I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

During their Investor Day Delta detailed how they’re pursuing “Emerging High Value Customers” like college students. They’re really high on their no annual fee Amex which offers double miles at restaurants as a tool for appealing to millennials, because every cliche’ about millennials.

This is hardly a new idea. For years the United College Plus program offered 10,000 miles at graduation, and they had a no annual fee College Plus Visa as well. United also has their new TravelBank product which has no annual fee, though it too is a rehash of the old Continental TravelBank MasterCard.

Brian Sumers of Skift shares this tidbit about how Delta uses data from its co-brand partnership with American Express.

Through its contract with American Express, Delta receives data on how consumers use their cards. For travelers of all ages, Mapes said, Delta can use card data to pursue “splitters” — or people with its American Express cards who split their business between Delta and other carriers.

It’s not at all new that airlines seek out data about wallet share. Nearly 15 years ago United has “The Great Offer” which gave elite qualifying miles for faxing in frequent flyer statements from other airlines with activity on them. And luggage tags. They incentivized sending up to 3 statements excluding Star Alliance partners.

While Delta only gets a window into consumer spend on its co-brand cards, they apparently see if you buy a ticket on United using a Delta American Express.

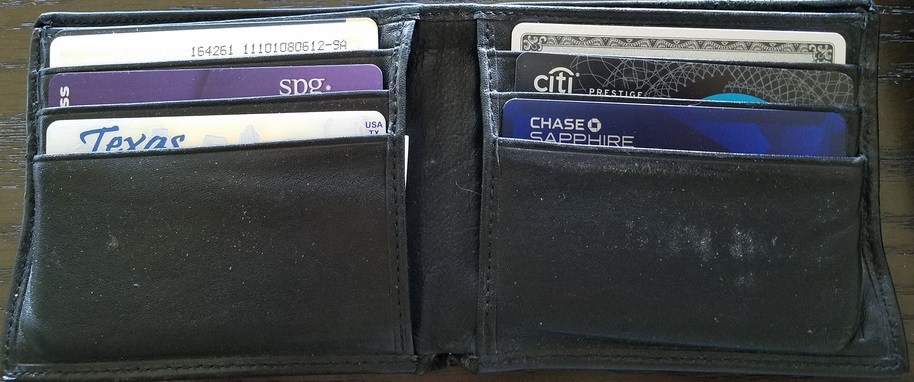

but who in their right mind would be using a delta amex to buy ANY plane tickets!?! only worth having for luggage credit and maybe mqm.

chase reserve or amex platinum for travel!

What kind of offers do they have? If it’s good I’ll put more other airline spending on the Delta cards.

This is a problem only if one has only that one credit card! I would not use a Delta Amex to buy a UA ticket, because I want the double points by using my Chase Hyatt or Sapphire Preferred Visa 🙂 ! Although I must admit that when I had no CSP, I used a hotel-linked credit card a few times at other chain hotels. Indeed, one front-desk clerk even teased me about it!

Anyone who has any other credit card has to be crazy to purchase a UA ticket using the DL blue Amex.

All these companies think they are so smart to mine this “data” on customers that is going to increase their profit by letting them sell customized offerings. Well guess what for every customer you attract you push one away when they realize they don’t get the same offer or get some offer from the other airline they weren’t flying as much. In other words customers are hip to this, the way to get the best offer is to fly some other airline. In the end I suspect they are just as well off with a uniform offering and allowing customers to self identify for offers.

i wonder if they can see travel spend on other non-Delta AMEX cards.

I remember a long ago news piece(might have been 60 Mins) about the Delta team at Atlanta that got info on customers who split tickets with Eastern. The team would locate those passengers at the gate for their outbound Delta flight and try to get them to cancel the return on a Eastern and rebook with Delta. The team proudly showed off their Two sides Delta logo lapel pins the reverse was an Eastern tail logo with a big screw through it.

@daniel – If I were tops at AMEX I’d fire anyone who shared anything with DL other than the DL cobranded cards.

Another reason why one should not use an airline credit card for spend. My Amex plat card give 5X MR points for airline tickets — far better than Delta, and Amex says they don’t share my data for that account. (Do you really read those notices of privacy rights?)

When Citi had the Hilton Card, I would put my Hilton charges on my Citi AA card. I was hoping, with enough activity, to trigger a higher incentive targeted Hilton Reserve card. For IHG purchases, I use Amex. I want IHG, Hilton, Citi, and Amex to all target me for a promotional offer. I have no problem with them accessing my spending data if they want to effectively pay me for it. If I want to remain anonymous, I will start paying with cash and gift cards.

For those with privacy concerns, I hope you use a VPN, a paid email account, a disposable or prepaid cell phone, and be sure to opt out of all of the tracking Google “provides” on your behalf.

What the hell does delta think they’re running, a loyalty program? FF programs have nothing to do with loyalty. That applies to airlines as well as customers.