Rove Miles now lets you book hotels and earn their points and still earn points, elite night credits and status benefits with your preferred hotel loyalty program.

You can redeem Rove points towards paid travel of your choice, or transfer them to:

- Star Alliance: Air India Maharaja Club, Thai Airways Royal Orchid Plus, Turkish Airlines Miles&Smiles

- oneworld: Cathay Pacific Asia Miles, Finnair Plus, Qatar Airways Privilege Club

- SkyTeam: Air France-KLM Flying Blue, Vietnam Airlines Lotusmiles, Aeromexico Rewards

- Non-alliance: Etihad Guest, Hainan Airlines Fortune Wings Club

- Hotel: Accor Live Limitless

Chase’s The Edit and American Express Fine Hotels and Resorts let you earn loyalty program credit on their bookings, but those are genreally limited to premium and luxury properties and this is far broader.

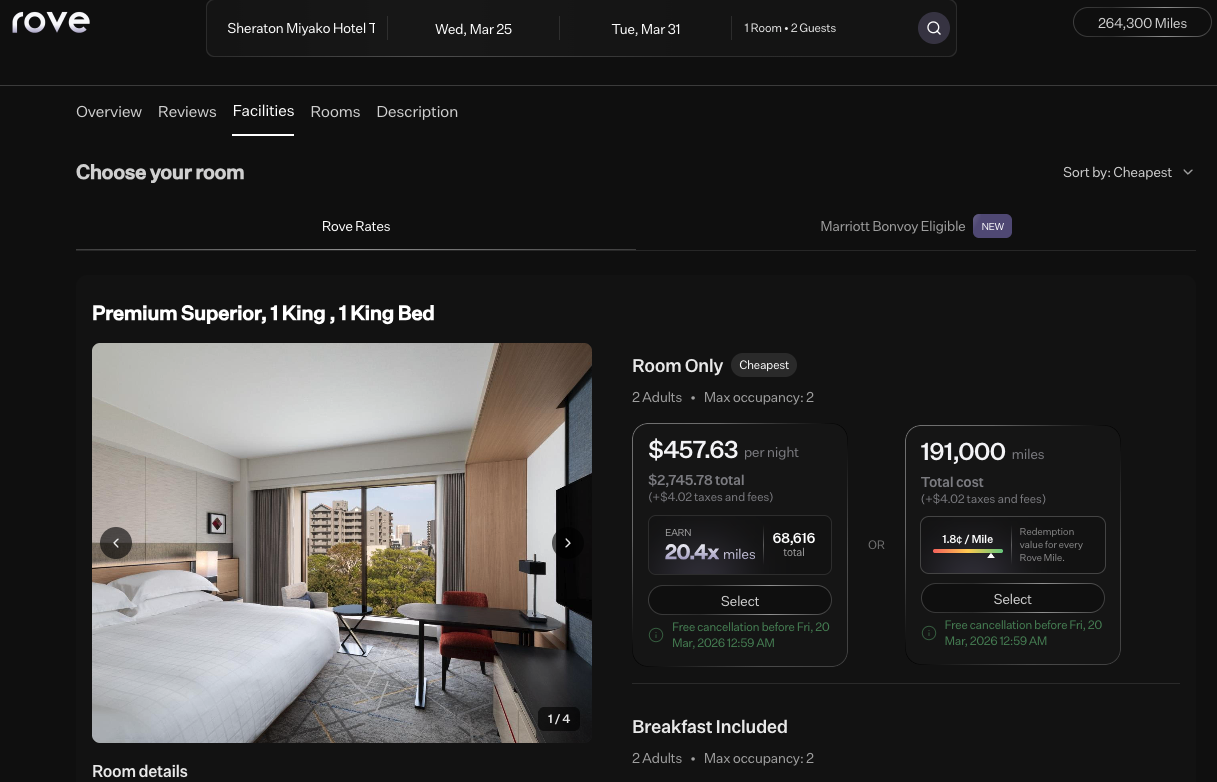

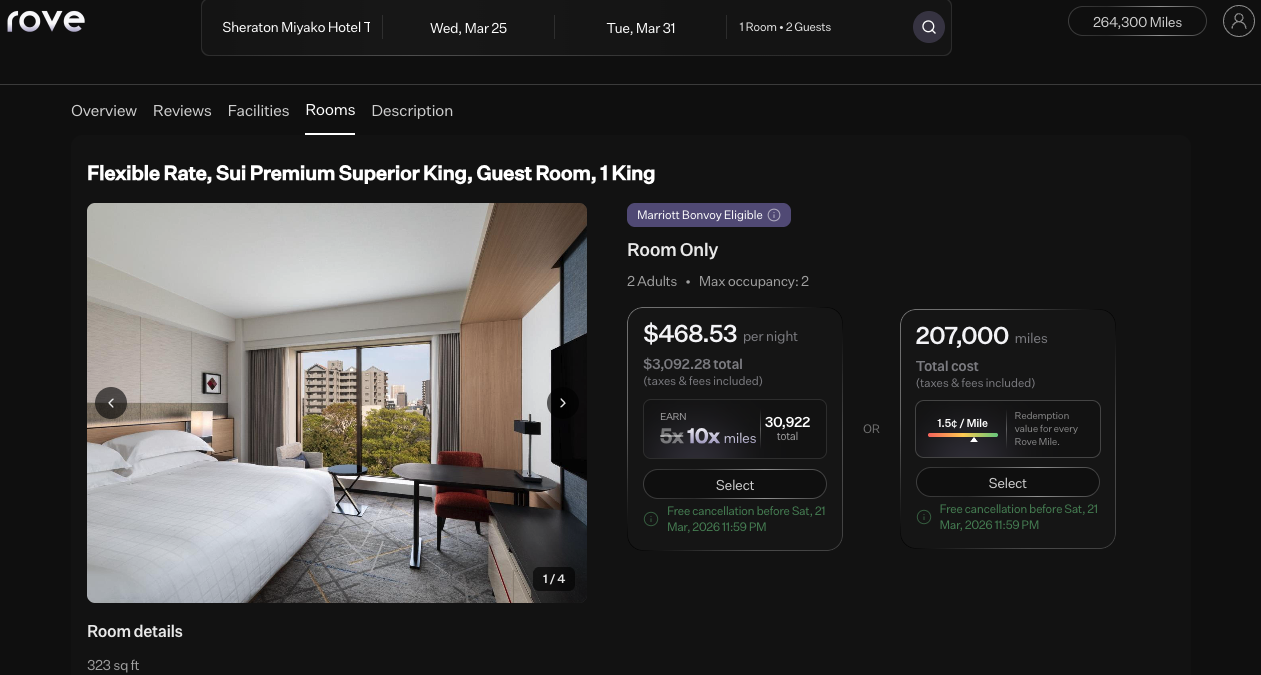

Their base earning rate for this feature is 5 points per dollar on eligible bookings, but through October 31 they’re awarding 10x for these bookings on top of what you’ll earn through your hotel program and for your credit card spend on the stay.

