I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

When Marriott acquired Starwood and merged the loyalty programs, as much changed with their credit cards as with the loyalty program itself.

Chase’s Marriott cards used to earn 1 point per dollar. Starwood’s Amex cards earned 1 Starwood point per dollar. Marriott themselves declared 1 SPG point worth 3 Marriott points. In other words, the Amex cards were 3 times as rewarding for spending.

That’s not surprising, the Starwood Amex was a standout. I got mine 20 years ago and I used it as my primary card for spend not bonused elsewhere for a long time. When the programs merged the earn rates met in the middle.

- Chase went from awarding 1 point per dollar spent to 2 points (outside of bonus categories)

- American Express went from awarding the equivalent of 3 Marriott points per dollar down to 2 points

The two issuers were now awarding the same for spend, Chase had doubled how rewarding its Marriott portfolio was for consumers, but Amex’s value proposition scaled back by one-third.

That hasn’t been popular with cardmembers. They’ve occasionally offered bonuses for spending and they are surveying brand new value propositions for the card that might return them to Starwood Amex glory.

For 2021, though, it’ll be possible to make American Express co-brand Marriott cards as rewarding for spend as the Starwood American Express used to be – because you’ll be able to earn that extra point per dollar spent.

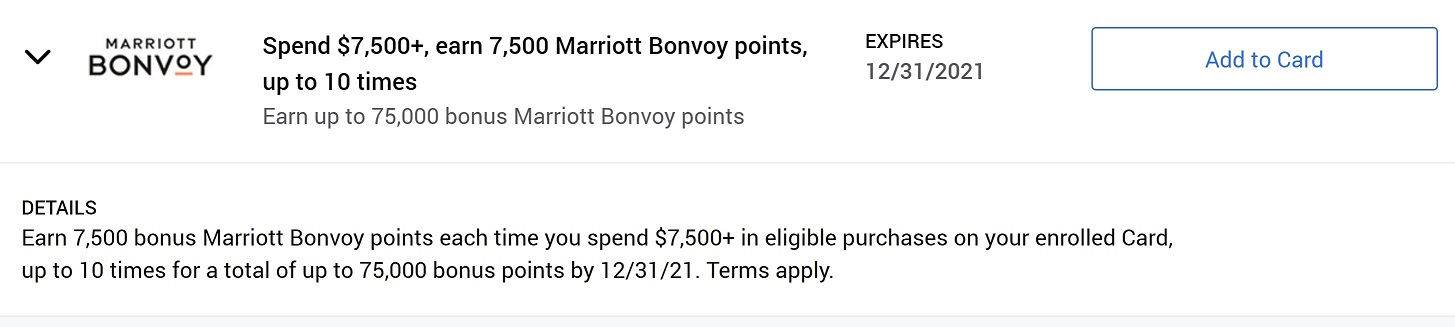

- It’s an ‘Amex Offer’ you need to enroll for

- And you’ll earn 7500 bonus points for each $7500 you spend on the card

- You can earn this bonus 10 times, up to 75,000 points for $75,000 in spend

The offer is available from enrollment through December 31, 2021, and only for those whose cards were issued prior to 2021.

To be sure, this isn’t exactly as good as earning 3 Marriott points (1 old Starwood point) per dollar spent, since you only earn exactly that on unbonused spend at exact $7500 spend thresholds. Anything over one of those without reaching the next one is effectively ‘wasted’.

Here are the terms from my Marriott Amex business card,

You must first enroll in the offer by adding the offer to your Card. Only purchases made with your enrolled Card are eligible. Offer to enroll is available to existing Marriott Bonvoy Business™ American Express® Card Members who are Basic Card Members prior to December 29, 2020. Limit of 1 enrolled Card per Card Member.

You are eligible to enroll starting from February 1, 2021 through December 31, 2021. Offer ends December 31, 2021. Eligible purchases can be made by the Basic Card Member only. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Starting from the time you enroll through December 31, 2021 (“Purchase Period”), you will earn 7,500 bonus Marriott Bonvoy points each time you spend $7,500 in combined eligible purchases (“Purchase Threshold”) on your Marriott Bonvoy Business™ American Express® Card during the Purchase Period, up to a maximum of 75,000 bonus Marriott Bonvoy points. Bonus points will be posted to your Member Account 8-12 weeks after you reach the Purchase Threshold.

Purchases may fall outside of the Purchase Period (and therefore not be eligible for the bonus points) in some cases, such as a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction. (For example, if you buy goods online, the purchase date may be the date the goods are shipped.) Eligible purchases do NOT include fees or interest charges, cash advances, purchases of traveler’s checks, purchases of reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of any cash equivalents. Eligible purchases to meet the Purchase Threshold are for goods and services minus returns and other credits.

To receive the bonus points, your Card Account must not be cancelled or past due at the time of fulfillment. American Express reserves the right to modify or revoke the offer at any time. The bonus points you may earn during the Purchase Period as part of this offer are in addition to any other points you may get from using your Card.

