Delta CFO Paul Jacobson spoke at the Baird 2019 Industrial Conference this morning, throwing shade at American’s CEO Doug Parker and talking up how his airline has transformed the way it sells elements of the flight experience that used to be available for no charge for passengers often on a first-come, first-served basis.

Throwing Shade at Doug Parker

American’s Doug Parker consistently tells investors their debt is high, because they’ve already purchased planes, and everyone else is going to have to do that to catch up.

Jacobson pointed out that Delta has the best reliability and lowest maintenance costs with its older fleet, it’s putting its MD88 fleet to bed next year, MD90s by 2022, they’re buying new planes without taking on American’s levels of debt. He later said, “we invest within our means.”

Monetizing What Used To Be a Commodity Product

Jacobson talked about how “historically airline seats were commodity.” People purchased on schedule and price because the experience was seen to be the same.

- If you bought early you’d pick your preferred seat, probably an aisle seat close to the front

- If you bought an expensive last minute ticket you probably wound up in a middle seat in the back because that’s what was left.

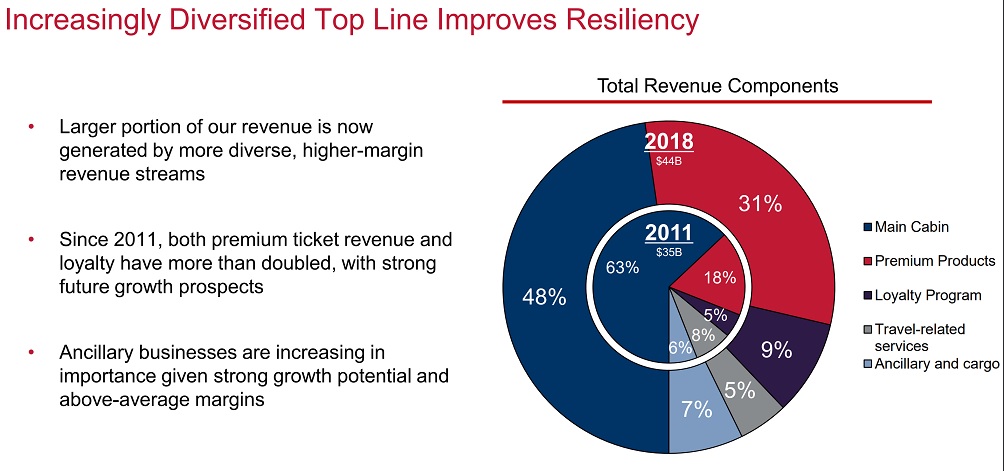

Now Delta sells seats, they sell upgrades, they sell priority airport services – and they do it both when a customer books and after a customer books.

I’d point out that frequent flyer programs were originally the way that airlines differentiated their commodity product. Delta now differentiates product by selling everything piecemeal or incrementally. That makes the loyalty program less relevant.

An airline can’t simultaneously monetize everything and have the loyalty program be a differentiator. Delta thinks that they have a currency you can use to spend for those monetized products, but the currency is worth less than other currencies. Ultimately the mystery is why Delta generates so much revenue from American Express, when customers would be better off spending on a cash back card. What does that say about consumers?

Why Airlines Make So Much From Credit Card Deals While Delivering Less Value Than Before

Jacobson offers, “historically airlines would chase credit cards because we wanted the loyalty to card providers to translate to our brands” [get American Express cardholders to fly Delta] and “the number one currency consumers want is airline miles, so American Express wants Delta customers as much as Delta wants American Express customers.”

This is really because of:

- Consolidation in the airline industry, there are fewer airlines for big banks to partner with. That’s help shift negotiating leverage – the bulk of benefit from co-brand deals used to be captured by the banks, now it’s captured by the airlines.

- Aggressive competition by banks to capture co-brand busienesses, the margins for airlines began to shoot up with Citi taking the Costco business from American Express causing Amex to agree to a rush deal to shore up their second biggest co-brand (Delta) which set off a chain reaction of more expensive deals.

Even with the margin shift to airlines, it remains perplexing why so much spend is on Delta cards – it points to an irrational consumer when they can get the benefits of the cards, if they need them, without spend – and earn more points and more valuable points using other products.

Indeed, even the consumer who oddly prefers collecting Delta miles would earn more of those through American Express’ other products whose points transfer to Delta (thanks to more generous category bonuses) while maintaining the flexibility to transfer to other airline programs as well.

I thought DL Amex products also help you reach elite status. Maybe that drives spending more than the value of earned miles.

A few thoughts

1) The only way to earn transferrable miles is through sign up bonuses and spending on cards. You also earn airline miles through actual flying. Spending on cobranded airline cards, plus miles from actual flying, allows for the appearance of quicker balance build up

2) Delta makes it easy for customers to spend SkyMiles at relatively low total mile costs. Cheap economy flights, upgrades, etc. So Skymiles are easy to burn, particularly for domestic focused customers

3) The value proposition of applying for and holding Delta cards is clear – free bags, priority check in, lounge access, companion passes, etc. It is foreign for most cardholders to apply for a card then not spend on it. People tend to spend on cards they think they get value out of regardless of the earnings potential. Plus, most people don’t have dozens of cards – only a few.

