Alongside Amtrak’s new revenue-based loyalty program comes a new co-brand credit card partner.

Under the new program points are worth 2.5 to 2.9 cents apiece… kind of. That’s less than a 6% rebate for paid Amtrak travel, but represents good value for points transfers or credit card earning.

Via MileCards, while the new co-brand credit cards are not yet online we do have details about them.

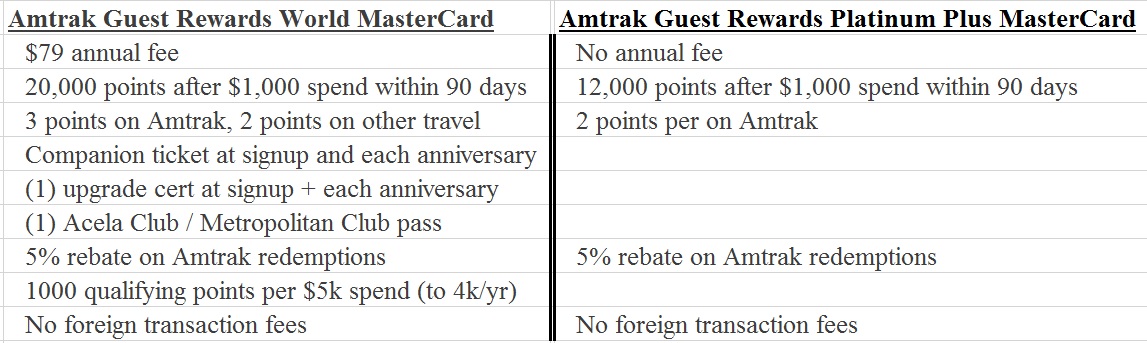

There are two different cards — an annual fee version that comes with a companion ticket and upgrade certificate each year and a no fee version with weaker earn. Here are the details of each and how they line up:

No no annual fee card is similar to the old Chase co-brand card, except per MileCards only the premium version will allow you to transfer points out of Amtrak Guest Rewards.

The premium card especially offers good earn for Amtrak spend. And both cards offer good earn (2.5% – 2.9% rebate) for unbonused spend, provided you’d otherwise pay out of pocket for Amtrak. Double points on travel is the only category bonus.

20,000 points is a very respectable bonus since that gets you $500 or more in train travel.

I think the premium card though is a real winner for the heavy Amtrak customer, since it helps earn elite status and throws in travel-related goodies.

Outside of the core Amtrak customer, it’s going to be a niche product. Even though it’s got good earn, as long as the Starwood Preferred Guest points continue to transfer to Amtrak then the Starwood Amex will be better for unbonused spend because the points move to Amtrak or so many other places.

Did a line get left off of each of the two rubrics? Neither one mentions earning one point per dollar of regular spend.

This program is a bit of a sleeper.

Of course you never know if you’re going to wake up to find that your pocket has been picked overnight by the program’s management.

Previously, there were certain activity requirements in order to xfr the points to another travel program (can’t even recall the options, to be honest). Wouldn’t bother me to pay the AF once in order to empty my Amtak balance. Otherwise, we’re going to “inactivity out”.

Do you know if these additional requirements (spend/activity) will remain?

@LarryInNYC sorry, I guess i figured that was understood.

I notice you conspicuously omitted reference to the card issuer. Do you still think it is BofA as referenced in your prior posts?

Also any indication on the launch date? (this is personally important as it so happens I need 12k points for a sleeper-car award under the old program – and would prefer not to transfer more valuable Chase points).

@Boraxo yes it is Bank of America, you can apply now by phone, should be on the website within 2 weeks

FWIW, I encountered an ad and invitation to apply to both cards on the Amtrak guest rewards site. I was signed into my account and this was about 3 days ago. Haven’t been able to get it to come up since though.

Application/official details are now available online:

http://AmtrakGuestRewards.com/Apply

Terms and conditions for the companion pass seem about the same as the one I got when I applied for the old Amtrak card (round trip, full-fair, rail fare portion only, etc). Though it’s an e-coupon now, should make things a bit easier to use (only the lounge pass is a physical coupon). It looks like for hotel transfers, you have to put $20,000 spend on the card, and it’s capped at 25,000 Amtrak points out.

I just got my new Starwood AmEx in the mail this week, but I imagine I’ll be applying for the fee card pretty soon (wonder if they’ll send out any enhanced targeted offers – my guess is no, since as you say this is a rather niche product).