I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Barclays just re-launched the Frontier Airlines World Mastercard and it’s one of the most creative new products I’ve seen in a long time. Frontier is an ultra low cost carrier, but for cardmembers it doesn’t have to be. In fact if Frontier had onboard internet this card is good enough to make me consider the airline.

Signup Bonus, Ongoing Earning

New cardmembers earn 40,000 bonus miles after $500 spend within 90 days and paying the card’s $79 annual fee. Domestic saver awards are 10,000 miles each way per person. And the spending threshold to earn the bonus is really low.

Earning with the card is:

- 5x miles on purchases at flyfrontier.com

- 3x miles on restaurant purchases

- 1x miles on all other purchases

Additionally, spend $2500 on the card each account year and receive a $100 flight voucher. This covers the card’s annual fee, and provides an extra ~1% rebate value on that $2500 spend.

The card has no foreign transaction fees. The card also comes with Zone 2 boarding when flying Frontier.

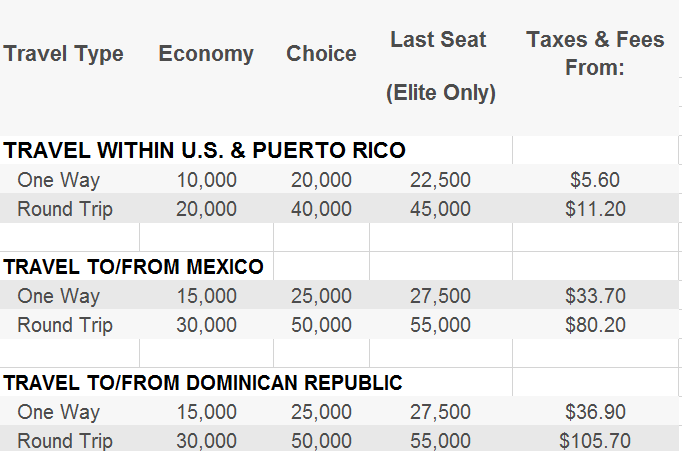

Here’s the Frontier award chart:

Earn Elite Status on Spend Alone

Frontier offers elite status after 20,000 miles or 25 segments per year. The card earns 1 elite qualifying mile per mile spent. No one has ever done it like this before.

You can earn standard elite status after $20,000 spend on the card in a year, or a combination of flying and card spend to earn 20,000 total qualifying miles.

- Priority check-in, zone 1 boarding and priority security

- Free carry on bag

- Advance seat assignment, including extra legroom seats at check-in if available

- Call center fees, close-in award booking fees, unaccompanied minor fees, same day confirmed change fees, standby fees all waived

- Spend extra miles for last seat award availability

A 50,000 mile level — achievable through flights or spend or a combination also now provides “family seating and seat assignment for the cardmember and eight travelling companions on the same reservation.”

Spend $100,000 on the card or fly 100,000 (or a combination) and receive ‘the WORKS’ bundle including up to 8 travel companions on the same reservation.

- Free carry on bag

- Free checked bag

- Free seat selection including extra legroom seats

- Free refunds and flight changes

If you spend $100,000 a year on the card all of your tickets become refundable. No one matches that.

Copyright: zhukovsky / 123RF Stock Photo

Family Benefits

Frontier isn’t a premium carrier, but they’re cheap, and they’re making their frequent flyer program very family friendly.

They’re introducing family pooling to combine up to 9 accounts for redemptions. And elite benefits extend to 8 passengers on the same reservation. Plus waived unaccompanied minor fees for elites.

This Card Overcomes the Biggest Downsides of the Frontier Program

Miles in the Early Returns program expire after 6 months of inactivity. Having the card makes it easy to keep your points alive without flying. (You can also transfer hotel points, e.g. Marriott, to keep your points alive.)

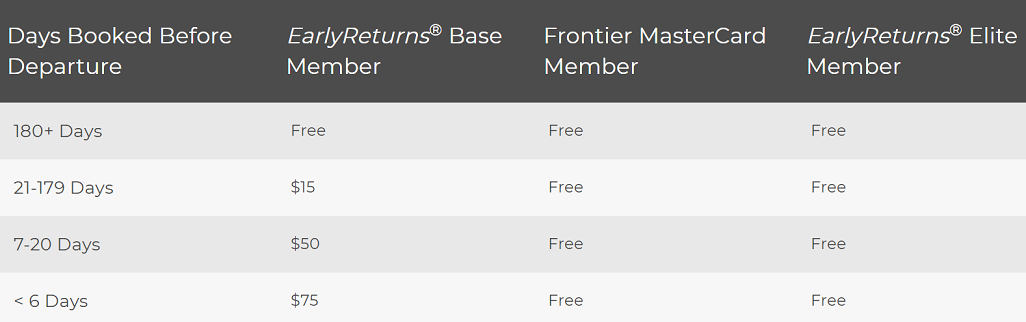

Frontier also has close-in booking fees, but absurdly ‘close-in’ means within 180 days (~ 6 months). Those fees are waived for cardmembers.

