American Express is surveying customers about a new suite of benefits for their premium Marriott credit card, and a potential new Marriott card with stronger earning than Chase’s Marriott Visa but at a lower price point than the current $450 annual fee product Amex offers.

Today the $450 annual fee Marriott Bonvoy Brilliant offers 2 points per dollar (plus 3x at U.S. restaurants and on flights purchased directly with airlines and 6 points at eligible Marriott hotels); Platinum status after $75,000 spent each year; a $300 Marriott credit [offer expired]; Priority Pass Select; and an annual free night up to 50,000 points.

- Effective 9/22/22, the $300 Marriott Bonvoy statement credit benefit will no longer be available. It will be replaced with a NEW benefit of up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide.

- Stronger earning such as 3 points per dollar instead of just 2, put another way restoring the earning power of the old Starwood American Express card. They also tested a 5000 point bonus points per Marriott stay paid with the card.

- Waived resort fees. Hyatt waives resort fees for top elites, and neither Hyatt nor Hilton charge resort fees on free night redemptions. Marriott’s CEO says resort fees are good for you. Are resort fees the new checked bag fees, something only non-cobrand cardholders pay? Hotels should get rid of these entirely. If they encourage people to pick up the credit card it’s because these fees are so hated by consumers.

- Guaranteed Suite Upgrades 5 nights per year. If this was akin to Hyatt’s confirmed at booking suite upgrades there would be real value. On the other hand if it’s providing a certain number of ‘Suite Night Awards’ those don’t clear anyway and oddly that hasn’t changed during the pandemic when hotels are empty.

- 50% off a second room. Watch out for potential restrictions like ‘rack rate only’ on the first room, Starwood used to offer the SPG50 rate which you could spend 1000 points for – this had a similar restriction but was occasionally useful, especially on premium suites. My mental model though is this is ‘worth’ 3000 Marriott points each time you use it, and that’s about a $20 value.

There’s also an option for a one-time second room free (buy one get one). If that’s limited to the highest rates it’s not really a 50% savings on two, and of course this is mostly going to be useful for families and not necessarily for road warriors without kids.

- Improved value for free nights instead of a room up to 50,000 points it might be uncapped, or valued at 80,000 points, underscoring that Marriott rooms cost more than they did when the card was first introduced a couple of years ago. In one option the free night would come only after $50,000 spend.

- $100/stay on-property credits. Usefulness of which would be dependent on any property list or rate restrictions.

- Automatic Platinum status or reduced spend for Platinum. Spend $50,000 for Platinum instead of $75,000. Oddly they separately tout the benefit of free breakfast, which you’re supposed to get with Platinum. Maybe surveyed customers don’t understand this. They also surveyed offering 30 nights of elite credit each year rather than the current 15 nights.

- More flexible annual statement credit they surveyed reducing the Marriott credit from $300 to $250, and also surveyed allowing use of the credit at restaurants (including reducing it to $240).

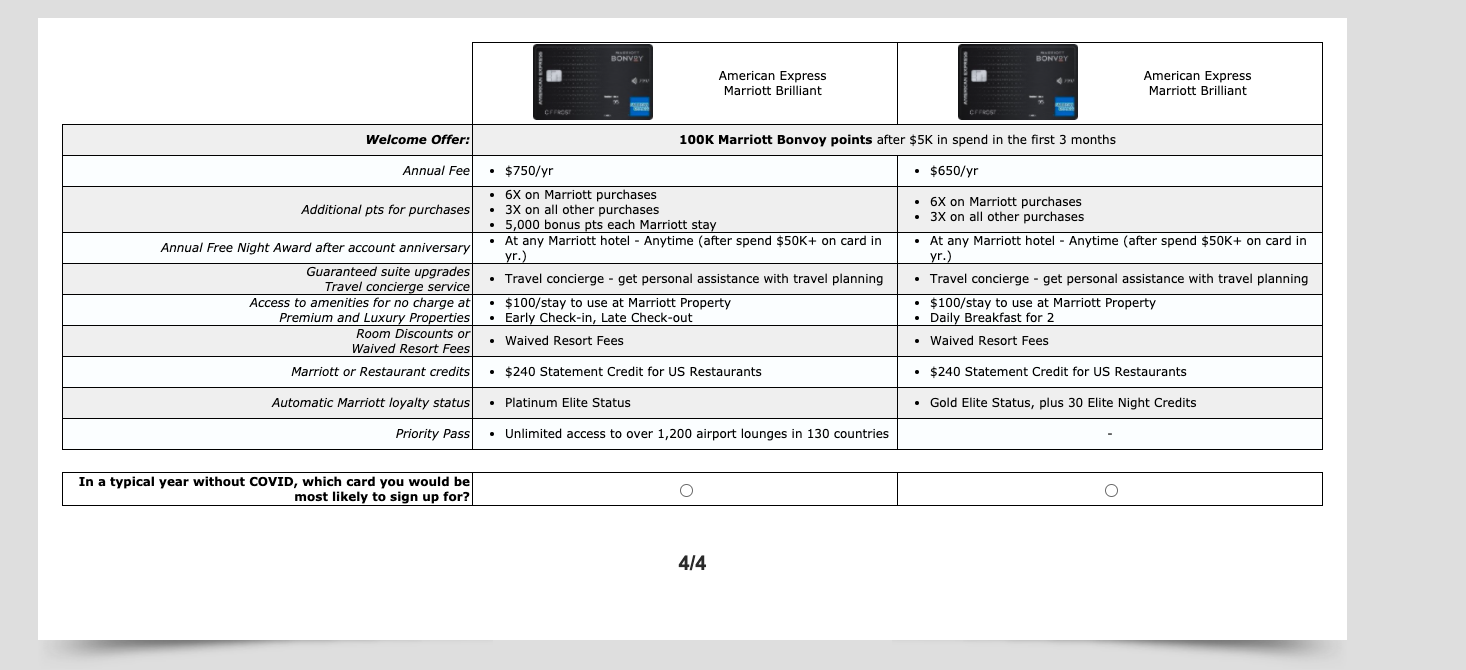

They’re evaluating annual fees for this card up to $650 or even $750, but might offer benefits such as:

They also surveyed a new $195 or $250 annual fee card without Priority Pass and a lower annual Marriott credit, but with stronger earning for ongoing spend.

