My local CVS pharmacies are endless sources of Vanilla Reload cards. They’ll sell me up to $5000 per day on a credit card (any amount of $1000 or more they will scan my drivers license).

Vanilla Reload cards are essentially money — you buy them and can load the funds onto a variety of prepaid money cards like MyVanilla Debit and American Express Bluebird.

And since I have an almost endless supply of these cards (many people can’t find them at all, or their nearby stores won’t take credit cards), I have no problem exceeding the $5000 monthly limit I can put onto an American Express Bluebird card. Bluebird is a great banking product, given its billpay functionality, I can use Bluebird to pay a mortgage, rent, or even monthly bills from other financial products. They also offer electronic funds transfer to linked bank accounts.

In other words, I can buy Vanilla Reload cards with a credit card (and earn points), then put the funds from those reload cards onto Bluebird. And use the funds to pay bills that I can’t pay by credit card, or just move the funds to my bank account (where they are available to pay my credit card bills or other bills).

That’s great for earning miles. But Bluebird only lets you do $5000 per month. And I want to earn more than that.

There are plenty of products that’ll help you do that. I’m going to share my experiences with my MyVanilla Debit Card. (You can buy the card at a store, or online for free.)

Here’s the scoop on MyVanilla Debit:

- You can load up to $2500 per day

- The maximum allowable balance on a card is $9999.

- You can withdraw up to $400 per day from an ATM at a cost of $1.95 (for domestic withdrawals, plus any out of network ATM fees)

- There’s a 50 cent per transaction fee for purchases

- They charge you $3.95 each month your card has been inactive for 90 days. (So use it at least once every 3 months.)

- Upon account closure they’ll charge you $9.95 to mail you a check for your remaining balance.

I load the funds onto MyVanilla Debit, then how do I get them off?

Taking Funds Back Via Cash Advance

Now, some people just buy Vanilla Reload cards (which cost $3.95 and can be loaded with up to $500 each) and load them to MyVanilla Debit cards and then go get a cash advance off those cards from a bank.

I wrote about this a year ago. But not every bank is helpful with that.

And compared to when I wrote a year ago I no longer have a bank willing to cash advance off of unregistered cards.

Buying Money Orders With MyVanilla Debit

Some people use their MyVanilla Debit card to pay quarterly estimated taxes, since it is cheap to do so via debit card. Or they get the money off by using it to fund Amazon Payments transfers. But I pay taxes with my Suntrust Delta debit card which earns 1 Delta mile per dollar already. And I max out Amazon Payments through other cards.

So I adds funds from the Vanilla Reload cards onto my MyVanilla Debit card and use the card to buy money orders. Those can be used to pay bills, or deposited bank into your bank account.

One common place people go to for that is a Walmart Moneycenter. But I do not live within 30 minutes’ drive of a Walmart.

In fact, I’ve been inside of Walmart very few times in my life, although I think the idea of Walmart is fantastic. When I moved from California to Northern Virginia 17 years ago, I shipped my CDs ahead. I had only a single CD in my dash, and discovered that much of the middle of the country didn’t get a consistent radio signal at least during the day. (This was long before Sirius or XM.) Oddly, it never once occurred to me to stop off at one of the 3000 Walmarts along the way to buy music. Instead, I had nothing but the Reservoir Dogs soundtrack to listen to. Nearly two decades later I haven’t listened to it since…

Without Walmart and their 70 cent money orders, I find the best place to buy money orders with a debit card is a US Post Office.

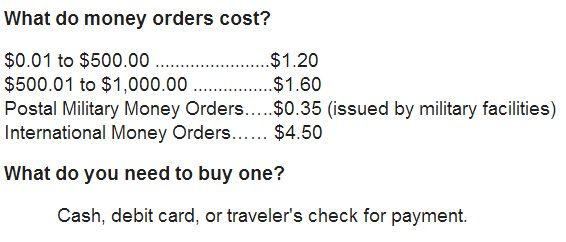

They’ll sell you a $1000 money order for $1.60, and they’ll let you pay with a debit card.

