Before the pandemic the American Airlines co-brand portfolio had the largest charge volume, but American, United and Delta were all over $100 billion annually. Delta now says they’re “approaching 1% of U.S. GDP” on their co-brand cards, which would be ~ $255 billion.

Inflation helps, but it’s reasonable to think they’re suggesting they’re around $200 billion in annual charge volume on Delta Amex cards. Even if American and United are lagging Delta’s growth surely then these three airline co-brands are now taking a slice out of more than 2% of U.S. GDP.

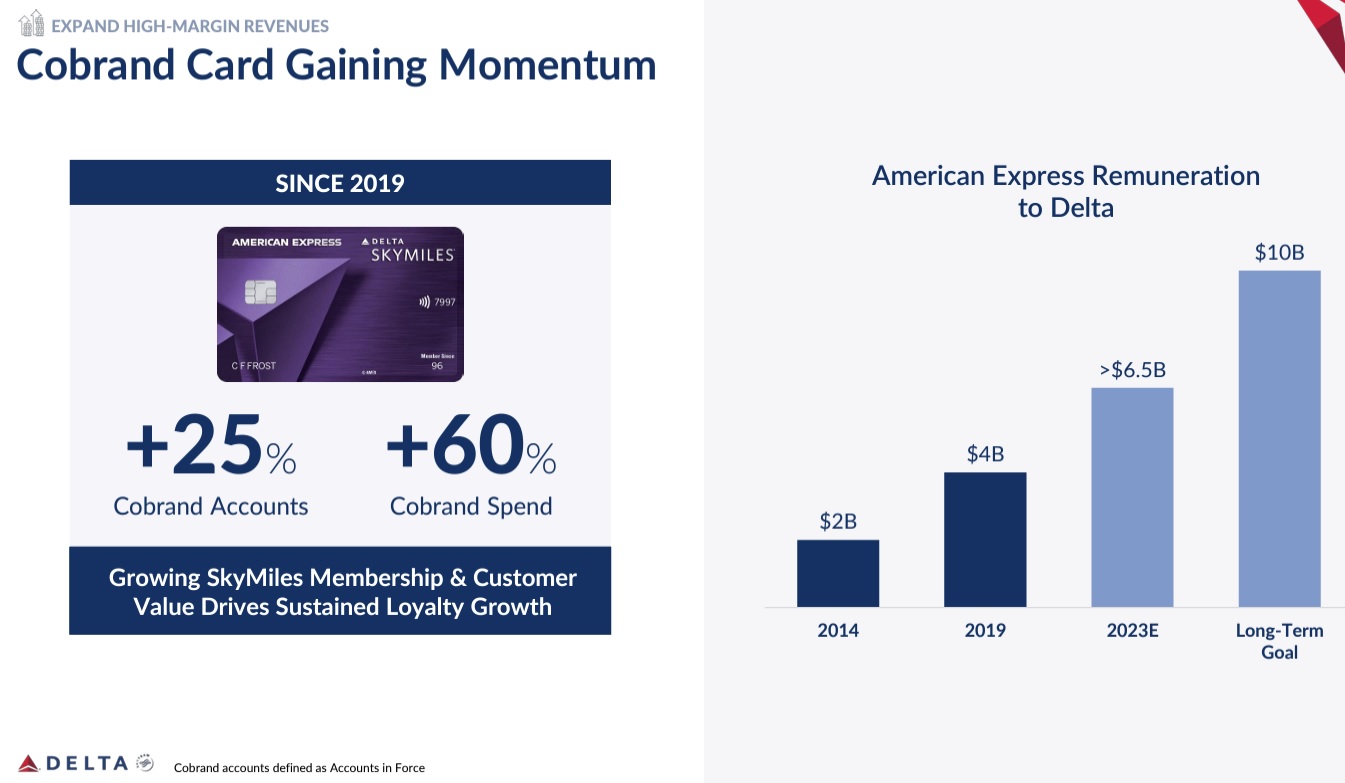

The total number of cobrand card accounts is up 25% since 2019 while spending is up 60%.