Finally they tested a new highest annual fee card, new $250ish annual fee card, and the Chase-issued Marriott card against each other, and just their new cards separately against Chase.

(HT: A generous reader)

@ Gary — WTH are they smoking? No one in their right mind would pay $650/$750 for the cards described above. Marriott points devalue faster than SkyMiles, and Marriott doesn’t deliver promised elite benefits.

I had and completed this survey. It was quite a good conjoint exercise. Overall I’d say Amex is exploring if they can increase card loyalty by increasing the annual fee (so you are really bought in) and expanding the $ value you can get back so the net is about the same. The difference is you feel you really want to use a card you spend $550-750 on. Clearly not an average retail consumer card.

Agree with @Gene. Marriott management has lost all credibility, they can’t pull off charging that kind of fee because people won’t trust them to deliver the promised benefits. Every “benefit” they ever tout is full of restrictions, asterisks, and carve-outs of properties that don’t participate or rates that don’t qualify. There’s only so much chain yanking you can do to your customers before they tune you out and Marriott passed that point a couple of years ago for me.

I think Marriott is weak at establishing benefit rules across the chain – leaving policies to the discretion of individual property owners. I wouldn’t trust this card to guarantee universal results. I’d expect a lot of conditions attached to the benefits as well – e.g. minimum rates, booking method, etc.

Classic Marriott would be no resort fee then a list of exclusions including the Cosmo in Vegas.

the proposed $750 card carries Platinum status, further devaluation expected

@ Rob — “Tune out” is the perfect description for my relationship with Marriott. It is all noise, and I pay it no attention.

Loyalty status level with a premium card is important. One thing that is frustrating with the Marriott program and the co-branded cards is the loyalty level – none of these premium cards should have anything less than Platinum or Platinum Elite. Marriott Gold is not competitive with other loyalty Gold levels and was a main reason I downgraded my Brilliant AMEX.

Would love to see what Hyatt offers with a premium card (from Chase). Hilton offers numerous Amex personal and business cards, Marriott offers multiple cards (through Chase and Amex), and even IHG has two cards. The World of Hyatt Visa is a good card, but it’s high time to see what a high-end Hyatt card looks like.

Hilton for $450 offers Diamond status. If you’re looking for status/benefits, that’s a better deal.

If the card conferred onto Ambassador members benefits such as “breakfast at all properties”, “not being treated like dirt at Ritz properties”, and “suite night awards that are actually honored”, then maybe I’d have a look!

If they’re not delivering as promised perks and benefits, then why pay 650-750. Sounds nuts.

A card that offers Platinum is definitely coming. I called to cancel my Bonvoy Brilliant last month, after I got the Marriott business card offering Platinum for 2021 and AMEX offered me 60,000 points to not cancel for 12 months, which I took. I was still planning to cancel before the next annual fee in 9 months, if they claw back the 60,000 points, so be it. Now it looks like I will be able to upgrade the Brilliant and cancel the business Marriott Amex after 12 months. A 50,000 point free night certificate is more often than not the same value as a 35,000 point certificate to me, which is to say very little. Free breakfast is worth a lot while traveling, especially in Europe

@JFKPHL — AMEX will claw back the 60k points if you close or downgrade before exactly 12 months from the day you accepted the offer.

So they want pay more to get Bonvoyed? Over and over again? No thanks.

Fool me once, shame on you. Fool me twice, shame on me.

They’ve confused Rewards (rebates) with Loyalty. Quite different things… Bonvoyage! Not worth it.

I used to put close to $50k a year on my spg card, before better options came around. As the annual fee comes around, I’m cancelling my Bonvoy cards (I had 4, including one for my wife). The 35k free room has been so devalued, it’s not worth it. Earnings down by a third and costs/room through devaluations up more. To pay $750 for this? Nope.

1st – for the business traveler, Marriott properties are wonderful and consistent and secure, all over the world.

2nd – I am retired now, but for the road weary business traveler, the huge “fee” for this card means nothing if your company reimburses you or if you own your own company and charge the card to it.

3 – If you own your own company and you pick up the fee for your top exec road warriors, this card is great.

Marriott is onto something for these type people, or simply wealthy people who really don’t care.

If they actually deliver on the promises, and give enough rebates so the net cost isn’t too bad, I would definitely upgrade, and again make this my card of choice for most non-bonus spend…as long as they reinstate the earning ratios of the SPG card, relative to airline transfers. Then, it has real value to me.

This may be ongoing market research, but could be a sign of AXP continuing to stay one step ahead of Chase in the proprietary card market and testing how they can continue to segment upmarket with higher annual fee products, which aligns with their core messaging of selling ‘memberships.’ It wasn’t too long ago the conventional wisdom was that annual fees were going away for good but they reinvigorated their charge portfolio by actually encouraging spend and staying one step ahead of Chase. Note too that they set a new bar for their top tier annual fees (excluding Centurion) to $550, so if they plan to take Brilliant to $650 or $750, expect they will do the same with the top Delta, Hilton and Platinum products. by adding benefits to support their “Premium Value” positioning and consistency across their full card portfolio.

Thanks for sharing. I hope they roll out better Bonvoy business offerings while they are at it on personal versions.