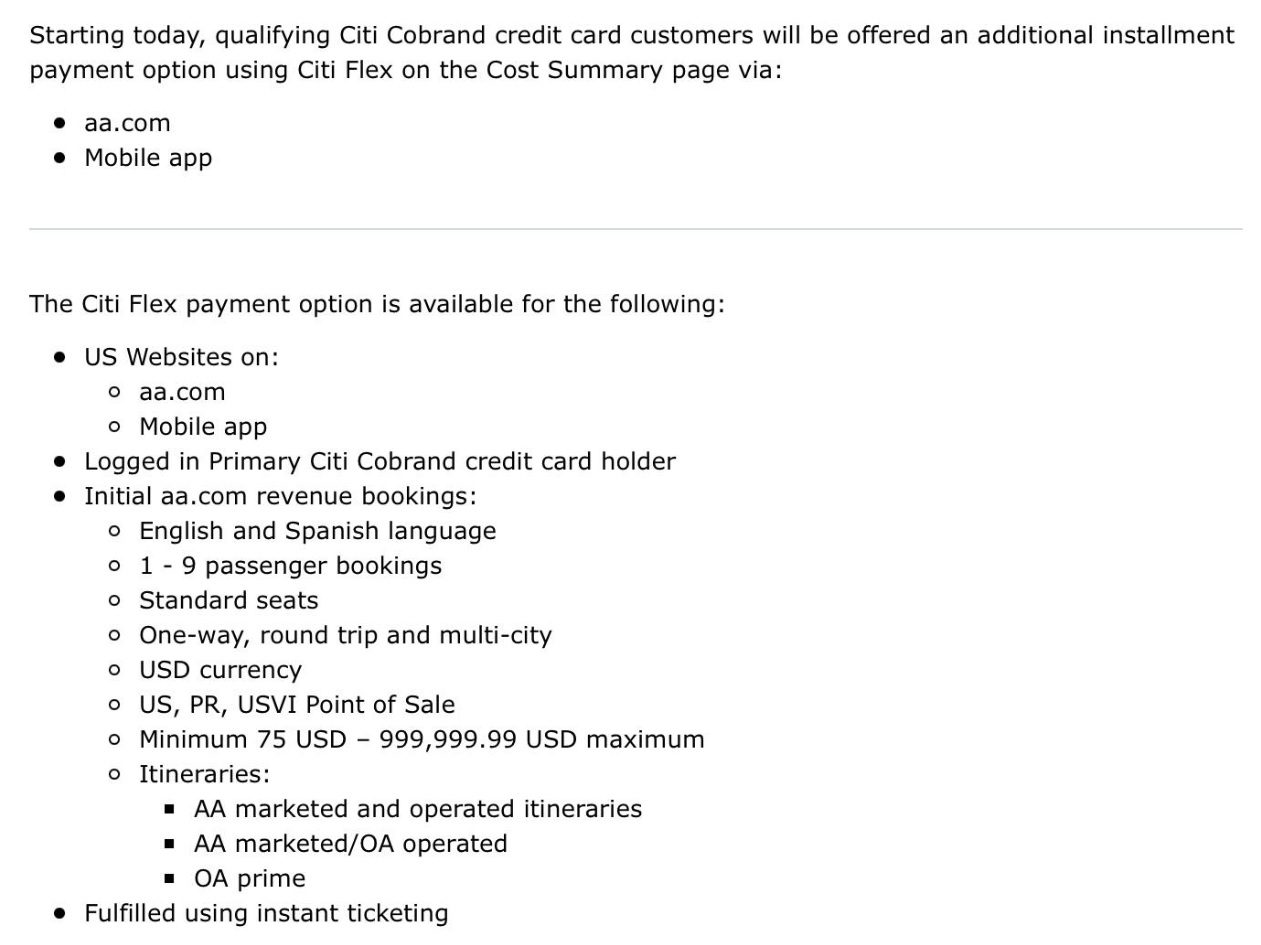

Customers buying a ticket from American Airlines, who have a Citibank AAdvantage credit card, are now being given the option to take out a loan to cover the cost of their travel. And since travel has gotten so expensive, the loan amount can be up to $999,999.99.

In some sense that isn’t all that different from paying with a credit card – you should pay it off each month, but you don’t have to. Citi Flex Loans use available credit on your credit card, and assign a fixed APR (which may be lower than your card’s rate) and fixed term for payoff. Most co-brand cardmembers don’t have six figure card limits, of course.

A year and a half ago Delta tested offering American Express financing for ticket purchases and upgrades, before rolling this out more broadly. Last fall American partnered with Affirm for Buy Now, Pay Later.

None of this is new, of course, airlines have had alternative means of payment for years. But they’re looking for new ways to make sales easier – that’s a good thing for customers who need it, and for whom the alternative would be more expensive forms of credit. I do question the 15% of people who finance their vacations, though.

That would just about cover a one-way economy-comfort ticket on Delta between the US and Asia.

Will the million dollar loan cover

New York to Chicago one way or can I cash in 3 million American miles instead?

I assume the million dollar fare would offer better value

Alternatively, one could use an Amex card and Pay Over Time. It seems the banks want to see interest income from carried balances.

Looking for $999K at 2%