Choose Between Maximizing Rove Miles And Double Dipping

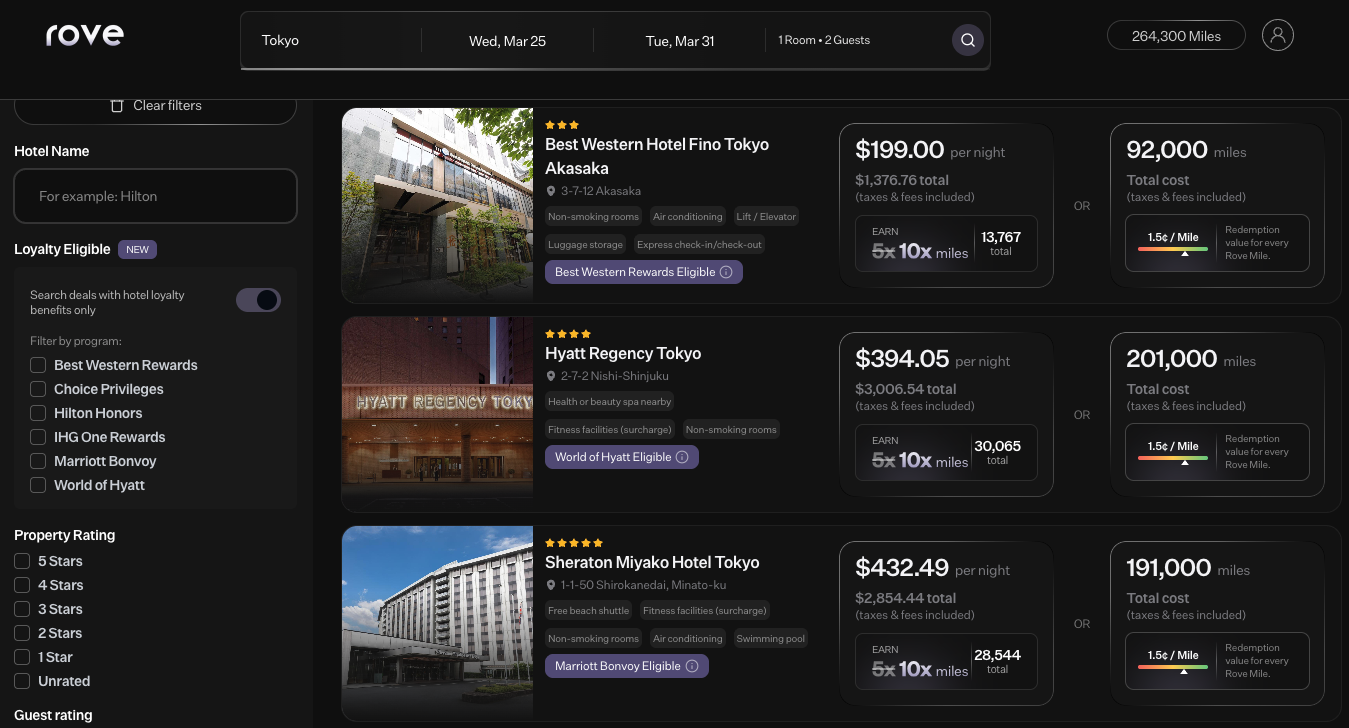

Rove has ‘loyalty eligible’ rates with Marriott, hilton, IHG, Hyatt, Choice and Best Western. When it’s available, these rates will appear flagged as loyalty-eligible in search results and you’ll be able to service them directly with the hotel chain.

Here you can earn over 20 points per dollar and pay a slightly lower room rate, eschewing Marriott points, status credits and benefits (some hotels earn up to 25x):

Or here pay a standard rate, earn 10 points per dollar from Rove and also earn Marriott points, status benefits and status credits.

Incidentally, Rove now also lets you turn any hotel rate into a non-refundable rate where you earn points for the booking instantly (this wouldn’t earn also with the loyalty program). That way your hotel stay can immediately fund other travel redemptions, even if you aren’t staying until far out in the future.

This Makes Booking Through Rove Worthwhile For Hotel Loyalists

Gondola.ai already does this, of course. But I prefer Rove’s transferable points over credit towards future hotel bookings that Gondola offers. I spoke with another startup a few months back working on the same thing.

At 10 Rove points per dollar at launch, this is absolutely huge. I’ll still prefer 5 points per dollar over 3% back towards future bookings. (I value a Rove point at more than a penny apiece for the transfers, and they generally let you redeem for paid travel at around 1.5 cents apiece and sometimes higher.)

What I like about Rove’s plan here, though, is that they tell me they will ultimately launch rewards on Member Rates and also AAA rates since those can be commissionable. That’ll make me far more likely to use this since I won’t be paying more to earn the points, even though that’s often worth it in its own right. The program is clearly worth joining in any case.

I notice it suggests you can triple dip with airlines. Don’t some require you to book direct these days to get mileage (could be wrong)… But more importantly I presume this will go through as an OTA booking (same with hotels?). If so how easy are they going to be to deal with when if you need to make changes/when something goes wrong. Often when something sounds too good to be true there’s a catch somewhere…

Always good to have competition and another option. Here’s a random search for a one night stay at the JW Marriott Aerocity in Delhi on January 6:

Marriott direct member rate: ~$350 + Marriott miles (3500) + credit card miles (CSR 4x hotels perhaps)

AA Hotels: ~$380 with 3200 AA miles/LP (AA status/card holder) + 3800 miles (10x) through AA exec card (if in the 30% bonus, 4540 LPs)

Agoda: ~$380, stack with Rakuten for 10x miles (so 3800 MR) + credit card miles

Rove: ~$390 with 3900 Rove miles (10x through 10/31) + Marriott points/status (10x so 3900 + status bonus points etc.) + credit card miles (Rove recommended Citi Strata Premier presumably because Rove is merchant of record and it will code as a ‘travel agent’ so you get 3x points – sensible!)