They’re acquiring about 1 million new SkyMiles members per month. That’s up from 700,000 last year. Giving free internet on board to SkyMiles members helps drive this but the sharp turn of the hockey stick in the graph below happened before this. I suspect they’re just smoothing the graph.

They’ve previously claimed to convert about 1 in 8 new SkyMiles members to co-brand cardholders. And there are now around 7.5 million Delta Amex customers. We know this because Delta says,

- They have 25 million active SkyMiles members (active is not defined)

- 30% of active members have a co-brand card with them.

They previously disclosed adding 1.2 million cardmembers in 2022.

While they’re doing well, they aren’t doing quite as well as they’d like you to think. Here’s why. When Delta and Amex re-upped their deal in 2019, with American Express paying Delta more, it was supposed to hit $7 billion in 2023 without the inflation we’ve seen over the last couple of years. And they’re only on track to hit $6.5 billion.

So what happened? Cardmembers are spending more, some of that driven by inflation, and that wasn’t in the 2019 projection. That’s offset, then, by a smaller co-brand portfolio than expected. That’s not surprising. Customers were cancelling cards during the pandemic, as they always do, and they weren’t acquiring as many customers as they normally would have.

This is one big reason you see such big card bonuses. It’s aggressive acquisition to make up for the shortfall.

Delta has been uniquely positioned to earn ever more money off of SkyMiles even as they provide ever less value. That’s not something other airlines have been able to replicate to the same extent. (When airlines like United and American have devalued that’s impacted co-brand card charge volume).

Delta’s hubs in Atlanta, Minneapolis, Detroit and Salt Lake City are less competitive. Travelers there see themselves as Delta customers. And they have offered by far the best service options in New York for anyone that sees Newark as ‘not New York’. (That’s why Delta hates the American Airlines-JetBlue alliance so much, and why they lobbied so hard for the Biden administration to try to kill it.)

And Delta’s success derives from its brand. They’ve been a more premium carrier, and a more reliable one, although both of those pillars have taken significant hits over the past few years. Whether their card success is sustainable, as they continue to gut the SkyMiles program, is an open question. And whether it’s sustainable with operational performance that still lags 2019 is an open question.

Moreover, if they’re already putting cards in the hands of 30% of active SkyMiles members, how many more signups can they do? They need new members. That’s why they have to give away free wifi with program signup. If they can continue to add 1 million members a month, and they can continue converting 1 in 8 new members to cardholders, that would be 1.5 million cardmembers per year or about 20% more than last year. But people signing up just to get wifi may not convert at the same rate.

Even a 20% increase in annual cardmember acquisition from new members, and addition by continue to market to SkyMiles members they’ve been pitching to who haven’t signed up yet, has to net out against cancellations, and doesn’t seem to get them to $10 billion in revenue per year (around a 50% increase) without a lot of inflation.

glad you found and are discussing the “1% of GDP” comment because it is simply stunning.

You got most points in your article right except failing to note that the pandemic dramatically slowed the travel industry. Amex has always been a card that has a higher percentage of travel and entertainment related spend and also attracts consumers with higher average salaries. DL also noted that 75% of its passengers have annual household incomes above $100k which helps insulate them from economic downturn and inflation fears and also supports higher buyups to more expensive services.

Despite your caveats, Delta undoubtedly legitimately can justify its “1% of GDP” claim on its cards or it wouldn’t have said it in a filing that they made with the SEC.

And DL’s agreement with Amex started pulling away from AA and UA’s card agreements long before it re-upped the agreement and before its aggressive recent buildups of BOS and LAX. The coastal hubs and their wealthier base – an advantage UA has said before it has because of the larger and richer metro areas but not the specific travelers – are very healthy icing on the cake for any company.