4) On the high end, there is clear benefit from spending on Delta cards to earn status and to meet MQD waiver requirements

5) Transferrable currencies are overrated for most consumers, because most travel is domestic, and most transfer partners are foreign airlines that few customers will want to work to optimize. This is why the Chase Portal is so popular.

6) Amex has only really improved the earnings power of its MR cards in the past year – consumers weren’t using BBP, Amex Platinum still only offers 1x on most spending, PRG and Amex EDP cards weren’t heavily marketed, etc. The huge push for the Amex Gold and Green may change things

Ultimately the mystery is why Delta generates so much revenue from American Express, when customers would be better off spending on a cash back card. What does that say about consumers?

What does it say about industry experts who prophecy the demise of Delta’s loyalty program and declining loyalty in general?

it remains perplexing why so much spend is on Delta cards – it points to an irrational consumer when they can get the benefits of the cards, if they need them, without spend

To irrational consumers and a marketplace that does not function like the comic book version imagined by so many so-called free marketeers.

I think most consumers don’t want to deal with confusion of transfer partners. When I mention other Amex cards (e.g., BBP, Green, Gold, Platinum) to my friends with a DL Amex, they get confused and say it’s too complicated. Some of them who are a little more savvy mention the bonuses for hitting spend thresholds (i.e., Miles Boost). I sense they’re more pleased to hit the threshold than receive than bonus itself.

I think the number one reason consumers get the Amex Delta cards is because of the statement credit offer to sign up while checking out. $200 off a flight is not a bad deal. It’s an effective acquisition strategy. I see Delta Gold cards everywhere in the wild in cities with Delta hubs. After that, consumers keep it open because it saved them on baggage fees for the few trips they make annually. And then they spend it on it because it’s better than their debit card or no annual fee credit card they were sold with their checking account.

Consumers spend for SkyMiles out of laziness. Delta has won over low-effort, passive loyalty. This is easier for more consumers than maintaining a portfolio of Amex MR cards.

I spend on my Delta Amex cards up until I max out my MQM bonus, then I stop using it. I get a fair amount of value out of being a Platinum Medallion flying out of a non-hub. Upgrade rate is good and I have never had a problem using my certs. Will probably make Diamond next year, and I get a lot of value from that.

I keep remembering my friend who was always traveling for work. He finally took a vacation, taking his daughter to Vietnam for her high-school graduation, and he mentioned that he did it with SkyMiles. I asked him how many it cost him, and he just said: “I don’t know. Whatever it was, I had it.”

The real mystery is why Delta is going to start giving all sorts of bonus mile categories on their Amex cards next year, when there seems to be ample evidence that they already find tons of people willing to use their cards at the existing terrible ROIs.

Similar to others, I spend on my Delta Amex up to the MQM Bonus (30k) (15k MQMs). I fly 30-40 times a year but outside of a few international flights, they are short regionals. The 15k in MQM’s is an important part of qualifying for high tier status. Outside of mileage run flights which I dont really have time to do, there arent many other ways for me to get them which makes CC spend the easiest way to get them. I do this knowing the Delta Sky miles I am earning are less valuable than the UR or MR points I could be earning. Couple this with the lounge access and companion ticket, and it makes the Delta Reserve card valuable to me.

This is likely what drove Delta’s recent change to allow more MQM’s to be earned through card spend and also what United and American are missing in their cards.

@ Gary — A lot of our credit card spend ($90,000 this year) goes on Delta AMEX cards in order to earn MQM/RDM Boosts. I value MQMs at 4.8 cents and RDMs at 1.2 cents each. For $90,000 spend, we earned 90,000 RDM + 45,000 Boost RDM + 45,000 Boost MQM, for a total value of $3,780, or 4.2%. That is an excellent return, and neither of these currencies expire (MQMs rollover).

IMHO, Delta is really hurting their premium cards’ value by dropping the Boost RDMs. Doing so reduces the return in my scenario above from 4.2% to 3.6%, which will drive some of our spending elsewhere. I consider this a MAJOR ERROR on Delta’s part. We’ll see if they change it back in the future.

I fly delta a ton, 90% basic economy, whatever other stuff delta is trying to sell to me, I am not buying.

I had a Delta gold card, will be cancelling next year. Absolutely no value for me. If I am going to spend 25k a year on a credit card, I put it on something more than 2-3% return.

And what does it say about the government that approved all these airline mergers? Consumer loses again.

I decided cash back was the way to go for me, and never looked back. It’s working great.

@bgriff, I think it’s precisely because people are spending even with a terrible Roi. They just want them to spend more! I think, right now the most Savvy card users are only charging as much as they can pay back the next month. That way they are avoiding the interest rate payment. Amex wants them to spend more so that they can’t pay it all back and thereby incur interest fees.

“Throwing Shade”…okay boomer

There’s no e after the i in businesses.

Delta customers not Delta custoemrss