For a $1000 money order, you’re effectively paying $10:

- $7.90 to load the funds onto MyVanilla Debit ($3.95 x 2 for Vanilla Reload cards)

- $1.60 for the postal money order

- $0.50 for the transaction fee from MyVanilla Debit

Oddly, my post office charges me $1.25 instead of $1.60, but recently MyVanilla has charged me $1.95 instead of $0.50. The post office will also let you do modest cash back in conjunction with the purchase of a money order.

For the purpose of the illustration though I’m using the ‘official’ costs. On a card that earns 1 point per dollar when purchasing the Vanilla Reloads, that means you’re paying 1 cent per point.

Things to Be Careful of

Some people, mostly those that either have multiple cards and are doing large transactions (and thus are considered a big risk) or who have loaded large amounts of money onto the card and then pulled out all the funds as cash from banks (and thus are completely unprofitable), have had their accounts closed. Usually it’s big volume folks that get shut down.

Blogger Frequent Miler had a card converted into MyVanilla Debit from ‘Mio’ that was frozen and he had some hassles before he got his money back.

One thing I’ve been doing since his experience is keeping the receipts for my Vanilla Reload purchases and noting which cards have been loaded onto the MyVanilla Debit card — to help the process go smoother if I ever do run into problems.

Some folks might come onto this thread with scare stories. The truth is that there’s a lot of fraud with prepaid cards, and so card issuers clamp down on what they see as the riskiest behaviors. If you’re modest in your ambitions, you are generally fine. You can also ‘go big’ with the expectation that you will be shut down. Just don’t put more money onto prepaid cards than you can afford to float for a few weeks. In a worst case scenario, legitimate customers get their money back even when accounts are frozen. But it can take a few weeks to sort out.

How This Helps Me Earn Big Miles

Ultimately, by loading a debit card via credit card, I earn points. And by using my debit card for money orders, I can effectively pay any bill and earn miles, even if the merchant doesn’t take credit cards. I can even deposit the money orders bank into my bank account.

It comes at a cost — roughly a penny per mile — but that’s worth it for earning highly valuable points or 2%+ cash back.

I don’t like this as a card for everyday spend because of the 50 cent fee per transaction. But using it regularly for money orders is a great supplement to a mileage-earning toolkit for those with access to more Vanilla Reload cards than can be added on Bluebird in a month.

- You can join the 30,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Bluebird is still much easier. just open more Bluebird accounts by asking family members to also sign up. much easier than trying to spend it out via debit transactions.

Gary, is it also safe to use it for walmart BILL PAY? Its more economical if paying higher bills since the fee is only $1 or so per bill…

@EFD some people might already be doing that, and looking for even more… 😉

MyVanilla is a huge red flag. I would caution anyone who wants to get one that they will lock up your funds at some point when they shut you down. And you’ll have to fight to get back your monies. It would be my last choice in the MS arena.

and FYI I got shut down at about 10k in 2 mos.

I’ve been using MyVanilla successfully for at least 6 months now. Never had an issue, but I only load maybe 2K/month on that card. At 10K/month I would think they would question. I use MyVanilla very sparingly, after my bluebird limit of 5K, and I am always sure to make a few regular purchases (online and in person) using the prepaid cards. Keeps things running…smoothly.

Basically folks who hit it really hard get shut down but I decided to share this because it seems that folks who use it modestly probably don’t. I flag in the post that both strategies can be useful (a lot of miles quickly vs a few thousand a month over time) and that you shouldn’t pursue any strategies like this if you can’t handle the float.

But usually you don’t have to fight to get money back, you get put into spend down mode meaning they won’t let you add anything to the card — you spend down the current balance and are done.