Delta simply attracts a wealthier clientele, Amex is the best suited card to tap into that wealth, and DL has managed to connect those factors with other initiatives such as its fuel strategy and balance sheet management to not only pay its employees more but also to generate profits that other airlines cannot match because they cannot match the structural advantages which Delta has.

I’d also love to see you present a shred of evidence that Delta fought to have the AA-B6 NEA overturned.

Buy the stock! If the card is doing $255Bn then Delta’s 2% fee is worth $51Bn. The stock trades at an implied $30Bn.

And that…

— doesn’t include the pastime of flying planes.

— Gary will throw in a free susbscription to point.me as well..

How does inflation help? Sure it increases credit card spend, but it also increases GDP, so it’s a wash.

Also, are that many people really that bad at the points game? Who wants Delta SkyMiles when they could earn… ANYthing else?

@L3: $5.1 billion. Which has to make up for losing money on their pasttime of flying planes.

@Christopher Raehl: That’s PER YEAR. What do you get if you discount $5.1B at 10% as a perpetuity?

@TimDunn is correct about Delta not putting up a fight against the NEA. Spirit was the one which lodged a formal objection in January 2021, and was supported by various parties including some airlines (Southwest and United) but Delta was noticeably absent from any official objections. There is no mention anywhere in any official DOT NEA documents of objections from Delta.

The internet and sloppy bloggers just decided that Delta must have been against the NEA because the NEA would present additional competition for Delta, but any thorough search would show Delta has never filed or joined in any official objections to the NEA.

@Tim Dunn – “And DL’s agreement with Amex started pulling away from AA and UA’s card agreements long before it re-upped the agreement”

Not in terms of charge volume, AA had higher charge volume than DL in for instance 2017

But Delta has been strategically brilliant in its buildup in New York, LA, and even to an extent Chicago less due to the flight yields and more because of the card spend those markets represent.

What would be more interesting is a plot that shows the total number of skymiles card holders for each year, from 1993 – 2023.

Everyone can boast about 1 million signups, but if cancellations run at 2 million, then there is nothing to celebrate.

@Todd – sources on the hill say otherwise

Gary,

I’m not talking about card spend volume but what DL could get from their card agreement compared to AA or UA.

DL doesn’t really care, how much volume gets charged to Amex cards as long as Amex pays DL larger and larger volumes.

And, yes, long before AA came to the realization that cutting NYC hurt its card agreement, DL had not only grown to twice the size of AA at JFK and commanded a hefty revenue premium at LGA.

And DL started building LAX the minute AA started showing signs of cold feet.

DL mgmt simply understands the dynamics of the industry better than everyone else and leaves everyone else following DL.

Good for Delta. I dont touch their cards and where I live (DC) they simply do not offer a compelling service for where I travel. Their mileage program is a joke for my needs. I wont be contributing to their numbers.

@Tim Dunn – You and I completely agree that Delta understood the role of card better than competitors. They ALSO found themselves in a fortunate position when Costco left Amex to really begin putting the screws to Amex in terms of the balance of their deal. Those two have combined to let Delta build a stronger position, though Delta’s brand is also a big part of that success.

As for New York, I told Vasa Raja four and a half years ago that he was thinking about the P&L on the New York market all wrong, that writing off the New York market meant walking away from the card spend there, but he wasn’t responsible for that book of business back then. He was being judged just on what the flights contributed directly. That’s a Doug Parker failure, and especially one in comparison to Bastian.

Gary,

you and I should both be getting a whole lot more compensation for our understanding of the airline industry than we get, now shouldn’t we?

Delta is Amex’ strongest relationship in a much stronger relationship than AA or UA have w/ their respective card issuers. I’m not sure that Costco really had anything to do with that.

@Tim Dunn – Losing Costco is what motivated American Express, they locked in a re-up early and gave Delta better terms, and losing Costco elevated Delta in importance because the Costco co-brand had been Amex’s largest and their departure left Delta as their largest partner. I can tell you with absolute certainty from the Amex side that losing their Costco partnership changed the nature of their relationship with Delta.