For questions regarding your Card Account, please call the number on the back of your Card. If American Express or Marriott determines that you have engaged in abuse, misuse, or gaming in connection with the promotional offer in any way or that you intend to do so, we reserve the right to withhold or revoke bonus points from your Member Account. American Express may also cancel this Card account and other Card accounts you may have with us. This offer is not transferable. Bonus ID: SAOT POID: K1MX:0002

This may not tempt you into using the card for your spend, but it’s nice to see the earning power of the Marriott Amex cards return to their old SPG levels for 2021.

Sounds nice but I do not have such an offer on my legacy Starwood/Bonvoy card.

It’s targeted. Not everyone will get this offer. This has been widely noted on the other points blogs.

This offer is not on my card either!

they ran this for me last 2020 last quarter up to 3 times. Yes, I did the math and realized it was a return to the good old days of SPG. Aleady signed up for the offer for this year. My only problem is that I want to put most of my spend on Hyatt for the threshold bonuses so perhaps only after I hit $75000 spend (to hit 60 nights) will I start with Bonvoy. So many exciting things to spend on this year!

Check whether you’re *pre-registered* for this offer, it was pre-added to my premium consumer card, I had to add it to my business card, it is not intended to be targeted.

I went from spending 5k a month to under 100 dollars a month and that was before Covid Rona

Now I’m about 44 dollars a month on Amex for a subscription

I like the Citi Cash Card earning 2’5 percent and their customer service is superior to Amex

Marriott keeps raising redemption’s through the roof during low occupancy.GREED!

Revenue is far more valuable than their point currency when the cost of a stay is less than using points .Cash is king when airlines are also gouging on award redemptions and in risk of bankruptcy. Did I say cash is king?

As always, Marriott sucks

Marriott is nothing but a Dumpster Fire.

Ah, Starwood American Express – good times!

I closed this card in 2017 and have slowly closed all my worthless AMEX cards………….let them offer this with a huge signup bonus and I “might” consider it………the company is a legend in their own minds but no one else’s

Such crap! Even at 3¢ per dollar spent, these are still Marriott Bonvoy points, not SPG points. This does not bring the earning up to the old level of the SPG card, by virtue of the fact that these points are intrinsically less valuable in the Bonvoy program.

Still mourning Starwood and the old SPG card. It was my first points card and I used it for everything. When Marriott came in, I moved over to Hyatt, but you never forget your first love.

It’s only on the Bonvoy card with the $450 yearly fee. Not offered on the cheaper card. What a waste

I agree that this must be targeted or only for the “business” version. I have a legacy Bonvoy Amex and it is not pre-registered and not on the list. Of course, I can get 40% off from wine-in-a-can or $25 back on $50 at Wine Insiders or $25 back on $50 at Martha Steward Wine Co. or….at a bunch of other random places I’ve never heard of.

Trying to clarify this. This means you can get effectively 3:1 by spending exactly $7,500, ten separate times?

I was given this offer and it reminded me to get my Bonvoy Biz card out of the drawer and cancel it. It used to give Gold status which made it worth something. Why pay an annual fee on a card that gives you nothing in return.

Us customers also have windows of opportunity that we close. I’ve moved on. Keep your weak a$$ promo Marriott.

At most it would shift $75k worth of spend to my dormant Bonvoy card, which saw business spend in the 6 figure range down to nearly zero when they devalued.

This promotion takes the Marriott Amex back to the glory days of the SPG Amex, but I think the world has changed since then.

The SPG Amex functionally earned 1.25 airline miles per dollar spent, which was great for the time, but not as good as offered today by the Chase Freedom Unlimited (1.5 miles per dollar), Citi Double Cash, or Amex Business Blue (2 miles per dollar).

The only reason I can see this promotion being appealing is for users who are chasing American or Alaska miles, which are not available through one of the transferable programs.

Before canceling your Amex Bonvoy cards I’d highly recommend asking for a retention offer. I was getting ready to cancel my little-used personal card due to the $95 annual fee but chose to stay after accepting a 40K retention offer.

Gary, I found this offer on offered on 2 of my 3 Bonvoy Amex cards (Legacy SPG, Business, and Brilliant). I am only permitted to have this offer apply to ONE (1) of my cards, and furthermore only as to my personal spend–zilch as to my supplemental cardholders’ charges! (I have stopped using for the most part what was once my “go to” card, after it was devalued by 33.3%.) Very disappointing.

Also, I manage the Legacy Amex/SPG-Bonvoy card for a friend. No such offer appeared among the Amex offers applicable to her card, and 2 phone calls later, the best that a supervisor could do was to explain that the offer IS a targetted offer and that he could only submit a complaint, but otherwise, there was nothing else he could do. Go figure!

I have lots of offers which I will never even consider to use, I wish I could delete time wasteful offers.