And to be clear this post is not aimed at extreme expert folks who are looking to do large scale ‘manufactured spend’ (if it wasn’t obvious from the way it was written).

@Gary Aren’t USPS money orders considered cash advances (hence why you can’t use VGCs)? Might explain why you’re getting charged the higher fee.

Can I buy a USPS money order with an Amex gift card? And then deposit the money into my bank account? I was able to get a nice cash back bonus by buying the gift cards through Big Crumbs, but hadn’t thought about the possibility of the MO at USPS.

Kroger sells money orders for 79 cents, at least near me. They also own Ralphs, Smiths, King Soopers, Harris Teeter and several other chains depending on where you live

Hey Gary – When you do the 5k load up on Bluebird cards, do you put it all on one credit card in the same transaction?

@jenny you can only do USPS money orders as PIN transactions which won’t work with an Amex gift card

Does anyone have issues depositing thousands of dollars of money orders into a bank?

Great post. Thank you.

@mark – I actually had you in mind when I wrote it. I felt *sure* you would think my cross country drive Walmart story made the post too long.. 😉 😀

Nice post. Just waned to add my warning for the vanilla Debit Card as I was shut down within a couple of months after doing 3 cash advances at my bank. they put a hold on the funds and after several calls they lifted the hold and told me i had 48 hrs to withdraw the money and never use their services or any of their affiliates again. I believe the same company is behind the majority of the prepaid permanent cards out there. just my experience.

Gary, have you had any trouble with a specific credit card issuer when attempting to make a large purchase at CVS? I know my Citibank card’s have been declined several times when I go over $1000 in one purchase.

Also, have you heard of issues where a credit card shuts down your account because you have a bunch of $500 or $1000 charges from CVS in a month?

@Andrew – some card issuers will trigger a fraud alert on multi-thousand dollar purchases at CVS. usually a phone call can resolve. And yes — issuers generally shut down for one of two reasons in my experience, (1) a financial review a la Amex (as discussed in post linked to in the thread above), the flag is large out of pattern purchases, especially new accounts with repeated large purchases, or (2) Citi in particular with their Thank You card that had been offering 5 points per dollar at drugstores, a version of ‘perk abuse’ I don’t fall into either category and have not had problems.

@behxho – how big were your cash advances? I flag issues with cash advances in the post above.

What, no circles and arrows?

It’s understandable that people ask whether their banks will “mind” their manufactured spending (MS) activity. The problem is that banks have repeatedly acted randomly in response to MS “abuse.” Two people could be doing the exact same MS activity, and one will be shut down and the other will not be bothered. Obviously, the more MS you do with a bank, the greater your odds of being shut down are. But among those who do that level of activity, the response is still often random.

In other words, if you’re deathly afraid of being shut down by a bank, you shouldn’t play this game. Most of the people who get involved seem to think the financial gain outweighs the risk (especially since getting shut down is rarely a huge deal).

@Kelly – did you want some? 😛

@Gary – 😉

Honestly, great post.

Be CAREFUL…..

I had a My Vanilla Debit Card until June, 2013 (used for three or four months….)

I was spending/cash advancing just under $10k/month (an even mixture of both).

One day my log-in did not work.

Called and was asked to fax ID and Social Security card to Incomm.

Was told that once verified the card would be re-activated. This process took four phone calls over a period of SIX weeks.

Not until I wrote the OCC (Office of Comptroller of the Currency) did I get my funds ($7,400) back. The Bancorp Bank is the issueing institution (behind Incomm), subject to OCC jurisdiction.

Don’t go near the MVD card unless you’re disciplined enough to do small amounts AND can handle your funds being frozen at their discretion.

Gary, Since you’re far better connected an in tune than me, do you have any thoughts or insight on Frugal Travel Guy’s recent post–a week or two back–regarding changes coming to Bluebird? It was highly cryptic and seemed pretty inane, but clearly he’s implying knowledge of some big change on the way.