Guess my family and I are part of the 70% that do not hold DL Amex cards. Not a shocker as NorCal is United country. That said there is little incentive to keep these cards beyond the SUB unless you are a regular DL flyer. Why would anyone use these cards for everyday spend when you can get a far higher ROI with almost any other rewards card?

$2bn and 7.5m cardholders works out to average annual spend of $26,666 per cardholder. That seems incredibly high for an individual consumer, and I am sure there are some corporate cards that are helping bring that average up. But it also interesting to note that the MQD waiver is $25,000 of spend on one of the cards, as is the spending threshold for MQMs.

I suspect Hyatt has a higher than average spend/user given the ability to earn EQNs. And AA is probably growing even more rapidly given the switch to LPs.

This is where the industry is headed, spend for status not just points.

I’ll take your word, Gary, that the Amex/Costco relationship influenced Amex’ relationship w/ Delta. Either way, Delta saw opportunity and seized it.

and the real issue is how any other airline is able to match what DL has w/ Amex. I’d love to hear a potential path for any other airline.

Tim Dunn, I think Gary “trusts” Your words because you used to work for the airlines, I believe specifically Delta. Gary lives and breaths in the Credit Card/Finance world amd therefore I don’t even think for a millisecond when he states something about the relationship between banks/Card issuers and the travel companies (hotels/airlines/cruises).

Lastly, Delta MOST DEFINITELY worked HARD behind the scenes to kill the NEA. They didn’t feel the need to officially sign on any complaints. They used their influence on “the hill” to quash it privately.

Benjamin,

again, you make assertions throughout your post that you can’t back up w/ facts.

The NEA was killed because it violated US law which was never extended to any other two domestic airlines.

Let me guess. You work for one of the many US airlines that can’t and won’t come close to matching what Delta gets from its loyalty program.

When you can’t beat the facts, just attack the messenger.

Gary I’m sure you don’t mean it to be, but the “kimono” phrase is considered inappropriate by many and I hope you avoid using it in the future. Thank you.

The points about Delta building up in markets like NYC, LA (and Boston, which has not been mentioned) for credit card spend is interesting. But Chase/United have a big presence in the NYC area (Newark), the SF Bay Area, and Chicago. For American Airlines, Chicago, Dallas and Miami are centers of wealth. Does Delta really have an advantage here in terms of geographic areas where people spend a lot on credit cards? Maybe something else about the cards themselves also attracts customers?

Anthony,

as I noted, American Express has always attracted more affluent cardholders on average than any other card brand.

I’d love to hear from Gary how Delta ended up with Amex but it has turned out to be a brilliant partnership.

and even if AA and UA markets have lots of wealth, neither of those carriers have grown as much in lucrative coastal markets as Delta has including in BOS which I mentioned above.

Hey would you consider changing the title of your article? “Opening the kimono” is widely recognized as inappropriate on many levels.

Well, I’m doing my part. I’ve got Amex/DL cobranded Gold, Blue, Platinum and Reserve cards. I’m flying DL exclusively. Their service on ground and in the air can’t be met by any other US carrier.

Beth says “Opening the kimono” is widely recognized as inappropriate on many levels.”

Dan chimes in that “the kimono phrase is considered inappropriate by many and I hope you avoid using it in the future.”

My wife who is Asian is asking why this is inappropriate and I don’t have a clue. I hope this is not just another phrase that the woke crowd is now jumping on the bandwagon about.

@CMorgan, she’s Japanese? Asian doesn’t mean Japanese. Although kimono is robe, it’s most often associated, by westerners, with geishas. So it’s like saying opening the skirt, which seems a bit crude. Also maybe some cultural stereotyping connotation about Japanese being secretive.

Spending money on Delta credit cards is a tax on intelligence.