Who Is This Good For?

I love using my miles for international premium class travel. That’s not how most people use their rewards.

If I were a small business owner putting a lot of spend volume on my credit card, and I lived in Denver or Orlando, flying domestically this would be a no brainer. I’d probably get the Southwest Rapid Rewards® Premier Business Credit Card which has an offer to earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open, and spend on the card for a Southwest Companion Pass. And I’d get this card too and do $100,000 spend on it for the benefits.

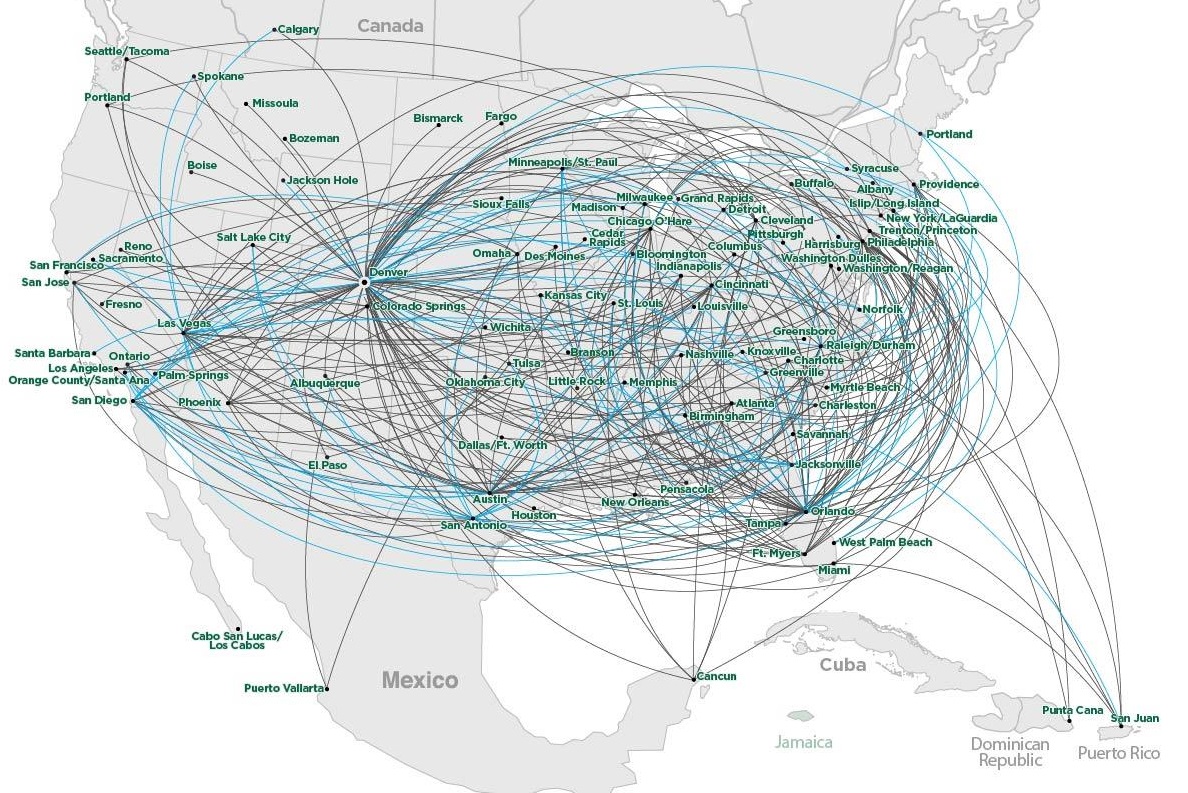

Here’s the Frontier Airlines route map:

Frontier has been growing in Austin. Their fares have been fantastic. The biggest stopper at this point for me is that they don’t have onboard internet, so flying them means several hours of lost productivity. But most people don’t pay for onboard internet, they should give Frontier a look if there’s much service in their city.

I’m not signing up for this card, but there are plenty of people that it may make sense for, and in a world where Sun Country becomes an ultra low cost carrier and eliminates its elite program Frontier and Barclays deserve real kudos for getting creative about offering credit card and rewards value through an ultra low cost carrier.

Frontier Airlines World Mastercard

Frontier, the airline famous for entering a new market; then exiting with no notice, and leaving passengers with no compensation for having to rebook on another airline.

No thanks.

I have to digress. AirBerlin offered 1 EQM per 1 euro spent on its German credit card

They’re assuming most people who routinely fly frontier don’t have that much money to spend.

A couple hours ‘lost productivity’ due to no internet is nothing compared to lost and wasted time during irrops. Many, if not most, of their routes are 2x or 3x per week. There is no redundant route network to get you there. A delayed flight turns into a cancelled flight, and you ain’t going anywhere.

This makes it interesting. My home airport recently got a couple of Frontier flights. I might pick up the card, after my Chase 5/24 app-o-rama in a few months.

Nope…Frontier status isn’t worth it. Frontier hasn’t been worth flying for at least a decade now.