And I will note that I understood every code he was using, I just don’t think there was really any actual substance to the post.

Very helpful for those of us lost in the woods.

FYI, a couple of weeks ago I bought $2K worth of cards at a local pharmacist with a fancy new credit card (on which I’m trying run out a $10K spending requirement). The purchase generated an immediate inquiry from my bank via text message (“Did you recently attempt a purchase of X at store Y?”) which I was able to answer and clear by responding.

@Autolycus – I don’t think he said anything in his post. I did see it. My sense is the Amex marketing folks don’t like their product being a tool for generating spend, they like it as a banking product, and they’re getting clarity on how the card is positioned. That doesn’t mean they will do anything in terms of shutting down accounts (it could mean that, but I doubt Rick knows anything on that side of things, and I certainly don’t). I guess the different from before is they’re shifting from just full bore ahead pushing the product out there to thinking about how they position it more than before. That’s a marketing thing though and not an accounts integrity/security thing. Time will tell.

Incomm has been sitting on funds of mine for almost two months. I have contacted state AG and they are just now starting to be responsive.

Complaints about the card provider should be accompanied by context as to what sort of transactions and volume over what period of time were done.

I do 10k per month in VR cards spread over 4-5 different cards and use the Bluebird check feature to drain the account monthly paying rent, utilities and other odds and ends which I think is AMEX intent to get me to do and tie up the funds……..it’s simple…..it’s stress free and combined with another 4k of manufactured spend per month is sufficient “for now” for me…..don’t fully understand how this is all profitable for CVS, Vanilla and Bluebird but I have to think that they are hoping for fees and the most they get from me is $7.90 per $1k………..

Intercom is a poorly manged company that don’t really know what they are doing. So I started to CA in Dec 2013 and CA about $1500 each time weekly for about 4 weeks and suddenly found I couldn’t log in to my account anymore. In the beginning, they said they just need me to fax two recent transactions and drive license to verify. ” It will only a couple days to unfreeze your account.” I have been waiting and call them two weeks ago and they said they never received my documents even though I had faxed three times already. I asked to talk to manger. After on hold for half hour, the same agent told me my account was shut down since the final time I CA in late Dec. 2013. Funny thing is I called in Jan and they still asked me to fax supporting documents to compliance department. So I consider myself as a moderate user as I only CA $6,000 in one month but still got shut down without any notice.

I usually get 4-6 new credit cards per year and I have no problem with the minimum spend as I usually charge at least 75,000 per year on cards between work and personal spending.

What credit card would you consider to be the best card for purchasing vanilla reload cards? I have about 20 different cards.

I have yet to find a CVS or any gas station in southwest Florida that will let you purchase a Vanilla Reload with a credit card. It’s just not allowed.

Gary not sure if you should be advising people to use the reload cards in ways they are not intended.

I believe it is against the terms of the reload card companies to have people load cards with a credit card, and then withdraw cash from the reload card.

If you do a google search for these there are many horror stories of people who are loosing money and having accounts locked and frozen.

Hi Gary;

Great post – read it at the Park Hyatt Haddaaha!

Now that I’m back in the VR game, have you heard of Citibank issues on other cards?

Very tempting now that the Citi American Executive is churnable, can meet the minimum spend in two days with CVS, but I think that might put me in the category of those who should expect to get shut down.

@beachfan – immediate large spend, spend close to credit line can be a problem with any issuer. Citibank has had the biggest issue with folks who go the card offering 5x at drugstores. I haven’t seen folks getting their Citi Executive card closed.

Unloaded $750 each on two money orders at Fry’s yesterday.

Cost was 49 cents each. $1500 done for 98 cents.

Gary,

I have been hesitant to buy so many vanilla cards with CVS scanning my license. I am not really sure why that worries me, but it does. Any rumors of CVS doing anything with this information?

I have not heard of any problems, I have not had any problems, and it has not stopped me at least.

Thanks for the info.