So Rove is the most expensive, in this example. Favorably compares with Rakuten for now, but not for long once the 10x drops to 5x on 11/1. And if I was going to spend the extra $30-40 on top of Marriott member rate, I would for sure do it through AA hotels / AA Executive card and get 7,000 AA miles + 4540 LPs versus Agoda/Rakuten combo or Rove.

I do think it’s always nice to compare eshopping rates, so in circumstances where Rove is better than Rakuten, etc., no issues with using Rove. Enough transfer partners and nice to even see a 20% transfer bonus to FlyingBlue or Finnair right now.

@Peter — Excellent comparative analysis. If anything, you’re making me think that I need to take a second look at AA Hotels. Maybe instead of settling on Platinum Pro, I should go for EP again. A few nights at some pricey hotels over the holidays and you’re nearly there!

@Peter Nice summary. I think there’s another option out there. For months now, the Capital One shopping portal has been giving 11X Cap One points on most Hilton brands and 5-8X on Marriott. When going through the Capital One shopping portal, you don’t have to use a capital one credit card and you get all hotel/status benefits too.

You get 11X Cap One points, Hilton points/status, and you can use an Aspire to get 14X Honors points when paying. It’s hard to beat.

@Gary – How do the credit card charges code? As hotel? Travel? Something else?

@1990 – I think AA hotels when teamed with the AA executive card really offers outsized value. When you think about the extra $30 you’re paying in this example, you’re getting:

Marriott direct: for $350 figure you are getting 3,500 marriott points (yes if you have status you might earn more) but figure that’s worth $24.50 or so at 0.7cpp. Plus some amount of credit card points – let’s say 3x so 1,050 points at 1.7cpp or $17.85 in value . Plus book through a shopping portal – can book through AA and get 1x so there’s another 380 miles or $5.70 – total value $48.05.

AA hotels – assuming you have any AA status/any AA card – for $380 you are getting 3200 miles/LP plus with AA exec card another 10x miles / 1x LP. So that’s 7,000 miles total – if you value those at 1.5cpp you’re getting $105 in value. That’s $56.95 more than the Marriott direct example which easily makes up for the $30 cost difference. PLUS you are getting LP – at least 3580LP and potentially more if you are in the 20% or 30% bonus for earning 60k/100k LP (if the 30% would be 3200*1.3=4160 + 380 from card = 4540 LP). PPro is still the sweet spot (175k to earn the SWUs I suppose) but EP is much more achievable with some AA Hotels plays.

And it’s yet another reason why I don’t understand the Strata Elite. Sure the Elite has more credits so that you can net-out your annual fee. But for the $595 i’d much rather hold the AA exec card. The 12x points on citi’s travel portal is not worth much when you can consistently get much more value from AA hotels. Or even 10x points at Agoda on Rakuten + pay with the Strata Premier for an extra 3x points – now you’re at 13x vs 12x. Both cards have travel insurance protections. TY points are worth a bit more on a cpp basis than AA miles, but AA miles are plenty valuable, and can still get MR points through Rakuten/Agoda if AA Hotels isn’t compelling.

@Thomas – I thought capital one shopping points were only redeemable for gift cards? Cashback monitor has Hilton at 3% on capital one shopping? Obviously rates may vary – although not all points are created equal. Depends how you value Hilton points – if you value them at 0.5 cents a point but MR points at 1.5 cents, i’d rather have 10x MR points than 14x Hilton points, for example. Also depends how you value status benefits at a particular hotel / hotel brand. Either way, your point is well taken that no reason not to go through a shopping portal when booking direct, and I neglected to account for that in my comparison.

@Christian – good question and would be curious to know. Rove says: “Rove is currently the merchant of record, which means you’ll want to pay with a credit card that maximizes hotel bookings, such as the Citi Strata Premier.” So the implication is that it is coding as a hotel, although the Premier also offers 3x on Travel Agents, so…